Even more gold bull catalysts are emerging as some indicators are now approaching 2009 collapse levels. Take a look…

“Brother, can you spare a loan?”

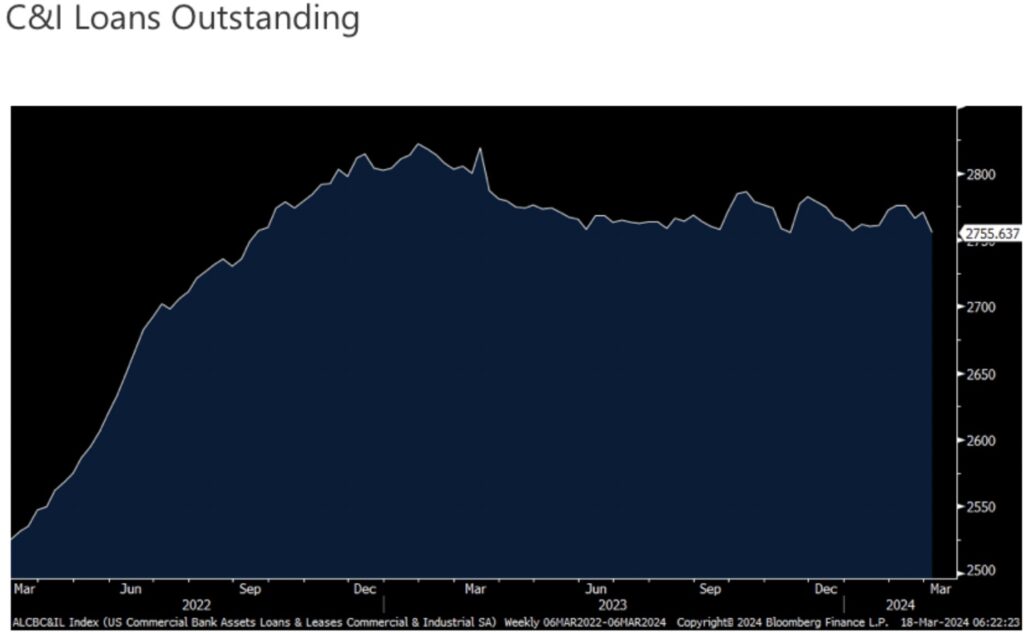

March 18 (King World News) – Peter Boockvar: Tight lending standards and slack demand with the high cost of capital resulted in a drop in C&I loans outstanding for the week ended 3/6 to just above the lowest level since September 2022. As seen in the chart below, you can see we’ve pretty much flat lined since the bank failures one year ago.

Debt Defaults Surge Near 2009 Levels!

Also of note, as seen in the Weekend FT there was an article titled “Debt defaults at highest rate since global financial crisis, S&P reveals.” The article goes on to say, “More companies have defaulted on their debt in 2024 than in any start to the year since the global financial crisis as inflationary pressures and high interest rates continue to weigh on the world’s riskiest borrowers, according to S&P Global Ratings.”

They went on to say, “This year’s global tally of corporate defaults stands at 29, the highest year-to-date count since the 36 recorded during the same period in 2009, according to the rating agency.”…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

A 2008 Collapse Type Event

I’ll add, some of those most vulnerable were those funded in 2020 and 2021 when all one needed was a power presentation and a heartbeat to get a loan/raise capital. Remember all those SPAC’s and poorly underwritten loans where zero rates and massive QE got many lenders and borrowers drunk on easy money and slack underwriting. As stated here many times over the past few years, I’ve been more worried about an economic death by a thousand cuts impact from higher interest rates rather than a 2008 type event and this news is a reminder that we still have time ahead adjusting to this new interest rate environment. The problem is not the current level of interest rates in itself as they seem more historically normal. The problem instead is that the current interest rate environment comes after 15 years of zero.

Consumers Not Making Credit Card Payments

In case you missed too on Friday, Capital One and Synchrony filed 8k’s with their monthly net charge off and delinquency data that came in higher than expected, hat tip Quill Research. Capital One stock was down 2.8% and Synchrony Financial was lower by 3.4%. For Capital One, net charge offs for credit cards for month end February rose to 5.95% from 5.71% at the end of January and vs 5.78% at the end of December. 30+ day delinquencies fell a touch to 4.72% from 4.78% in the month before but still up from 4.61% at year end. These are the highest levels in a while. For Synchrony, its net charge off rate rate to 6.5% from 5.8% in the month before and vs 4.7% one year ago. The 30+ day delinquency rate for them rose to 5% from 4.9% and vs 3.9% one year ago.

Another Inflation Wave Is Well Underway

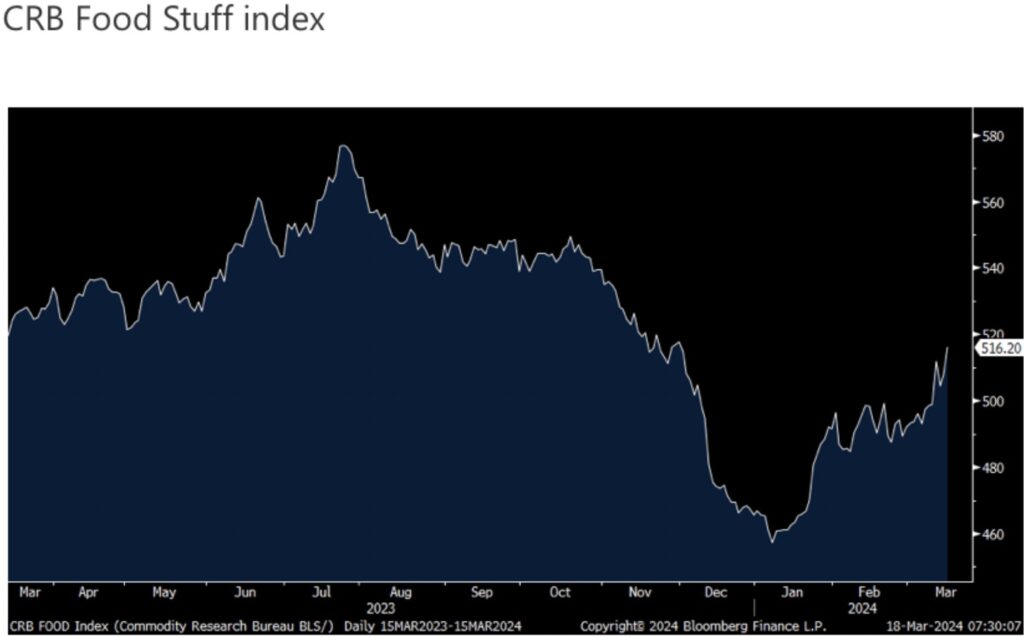

Ahead of the Fed meeting this week, we’ve seen a rally in commodity prices and where I’ve been pointing out the CRB raw industrials in particular, led by energy. Well, the CRB food index on Friday rallied almost 2% to the highest level since late November.

Fed To Raise Rates Into Soaring Inflation?

Bullish For Gold, Silver And Miners

King World News note: Another inflation wave is yet another gold bull catalyst. The gold market senses inflation and has already moved to new all-time highs. Silver will soon follow to all-time highs along with the HUI Mining Stock Index, which is currently at 232 about 400 points below its 2011 all-time high of 630.

Alasdair Macleod’s latest audio interview discussing the short squeeze in the silver market has just been released CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.