As we come to the end of the third week of trading in July, the COMEX gold and silver war continues to rage. Here is the latest update.

COMEX Gold & Silver War Continues

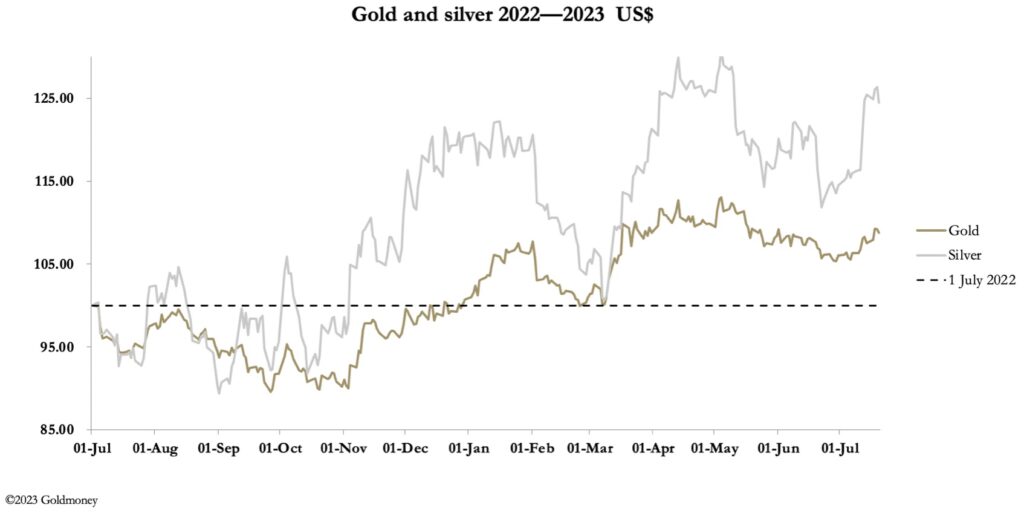

July 21 (King World News) – Alsadair Macleod: This week has seen a consolidation in gold and silver of their price rises from the end of June lows. In Europe this morning, gold was trading at $1964, up $9 on the week after testing $1987 on Tuesday. Silver was $24.72, down 18 cents since last Friday’s close.

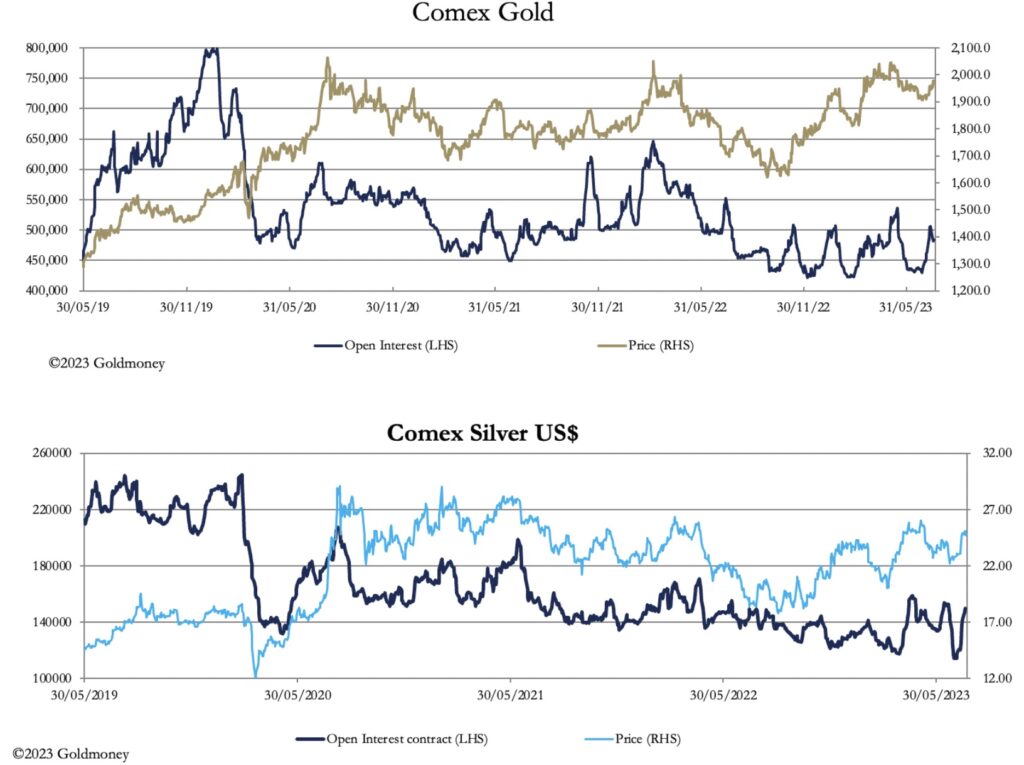

On Comex, volumes in gold were healthy, while in silver they were low, indicating the lack of liquidity in the latter contract. Gold contracts stood for delivery this month so far are the equivalent of 6.76 tonnes, and in silver over 10 million ounces, or 329 tonnes. While we have become used to gold being stood for delivery, silver less so. Perhaps this drain on Comex silver stocks will intensify bear squeezes.

Open Interest on Comex has recovered somewhat for both metals, as our next chart illustrates, but they are still at relatively low levels. Open Interest is a key indicator of speculator bullishness, which along with public interest is fairly low.

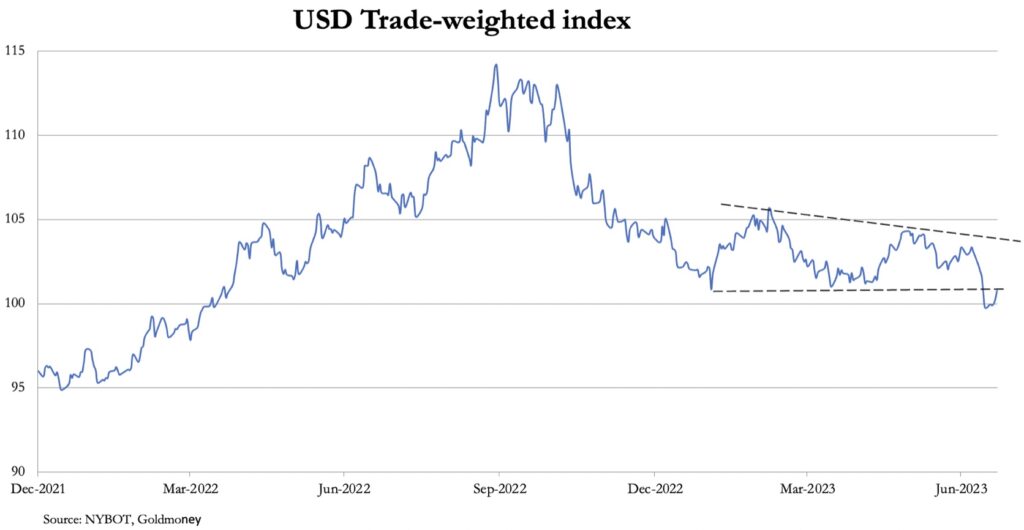

If Comex is anything to go by (it is only one eighth the size of London) its generally oversold position in gold and silver strongly suggests that both contracts are now resuming a bullish trend, and that the current correction is a buying opportunity. What has undoubtedly caused it is the short-term recovery in the dollar, having breached an important support level in its trade weighted index. This is next.

Having broken an important support level at 100.80, the dollar’s TWI has rallied to test that level. What normally happens in these cases is that stale bulls grasp the opportunity to sell, which is why previous support turns into supply. Therefore, the betting is that this is a last gasp for the dollar before it resumes its decline…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

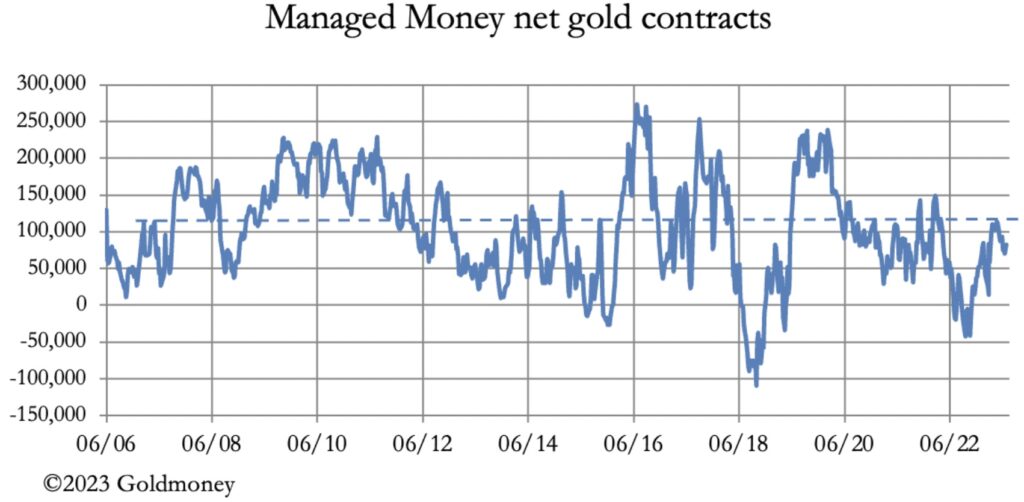

When that happens, we can expect hedge funds in the Managed Money category to sell dollars for other currencies and gold. And the technical traders, noticing the lack of liquidity in silver might use it as a leveraged play on the back of rising gold prices. The last known position of this Comex category was net long 82,443 gold contracts on 11 July (update due after market hours). This is next.

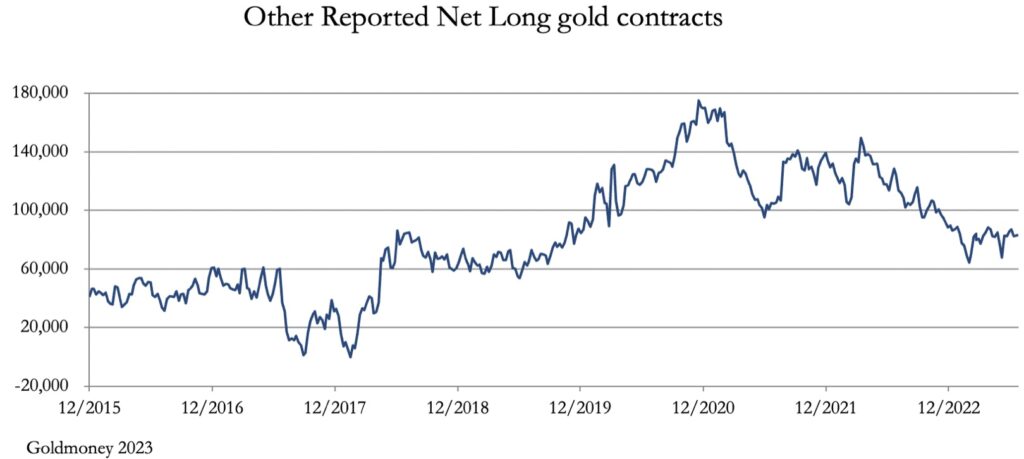

The pecked line is the average net long position since 2006 at about 110,000 contracts. On renewed dollar weakness one could envisage further buying in this category alone of an additional 150,000 contracts to the levels seen in 2016, 2017, and 2019. But that is not all. The Other Reported category, which includes central banks, sovereign wealth funds, and large traders from around the world not in the Managed Money category hold a similar net long position, of 83,311 contracts.

It is this category which stands for delivery. Therefore, since the peak net long position at the end of 2020, we must allow for 480,000 contracts (1,493 tonnes!) taken out of the system by Other Reporteds.

And lastly, a look at the technical chart for gold.

This consolidation is at the 55-day moving average level. Once that is surpassed, 2060 and then beyond beckons.

ALSO JUST RELEASED: We Are Witnessing The End Of The Fiat Currency Era CLICK HERE.

ALSO JUST RELEASED: This Is How Broke People Are In The United States, Plus A Look At Housing CLICK HERE.

ALSO JUST RELEASED: Celente – Dollar Sinks To 14 Month Low; Death Of The Dollar? CLICK HERE.

ALSO JUST RELEASED: Public Has Gambled All In On This Market But Hates This Market CLICK HERE.

ALSO JUST RELEASED: Dollar Suffers Historic Decline But Here’s Why The Worst Is Yet To Come CLICK HERE.

ALSO RELEASED: SPROTT: John Hathaway’s Big Update On Gold And Gold Stocks CLICK HERE.

ALSO RELEASED: Greyerz – DANTE’S INFERNO: This Catastrophic Financial Collapse Will Happen Incredibly Quickly CLICK HERE.

ALSO RELEASED: BREAKOUT: After Silver Surged To $25 And Gold Hit $1,960 Here Is What To Expect Next CLICK HERE.

ALSO RELEASED: Nomi Prins Just Warned What Is About To Be Announced Will Shock The World CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.