It’s amazing how mass psychology works, especially in global markets. It appears the public has now gambled all in on the market listed below but hates the other market. One thing is clear, this will not end well for them.

A Tale Of Two Markets

July 19 (King World News) – Jason Goepfert at SentimenTrader: Investors love stocks and hate bonds.

Key points:

- Optimism on stocks is over 60 points higher than that of bonds

- This is a record spread in optimism between the two markets since late 1998

- Despite potential contrarian risks, sentiment does not get this stretched during bear markets

Never before have investors favored one major market over another

Investors love stocks. And they hate bonds…

ALERT:

This company is about to start drilling what could be one of the largest gold discoveries in history! CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

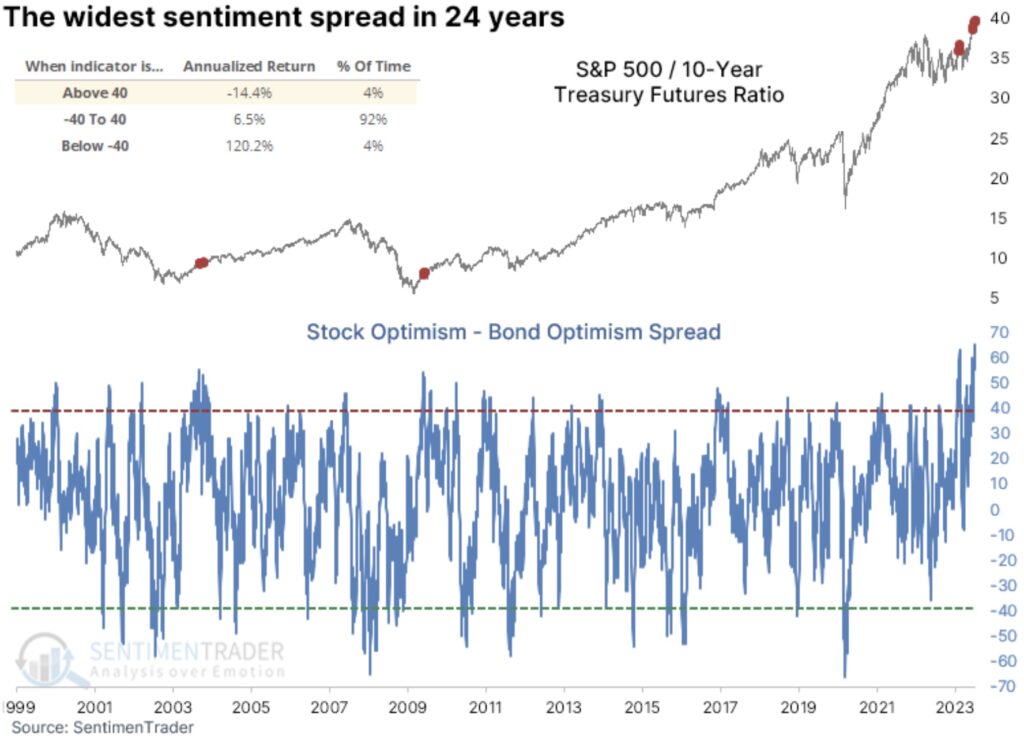

The difference in sentiment between the two markets is so stark it has never been wider in the 24 years we’ve been calculating the Optimism Index in the two markets.

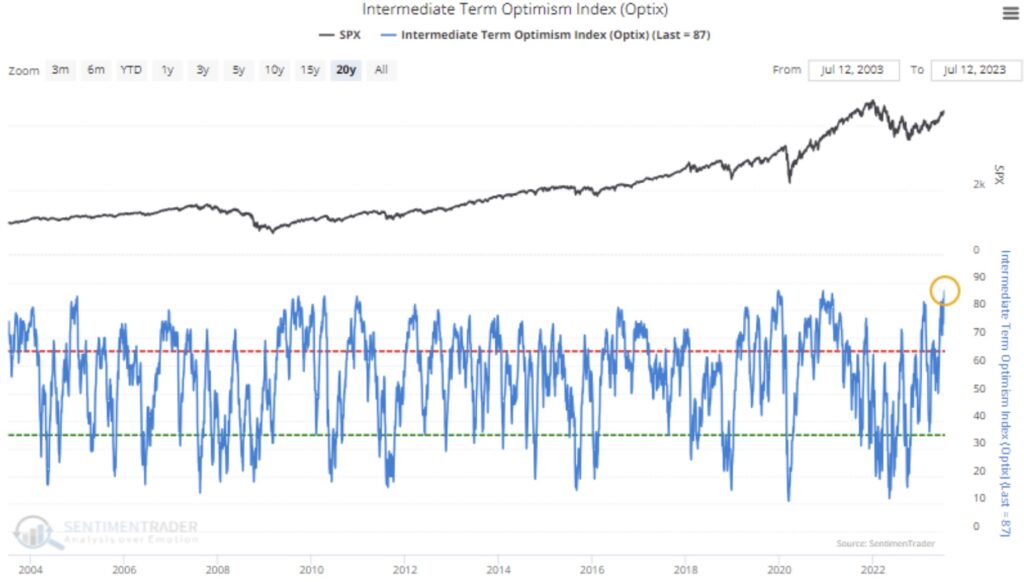

The Intermediate-Term Optimism Index for stocks has approached 90 and is the 3rd-highest since we began computing it.

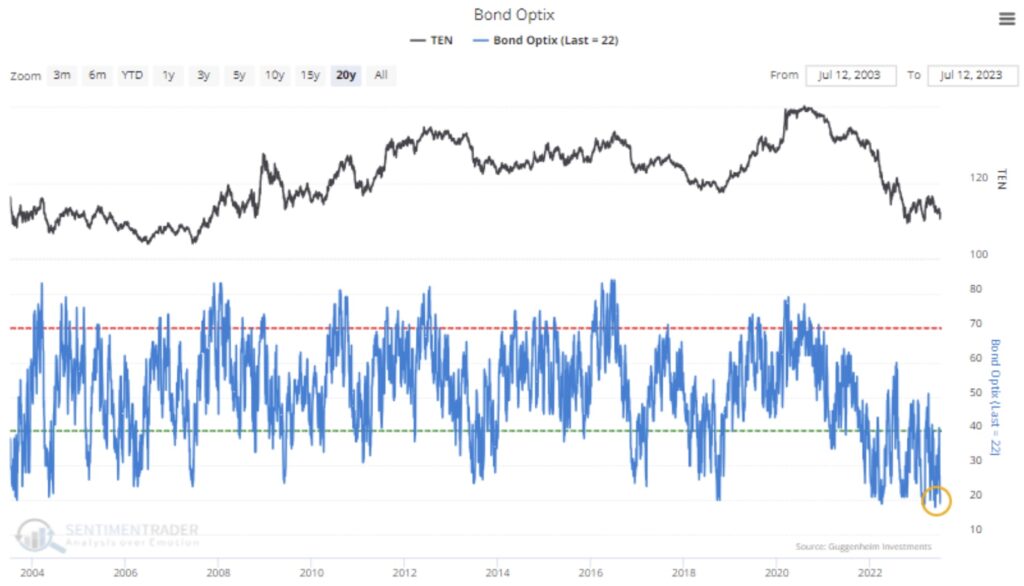

At the same time, the Optimism Index for bonds has cratered to one of its lowest-ever levels.

That means the spread between the two measures just rocketed above +60, a level we’ve never seen before. How they perform after lesser extremes depends on time frames.

We can see in the chart below that when the spread exceeded +40, the annualized return in the ratio between the S&P 500 and 10-year Treasury futures was abysmal. When the spread plunged below -40, then stocks soared versus Treasuries.

However, when the spread really blew out, above +50 or more, there were only a couple of precedents…and they both triggered at the ends of the last two protracted bear markets. This highlights something we’ve repeatedly noted in recent weeks and months – sentiment on stocks like we’re seeing now doesn’t happen during ongoing bear markets.

Extreme differences in sentiment preceded inconsistent reversions

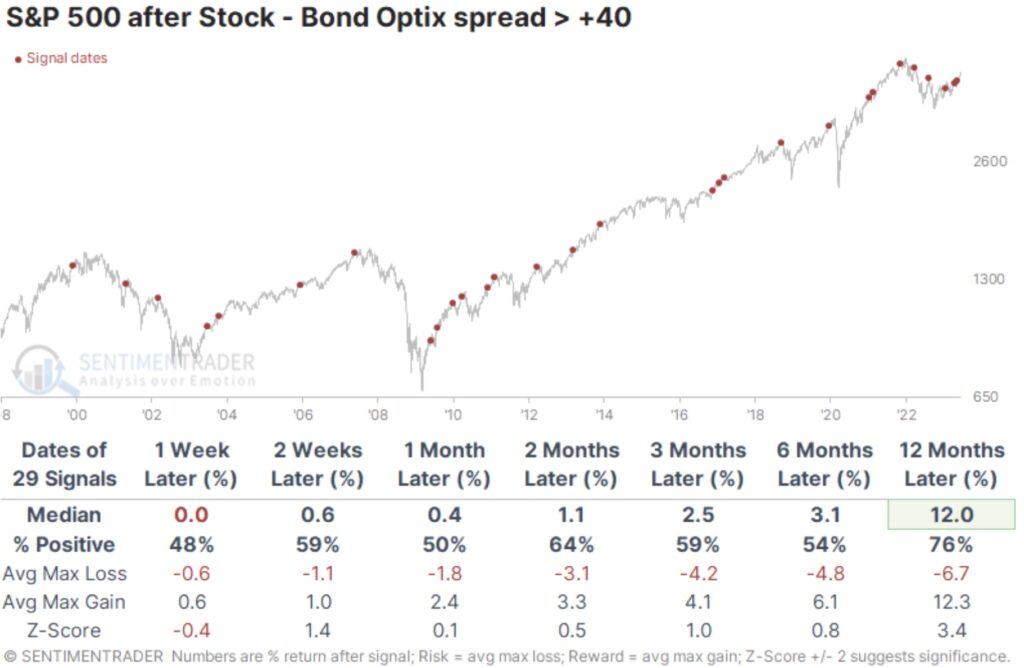

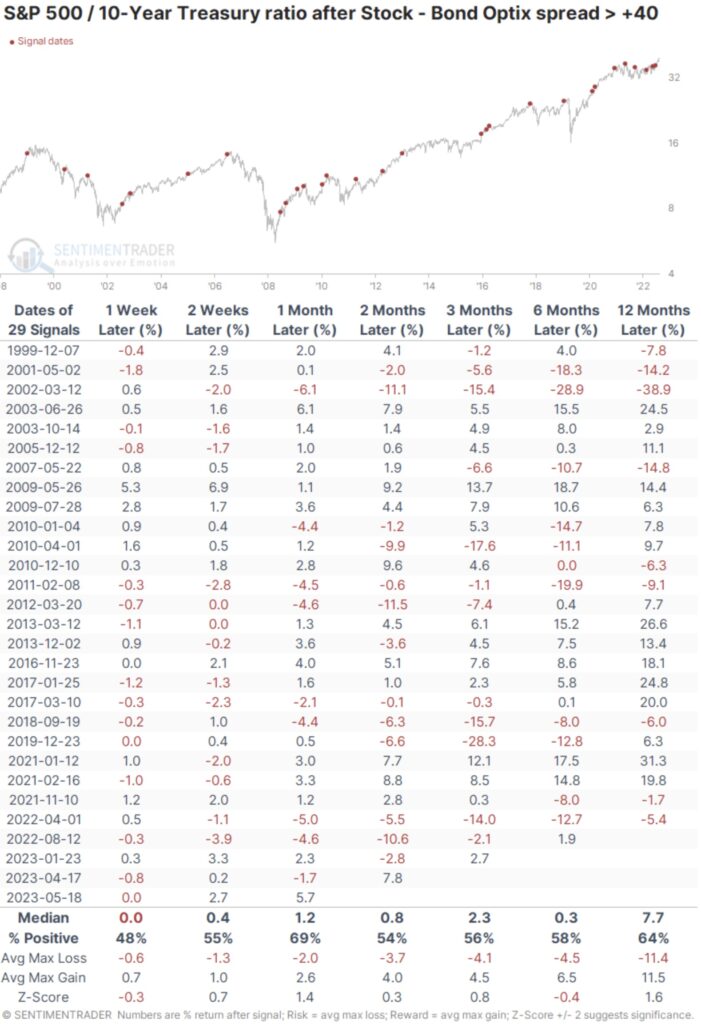

Since we have so few precedents with which to compare the current reading, the table below looks at lesser extremes. It shows future returns in the S&P 500 after the spread between stock and bond optimism exceeds +40 for the first time in weeks. And, overall, those returns were okay. Over most time frames, the S&P modestly outperformed a random return. Nothing up to a year later was especially encouraging, though – win rates, median return, and risk/reward were all yawn-inducing.

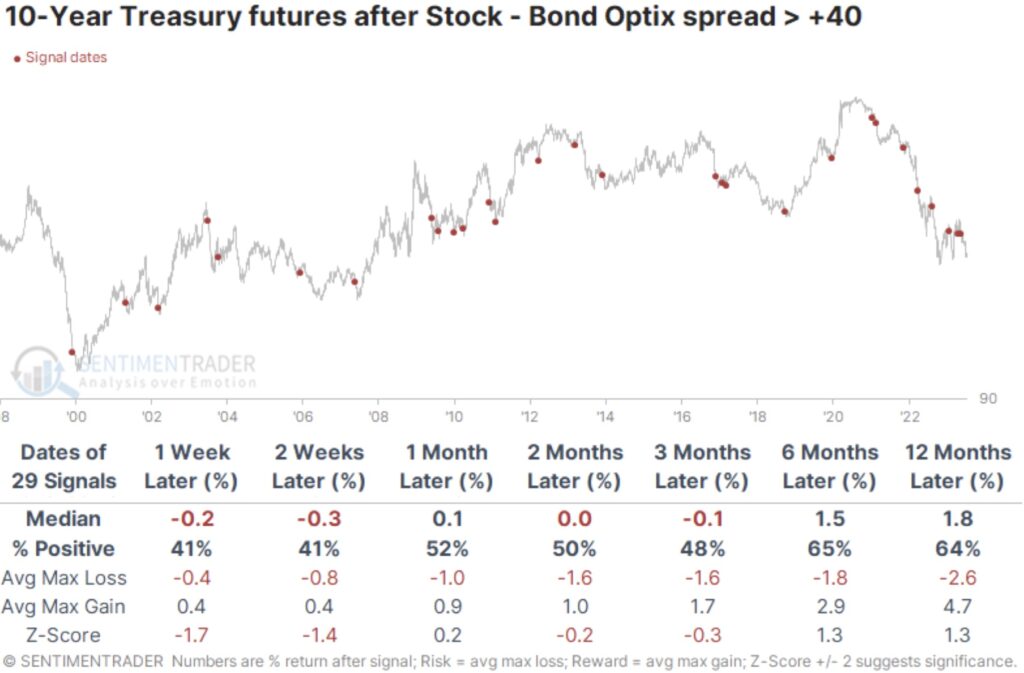

For 10-year Treasury futures, it was even less enticing. Prices on the notes didn’t show a consistent tendency to snap back. Up to three months later, returns were actually quite poor.

Since we are looking at the spread between stock and bond optimism, it makes the most sense to look at future returns between the two markets. The table below shows how the ratio between the S&P 500 and 10-year Treasury futures behaved after extreme wide spreads in sentiment.

It’s somewhat surprising that despite investors preferring stocks over bonds to an extreme degree, stocks still outperformed in the months ahead. There was no consistent contrary tone to the data, though the few signals triggered during ongoing bear markets preceded an almost immediate reversion from stocks to bonds.

What the research tells us…

Multiple times in recent weeks, we’ve seen evidence that the sentiment investors are exhibiting toward stocks has tilted strongly into excessive optimism. The knee-jerk reaction for any investor with the hint of a contrarian streak is that this is bad. And usually, it is. The most consistent exception is when there is extremely extreme optimism, especially when it’s the first instance following a prolonged bear market.

Several times lately, we’ve looked at readings that simply haven’t occurred in other ongoing bear markets. Evidence has piled up since October that we’re likely in a new bull market environment, and the current level of sentiment among markets is further evidence of that. Granted, sentiment is so extreme that it likely means subdued forward returns, but it’s not good evidence of an imminent and protracted retracement. This is another example of why Jason Goepfert is the best in the world at what he does – providing actionable market data. To subscribe to the internationally acclaimed work Goepfert produces at SentimenTrader CLICK HERE.

ALSO JUST RELEASED: Dollar Suffers Historic Decline But Here’s Why The Worst Is Yet To Come CLICK HERE.

ALSO JUST RELEASED: SPROTT: John Hathaway’s Big Update On Gold And Gold Stocks CLICK HERE.

ALSO JUST RELEASED: Greyerz – DANTE’S INFERNO: This Catastrophic Financial Collapse Will Happen Incredibly Quickly CLICK HERE.

ALSO JUST RELEASED: BREAKOUT: After Silver Surged To $25 And Gold Hit $1,960 Here Is What To Expect Next CLICK HERE.

ALSO JUST RELEASED: Nomi Prins Just Warned What Is About To Be Announced Will Shock The World CLICK HERE.

To listen to Nomi Prins discuss how the BRICS gold-backed currency is going to be a historic game-changer for the world, the global financial system, and the gold market CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss the coming gold-backed currency and how it will impact the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

To listen to this timely interview with Tavi Costa discussing $2,700-$3,000 gold, $50+ silver and mining stocks soaring CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.