We have seen continued volatility in the gold and silver markets this week but look at what is happening behind the scenes.

Continued Volatility For Gold & Silver

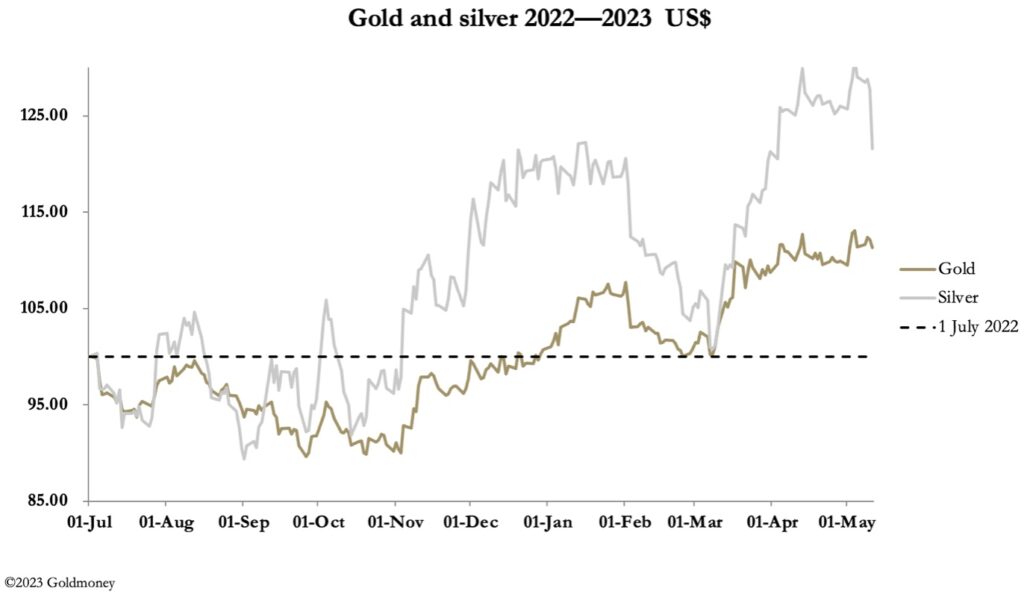

May 12 (King World News) – Alasdair Macleod: This week, gold and silver continued last Friday’s sell-off. On a net basis, gold was down only $8 from last Friday’s close in European trade this morning at $2008, following last Friday’s $34 decline. Silver was marked down more aggressively, falling $1.70 since last Friday’s close to $23.93 this morning, for a total markdown of over $2 from its peak on 4 May.

Yesterday, the dollar’s trade weighted rallied to 102.04, providing the conditions for the Swaps on Comex to try to shake out the speculators. Volumes in both gold and silver contracts were heavy, typical of sell-off conditions before subsequent advances in price. And the underlying technical position looks very strong. This is our next chart:

This consolidation at the $2000—$2050 level is entirely natural, requiring speculators to get used to the idea of prices over $2000. The professional traders know this, and being net short see the opportunity to shake out weak holders. But with strong support from the underlying moving averages, they know that for them this is the last chance saloon.

It looks only a matter of time before the dollar’s trade weighted index breaks below 100. This is our next chart.

So, what could make it break down?

The most obvious factor is failure over negotiations to raise the debt ceiling. In the past, raising the debt ceiling has been a charade, but this time it looks like the Republicans are digging in their heels over Biden’s Inflation Reduction Act, demanding $4.8 trillion in cuts over ten years. And one-year credit default swaps, reflecting US bankruptcy risk are at a record 150 basis points, compared with Germany at 2.5bp, UK 7.5bp, and even Italy at 39.

Markets are obviously worried. Furthermore, money supply is contracting with the biggest drop since the Great Depression, according to Ryan McMaken of the Mises Institute. And PacWest Bank is another Californian bank to be in crisis — and it won’t be the last…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Besides Credit Suisse, the banking crisis is yet to surface in other jurisdictions, which means the focus is firmly on the fragility of the US banks and the dollar. With deposits of over 40% of the banking system’s total owned by foreigners, their evolving view of banking risks, with the Fed itself deeply under water on its balance sheet, will be key. Furthermore, foreign depositors have almost none of their exposure in regional banks, being heavily concentrated on the global systemically important megaliths.

It is very likely that that will fuel the next stage of a US bank run, undermining both these G-SIBs and the dollar itself.

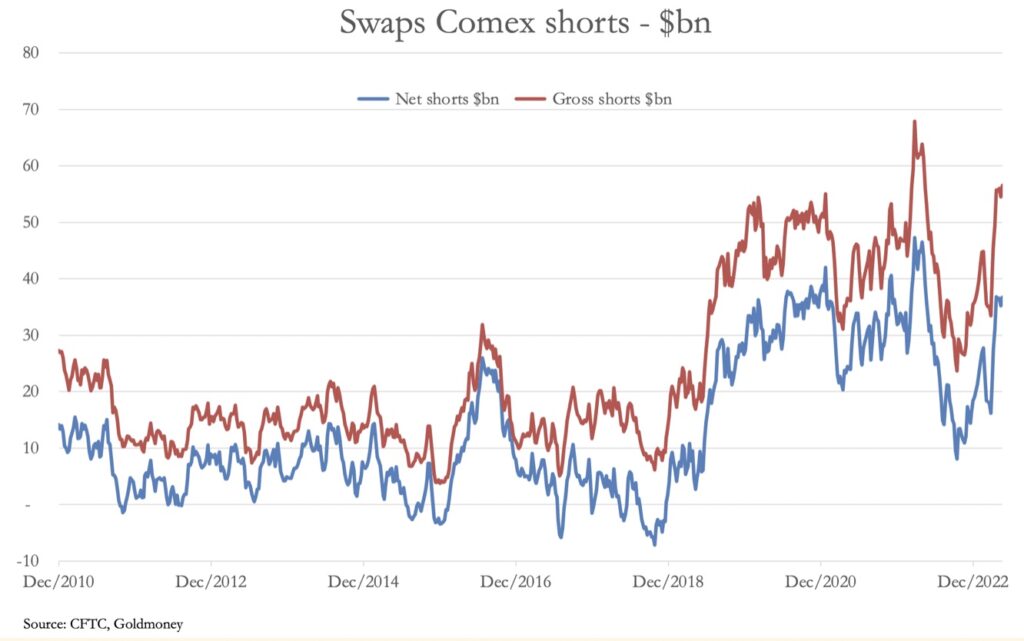

Meanwhile, our next chart shows the gross and net Swap gold contract positions measured in dollars.

Gross shorts stood at $56.6bn on 2 May, spread between 23 traders, for an average position of nearly $2.5bn each. With contracting bank deposits, the bullion bank majority in this category will be coming under significant pressure from their treasury departments to reduce them as soon as possible.

In case you missed it…

Finding The Gold

N. Superior drills 31.4 m of 2.13 g/t Au at Philibert!

Simon Marcotte, president and chief executive officer of Northern Superior, commented: “The results communicated today continue to demonstrate the exceptional grade and width of the Red Fox zone. With the campaign uncovering this new high-grade area, we see a clear opportunity to extend near-surface mineralization along strike and down plunge towards the east-southeast.

Moreover, the drill holes investigating the western extent of the Red Fox zone have revealed that it remains open in that direction, providing a significant opportunity for the company to expand the mineralized corridor in the future. Over all, these results continue to demonstrate the significant potential of Philibert as we continue to progress towards a maiden resource calculation, which we believe will establish Philibert as a pillar in the rapidly emerging Chibougamau gold camp.” Norther Superior Resources, symbol SUP in Canada and NSUPF in the US.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.