We are in the early stages of a bear market in trust that is heavily impacting the gold, silver, and mining share markets. To make matters even more turbocharged, QE is coming soon.

Sweet Smell Of QE On The Way

September 30 (King World News) – Albert Edwards, Former Head of Macro Strategy Société Générale: When I look at the recent supercharged performance of Gold, Silver, Platinum, Copper, Uranium and even food prices, etc, etc, it’s pretty clear to me investors are inhaling the sweet smell of QE in the morning. Breathe in folks.

Take A Long-Term Horizon

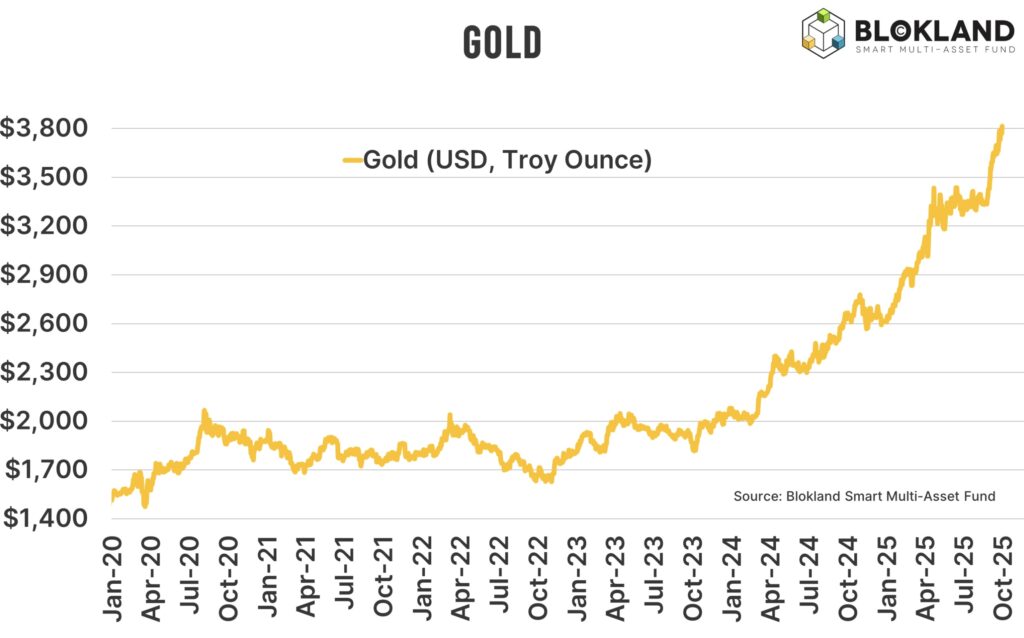

Jeroen Blokland:Another 1.5% increase in the price of gold today. Is gold going too fast? It may well be. Is gold going to correct? 100% sure at some point. Is it too late to invest in gold? Not if your horizon is long enough and you embrace what is happening.

Making short-term price predictions is impossible and hence useless. In November of last year, many investors and market commentators predicted a sharp decline after gold peaked at $2,780. When gold plateaued for months around $3,350 from April this year, experts were sure that the rally was over. Today, we are above $ 3.800. So, if gold drops 12% from here, does that mean victory for those who called the end of the price rally at these previous levels?

I have no idea if we are close to a peak and if that peak is temporary. I do know that, every day, more people recognize that massive budget deficits, runaway debt levels, and the need for higher inflation to keep the system afloat necessitate a significant rebalancing of their portfolios. A trend that will take years, if not decades, to mature. That is my reference for investing in gold.

Gold Pullback

Ole Hansen, Head of Commodity Strategy at Saxo Bank: Gold trades sharply lower after reaching another record high overnight.

The nervously anticipated correction appears underway, triggered by end-of-month profit-taking and the onset of China’s Golden Week holiday. The metal has rallied nearly 15% since Jackson Hole, supported in part by political noise around the Fed’s independence, but the current pullback will help gauge the depth of underlying demand.

From a technical standpoint, Fibonacci retracement levels point to initial support at USD 3,780, followed by USD 3,750, with USD 3,721 seen as key to maintaining the broader upside focus. Silver and platinum are extending the move, down 1.2% and 4% respectively amid thinner liquidity.

Gold

Peter Boockvar: Gold just hit another record above $3,843. We’re in the early stages of a monetary reset as central banks move off the dollar standard and back to gold. This shift will end U.S. dollar hegemony, raising our interest rates and consumer prices while lowering our standard of living.

Early Stages Of A Bear Market In Trust

Simon Mikhailovich: Systemic risks are more apparent but the consequences are yet to come.

What looks like a late stage of a bull market in gold is an early stage of a bear market in trust.

Silver

Otavio Costa: Gold miners made this move a few weeks ago, and now junior silver miners are beginning to break out relative to the price of silver.

KING WORLD NEWS NOTE: It’s Junior Silver Miners Turn To Shine

Although the metals themselves are still undervalued compared to the money supply and other financial assets, it’s important to note that in-ground mineral reserves remain historically underpriced — and they’re only now starting to attract attention.

Exciting times for those holding high-quality silver assets, in my view.

Silver Preparing To Explode Above $50

To listen to James Turk discuss his price targets for silver as it prepares to explode above $50 as well as what to expect from gold and mining stocks CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED!

To listen to Alasdair Macleod discuss silver approaching the $50 all-time high set in 1980 as well as gold’s surge along with the mining and exploration stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.