With buyers continuing to take advantage of the takedown in gold and silver, a $248 price target for silver was just issued. Plus take a look at the big reversal an something not seen in 31 years.

Silver’s Parabolic Move Starts Above $32

June 23 (King World News) – Graddhy out of Sweden: The big breakout level for silver using the yearly time frame is $31-32, and not the $38 and $50 that is on lower time frames.

Measured move target for the huge pattern is 800% x $31 = $248.

Always know the very big picture.

Once Silver Breaks $32 Price Target Is $248

Economic Trouble Brewing

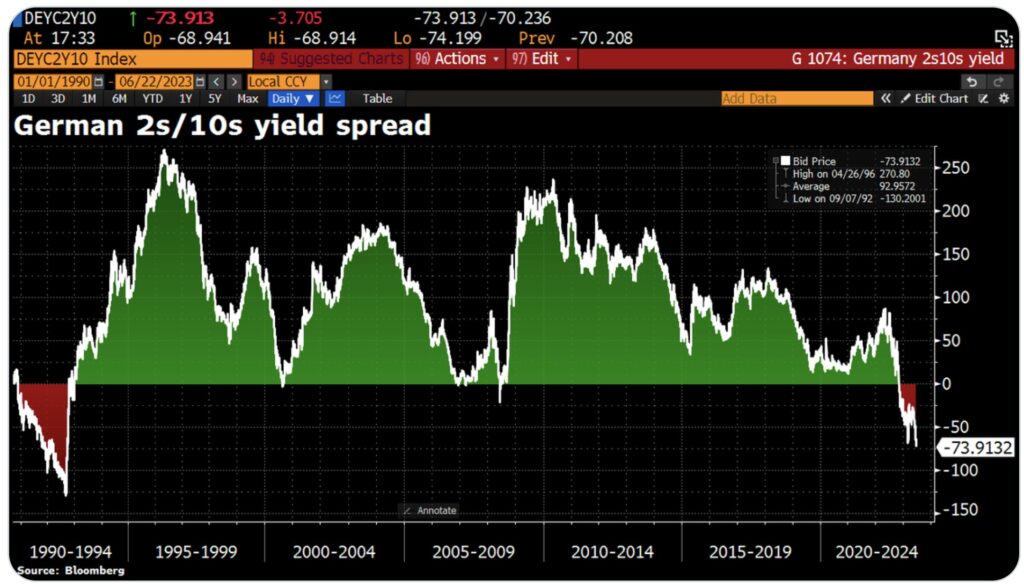

Holger Zschaepitz: OOPS! German 2s/10s yield spread drops to -94bps, inverts most since 1992.

Most Inverted German Yield Curve In 31 Years!

The Big Reversal

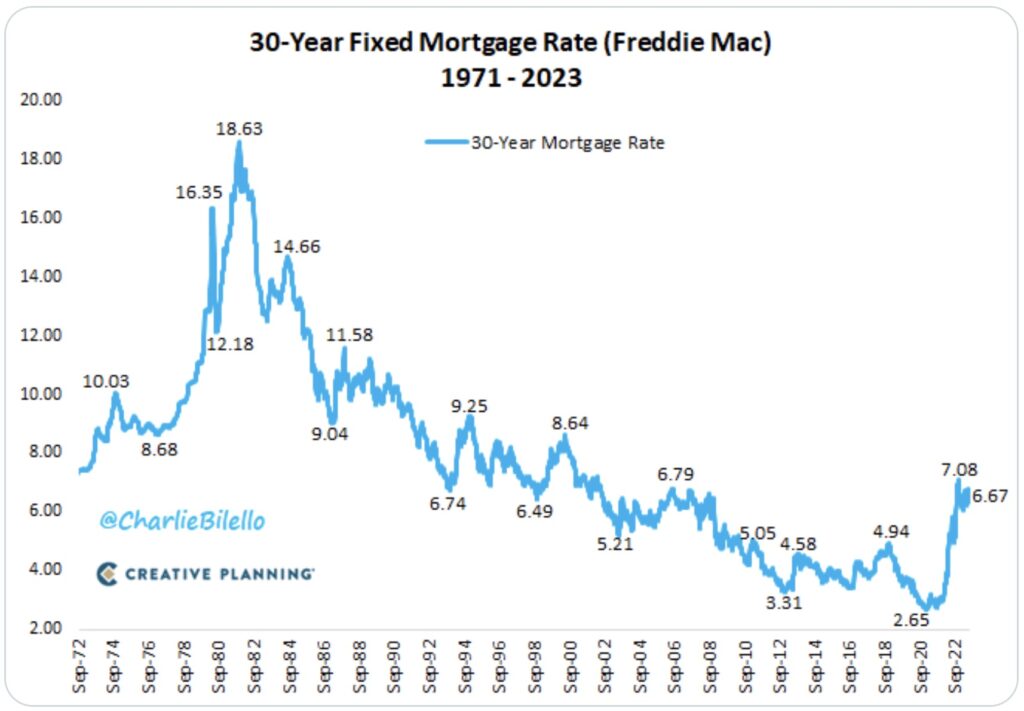

Charlie Bilello: Average 30-Year Mortgage Rate in the US…

1970s: 8.9%

1980s: 12.7%

1990s: 8.1%

2000s: 6.3%

2010s: 4.1%

2020s: 4.2%

All-Time Low (Jan 2021): 2.65%

Today’s Rate: 6.67%

Time To Head The Other Direction As 40 Year Bull Market In Bonds Is Over

This Won’t End Well

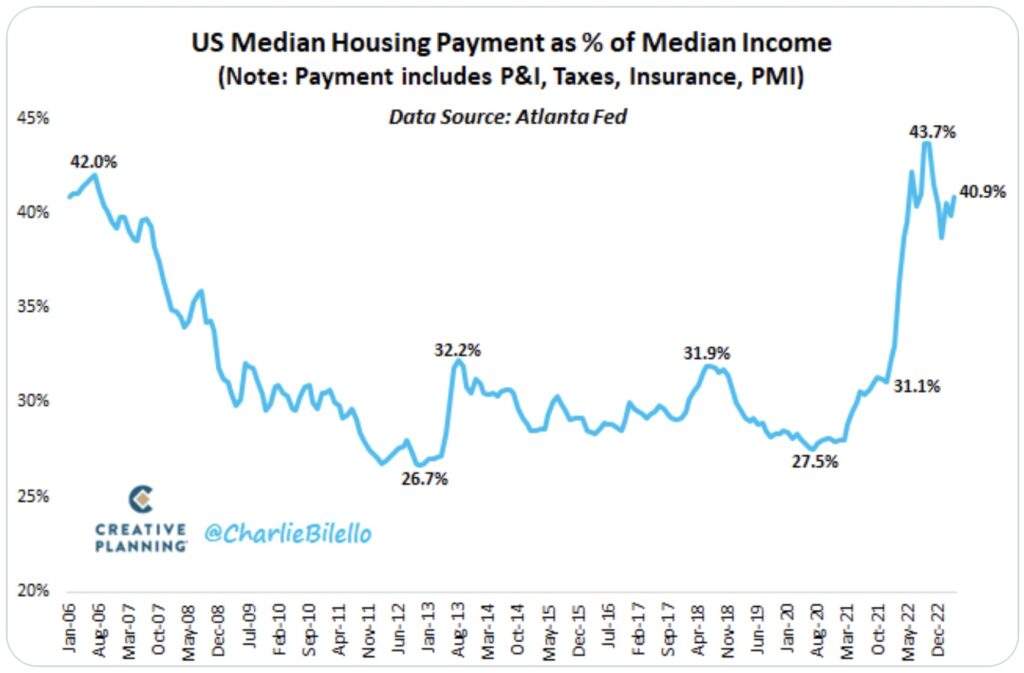

Charlie Bilello: The median American household would need to spend over 40% of their income to afford the median priced home for sale today, up from 28% three years ago.

It’s Not “Different This Time”

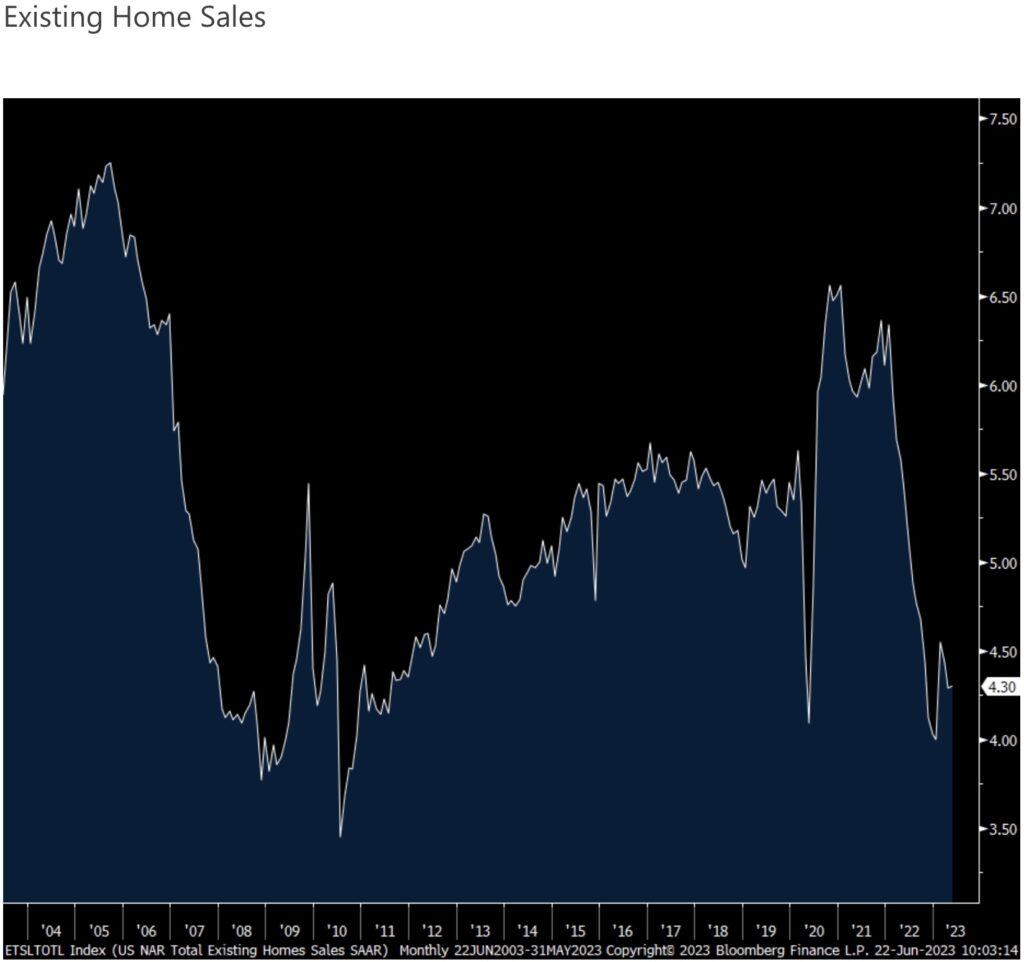

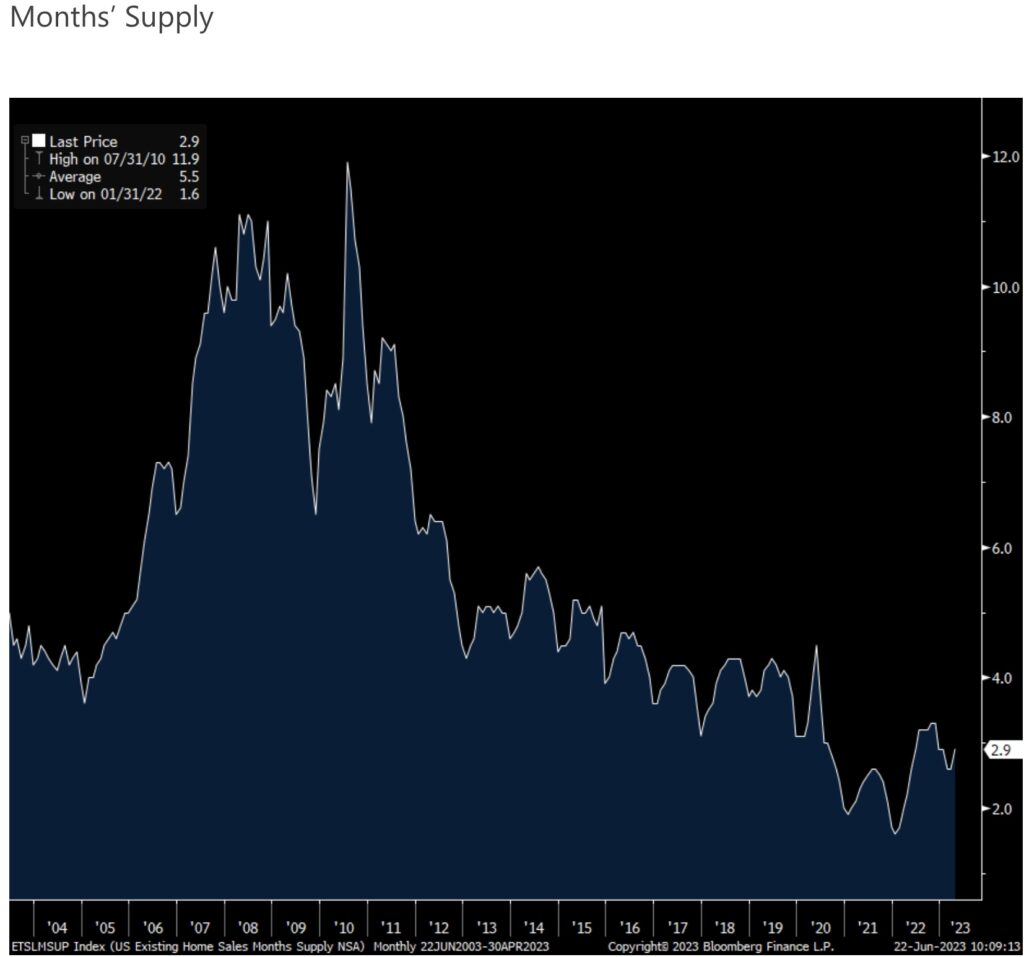

Peter Boockvar: Existing home sales in May totaled 4.3mm annualized, 50k more than expected and compares with 4.29mm in April. For perspective, the average year to date is 4.31mm and which compares with 5.08mm in April.

MORE INVENTORY AND LESS SALES:

High Home Prices Cannot Be Sustained

While still light relative to history, months supply ticked up to 3.0 from 2.9. That’s the most since last November and compares with 2.6 in May 2022 and the 20 yr average of 5.5 months.

The y/o/y price change was down 3.1% and that’s the 3rd month in a row of y/o/y declines. Sequentially though, the median home price rose to the most expensive since last July, helped too by mix.

First time buyers made up 28% of purchases vs 29% in April and 28% in March. All cash buyers slowed to 15% from 17% in the two prior months…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Bottom Line

Bottom line, the story remains the same here. Little inventory is leading to greater demand for something new and bidding wars for those homes that already exist even with high prices and after a doubling of mortgage rates. Listening to the big home builders and they sound so sanguine about good demand for their product and somehow consumers are getting used to higher rates. KB Home in particular last night said “With respect to demand, buyers are adjusting to the higher mortgage rates and the continuation of a more stable rate environment is a positive factor.” I’ll have to push back and say that buyers are only reluctantly ‘adjusting’ and doing so kicking and screaming because they feel they have no choice and maybe even KB acknowledges this because they then said “with the lack of resell inventory and market price is now starting to increase, buyers are demonstrating a higher sense of urgency than we saw earlier this year.” So buyers are chasing because of little choices available with existing homes. Not a healthy situation, especially with so many ‘trapped’ in low mortgage rate financed homes.

Why Rates Ticked Higher Today

Separately, Michelle Bowman a Fed governor, is one of the dots that wants to hike again and Treasury yields are at the highs of the day in response to her comments. The 2 yr is now at 4.76%. “I expect that we will need to increase the federal funds rate further to achieve a sufficiently restrictive stance of monetary policy to meaningfully and durably bring inflation down” she said.

ALSO JUST RELEASED: Look At What They Are Dumping To Buy Dips In Gold, Plus More Inflation On The Way CLICK HERE.

ALSO JUST RELEASED: Focused On Major Gold & Silver Bottom As Putin Declares “Beginning Of The End” For US Dollar CLICK HERE.

ALSO JUST RELEASED: THE FUTURE: Human Flesh For Fantasy And The Rise Of AI CLICK HERE.

ALSO JUST RELEASED: Crude Oil Will Soar To At Least $250-$350 And The “Perfect Gold Storm Surge” Will Skyrocket To $10,000-$15,000 CLICK HERE.

ALSO JUST RELEASED: Ignore The Gold & Silver Takedown And Look At These Surprises CLICK HERE.

ALSO JUST RELEASED: Peak Cheap Gold And A World In Chaos CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.