Here is a look at gold, silver, the US dollar, euro inflation and oil.

June 10 (King World News) – Peter Boockvar: In response to the parliamentary election results in the EU, the French CAC index is getting hit the hardest, down about 2%, though there is weakness across the board, as Macron in response is calling for an early parliamentary election in France (first round June 30, 2nd round July 7) where the results could influence his ability to get things done. The next presidential election in France is not until 2027.

As for the overall election results, there was a reason why some in the UK were happy to leave the EU and that was to avoid the bureaucratic rule making of the EU parliament. Sovereign bond yields are higher by 5-10 bps and the euro is falling to the lowest level since early May vs the US dollar.

Higher European yields though followed a jump in JGB yields and US rates are following. I don’t expect immediate notable economic consequences from the election results though with European Commission President Ursula von der Leyen likely getting a 2nd term. The BoJ meets this week.

With container shipping rates continuing to spike as seen last week, the switch by some to air is resulting in continuing gains in air cargo rates. On Friday the WorldACD Market Data said “Rate surge continues throughout May from Middle East & South Asia (MESA)…Amid continuing strong demand, and disruptions to ocean freight services caused by the attacks on container shipping, average air cargo rates in May of US $2.78 per kilo from MESA to worldwide destinations were up 47% y/o/y with tonnages up 17% higher, based on the more than 450,000 weekly transactions covered by WorldACD’s data. And from MESA origins to Europe, May’s average spot rate of around $3.35 per kilo was more than double the level in May last year, with the average spot rate in week 22 (27 May to 2 June) up by 128% y/o/y.” https://www.worldacd.com/trend-reports/weekly/worldacd-weekly-air-cargo-trends-week-22/

I’ll reiterate my belief again that after the inflation spike and inflation slow down, we are not just magically coming down to around 2% and staying there. Inflation volatility is here and will be for a while…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

We also saw the Manheim wholesale used car index Friday and it showed a seasonally adjusted .6% drop with prices down 12% y/o/y. They said “While declines in used vehicle values overall were a bit muted in the first half of May, they picked up in the latter half of the month. It’s seasonally normal to get some weakening in the market over the Memorial Day weekend; but this month, we experienced a little more softening in the final week. As we move into summer, used retail days’ supply remains lower than last year, which could bring in more buyers at Manheim in coming weeks.”

The housing affordability crunch was clearly evident in the May Fannie Mae Home Purchase Sentiment Index which fell 2.5 pts m/o/m “as the component measuring consumer attitudes toward homebuying conditions fell markedly, reaching an all-time survey low.”

“This month, only 14% of consumers indicated that it’s a good time to buy a home, down from 20% last month, while the share believing it’s a good time to sell fell from 67% to 64%.”

The one positive that can be gleaned by the increase in those who say it’s a good time to sell is that maybe they actually put more homes on the market, adding needed supply to the market. As for buyers, “While many respondents expressed optimism at the beginning of the year that mortgage rates would decline, that simply hasn’t happened, and current sentiment reflects pent-up frustration with the overall lack of purchase affordability.”

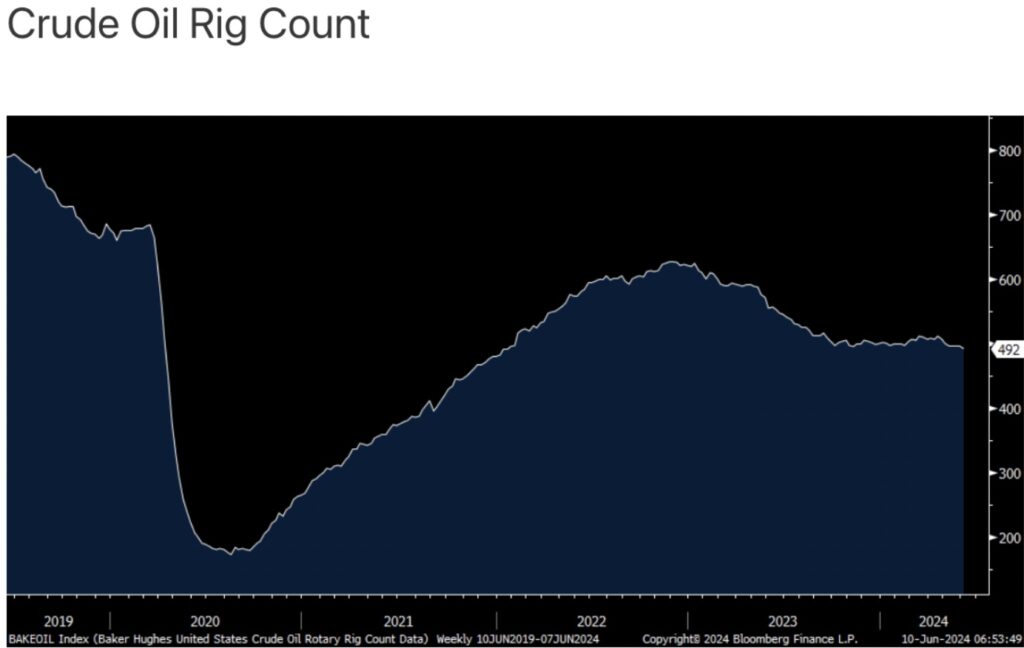

In response to the drop in oil prices, the crude oil rig count broke to the lowest level since January 2022 for the week ended June 7 to 492 rigs. it was at 683 in mid March 2020 right before you know what.

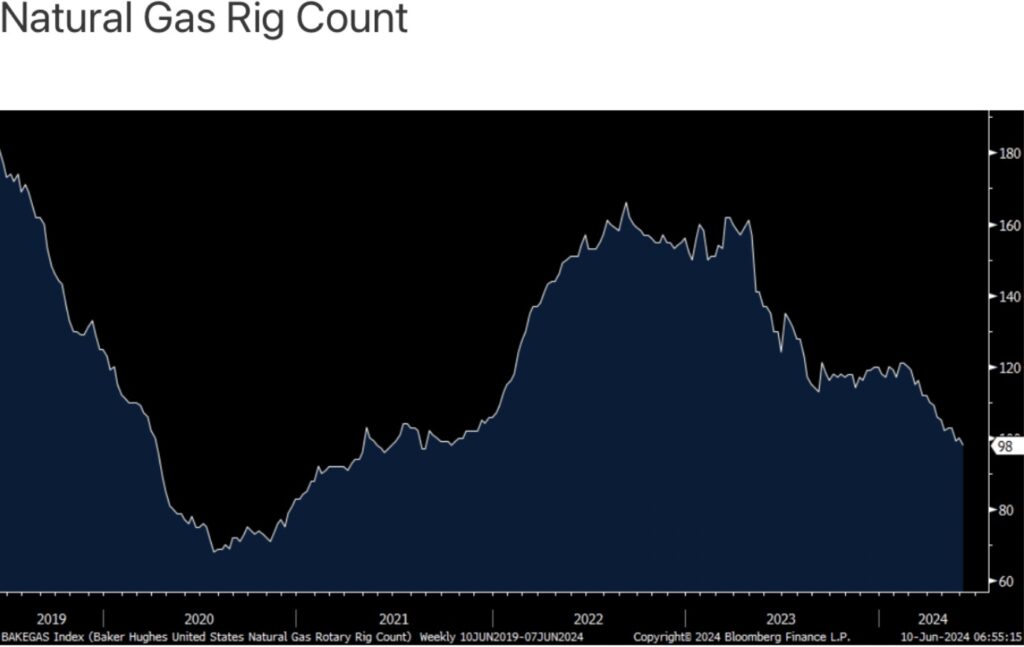

The rig count for natural gas fell 2 rigs w/o/w to just 98. That was a level last seen in October 2021.

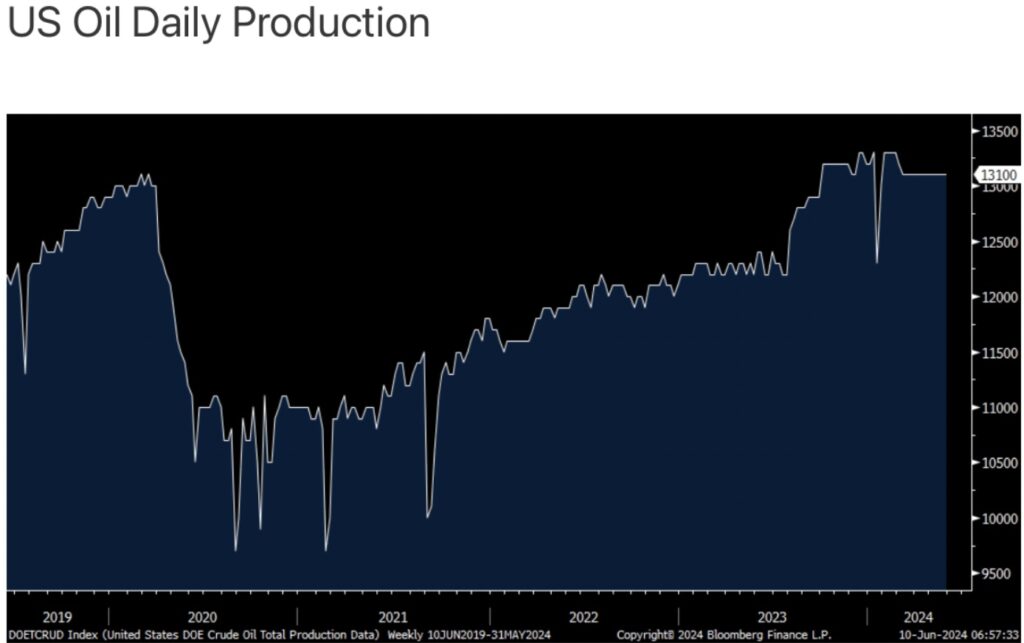

We remain long and bullish oil and gas stocks as it looks like US oil production is topping out, for now, at around 13mm barrels per day.

And natural gas still has tremendous demand side drivers with a lot of potential asymmetry in pricing to the upside.

What Does All Of This Mean?

King World News note: The US has been orchestrating lower oil prices ahead of the coming election in November. The current administration wants to see rates lowered, and for inflation to recede ahead of the election. There is another side of this which is the oil production nations have made it quite clear that they are extremely uncomfortable with an oil price anywhere below $80. So we will have to keep an eye on how OPEC+ reacts in the coming months.

When it comes to the US dollar, the long-term charts remain bullish at this point in time. Regardless, gold and silver are now in phase III of their respective bull markets. It will be wildly volatile at times, but the overall trend will be decisively to the upside and culminate in a mania. The same is true for the high-quality mining and exploration stocks.

Friday’s Gold & Silver Takedown

To listen to James Turk discuss Friday’s orchestrated $82.50 takedown in the gold market and $2.20 in silver CLICK HERE OR ON THE IMAGE BELOW.

Friday’s Gold & Silver Takedown

To listen to Alasdair Macleod discuss Friday’s orchestrated gold and silver takedown as well as what the Chinese are up to and more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.