Today the man who remarkably predicted the collapse of the euro against the Swiss franc warned King World News that we are now heading into the next round of global crisis and total chaos but he also cautioned that there's a nightmarish twist.

Egon von Greyerz: “Eric, the confiscation of money from savers and investors is continuing at an alarming rate. The latest proposal now in Australia is to tax bank deposits. But it won’t stop at that because as desperate governments worldwide increase their deficits and financing requirements, they will announce even more draconian measures against savers….

Continue reading the Egon von Greyerz interview below…

Advertisement

To hear which company investors & institutions around the globe are flocking to

that has one of the best gold & silver purchase & storage platforms

in the world click on the logo:

“I expect governments in the U.S., Europe and Japan, to force savers to invest in government bonds. It will be the same with pension funds and insurance companies. Any surplus within the financial system will be used to finance ever-increasing government debt issuance.

So not only will we see a tax on savings, but also compulsory buying of government debt. This is, of course, on top of the total absence of yield on government debt today. Savers are being totally punished and should now seriously think about Mark Twain’s words when he said, ‘I’m more concerned about the return of my money than the return on my money.’

As it looks now, Eric, there will be no return or yield on savings, but it is also unlikely that savers will receive their money back at all. Either governments will print unlimited amounts of money in their futile attempts to save their economies, or the banks will not survive. So, sadly, to keep savings in a bank is extremely risky today, especially since there is not likely to be a return of the money or a return on the money. This is, of course, why it’s so important to own gold outside of the banking system.

Currently in Europe there is now 3 trillion euros of debt with negative yields. This doesn’t just penalize savers, but it’s also a disaster for insurers and pension funds. With these rates they will have major deficits, which will lead to unfunded or underfunded pensions, and eventually to insolvent pension funds and insurance companies.

Savers Being Robbed

In the meantime the banks benefit from borrowing money at zero or even negative interest rates. In the $15 trillion U.S. banking system, interest costs have gone from $500 billion to $50 billion. This is a reduction of $450 billion in interest outlays, which has robbed savers of any return. This also means that their income and spending power has also been reduced by that amount.

So, Eric, neither negative interest rates or money printing is having any positive effect on the world economy. Most economic figures worldwide are now below expectations. I firmly believe that many major countries will have negative GDP growth in 2015, including the United States.

What Ammunition Do Central Banks Have Left?

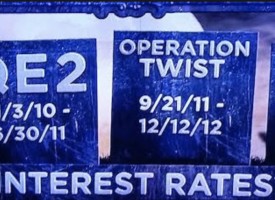

So what ammunition do central banks have left? There is only more money printing and it’s absolutely certain that we will see that in 2015, including in the United States. With sluggish growth and poor economic figures in the U.S., I do not see any chance of higher rates.

Financial markets, in particular stocks, have been the main beneficiaries of all this money printing. In addition, companies in the S&P 500 have spent $2 trillion since 2009 to buy back their own stock. This has created an even bigger bubble in the stock market.

In 2007 global equity markets were $60 trillion, but then plunged to $25 trillion. Today global markets have surged over 3-times that figure and are now at $80 trillion. So when people say, ‘We have no inflation,’ they are wrong. We have seen the most massive asset inflation in the last 6-years. This has been asset inflation of hyperinflationary proportions. As governments print more money and currencies accelerate to the downside, we will see hyperinflation in the general economy also.

Eric, currently I see very interesting situations in markets. I believe that the temporary dollar rise we have been seeing is now reversing and that the dollar will start a major and sustained fall. This is, of course, the mirror image of gold and silver, which will soon start a historic rise as they resume their climb to new all-time highs.

Investors Must Be Prepared For Coming Global Financial Destruction

This uptrend has already started in most other currencies, except the dollar. But gold and silver will now also go up against the dollar. Stock markets will also soon start a major secular bear trend. These massive changes in market trends will be triggered by a catalyst. With the current state of the world economy, there is an abundance of potential catalysts or black swans, whether it’s economic, financial or geopolitical. The key thing is that investors must be prepared ahead of this coming global financial destruction.”

© 2015 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the blog page is permitted and encouraged.

The audio interviews with Rick Rule, Dr. Paul Craig Roberts, Bill Fleckenstein, Dr. Philippa Malmgren, Egon von Greyerz, Eric Sprott, Robert Arnott, Gerald Celente, Michael Pento, David Stockman, Marc Faber, Felix Zulauf, Andrew Maguire, John Mauldin, Lord Christopher Monckton, John Embry and Rick Santelli are available now. Other recent KWN interviews include Jim Grant — to listen CLICK HERE.