China’s Shanghai Exchange is the reason the price of silver soared and gold surged today.

By Bill Fleckenstein President Of Fleckenstein Capital

April 19 (King World News) – Overnight Asia recouped what it lost Sunday night and Europe was about 1% higher, with the SPOOs gaining about 0.3%. That despite IBM declining on a horrible quarter, which was described as a “beat” for the benefit of the fools who only read headlines, when approximately $1 of its earnings (roughly half) was due to a tax rate change. Quarterly revenues are now back to where they were about 14 years ago. Gee, really great quarter, guys! The market wasn’t fooled, however, and the share price dropped 5% after hours and was 2% weaker still today…

To hear which company Eric Sprott, James Turk and George Soros invested in that is advancing the digital payments revolution and makes it possible for you to

spend gold with a prepaid-card globally click on the logo:

Netflix lost 9% overnight, and dropped about 5% more today, while biotech high-flier Illumina gave up 20% after stumbling at the game of beat-the-number. Meanwhile, in the supposedly bulletproof chip sector, Rambus fell 10% and, just to round out the trading, Goldman Sachs reported its worst quarter in about 12 years, although it did manage to rally.

One Last “Peak” In the Mirror

Though the S&P and the Dow were immune to the negative corporate news through about midday, with a rally of about 0.4%, the Nasdaq was a bit weaker. Thus, the jury is still out regarding just how macho the stock bulls are going to be. I continue to think that bad news has not been discounted, but the bullish psychology is so entrenched folks not only believe that it has been, but that we’ve started a new bull market.

However, the earnings reports between now and Apple on Monday might put a dent in that, and as far as my trading idea that stocks are vulnerable to the downside, the action of individual companies that have reported makes me fairly confident, but I have to say that the way the averages trade leads to the opposite conclusion. However, I have been to enough of these drunken stock orgies in the last 20 years to realize that, by definition, markets look the best at their peak.

In the afternoon, the “rally” stalled and by day’s end the Dow/S&P were up 0.3% while the Nasdaq lost 0.4%. Away from stocks, green paper was weaker while oil rallied 3%. Oil is now back approximately to where it was before the failed OPEC meeting, though that doesn’t mean it is headed dramatically higher. It may just mean it is trading around the “right price” for now. Fixed income was lower and the metals exploded.

High Ho, Silver

High Ho, Silver

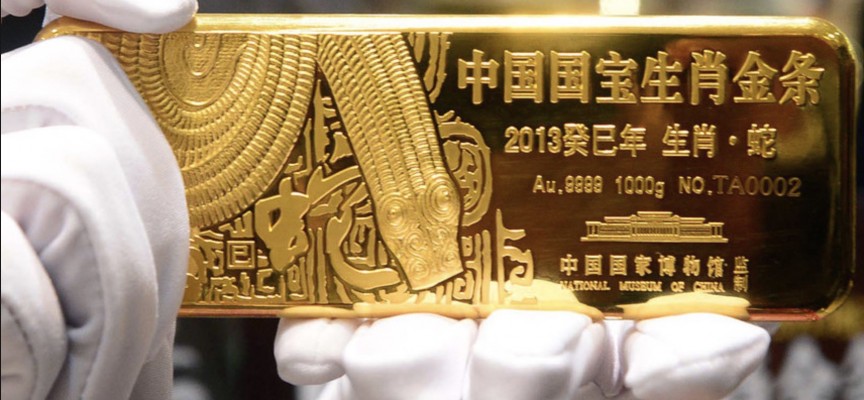

Since right around St. Patrick’s Day (March 17), I’ve been noting that silver seemed like it was ready to get on its horse and go, and today it really broke out and started to gallop higher, gaining almost 5%. Gold leapt about 1.5% as well. The proximate cause in my opinion was the fact that last night the Shanghai Exchange officially began trading gold. I’d had a hunch that we could possibly see the metals take off when that happened and that has in fact occurred. The move in the metals precipitated a rather large gain in the miners as well.

Included below are three questions and answers from the Q&A’s with Bill Fleckenstein.

Bonus Q&A

Question: Bill: Sitting tight on my miners after a long wait for this move. Expecting some jiggles but will use those to selectively add. Thanks for the steady advice. My question is about agricultural commodities like corn, beans, coffee. They have leaked for years now (in many cases) and wonder what you might think of them as a low/no leverage long here for someone who feels as you do that equities and bonds are mis-priced. Inflation is real and it doesn’t feel like abnormal Chinese demand distorted ag the way it did base metals.

Answer from Fleck: “Yes, I think the agriculture commodities are starting to turn higher.”

Question: Hello sir, I’ve noticed how you’ve been saying silver is about to break out the past few weeks and I feel the same way but I couldnt really describe it with any catalysts nor supported by any fundamental drivers so I was wondering if you could perhaps articulate your sixth sense/gut feeling on this variable which seems to be playing out in the silver market nowadays-hoping we’re both correct! Thanks for all you do.

Answer from Fleck: Nothing special, just watching the way it traded and my gut feeling… Just felt to me like it was getting ready to put on track shoes. 🙂

Question: Hi Bill: Regarding these words from a Rap last week —

“The Quick Silver Fox Jumped Over the Yellow Dog…It has become quite clear in the last week or so that silver is stronger versus gold and it continues to feel to me like it is going to make a pretty substantial move pretty soon.”

First of all, thank you and nice call -:)

Secondly – for us trader types, got any primary and secondary targets for this current move? $18 up to 21.50?

Answer from Fleck: “I have felt that it could be $18-19 fairly quickly, past that I just think it will go up faster than gold, but the corrections will still be brutal. I have no upside price targets, this is just a delusional exercise when it comes to precious metals.”

***To subscribe to Bill Fleckenstein’s fascinating Daily Thoughts CLICK HERE.

***KWN has now released the extraordinary audio interview with Nomi Prins, where she discusses the implosion of the global financial system, what investors can do with their own money and their actions to protect themselves from the coming carnage, and you listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

© 2015 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.