Bullion banks have been covering shorts in the gold market on the latest takedown, plus a look at silver and mining stocks.

Gold

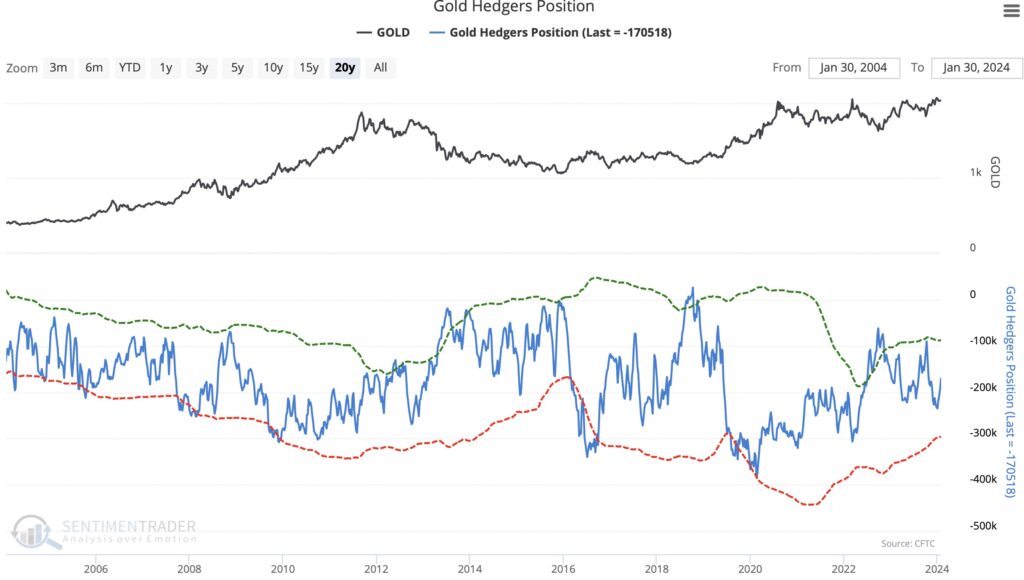

February 5 (King World News) – King World News note: Below you can see the latest report showing bullion banks and commercial traders have reduced their net short positions in the gold market:

20 Year Chart Shows Commercials Covering

Gold Short Positions On The Latest

Takedown In The Gold Market

Silver

Below is a look at how bullion banks and commercial traders have been positioned in the silver market for the past 20 years. There is no question the setup in the silver market is bullish at this point from a historic perspective.

20 Year Chart Shows Commercial Traders

Positioned In A Very Bullish Manner

From A Historic Perspective

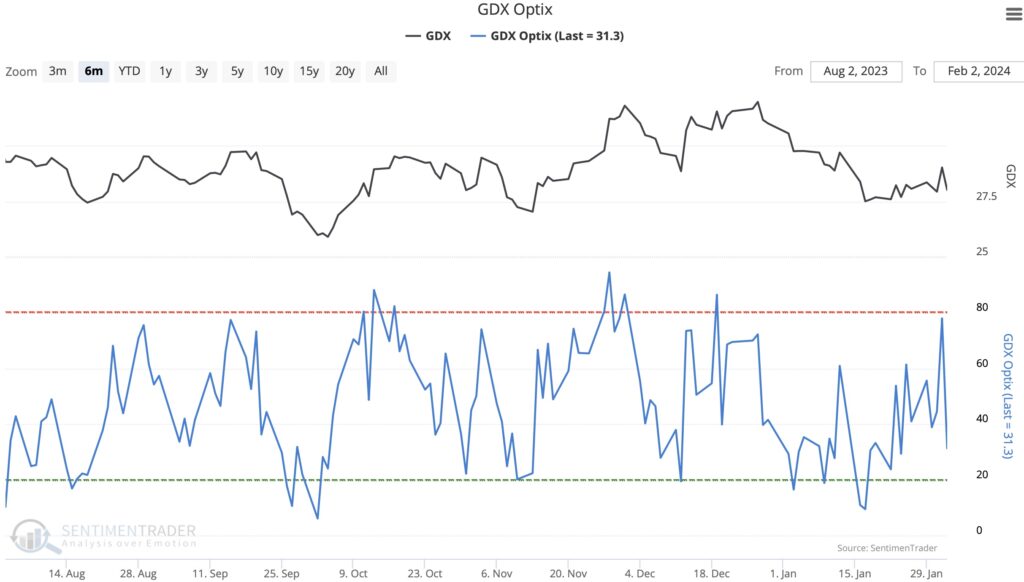

Crash In Sentiment Towards Mining Stocks

Below is a look at how sentiment in the GDX Mining Stock Index has crashed.

CAPITULATION:

Sentiment Toward Mining Stocks Crashed

For those who dollar cost average their purchases in physical gold and silver, remain disciplined and continue purchasing at the same time monthly or quarterly. Do not get cute and try to time these markets. But for those who are looking to accumulate physical silver for the first time at cheap prices or simply want to add to their existing hoard, right now and on any further weakness it is a good idea to be extremely aggressive in accumulating physical silver, even though it is possible the price may go a bit lower.

To listen to James Turk discuss what he expects to see from the metals markets short and long term as well as the mining share markets click here or on the image below.

Alasdair Macleod’s audio interview has just been released click here or on the image below!

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.