If you are worried about the recent plunge in gold and mining stocks just read this…

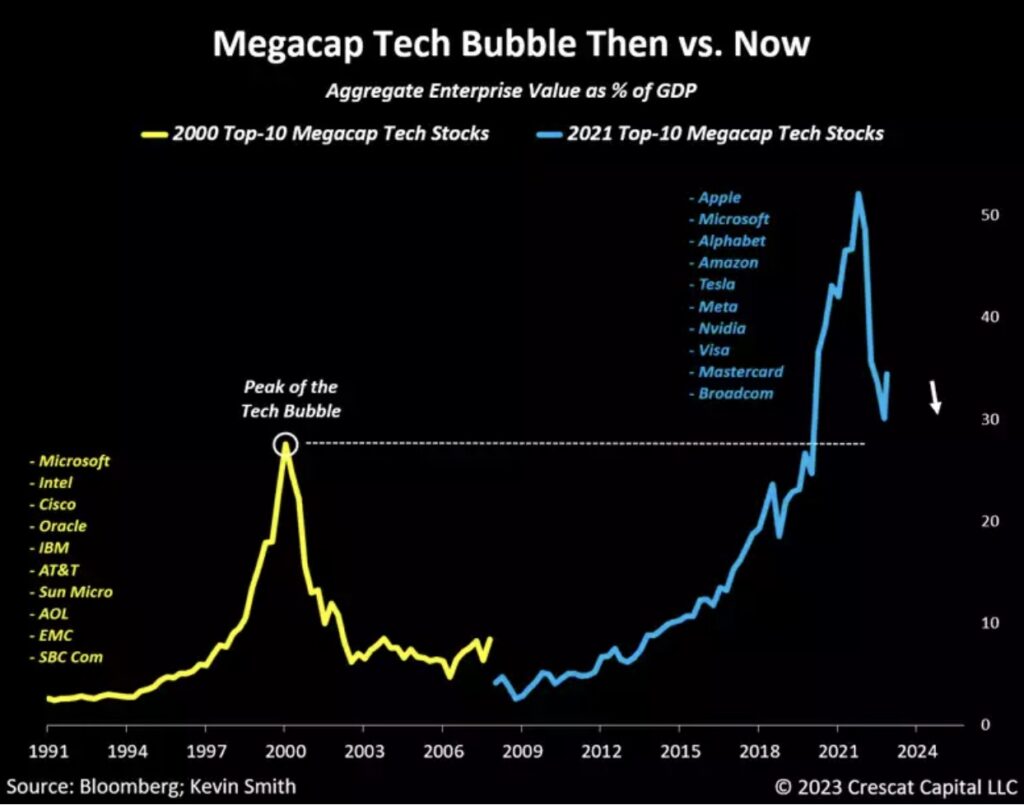

Megacap Tech Still in a Bubble

February 28 (King World News) – Otavio Costa: Valuations for the top-ten megacap tech stocks are still higher than they were for their comps at the peak of the tech bubble. Enterprise Value to GDP is the relevant measure here because once the underlying fundamentals for a group of companies have grown so large relative to the economy, as it has for these firms, then collectively, these companies can no longer grow any faster than the economy at large. They essentially are the economy. And when the fundamentals for these businesses start to turn negative yet these enterprises are still valued as if they will grow many times faster than GDP, then it is a mania whose unwinding can lead the entire economy into a recession.

Commodities’ Supply Cycle

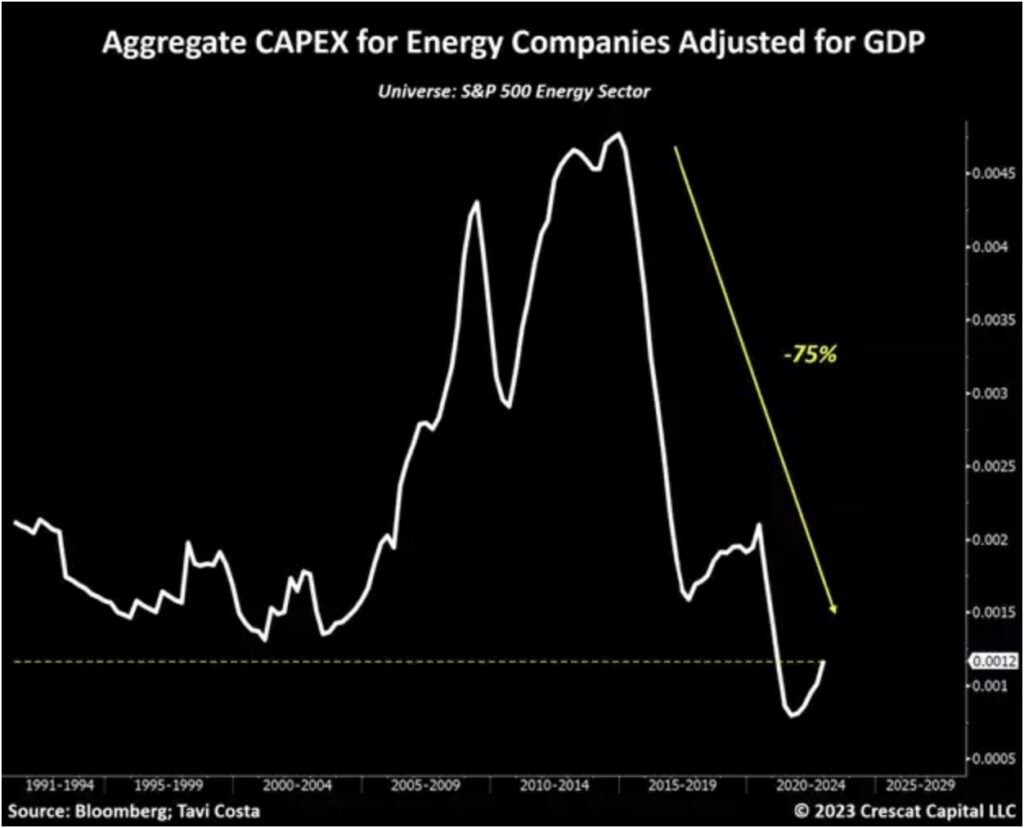

As we have written extensively in our prior letters, the potential for an early-stage wage-price spiral is not our only concern from an inflationary perspective. The chronic period of under-investments among natural resource businesses is yet another critical factor.

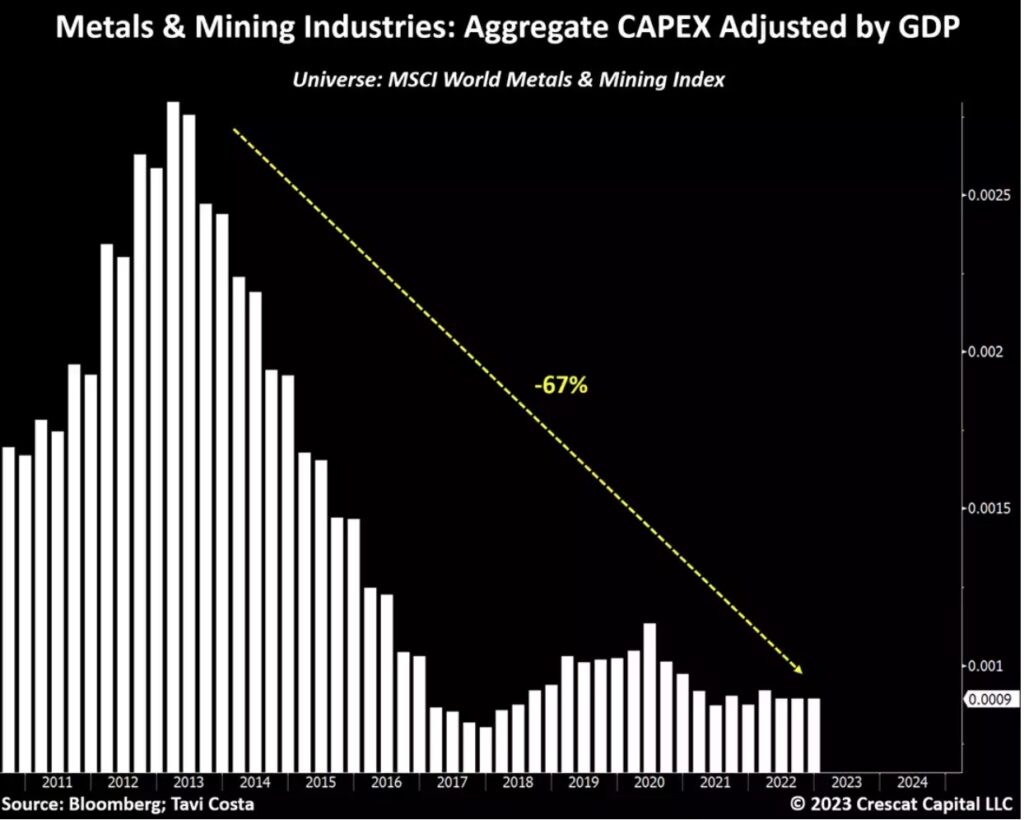

After adjusting for GDP levels, commodity producers are well over 50% below their prior peak in aggregate capital spending. The availability of raw materials follows the capital investment cycle for natural resource industries. However, despite the higher prices in most commodities, producers have severely lagged in their development cycle for bringing new assets into production. It is happening broadly across metals and mining, energy, and agriculture.

Aggregate CAPEX for energy companies adjusted for GDP levels is still below every other depressed level in the last 30-plus years. Current levels are over 75% lower than the prior peak.

This worldwide index of metals and mining companies also shows a nearly 70% decline in capital spending from 2013 levels.

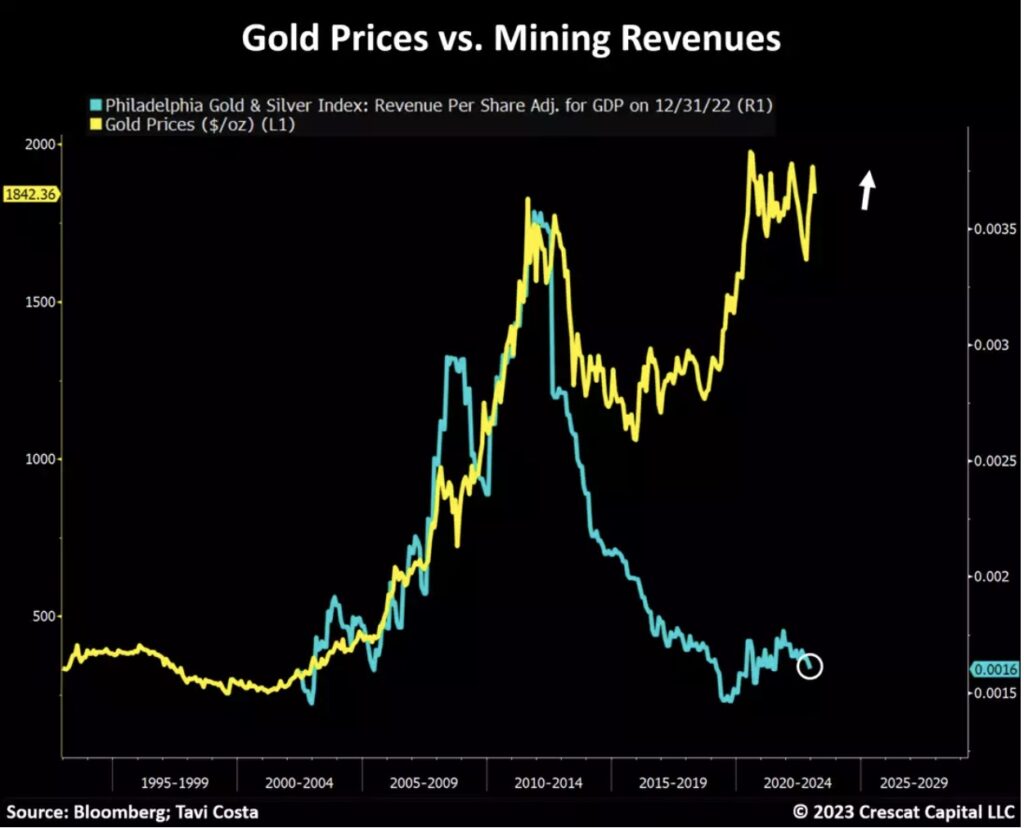

Mining Revenues Stalled While Gold Prices Are Near Record Levels

Gold miners have not been able to increase their revenues while the metal price remains near all-time highs. In short, this is mainly a function of declining industry-wide production, a key part of the macro investment case for gold. The large and mid-tier mining companies have underinvested in exploration as well as M&A, so both the quantity and quality of their reserves have deteriorated over the last decade.

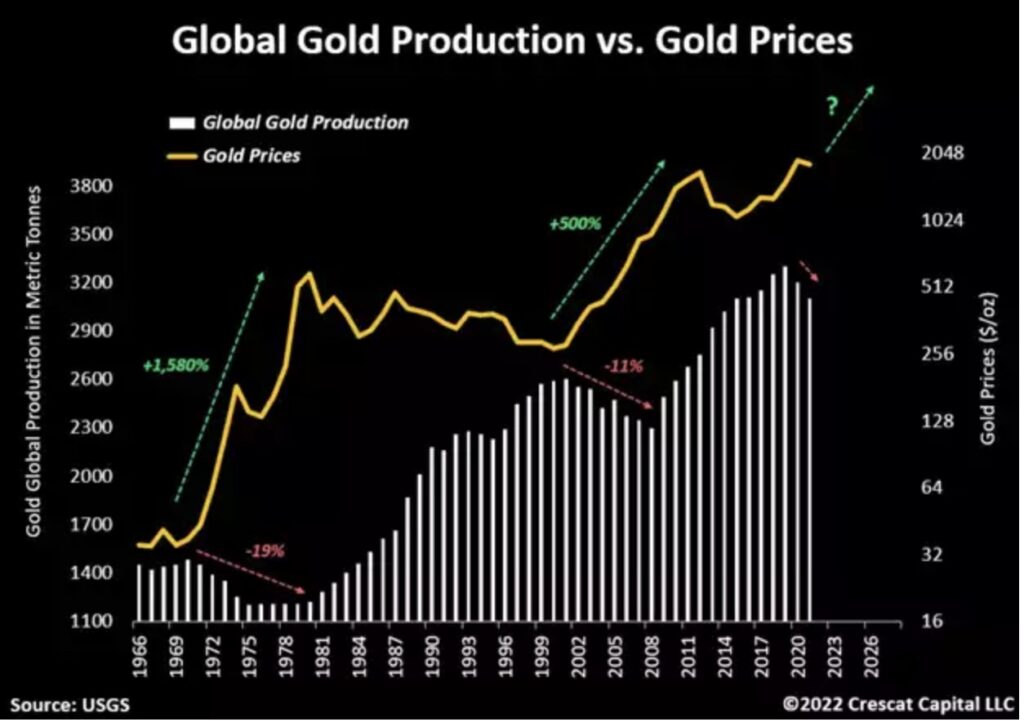

The Likely Beginning of Another Multi-Year Decline in Gold Production

The last two secular bull markets for gold happened on the back of multi-year declines in metal production. Today, this has been amplified by the shift toward battery metals as part of the Green Revolution.

To recall, the energy sector went through a similar issue over the last two years. As ESG mandates gained popularity, oil and gas companies became uninvestable for many capital allocators, especially larger institutions. Nonetheless, the energy sector still managed to have two of its best annual performances in 30 years. We believe a similar environment is setting the stage for gold and silver mining companies today…

This Is Now The Premier Gold Exploration Company In Quebec With Massive Upside Potential For Shareholders click here or on the image below.

Metals of all kinds are critical to electrification, for batteries, solar, wind, and electric grid which are all at the heart of the green energy transition. But there has been a major underinvestment across the entire hard-rock mining industry, a business where industrial and precious metals are byproducts of each other and where the ESG movement has unduly shunned the materials they need most for their own cause.

As investors, our focus remains mostly on where we believe we can create the most value which is by investing at an early stage in exploration assets with the goal of making big new metal discoveries that will be to generating both economic growth and inflation protection. The lack of industry-wide capital, investor attention, and experts with sufficient geologic expertise to navigate the early stages of the mining industry has created a major market inefficiency that Crescat has been exploiting opportunities to find large, scalable, and ultra-high-return potential precious and base metal projects. We believe the spoils will go to those with the ability to combine access to capital and foresight at this critical time with the most experienced and accomplished industry technical and operational experts in the industry. We are also intent on cultivating and attracting the best new talent amongst a much-diminished global graduation pool of geologists and mining engineers. Crescat has been building a portfolio of the most exciting growth mining businesses of the next decade, a portfolio of companies that we believe can and will deliver more new metal discoveries than all the majors combined. The objective is to create substantial wealth for our investors in the process.

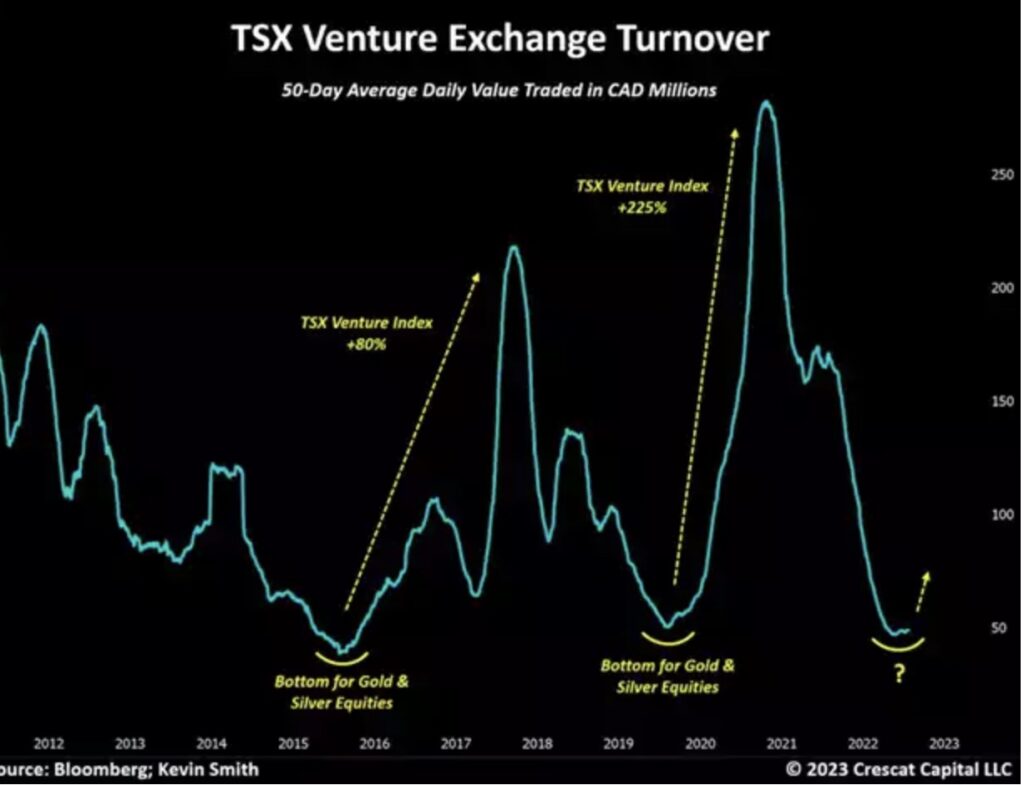

Low Volume Often Precedes Major Turns

The turnover volume for smaller mining companies remains incredibly depressed. As shown in the chart below, the 50-day average traded volume in the TSX Venture Exchange is currently re-testing its prior historical lows. Such levels of disinterest in the part of the industry have often marked major bottoms in share prices. We saw a similar scenario back in 2015 and 2019. In both periods, the TSX Venture index rallied massively over the next one to two years.

ALSO JUST RELEASED: US Stock Valuations Have Entered Dangerous “Death Zone”, Plus Latest Time We Saw This Gold Bottomed CLICK HERE.

ALSO JUST RELEASED: Greyerz – You Better Have Escape Plans For The Next Global Collapse CLICK HERE.

***To listen to Michael Oliver discuss what to expect for the stock and bond markets as well as the gold, silver and mining share markets CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.