Today the price of gold futures gold futures surged to $2,440, closing in on the recent all-time high.

July 29 (King World News) – James Turk: This week is going to be an important one, Eric, because several major markets are teetering on the edge.

Let’s start with the S&P 500. It has been hit hard over the past couple of weeks, particularly the big cap tech stocks that have been driving it higher for a long time. This recent weakness makes it look like equities have finally succumbed to the relentless pressure being applied by the Federal Reserve as it failed to lower interest rates at a pace that most people were expecting only a few months ago.

But ‘higher for longer’ interest rates have done little for the dollar. The Dollar Index peaked in September 2022, and since it’s low a year ago has done nothing more than complete a so-called ‘dead-cat bounce’. That action does not portend well for the dollar.

Take the weak Japanese yen out of the picture – which is 13% of this index – and the dollar looks even worse, as we saw last week as the yen rallied. Maybe the weak dollar is an indication that the market is expecting the Fed to lower interest rates on Wednesday, which is another reason this week is also going to be important.

Watch for two key events, the first being the FOMC announcement about interest rates. If it doesn’t do lower them on Wednesday, it probably won’t drop them at its September meeting because doing so could be seen as political interference in the approaching November election.

Then on Friday the CPI will be released. The Fed will have a good indication of what it looks like when deliberating whether to lower rates now, or wait until after the election.

I expect the Fed to drop rates 50 b.p. this week. The unanswerable question is how the markets will respond if they do.

If they don’t, I expect the ongoing liquidity tightening will not only rattle markets, but the banks too. They’re still trying to absorb the losses from portfolios with low interest rates in a high interest rate environment – which is the same problem that crashed Silicon Valley Bank.

This week is also important for the precious metals. Both of them were slammed last Thursday. While gold rallied back on Friday, silver did not. Its chart is revealing, and shows that silver too is on the edge.

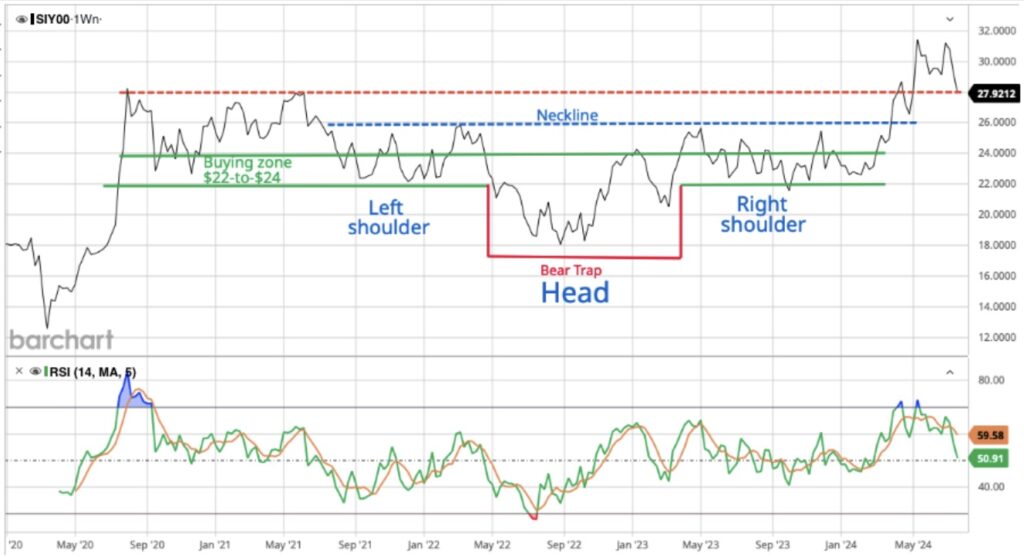

Silver’s Multi-Year Reverse Head & Shoulders Formation

The chart shows only the weekly closing price of spot silver in New York. Daily highs/lows and closes during the week are eliminated, which is very useful because it eliminates the noise. It removes from the picture the day traders, scalpers, and others unwilling to hold a position over the weekend – in other words, weak hands.

King World News readers are familiar with this chart, and will recall how I have emphasised that $28 is the support level for silver, not $30. Breaking below $30 has significantly changed sentiment in silver by discouraging a lot of people who thought $30 would hold. It didn’t, and now $28 is being tested.

Although silver is not oversold, and could of course head lower, it is important that $28 hold. Whether this level will be tested for just days or even weeks is unknowable, but the first step is for silver to close this week at $28 or above.

The events of this week and the response of the various markets themselves may set the trend for prices for months to come, Eric, or at least until the November election.

Just Released!

To listen to Alasdair Macleod discuss the volatile trading in the gold and silver markets click here or on the image below.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.