Inflation remains a big problem as Fed rate cut projections tumble and yields on the US 10-Year Treasury surge. May test 5% again this year.

Inflation Remains A Big Problem

February 13 (King World News) – Peter Boockvar: Both headline and core saw one tenth greater than expected prints for January, up .3% and .4% m/o/m. The y/o/y gains were 2 tenths above the estimates at up 3.1% and 3.9% respectively vs 3.4% and 3.9% in the month prior.

Energy And Services Inflation

Energy prices were lower by .9% m/o/m and 4.6% y/o/y, partly offset by a .4% m/o/m and 2.6% rise in food prices. Eating out of home remains expensive with full service meal prices up .4% m/o/m and 4.3% y/o/y while more quick service prices are higher by .6% m/o/m and 5.8% y/o/y.

Services prices ex energy jumped by .7% m/o/m and 5.4% y/o/y. Rent of Primary Residence saw prices up .4% m/o/m and 6.1% y/o/y while OER was higher by .6% m/o/m and 6.2% y/o/y. Both are well above current reality but it was well below when rental prices were spiking over the past few years. Medical care costs are now really jumping, in part because of the more realistic health insurance calculations (up 1.4% m/o/m and have been rising 1%+ each month since late last year). They rose .5% m/o/m vs .4% in December and .5% in November. Price gains for auto insurance are out of control, spiking by another 1.4% in January alone after a 1.7% increase in the month before and are up 20.6% y/o/y. Fixing your car is pricey too, rising .8% m/o/m and 6.5% y/o/y. Travel got expensive again as hotel prices jumped 2.4% in January after a one tenth rise last month. They are up a more modest .6% y/o/y. Airline fares were higher by 1.4% m/o/m and a .9% increase in December, though down 6.4% y/o/y.

On the core goods side, prices fell .3% m/o/m and continues the disinflation seen in this category and they are lower by .3% y/o/y. Used car/truck prices fell a sharp 3.4% in the month and a key reason why. They are lower by 3.5% y/o/y. New car prices were unchanged vs December and up .7% y/o/y. Apparel prices fell .7% m/o/m and are flat y/o/y. Prices related to the home fell 1 tenth m/o/m and by 1.3% y/o/y. With the pace of existing home transactions at the lowest level in almost 30 years, there is obviously going to be less demand for carpet, paint, furniture, flooring, etc…

Bottom Line

Bottom line, the data is a reminder that while inflation is decelerating in its rate of change, a target of 2% is not a snap of the finger. Also, while we’ll see continued moderation in rental inflation, medical care costs are now accelerating (which is the biggest weight in PCE), particularly in health insurance. Wages are still running well above the pre Covid pace, the cost of insurance for everything is off the charts rising and eating at a restaurant continues to get more expensive. On the goods side, we’re back to the pre Covid pace of basically zero but with rising transportation costs and the possibility of a turn toward inventory restocking, maybe they curl up again. And lastly, oil is quietly at $77 again and the average gallon of gasoline is at the highest level since early December.

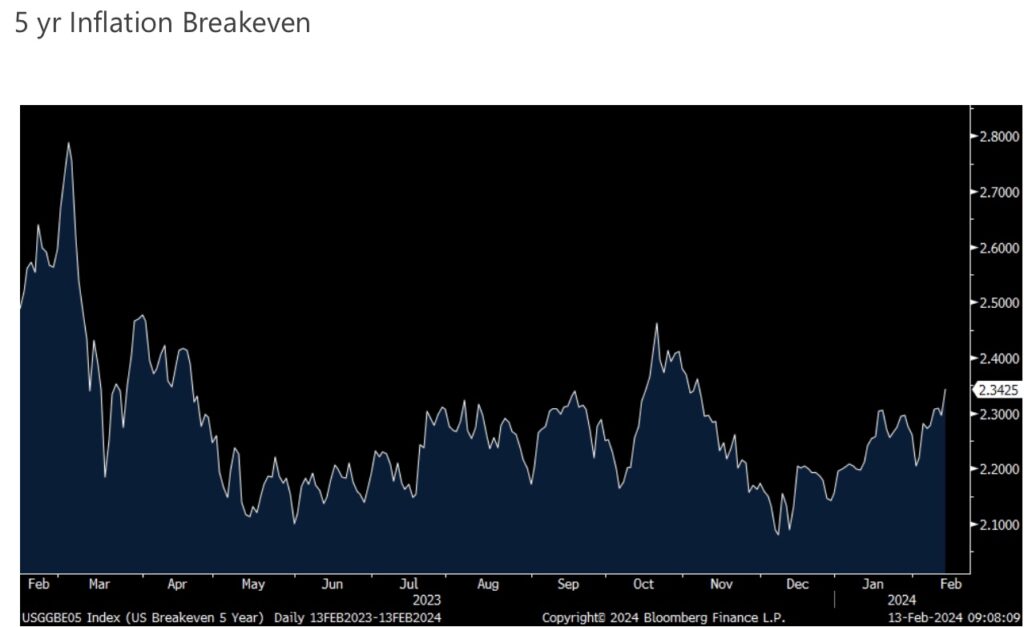

Treasuries are doing as should be expected, down sharply with yields jumping. The 10 yr yield is back to the highest level since late November. I remain bearish on duration and believe the 10 yr yield will retest 5% at some point this year. The 5 yr inflation breakeven is higher by 5 bps to 2.34%, the highest since early November.

Fed Rate Cut Projections Tumble

Finally, the December fed funds futures contract is yielding 4.485%, thus now only pricing in 3-4 cuts, down from 5-6 just a few weeks ago.

***To listen to Gerald Celente discuss why 2024 is going to be a wild year and what to expect from major markets CLICK HERE OR ON THE IMAGE BELOW.

***Alasdair Macleod’s audio interview was just released discussing the Chinese public buying close to all-time record amounts of physical gold. To listen to Alasdair Macleod discuss the near all-time record demand for gold and what this means for the price of gold in 2024 CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.