As we near the end of the first quarter of 2025, this is wild…

This Is Wild And It Will Impact The US Dollar

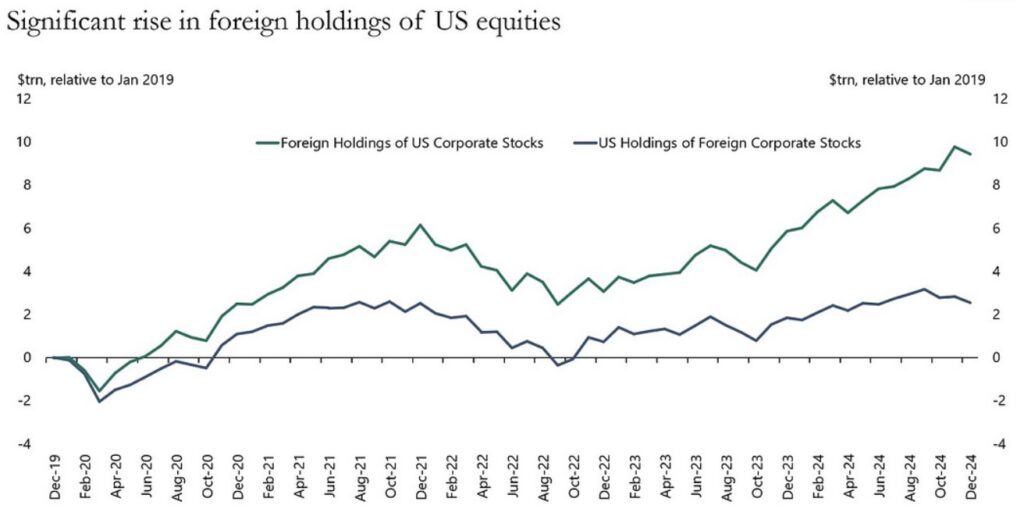

March 20 (King World News) – Peter Boockvar: I’ve argued over the past few months that the Mag 7 stocks became a reserve currency holding for foreign holders, including some central banks like the Norges Bank and the Swiss National Bank. My friend Torsten Slok posted this chart yesterday highlighting the extent to which foreigners own US stocks. I reiterate my belief expressed last month that the dominance of the AI tech/Mag 7 trade is over and also has possibly repercussions for the US dollar as foreign money finds opportunities elsewhere. Also, if the administration is successful in reducing the US trade deficit (whether a laudable goal or not), foreigners will have less money to reinvest in the US as they accumulate less dollars.

To use one example, as of 12/31 13F filings, the Norges Bank (Norway’s central bank) owned 105mm shares of Microsoft, 187mm shares of Apple, 324mm shares of Nvidia, 124mm shares of Amazon, 129mm shares of Alphabet, 34mm shares of Meta and almost 36mm shares of Tesla. The first six stocks mentioned here are their top six holdings. Tesla is 11.

With respect to Powell’s presser, it’s obvious they are in wait and see mode and he believes that they are not in a hurry to cut rates again, notwithstanding the dot plot refresh sticking to 2 cuts this year (though rounding it is slightly less than December plot). That said, the easing bias is clearly still there as he thinks they are still with restrictive policy and he used the T word again, transitory. On the slashing of Treasury QT to just $5b per month from $25b previously which was already cut, he was not very clear with his answers to questions on it. Initially it was thought to be in response to the debt ceiling and possible issues with it that once resolved, QT would increase again but yesterday he said it was more related to some tightness in money markets which he didn’t specify nor elaborate on and thus will be kept at this new pace.

Alexandra Harris at Bloomberg wrote a piece after the meeting yesterday titled “There are Inconsistencies in Fed’s Balance-Sheet Communication.” While Powell cited money market issues, she said “While there has been some upward pressure on repo rates around Treasury auction settlement days, and month and quarter end periods, funding markets have been relatively tame. Even the New York Fed’s newest indicator, Reserve Demand Elasticity, or RDE – a real time assessment of the abundance of US bank reserves – is little changed.” She also quotes Roberto Perli, “who oversees the central bank’s portfolio of securities” and who said “in remarks on March 5 that ‘signals from the repo market suggest no cause of concern.’ “

Something unusual here on the QT cut I believe. Chris Waller, why did you dissent? Scott Bessent, is this your way of getting help from Jay Powell in keeping long rates tame?

Either way on QT, he made it a point to say there should be no signals taken from this as they will just stretch out the time period of QT to get to the same place but that’s not how markets react as Treasuries rallied and are again today.

Elsewhere…

Elsewhere with monetary policy, the BoE is expected to leave its bank rate unchanged at 4.5% at 8am est. The Swiss National Bank got a step closer to going back to negative rates as they took their rate to just .25% in its obsession of wanting to weaken its currency, down 25 bps. They said “With today’s rate adjustment, the SNB is ensuring that monetary conditions remain appropriate, given the low inflationary pressure and the heightened downside risks to inflation.” Maybe they’ll stop here though and not go back to NIRP (what I’ve referred to as the dumbest idea in the history of economics and monetary policy) at some point. The SNB president said “This rate cut has an expansionary impact. In that sense, the probability of additional policy easing is naturally lower.” In response, the Swiss franc is little changed vs the euro, the main cross the SNB should be focused on.

In contrast, the Brazilian central bank hiked its Selic Rate by 100 bps to 14.25% as expected. They might though slow the pace of hikes from here. They said “Given the persistent adverse conditions for inflation convergence, the high level of uncertainty, and the inherent lags in the ongoing tightening cycle, the committee anticipates, if the expected scenario is confirmed, a smaller adjustment at the next meeting.” Along with broader US dollar weakness, the Brazilian Real yesterday closed at the highest level vs the USD since last October. Lula’s poll ratings are in the toilet but unfortunately there is not another election until October 2026.

Taiwan’s central bank left its benchmark rate unchanged at 2.00% as expected as did the Riksbank at 2.25%.

A Bit Flabbergasted

One of my go to sources on trucking and transportation is Freightwaves. In light of the ongoing manufacturing recession and tariff reality, this was from a piece they wrote yesterday. “If there was a freight market bull at the annual meeting of the Truckload Carriers Association, that person was keeping pretty quiet. Conversations from the stage, at receptions and at meals had a consistent theme: Can you believe we’re still talking about this freight recession? In 2025? Didn’t we say at this meeting last year that things would be better by the end of 2024?” The article quoted a senior VP of equipment and government relations at Knight Swift who said “We had expected to see a recovery. We had expected things to turn by now. In fact, some of our businesses saw the signs of a meaningful recovery in December and January, and then things kind of turned after that…I think we’re all a little bit flabbergasted on how long this has lasted.” https://www.freightwaves.com/news/carriers-big-and-small-at-tca-wait-for-signs-of-freight-market-turnaround

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.