Here is the setup with the Dow at 34,000 and Nasdaq over 11,500.

A sudden surge in wants over needs

January 31 (King World News) – Jason Goepfert at SentimenTrader: A sudden surge in wants over needs.

Key points:

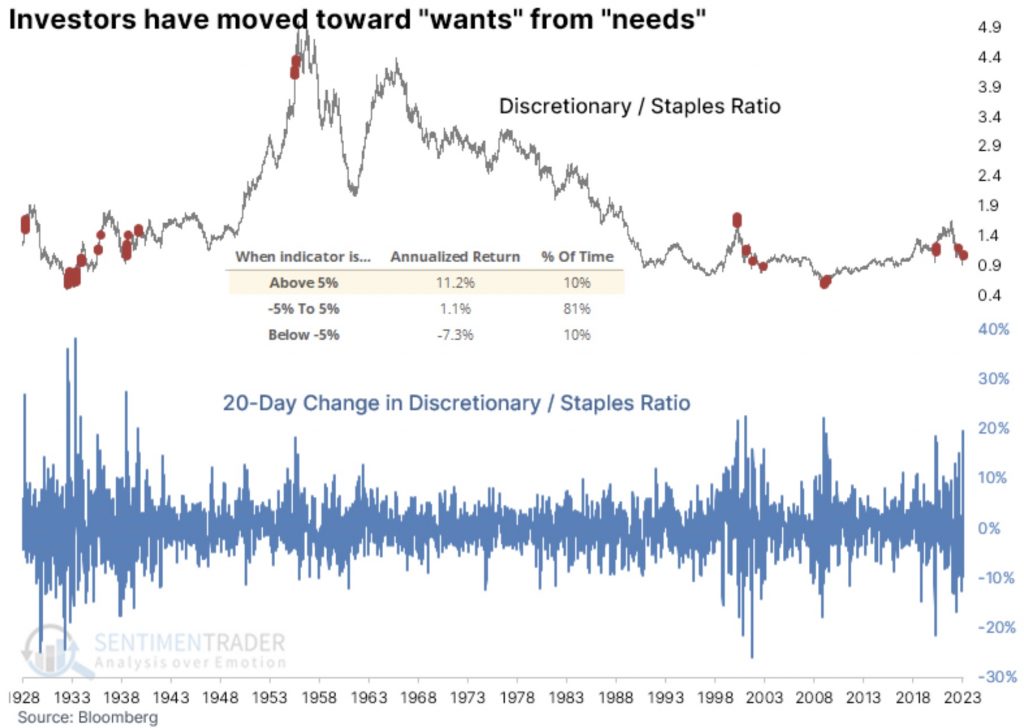

- Over the past month, Discretionary stocks have surged relative to Staples

- The quick about-face comes after a prolonged and severe decline in the ratio between the two

- When investors have suddenly switched back to “wants” from “needs,” it tended to precede gains

Investors have suddenly switched from needs to wants

There are many ways to gauge whether investors are in a risk-on versus risk-off mood. Increasingly, a quick and easy way has been to monitor the ratio between the Consumer Discretionary and Consumer Staples sectors…

ALERT:

Billionaire and mining legend Ross Beaty, Chairman of Pan American Silver, just spoke about what he expects to see in the gold and silver markets and also shared one of his top stock picks in the mining sector CLICK HERE OR ON THE IMAGE BELOW TO HEAR BEATY’S INTERVIEW.

Discretionary stocks primarily reflect companies that provide consumers with their wants, while Staples stocks are populated with firms supplying consumers’ needs. The more investors have a risk-on mentality, the more likely the ratio between those two sectors will rise.

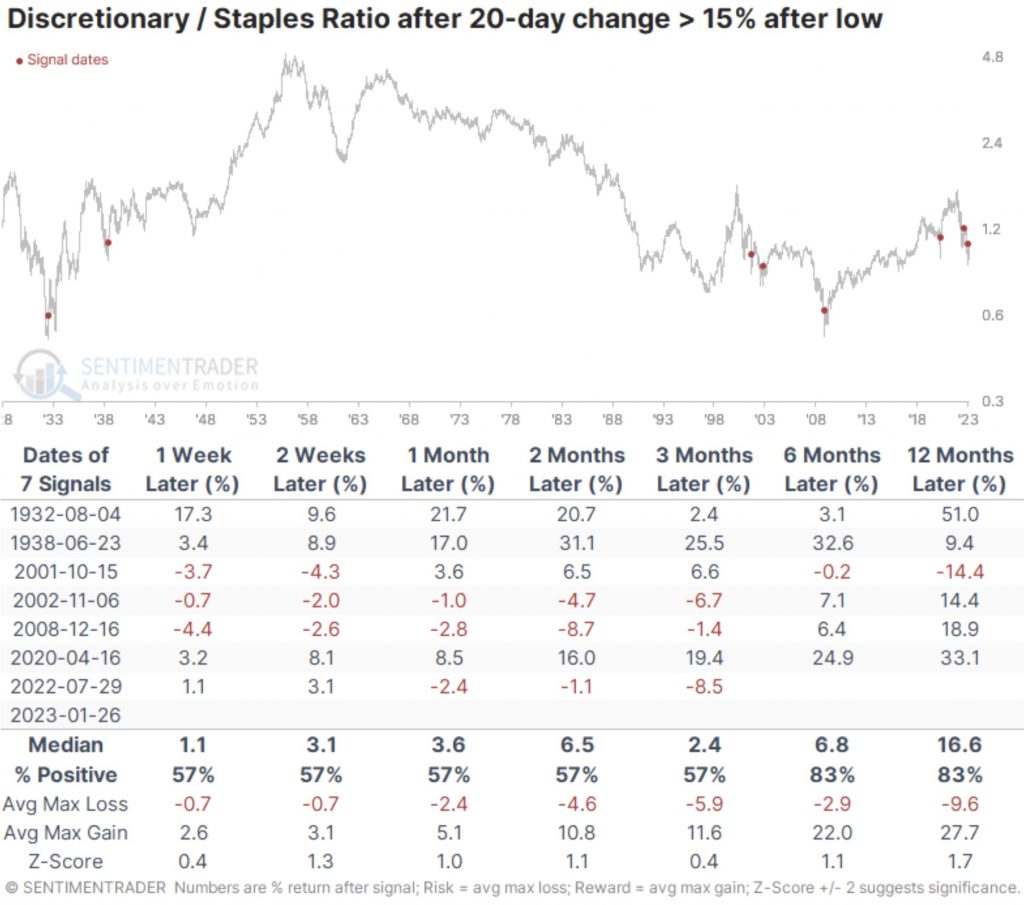

And rise it has. Over the past 20 sessions, the ratio of the total return between Discretionary and Staples soared nearly 20%, one of the largest changes in history. When the 20-day change in the ratio was at least modestly positive, investors tended to continue in that frame of mind for a while.

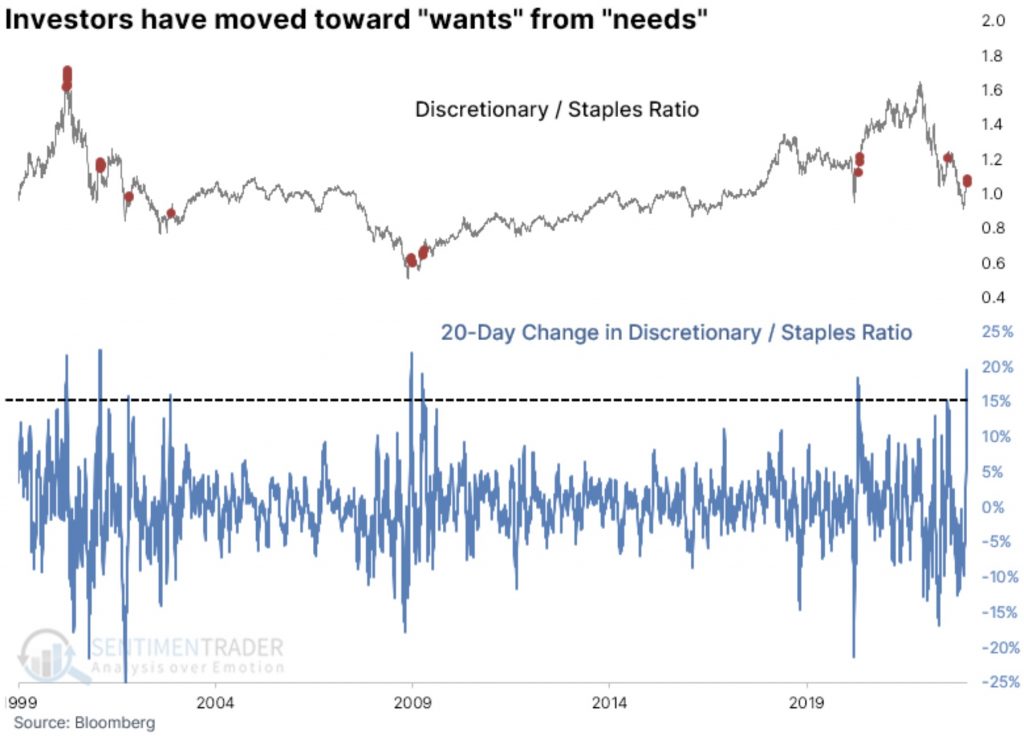

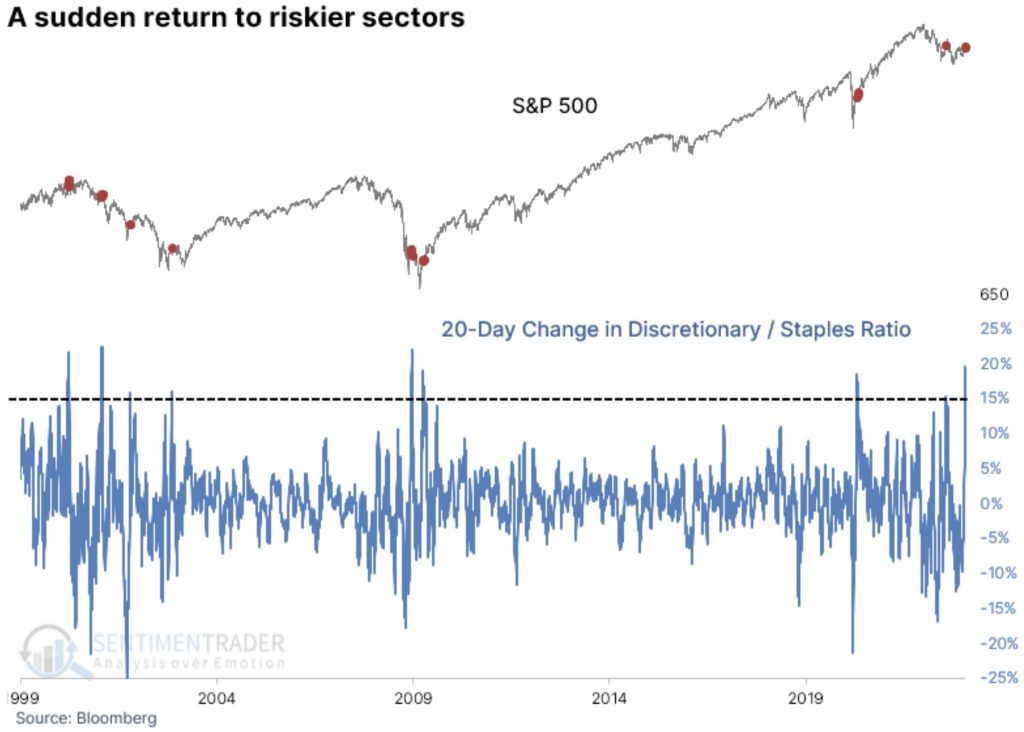

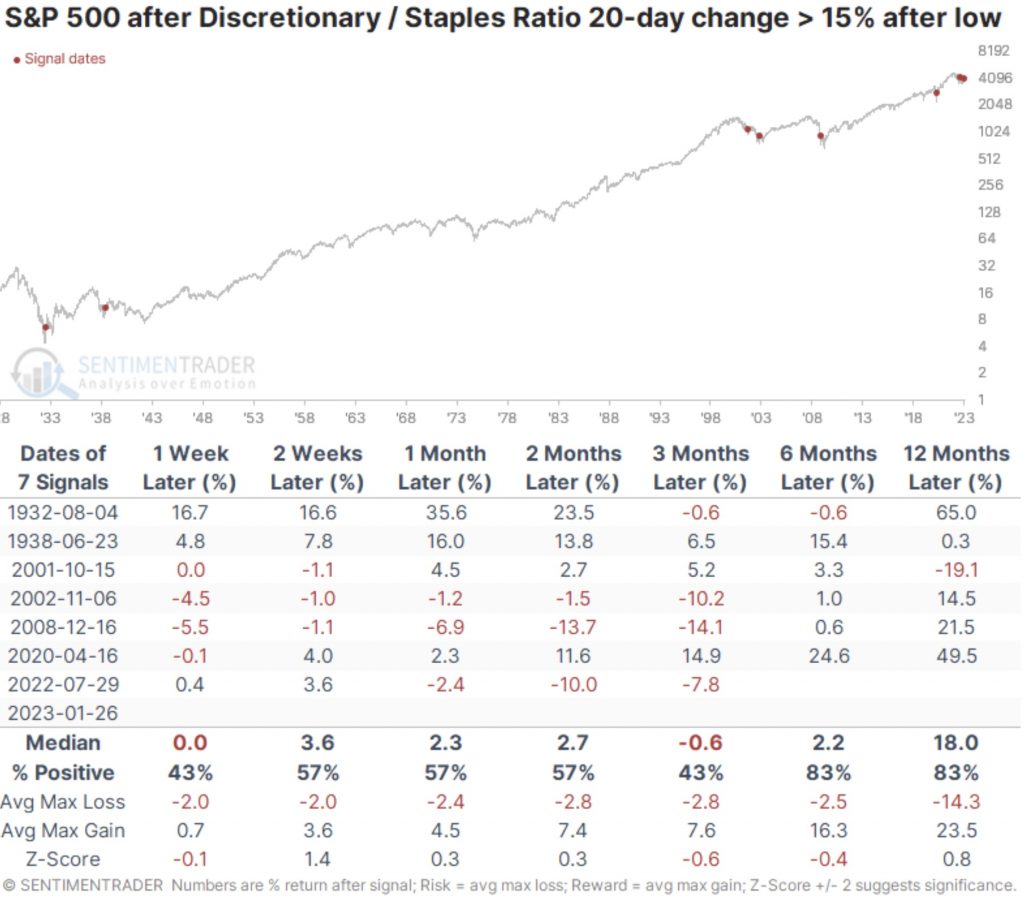

More recently, there were some false signals during the 2000-2002 bear market, but it also indicated the worst was over after the financial and pandemic crises.

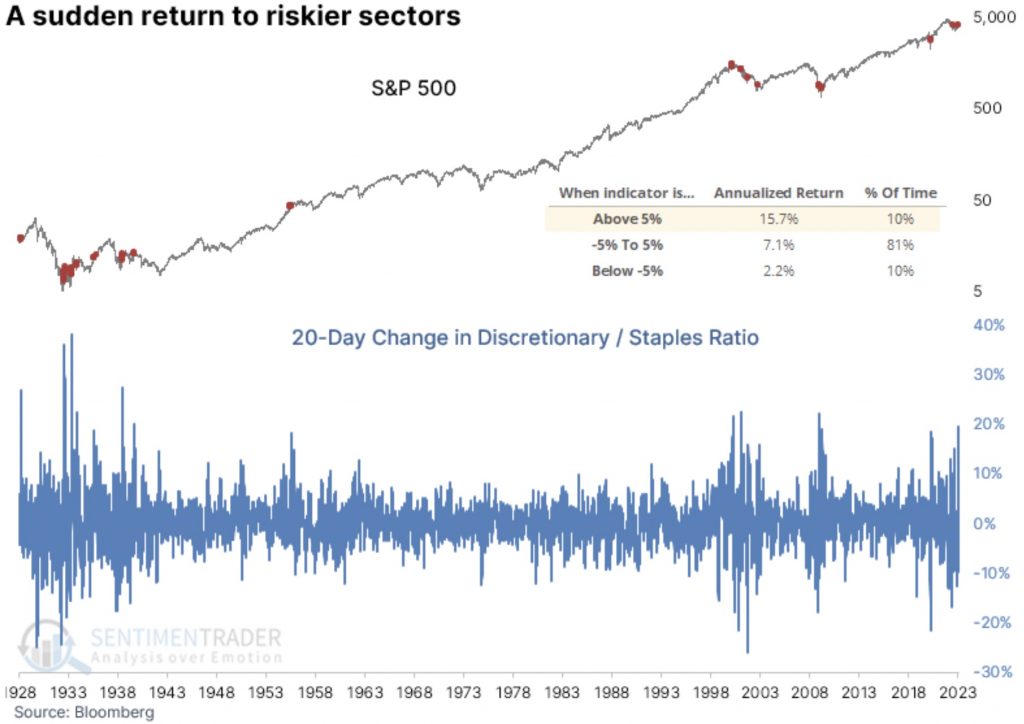

For the broader S&P 500 index, modestly positive changes in the ratio were good for the index. When the 20-day change in the ratio was above +5%, the S&P returned an annualized +15.7%, compared to only +2.2% when the change in the ratio was below -5%.

Of course, that index also suffered some false dawns during the bear market 20-odd years ago.

When the surge comes after a prolonged absence

One crucial piece of context is the behavior of investors before the surge in the ratio. When investors had pushed Discretionary stocks to at least a 2-year low relative to Staples, and then the ratio surged within the next few months, it tended to be a good sign for stocks. The sample size is tiny, of course, but over the next six months, the S&P 500 showed only one small loss that was erased immediately after.

It was also a good sign for the ratio.

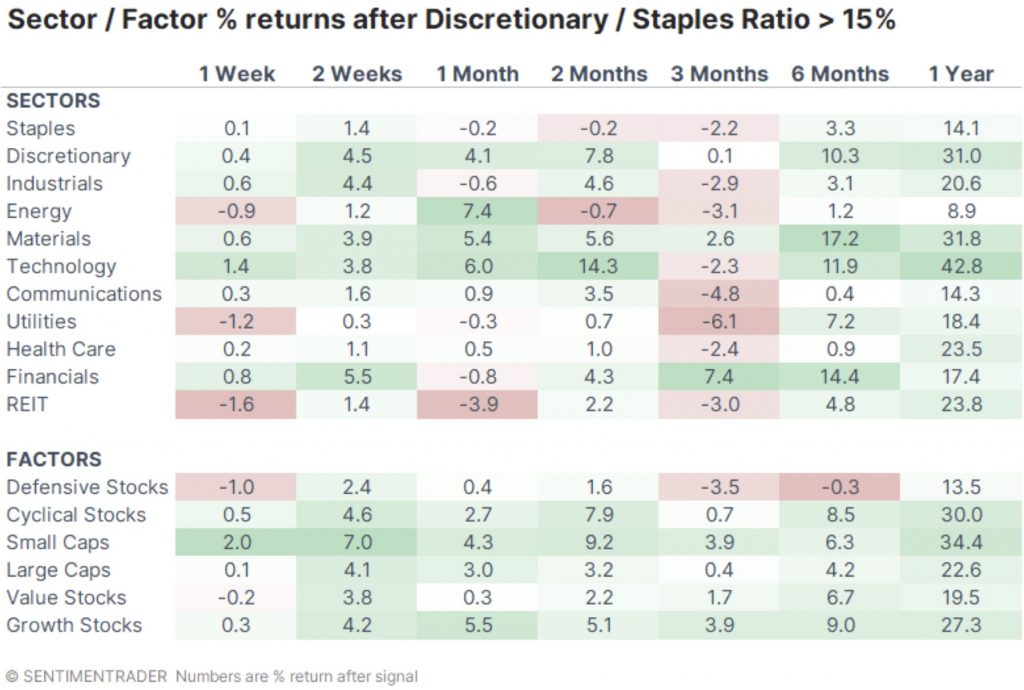

Among sectors and factors, Discretionary, Financials, and Technology tended to do best, as well as Small-Caps and Cyclicals.

What the research tells us…

Sustained bull markets need investors to be optimistic. There are signs that has occurred as stocks have rallied, which has been the way of markets forever. The move back into Discretionary stocks and away from Staples is another sign of an increasingly risk-on attitude, which can be dangerous during a prolonged bear market. The difference here is that the jump in risk-seeking behavior is coming off an extremely depressed level. While that can be a false signal (it has been a couple of times in the past), it tends to be more likely to be a sustained change in behavior and propel further long-term gains. This is another example of why Jason Goepfert is the best in the world at what he does – providing actionable market data. To subscribe to the internationally acclaimed work Goepfert produces at SentimenTrader CLICK HERE.

ALSO JUST RELEASED: Germans Buy Record Amount Of Gold! Central Bank Buying 2nd Highest Level In History! CLICK HERE.

ALSO JUST RELEASED: GLOBAL PARADIGM: The Great Gold Breakout And Monetary Fantasyland CLICK HERE.

ALSO JUST RELEASED: This Is About To Drive The Next Earthquake In Global Markets And Gold & Silver CLICK HERE.

ALSO JUST RELEASED: CHECKMATE: The Options For The US Are Now Horrific CLICK HERE.

ALSO JUST RELEASED: Putin Close To Finalizing Asian Trade Settlement In Gold That Will Rock Global Markets CLICK HERE. To listen to Alasdair Macleod discuss this in his powerful audio interview CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.