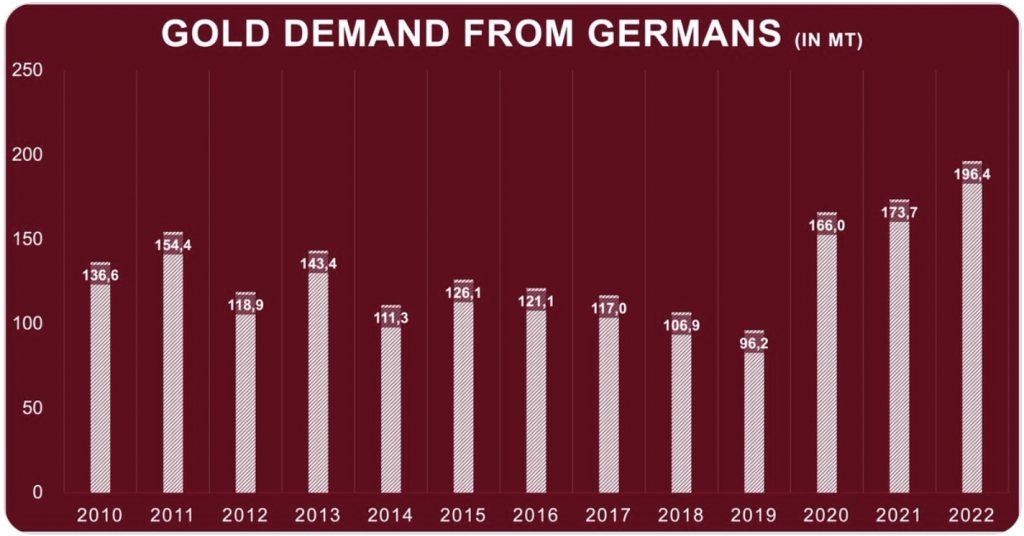

Germans bought an all-time record amount of gold. Central bank buying 2nd highest level in history.

“Germans Ultra-Bullish On Gold”

January 31 (King World News) – Holger Zschaepitz: Good Morning from Germany, where retail investors are ultra-bullish on gold. Annual bar & coin investment jumped 13.1% in 2022 to a fresh all-time high of 196 tonnes, aided by the highest inflation in 70yrs.

Germans Buy Record Amount Of Gold

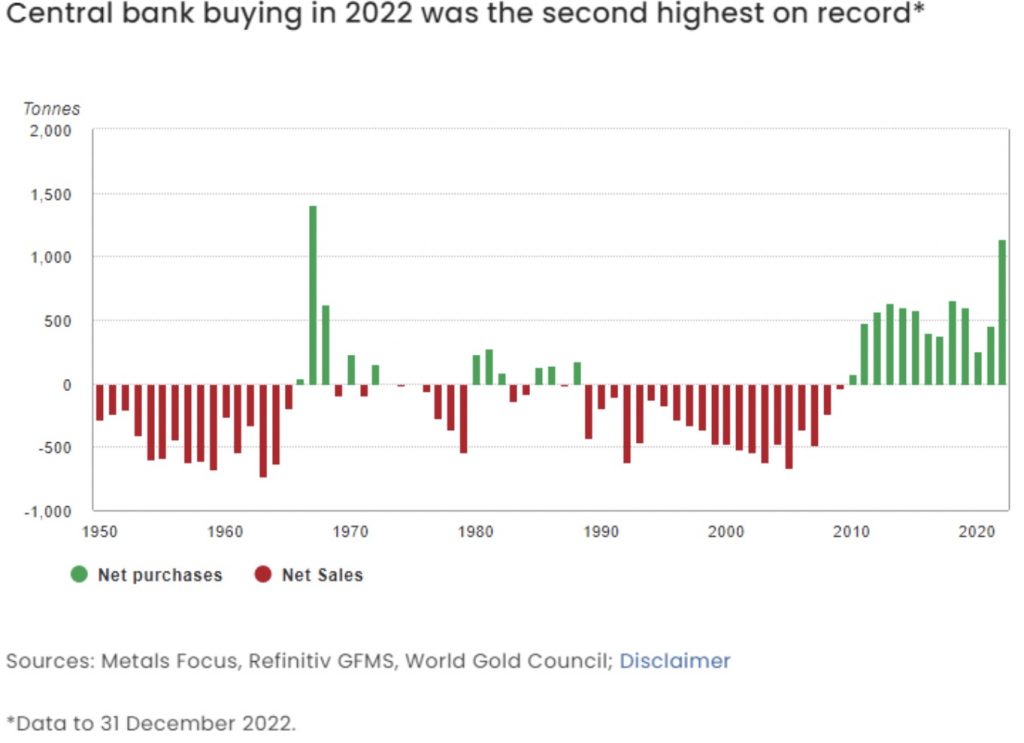

Central Bank Gold Buying Spree Continues

Krishan Gopaul: Central bank gold demand totalled 1,136 tonnes in 2022. Not only was this the thirteenth consecutive year of net purchases, but also the second highest level of annual demand on record back to 1950, boosted by +400 tonnes demand in both Q3 and Q4.

2022 Central Bank Gold Purchases 2nd Highest Level In History

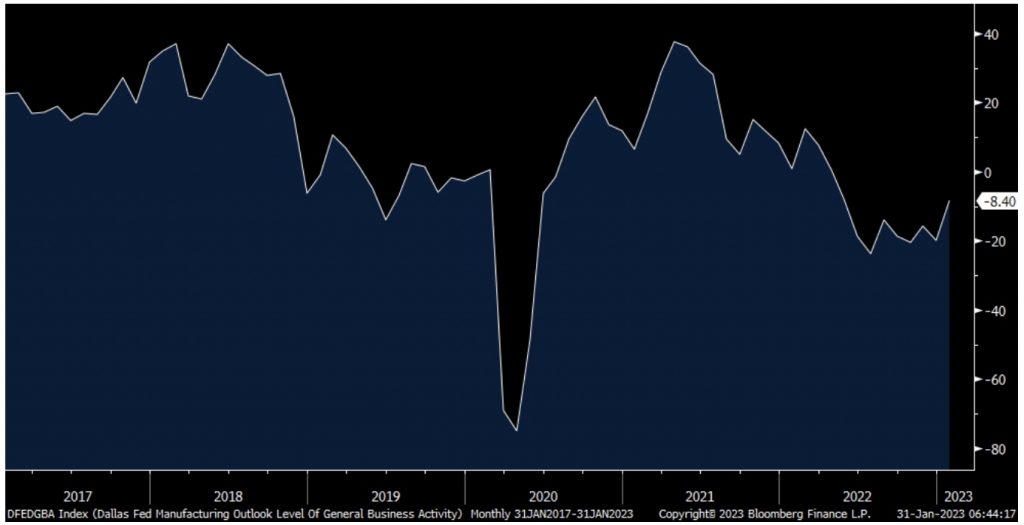

Things Are Tough All Over

Peter Boockvar: While yesterday’s January Dallas manufacturing index was better than feared at -8.4 vs the estimate of -15, it still marks the 9th straight month below zero and follows contractions seen in the regional surveys from NY, Philly, Richmond and KC. Chicago reports today and we get the national ISM tomorrow which is expected to be below 50 for a 3rd straight month.

Dallas Manufacturing Index Remains Negative

Here were some notable comments from businesses in the region and they don’t read well:

Food Manufacturing

“We had a customer in the pet food segment significantly decrease its orders due to an inventory backlog.”

“Uncertainty from the overall economic downturn is affecting our long term strategy.”

“Business is sluggish. We’re seeing increased illiquidity in our customer base.”

Beverage and Tobacco Product Manufacturing:

“We are still seeing input costs increase. We had let our gross margin erode over the last couple of years and are now playing catch-up. We are raising prices faster than our inputs increase in a bid to restore an acceptable gross margin.” Something I’ve talked about for many quarters as the goal for many companies…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Textile Product Mills:

“Uncertainty is high. Holiday sales were stronger than expected, but January is slow versus last year. Delivery times are down, but future demand and sales sentiment are low.”

Paper Manufacturing:

“Activity continues to slip, and selling prices are coming down. We still can’t find any workers and, with our six month projection, we have quit looking.”

Printing and Related Support Activities:

“We have definitely seen a slowdown in activity compared to prior months. It’s as if the spigot got turned off. All our supply chain constraints are pretty much gone, with delivery times much more like pre-pandemic times. We have work coming up but right now are very slow and struggling to get our hourly workers even 32 hours per week.”

Chemical Manufacturing:

“We are seeing a slowdown in orders and clients unwilling to hold additional inventory.”

Primary Metal Manufacturing:

“Recession is on its way.”

Machinery Manufacturing:

“We are seeing improvement in the business climate.” This was an outlier relative to everyone else.

“Order volume has been going down, and we expect the trend to continue.”

Computer and Electronic Product Manufacturing:

“We provided significant (10% or more) raises in December after a midyear raise in July 2022. We felt that this was essential in order to keep our employees, and we have successfully retained everyone we wanted to keep. We hope not to need to do another round of raises midyear. Since our employees are blue-collar workers, inflation hits them particularly hard, and they are more willing to look for another job for a 10-15% pay increase. We are investing in more automation and removing process bottlenecks to increase productivity and reduce lead time.”…

Look At Who Is A Big Investor In This Soon-To-Be Self Funding Gold Exploration Company! To learn more click here or on the image below.

Transportation Equipment Manufacturing:

“We are starting to see some customers pushing delivery out due to market uncertainty.”

Furniture and Related Product Manufacturing:

“Requests for bids continue at a steady rate; we have not yet seen a contraction. The only change is, when posting job openings, we actually have people responding – this is a big change and likely a sign of some layoffs after the holidays from other companies.”

NXP Semi said this in yesterday’s press release: “From an end-market perspective, our automotive business performed very well, while in our consumer IoT and mobile businesses we experienced a softening demand environment through the 2nd half of 2022.”

Autos

With respect to autos, that certainly has been a bright spot as manufacturers continue to rebuild inventory but buying a car has gotten ever more expensive with higher interest rates on top of the sharp multi yr rise in price. Yesterday Automotive News in its dealer survey press release, “Dealers are increasingly worried about the possibility of recession even as improving inventory levels have them more optimistic about the new-vehicle business in 2023…Several now believe rising interest rates and a potential recession, on top of intensifying vehicle affordability challenges, could ultimately disrupt their business this year.” One dealer said, “We’re in an affordability crisis.” I’ll say, similar theme in the housing market. https://www.autonews.com/dealers/car-dealers-increasingly-worried-about-economy

China

China said its January manufacturing and services composite index rose to 52.9 from 42.6 with both higher. Manufacturing just got back to 50 at 50.1 while services jumped from 41.6 to 54.4 on the reopening. Manufacturing never really was hugely impacted by the shutdowns and will be more subject to global demand while services will benefit from the Chinese consumer and its desire to make up for lost time.

As for global demand, Taiwan said its December exports fell by 23.2% y/o/y, but a bit better than the drop of 25% that was estimated. Inventory destocking and slower activity were the culprits. We’ll soon see what the China reopening does to reverse this.

Japan

Japan reported some December jobs data that was about in line as well as retail sales. IP was better than forecasted. With their cost of living continuing to jump, January consumer confidence did rise to a 5 month high because ‘Income Growth’ also rose to a 5 month to offset that rising cost of living. Bond yields rose while the yen is little changed and the Nikkei was down .4%. We still like Japanese stocks and they should benefit from the China reopening too.

Europe

Europe eked out a slight Q4 GDP increase of one tenth q/o/q vs the estimate of down one tenth. We also saw notable declines in retail sales in Germany and France in December. Germany also said that the number of unemployed fell by 22k in January vs the estimate of a gain of 5k while their unemployment rate held at 5.5%. Similar to the US, the employment situation has been relatively stable in Germany throughout their economic slowdown. Bond yields are falling in Europe and why Treasury yields are slightly down after yesterday’s rise. The dollar is higher across the board, including against the euro.

ALSO JUST RELEASED: GLOBAL PARADIGM: The Great Gold Breakout And Monetary Fantasyland CLICK HERE.

ALSO JUST RELEASED: This Is About To Drive The Next Earthquake In Global Markets And Gold & Silver CLICK HERE.

ALSO JUST RELEASED: CHECKMATE: The Options For The US Are Now Horrific CLICK HERE.

ALSO JUST RELEASED: Putin Close To Finalizing Asian Trade Settlement In Gold That Will Rock Global Markets CLICK HERE. To listen to Alasdair Macleod discuss this in his powerful audio interview CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.