There is no question that the economy is beginning to show serious cracks in the foundation.

The Economy Is In Trouble

August 29 (King World News) – Peter Boockvar: The drop in the number of job openings to 8.83mm puts it at the least amount since March 2021.

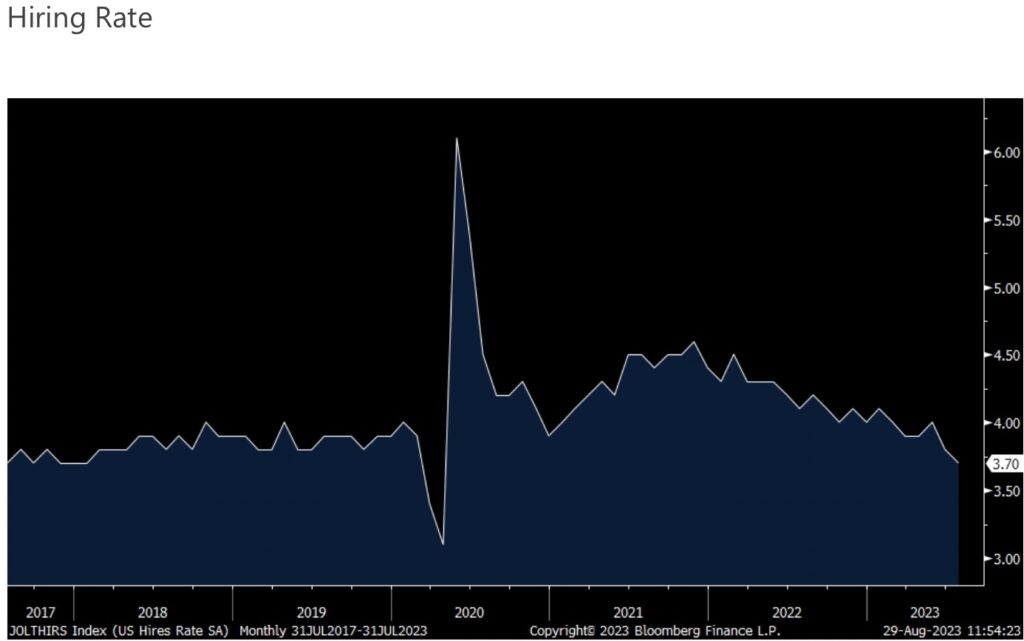

The hiring rate in turn slowed to 3.7% which is below where it was in February 2020 when it was at 3.9%.

The number of quitters shrunk too and the quit rate fell one tenth m/o/m to 2.3% which is where it stood in February 2020.

It was a drop in openings in the ‘professional/business services’ category that led the decline as it fell by about 200k m/o/m. Manufacturing openings fell by 30k to the least since January 2021. There was also a drop of 155k in the number of job openings at the government level, with most at state and local governments. Job openings rose by 62, in leisure/hospitality after dropping the past few months. Construction job openings fell by 23k. There was no change in retail job openings but comes after two months of declines. The ‘information’ category saw a bounce back of 101k in job needs to be filled.

Bottom Line

Bottom line, while job openings are still being overstated (can list multiple job adds in different states for one job and what I learned from the chief economist at ZipRecruiter is that employers sometimes now list one job opening but in multiple title roles/salaries to see what attracts and they get counted multiple times), this is just further evidence of the reduction in the pace of hiring’s as seen in a few different important data points. When you hear ‘challenging macro economic environment’ in just about every single conference call, this is the natural reaction on the part of an employer, to be more judicious with adding staff.

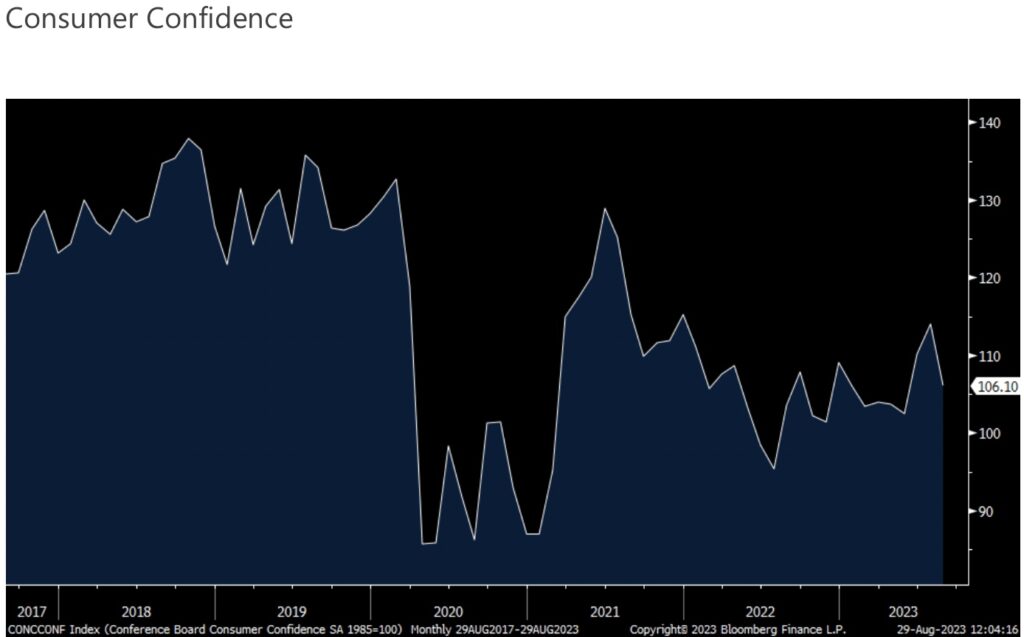

The August Conference Board’s Consumer Confidence index fell to 106.1 from 114 and that was 10 pts less than expected with both main components down and that’s a 3 month low.

One yr inflation expectations rose one tenth m/o/m to 5.8% after falling by a like amount in July.

Of note was the weakness in the answers to the labor market questions and follows the JOLTS report. Those that said jobs were Plentiful fell 3.4 pts to the lowest since April 2021 and those that said they are Hard to Get rose by 2.8 pts to the most since April 2021. Expectations for the labor market saw a 3 month high in those that expect ‘fewer jobs’ and almost no change in those that see ‘more jobs.’ Income expectations moderated for a 3rd month.

Spending intentions were little changed m/o/m for all 3 main things, auto’s, homes and major appliances. After the drop seen over the past 6 months, intentions to take a vacation rebounded but it always seems to rise in August.

Bottom Line

Bottom line, it was inflation in the basics that bothered people in August but the upper income consumer lost some confidence too. Said the Conference Board, “Write-in responses showed that consumers were once again preoccupied with rising prices in general, and for groceries and gasoline in particular.” Also, “The pullback in consumer confidence was evident across all age groups – and most notable among consumers with household incomes of $100,000 or more, as well as those earning less than $50,000…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Real Estate

If you didn’t see, last Thursday Redfin quantified the extent at which current mortgage rates has cut one’s purchasing power. They said “A homebuyer on a $3,000 monthly budget, for instance, can afford a $429,000 home with a 7.4% mortgage rate, roughly the daily average on August 23. That buyer has lost $71,000 in purchasing power since August 2022, when they could have bought a $500,000 home with an average rate of about 5.5%.”

“To look at affordability another way, the monthly mortgage payments on the typical US home, which costs about $380,000, is roughly $2,700 with a 7.36% mortgage rate. The monthly payment would be $400 lower – around $2,300 – with last year’s 5.5% rate.”

Much Higher Inflation Than What Is Being Reported

The tough part for the current buyer is not just where mortgage rates are now but the meme stock like home price rise over the past few years that the Fed’s monetary policy stoked with zero rates and massive buying of agency mortgage backed securities. And if home price gains were computed in CPI rather than rents, CPI would have gone over 10%.

ALSO JUST RELEASED: Bullion Banks Have Covered Massive Amount Of Short Positions In The Gold Market CLICK HERE.

ALSO JUST RELEASED: The Silver Market Is Potentially Set Up For A Major Short Squeeze CLICK HERE.

ALSO JUST RELEASED: Expect A Pretty Busy Week: We’re Already Seeing Volatile Trading In Global Markets CLICK HERE.

ALSO JUST RELEASED: Michael Oliver – Here Is The Most Important Monetary Metals Chart That Will Unleash Gold & Silver On The Upside CLICK HERE.

Don’t Miss This Interview!

All King World News readers around the globe need to listen to Alasdair Macleod’s fantastic audio interview that was just released by CLICKING HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged