Investors need to expect a pretty busy week and we are already seeing volatile trading in global markets.

Expect A Pretty Busy Week

August 28 (King World News) – Art Cashin, Head of Floor Operations at UBS: Overnight, global equity markets are borderline celebratory as China slashes its stamp tax on equity transactions virtually in half. The initial response was almost zany with one Chinese market up almost 8% on the day before they calmed down. Hong Kong managed to close up about 350 points in the Dow. Mainland China about 400 points. Japan hung onto some of the early Chinese reaction and closed up about 625 points in the Dow. India was fractionally higher.

London is closed for the Summer Bank Holiday. Paris and Frankfurt, as we go to press, are up about 200 points in the Dow.

The action in China will be watched carefully to see if it has a multi-day response.

This is going to be a pretty busy week internationally, but we are starting the day off with a very, very light economic calendar here in the U.S. In midmorning, we get the Dallas Fed Manufacturing Survey, and we have a small bond auction in late morning and then at 1:00 p.m., we have the five-year bond auction. So, not a lot to focus attention and, I think, they will continue to watch the spill out from the reaction to Asia.

Although the markets are now closed, there may be some sense of how they look forward to the next day’s trading.

Yields on the ten-year are one to two basis points lower and that is helping put a mild bid under stocks here in the U.S. Also helping is the rumored settlement in 3M, which as we go to press, is adding about 40 points to the Dow rally.

So, we will stick with the current drill. Given geopolitics, stay close to the newsticker. Keep your seatbelt fastened. Stay nimble and alert and most of all try to stay safe…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

How Long Will They Be Tightening?

Peter Boockvar: With regards to the Fed from here and our needed shift in focus to how long they’ll be tight from here, rather than how much higher they’ll hike from here, the most important comments last week came from former Dallas Fed president Richard Fisher in an interview on CNBC. I’m paraphrasing here but he essentially said that with Powell having another 2 1/2 yrs as Fed chair, he is not going to back off from his inflation fight as he will be committed to not making the same inflation mistake twice.

Highlighting how valuable a Nvidia GPU is now worth, I read an article in the Weekend WSJ on a cloud infrastructure company called CoreWeave that said the company after raising $400mm in equity “secured another $2.3b in debt financing this summer to open data centers by essentially turning chips into financial instruments, using its stash of highly coveted Nvidia semiconductors as collateral.” For now at least that collateral is holding its value.

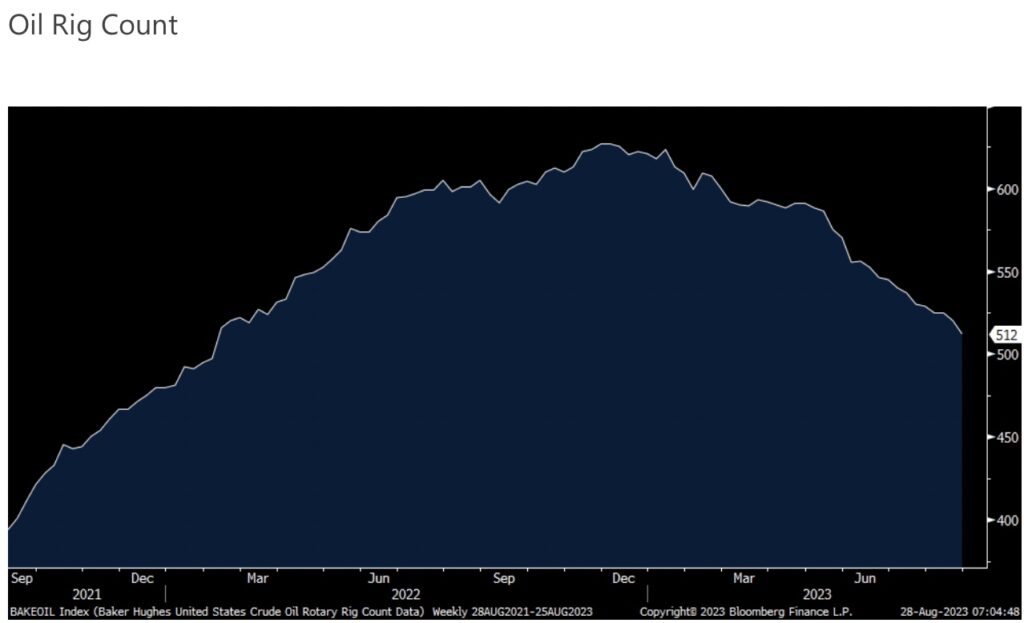

I’m going to keep talking about the US oil rig count as long as it keeps falling even with WTI at $80. For the week ended 8/25 it fell another 8 rigs to 512. It started the year at 621 and is now at the least amount since early February 2022. We remain bullish and long oil and gas stocks.

BULLISH OIL CATALYST:

Oil Rig Counts Continue To Tumble

After falling to the lowest level since last September, C&I loans outstanding for the week ended 8/16 did rebounded by $9b. Bank deposits fell another $48.8b and at $17.29 trillion stands at a 5 week low.

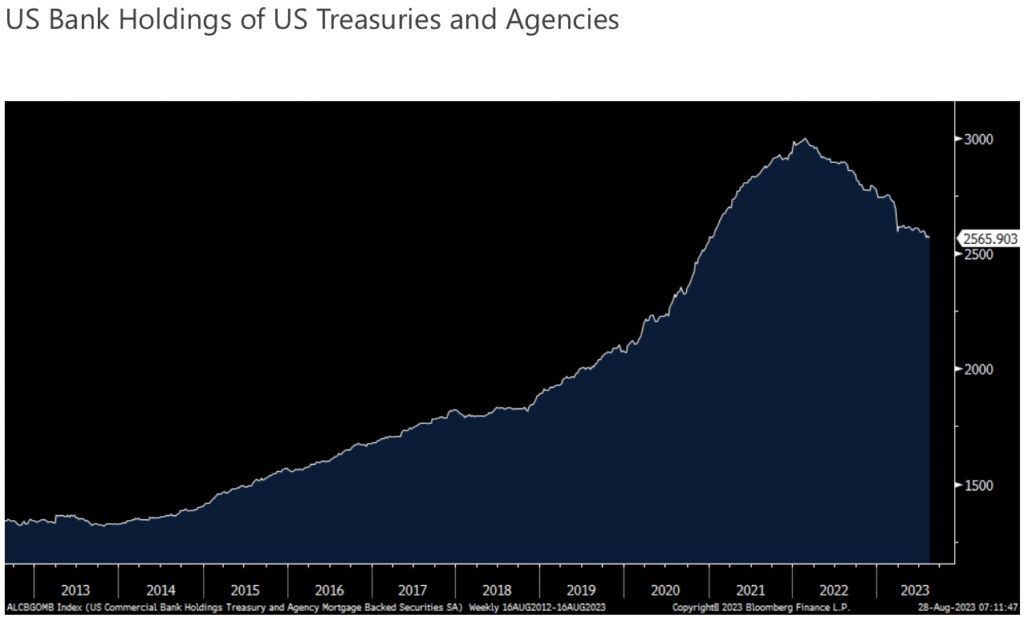

Real Reason Rates Are Rising

As we analyze the reasons for the recent rise in long term US interest rates, a big focus of course has been the massive amount of Treasury supply at the same time we question where the demand will come from. Unknown to some until the bank failures in March, US banks up until early 2022 were huge buyers of US Treasuries and Mortgages as they got flooded with deposits and didn’t have enough places to put the money. They reached for duration and the rest is history, especially for SVB and First Republic. In February 2020, commercial bank holdings of US Treasuries and agency mortgages stood at about $2 trillion. Two years later it rose by 50% to $3 trillion. As of the week of 8/16/23, it has now fallen to $2.56 trillion, the lowest since December 2020. Bottom line, the US Treasury market has lost the banks as net buyers.

Who Is Left To Buy?

The ECB rate hikes, with another one likely in September as heard from a bunch of ECB member comments at JH, are having its impact. Money supply growth in July fell .4% y/o/y vs the estimate of no change and vs up .6% in June. Loans to businesses were up 2.2% y/o/y (below the rate of inflation and thus negative in real terms) vs 3% in June. Loans to households grew by just 1.3% in nominal terms vs 1.7% growth in June.

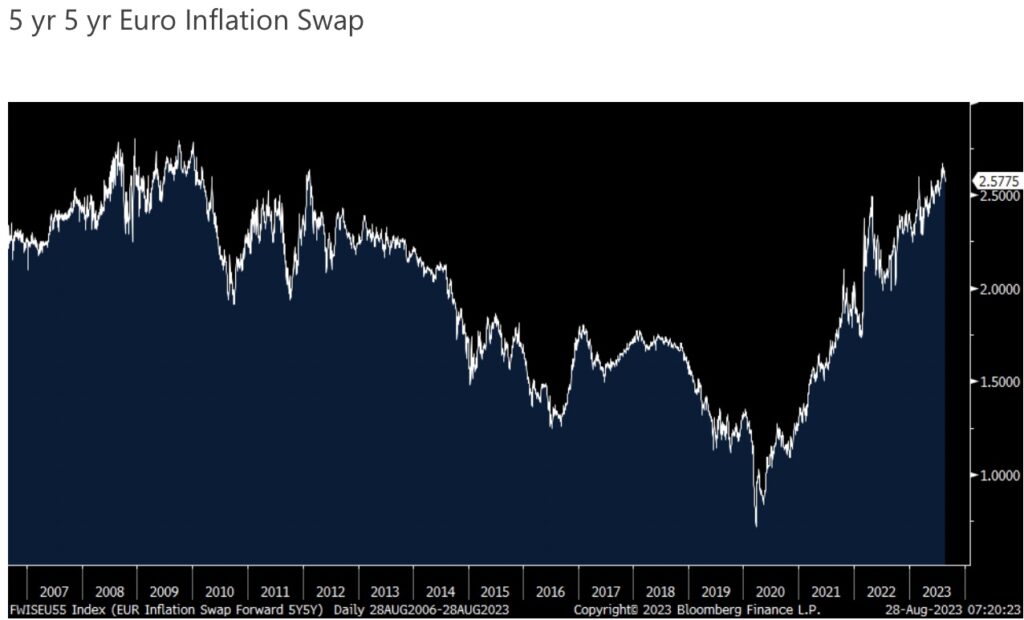

There was no market response but inflation expectations in Europe as measured by the 5 yr 5 yr euro inflation swap (was Mario Draghi’s go to figure) remains persistent at 2.58%, less than 10 bps from a 13 yr high.

European Inflation Swap Remains Close To 13 Year High

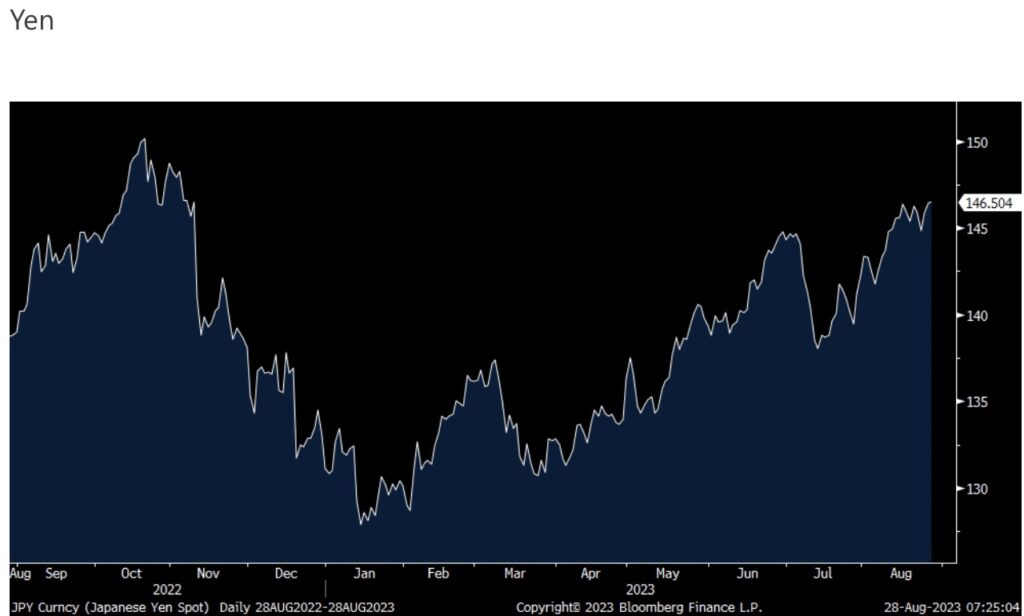

JAPAN: The Pain Of Higher Inflation

With respect to the BoJ, the yen stands at the weakest level vs the US dollar since November 2022 as Governor Ueda speaking in JH sounds like he thinks he’s done enough for now on policy and NIRP will remain with us. Just a day after Tokyo said its core/core inflation rate was up 4% in August, Ueda said “We think underlying inflation is still a bit below our target of 2%. This is why we are sticking to our current monetary easing framework.” While his inflation comments can clearly be debated, he also realizes that the Chinese economic weakness is a risk to Japan’s. Notwithstanding his comments, JGB yields are holding at its current ‘high’ levels, relatively speaking.

So we have Ueda continuing on with easy money, albeit a bit less so, to consistently generate higher inflation at the same time the Japanese PM Kishida is trying to figure out how to send money to their citizenry in order to mitigate the pain of higher inflation. All makes little sense I know.

One Of The Weakest Currencies In The World

Finally, and to finish with the tighter for longer theme, the Deputy Governor of the Swedish Riksbank speaking in Stockholm said they’ll keep things tight for a “fairly long time” as “While it is true that the average price level has risen slowly in recent months, this is due to the fall in energy prices. Prices of other subcategories behind average inflation are still rising too quickly.” He’s also not happy with the weak Krona.

ALSO JUST RELEASED: Michael Oliver – Here Is The Most Important Monetary Metals Chart That Will Unleash Gold & Silver On The Upside CLICK HERE.

Don’t Miss This Interview!

All King World News readers around the globe need to listen to Alasdair Macleod’s fantastic audio interview that was just released by CLICKING HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged