Here is the big picture for gold as we kickoff 2025.

KWN just released a powerful audio interview as we kickoff 2025. But first…

January 3 (King World News) – Alasdair Macleod: There are early signs that precious metals will rise along with the dollar and higher Treasury yields. But the transition to this way of thinking brings some short-term uncertainty with it.

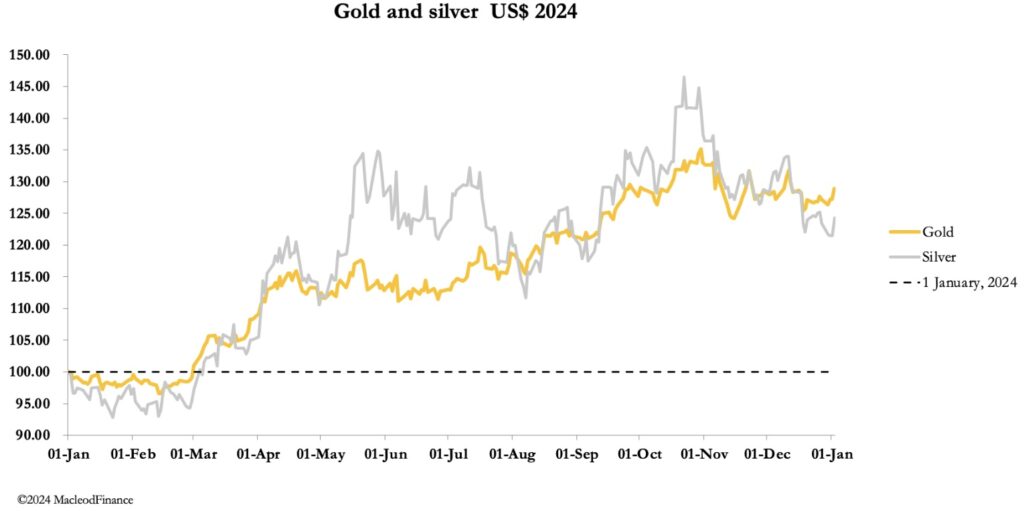

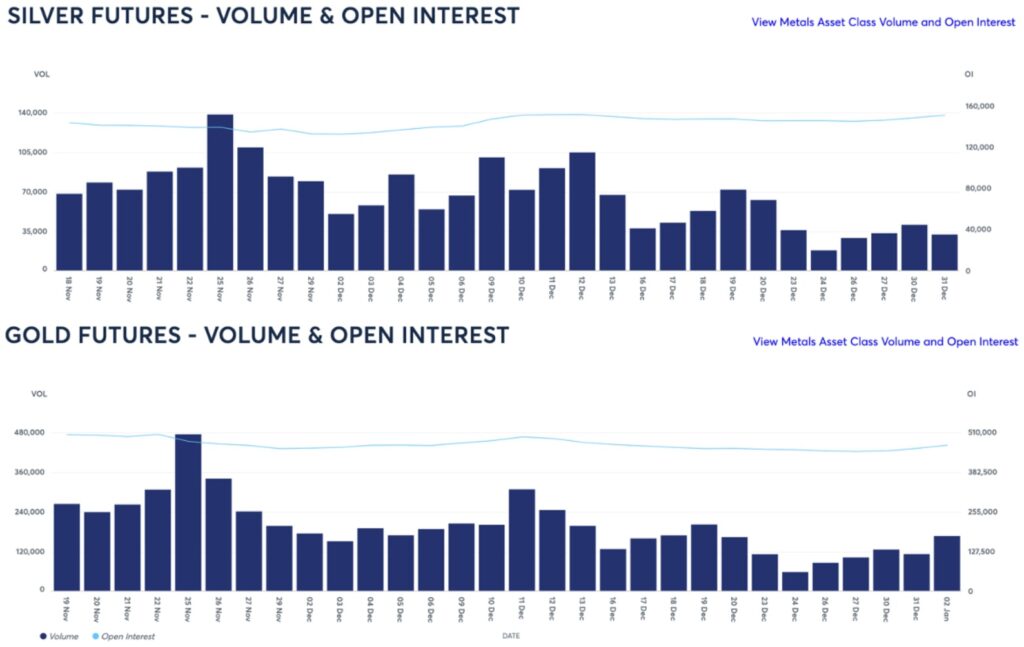

Gold and silver ended 2024 consolidating earlier gains. But the first few days of trading in 2025 were positive. In European trading today, gold was $2658, up $37 from last Friday’s close after testing $2600. Silver was $29.75, up 40 cents on balance. Trading has been seasonally light as shown by Comex volumes.

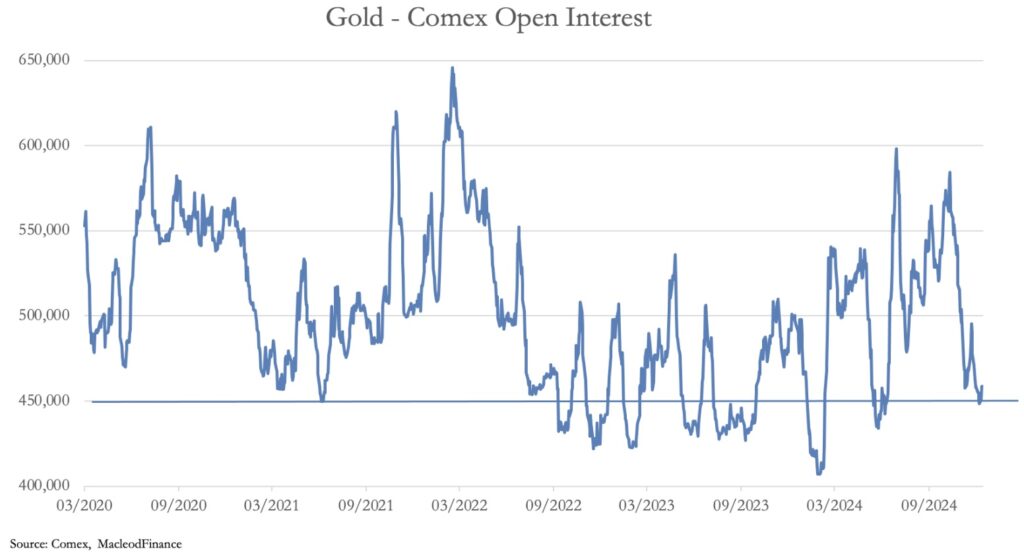

While Comex Open Interest in silver has held steady, in gold it has sold off to oversold levels. This is next.

Now let’s look at gold’s technical chart for clues for price development over the coming months.

Clearly, gold’s consolidation at the $2600 level has been healthy, finding support at the 55- day moving average. Open Interest on Comex is rising again having increased by about 20,000 contracts since last Friday. But gold will have to break through the $2700 level convincingly or risk further consolidation and rule out a move towards the 12-month moving average (currently at $2500).

While a $200 drop might seem painful, it is not really significant and might not happen. To assess the probability, we must turn to fundamentals. Without doubt, the greatest short- term threat is revealed in our next chart:

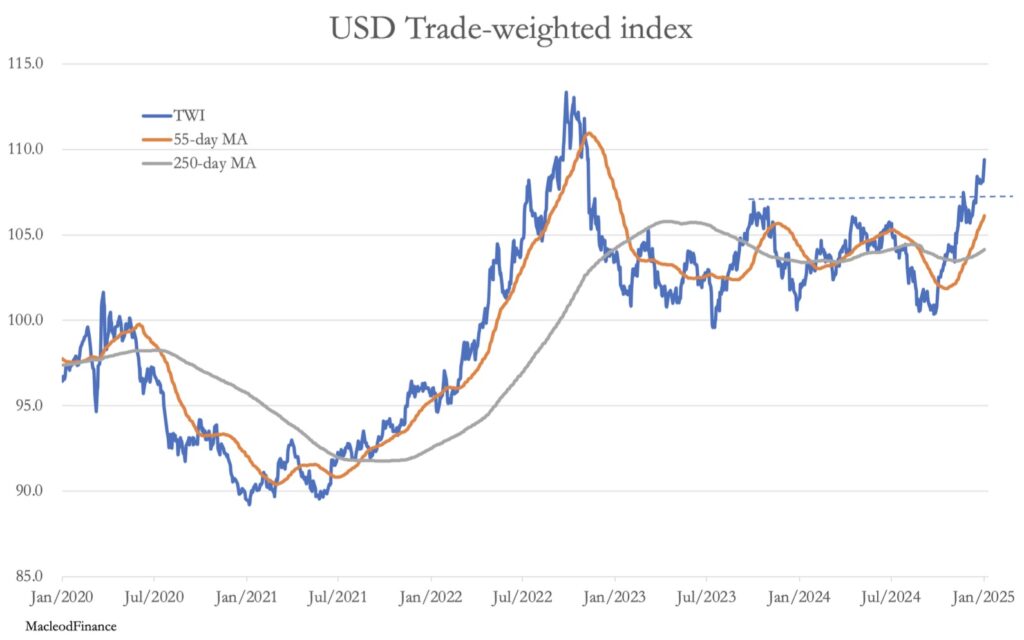

Clearly, yields on US Treasuries are rising, and have further to rise, a point which is now clear to speculators in gold futures, who normally would associate rising bond yields with lower gold values. Something has changed in their thinking, particularly when we see the dollar’s trade weighted, treasury yields, and gold all rising at the same time as it has on occasions this week.

I think the narrative is as follows. Market participants now expect higher budget deficits under Trump, at least initially. The US economy will grow at a more rapid pace in 2025 than previously expected because of this factor. And a combination of rising consumer demand and the impact of higher import tariffs will lead to more inflation. The Fed will put further rate cuts on hold, possibly increasing them instead. This is why bond yields are rising, but the increasing risk to equity markets from this change in interest rate outlook will make the Fed reluctant to raise them sufficiently. On a net basis this should be positive for gold.

There are two further factors. The first is that year-end window dressing, which is normally negative for gold, is now over and paving the way for higher prices. And secondly, the strong dollar is creating havoc for the euro, yen, and pound. The USD trade weighted chart makes this point for us:

Trump’s stimulus for America will force higher consumer and commodity inflation on the EU, Japan, and Britain all of which are stagnating and will suffer economic destruction.

In conclusion, it appears that gold, treasury yields, and the dollar can all rise in sync. But we cannot rule out doubt on this analysis if a more hawkish attitude is expected from the Fed, in which case gold may have to consolidate a little longer. However, the message is clear: all this uncertainty is extremely bad for credit in its relationship with gold, whatever the currency.

Happy New Year!

Turk Just Warned Financial Crisis Set To Erupt In Early 2025!

To listen to what this financial crisis that is set to erupt in 2025 will look like and how you can safely navigate your way through the coming global shockwaves CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.