As we kickoff another trading week, the US manufacturing collapse continues as stagflation rules the day.

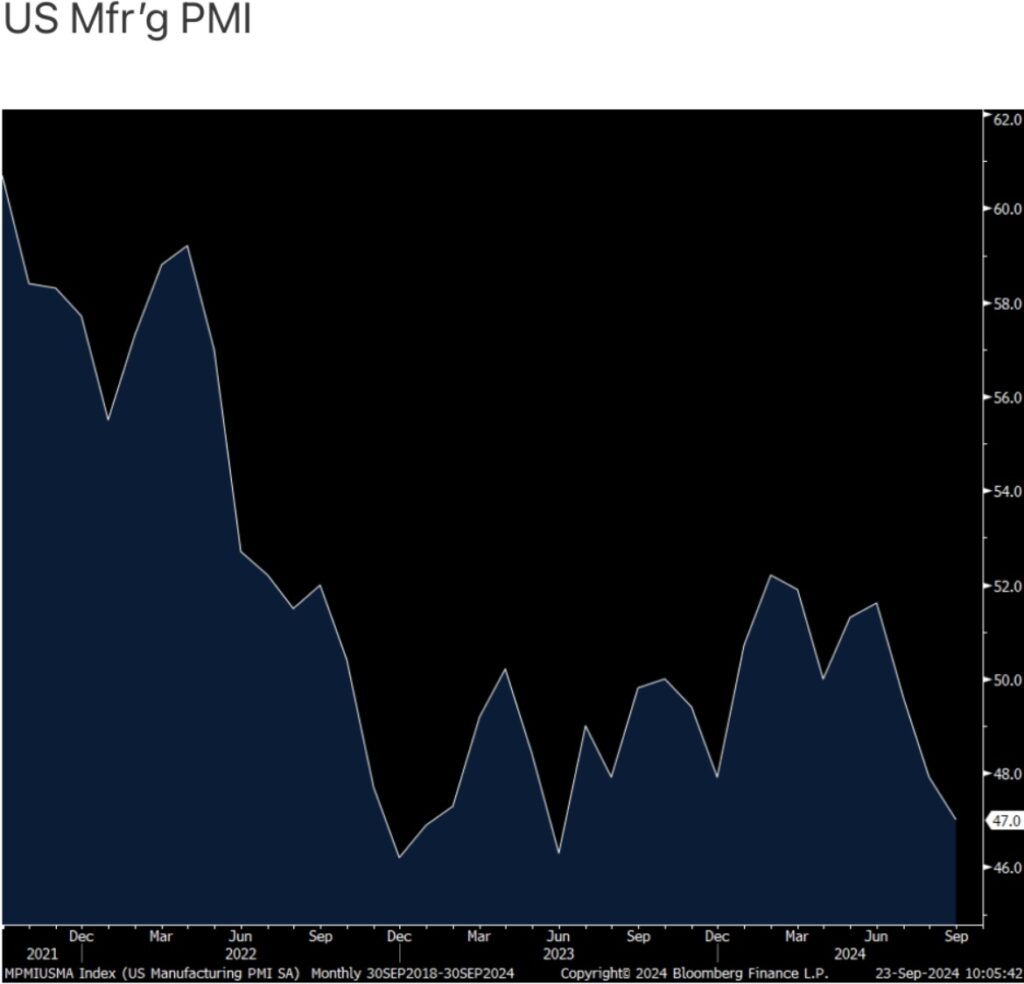

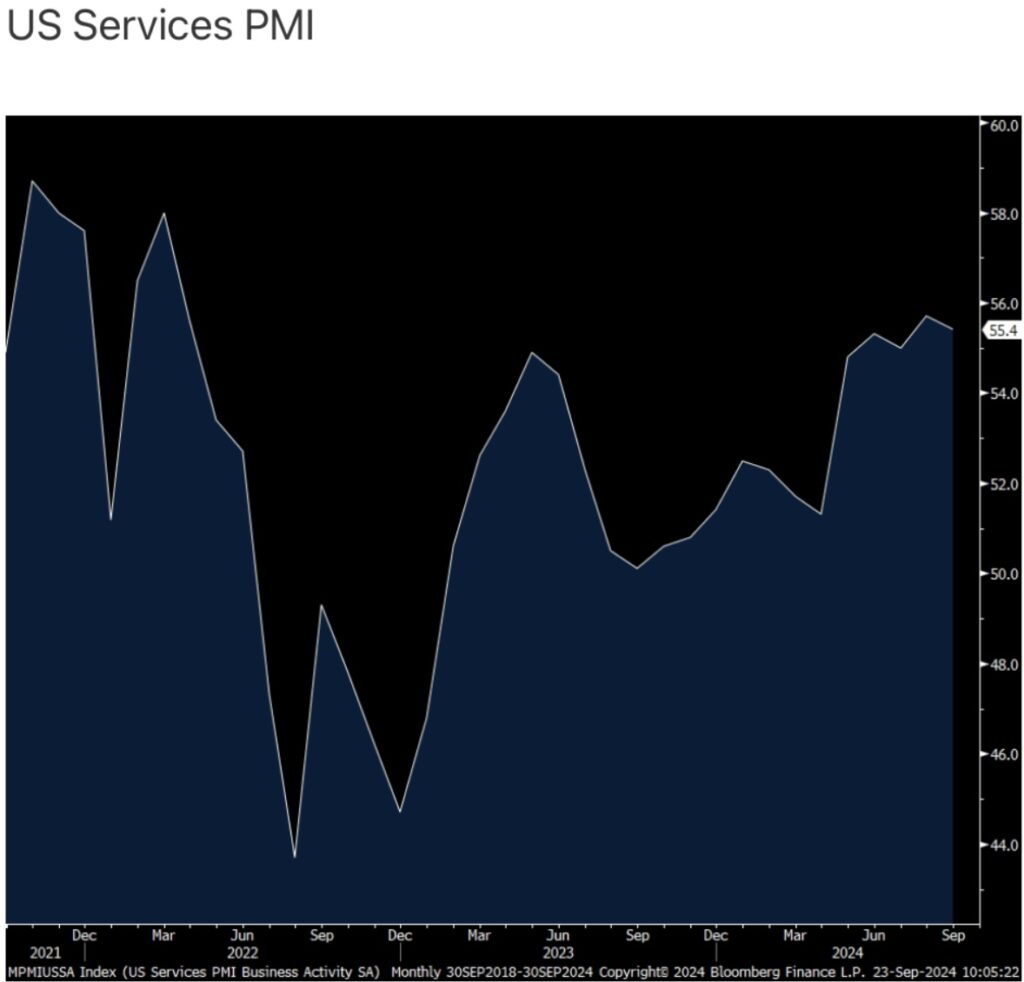

September 23 (King World News) – Peter Boockvar: The September US PMI fell a touch to 54.4 from 54.6 with manufacturing remaining weak at 47 vs 47.9 in August, the slowest since June 2023…

US Manufacturing Collapse Remains As Stagflation Rules The Day

… while services continue to carry the day at 55.4 vs 55.7 in the month before.

With manufacturing, “The largest negative contribution to the PMI came from new orders, which fell at the fastest rate since December 2022, followed by employment, which fell at a pace not seen since June 2020.” Ex Covid, the employment component was the weakest since January 2010 “as an increasing number of firms reported the need to reduce operating capacity in line with weak sales.”

While services held growth on its shoulders, S&P Global said the overall drop in headline optimism about output in the coming 12 months “was led by the service sector amid concerns over the outlook for the economy and demand, often linked to uncertainty regarding the Presidential Election.” With respect to the labor side, “The decline in service jobs was often linked to difficulties replacing leavers, though the addition of new staff was curbed by uncertainty about the outlook.”

Optimism with the one yr outlook lifted in manufacturing on hopes that it can’t get any worse and that lower interest rates will help.

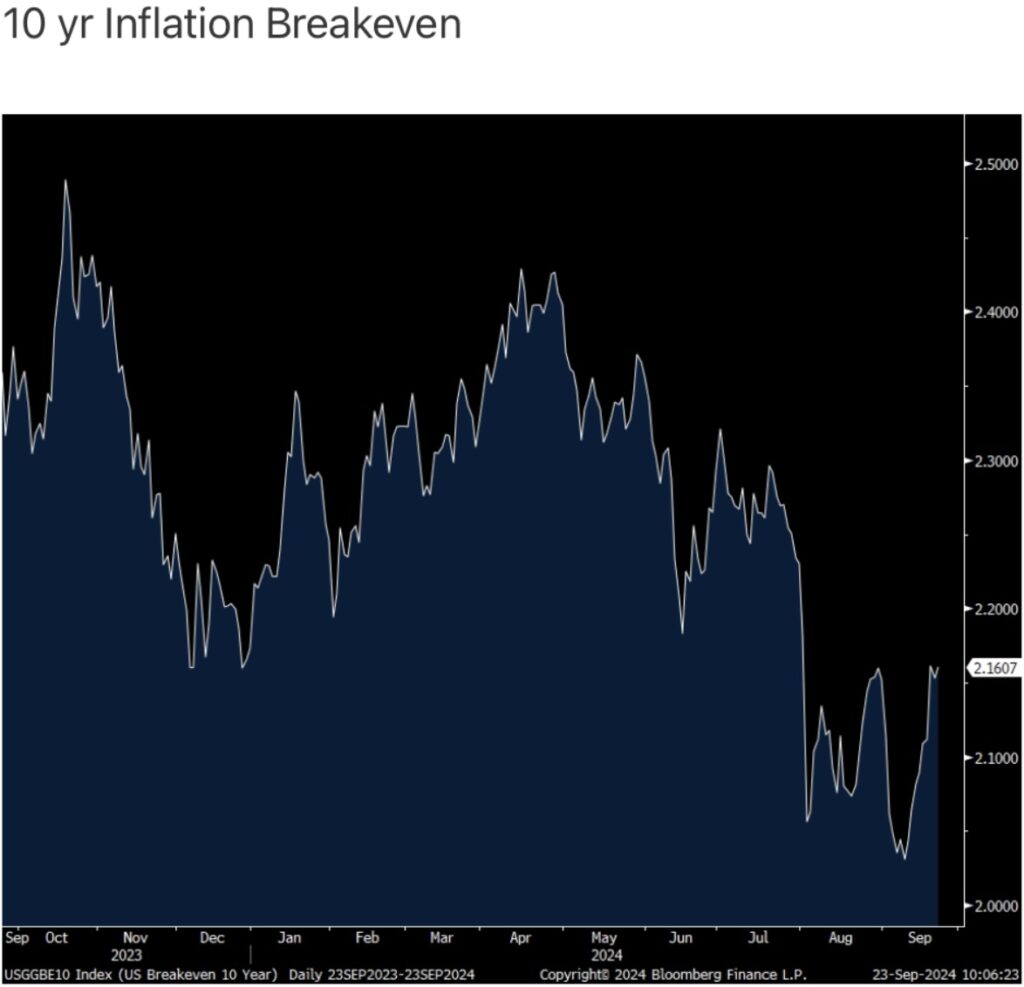

On overall pricing, “average prices charged for goods and services rising at the fastest rate since March, representing the first acceleration of selling price inflation for four months. The upturn lifted the rate of inflation further above the pre-pandemic long run average. Rates of selling price inflation moved up to 6 month highs in both manufacturing and services, in both cases running above pre-pandemic long run averages to point to elevated rates of increase.”…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

More on this, “Higher charges were driven by increased costs, with input costs rising at fastest pace for a year in September. A one yr high rate of cost inflation in the service sector was often linked to the need to raise pay rates for staff. In contrast, manufacturing input cost growth cooled to a 6 month low thanks to lower energy prices and fewer supply chain price pressures.”

The bottom line from S&P Global is that the current level of the US PMI composite index is typically consistent with 2.2% GDP growth which was about the average seen in the 1st half of 2024.

Bottom Line

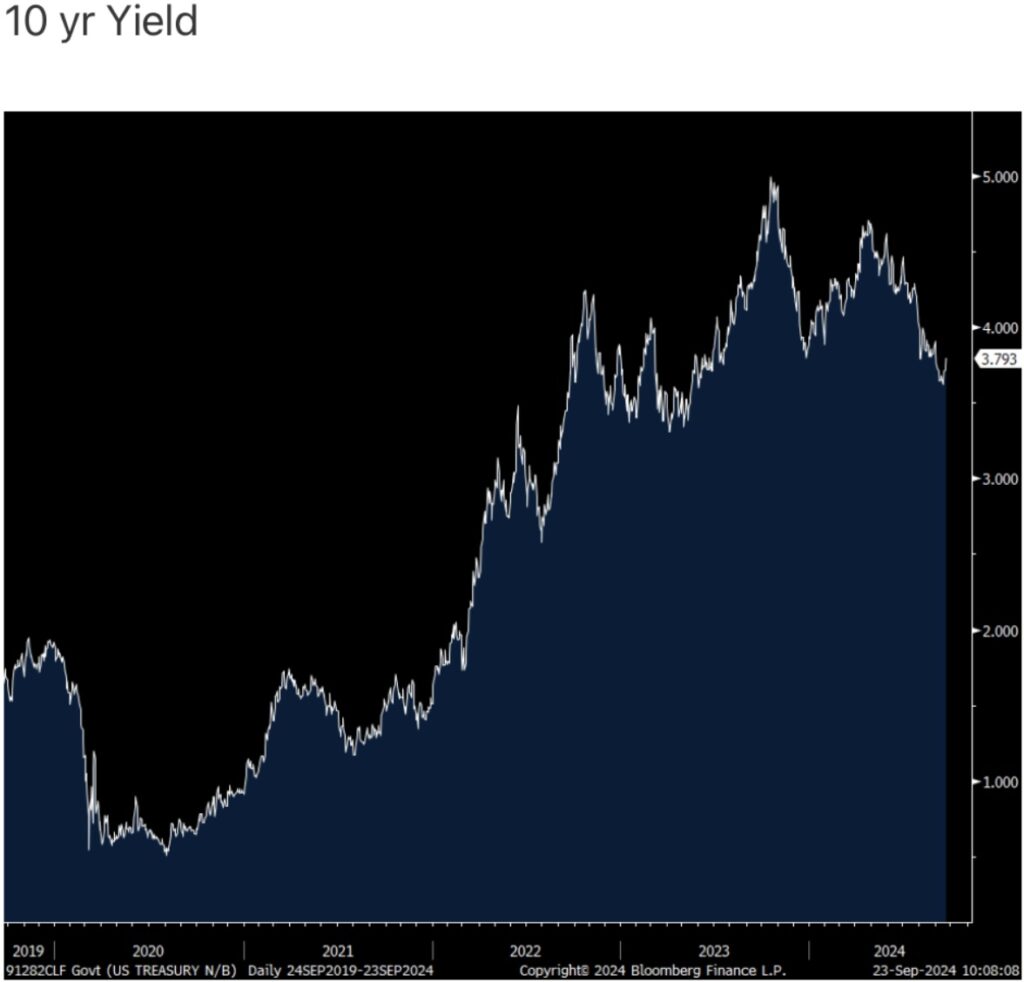

My bottom line, again the services side of the US economy is carrying all the water of economic growth and at least said here comes along with still inflationary pressures in contrast to manufacturing. I do want to point out again, the lift in the 10 yr yield post figure to 3.79% which is at a 3 week high, and something I thought was a high possibility when the Fed would start cutting short rates.

Put yourself in the shoes of a market participant in the long end of the US yield curve, and maybe you are one. After the traumatic experience of 2022 with blood in the streets of bond land and a 40 yr high in inflation, do you want to see the Fed aggressively cutting short term interest rates? Is that enticing to buy duration? No.

One Of The Most Important Interviews Of 2024

To listen to one of Michael Oliver’s most important interviews of 2024 where he issues a major crash warning for the US stock market and discusses what will happen with gold and the rest of global markets CLICK HERE OR ON THE IMAGE BELOW.

Another Record High For Gold!

To listen to James Turk discuss the wild trading in the gold and silver markets as well as what to expect next CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.