Today Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, shared with King World News a look at two bull markets.

Commodities Bull

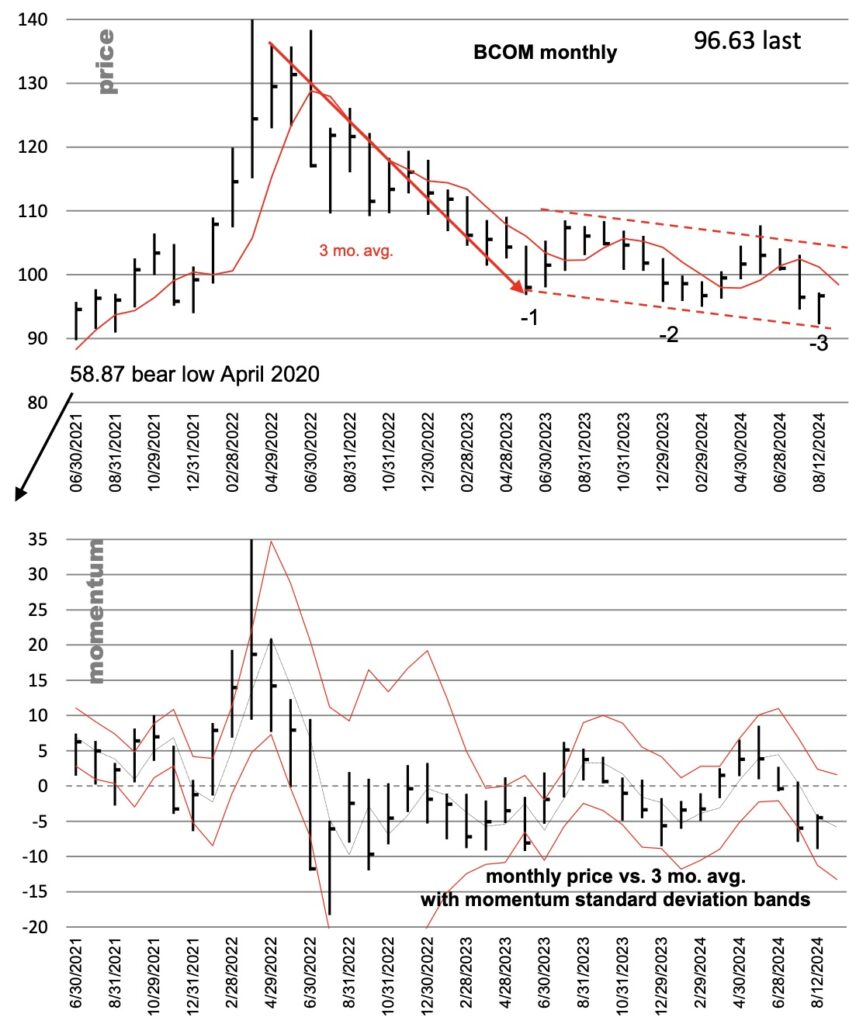

August 13 (King World News) – Michael Oliver, Founder of MSA Research: Our prior reports we have shown both annual momentum and quarterly momentum of BCOM. Annual momentum shifted to positive in October 2020 around 70 price level. Subsequent advanced carried to 140. Since early 2022 BCOM has corrected with most of the correction having occurred by early 2023. The annual momentum action dropped as well, but has held over the past year plus in a zone of likely support (in July 21 report).

Quarterly momentum generated a teaser upside breakout last quarter but that fizzled with price dropping, now only marginally below the lows seen early this year.

Commodities About To Resume Bull Market

Dissipating Downside Energy

We note that one of our MSA-conceived price chart patterns is what we term a power thrust with three humps (when upside) or on the downside a collapse move with three lower bumps. The third one we are currently seeing. Again, the pattern of lows is a minor staircase compared to the sharp collapse move from mid 2022 to early 2023. A three wave process of dissipating downside energy. Action so far this month looks like it wants to apply brakes. Will have clearer sense of that later in this month. We suspect it’s simply a protracted bottoming process underway since the May price low of 2023…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

Uranium

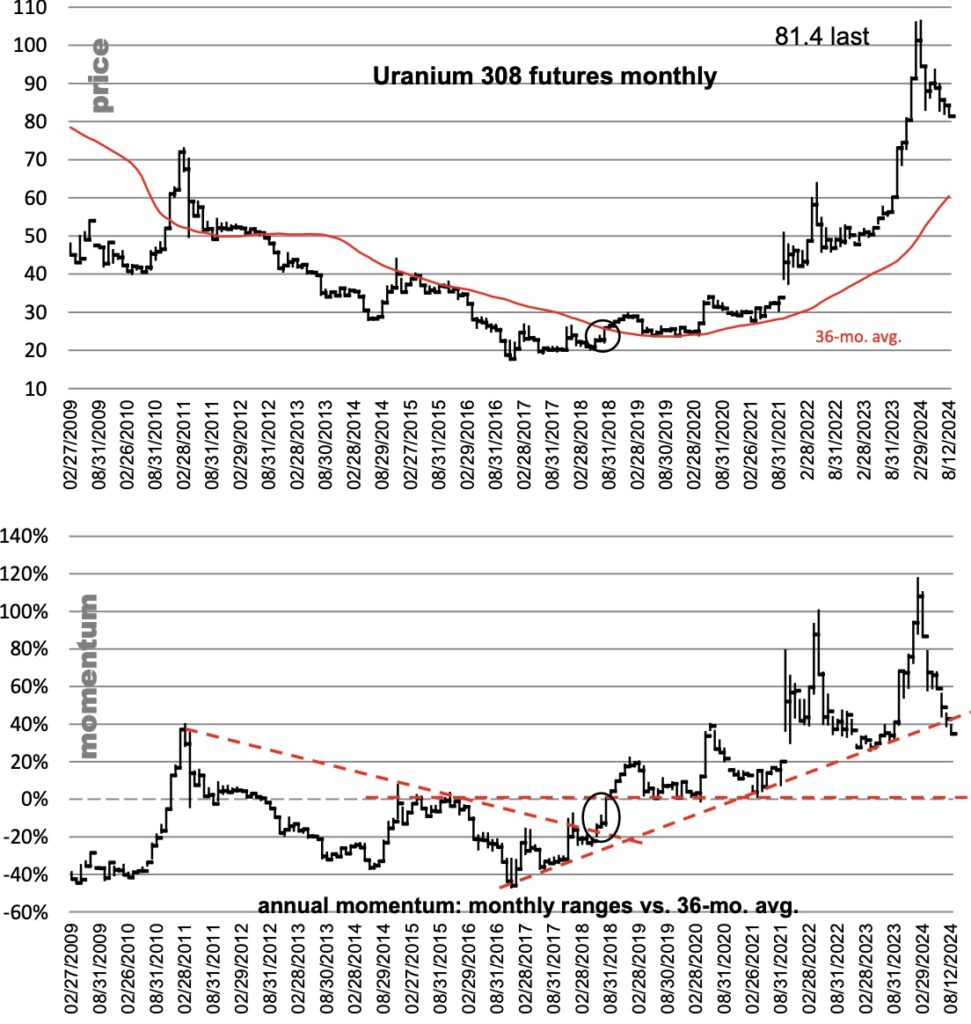

Since its 2018 annual momentum upturn, nothing on the downside has done damage to that trend. Until perhaps this month. If it closes out the month below 84 , then that trend line is finally broken.

Uranium Now Consolidating Massive Upside Gains

Uranium Bull Market Still Intact

End of the world situation? We doubt it, but a pullback to its rising 36 mos. avg./ zero line would not surprise, though that could take months to achieve. And that long-term average, as you can see, is rising each month. Looking out three months (November) for example the 36- mo. avg. is projected to be around $64 (rising about $1 each month). This is only 2 pages of an 11 page report, one of many issued each week by MSA Annual Research. To receive the special KWN discount to subscribe to Michael Oliver’s internationally acclaimed MSA Annual Research which is used by professionals and serious investors all over the world CLICK HERE.

RELEASED!

To listen to James Turk discuss the wild trading he expects to see in gold, silver, the mining stocks, the stock market and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.