Today the man who is connected in China at the highest levels predicted that, despite continued shenanigans in the paper market, the price of gold will surge $360 by the end of the year.

October 3 (King World News) – John Ing: In many ways investors should look to the past for lessons. The eighties, seventies or fifties? No, they should look to the “biblical past”. First came wars, followed by food shortages, then a pandemic, then fires and floods. What’s next? Kingdom against kingdom? Today we are experiencing all the above, and to some investors, the financial apocalypse. We believe the next disaster is inflation.

Before 2020, the Federal Reserve wanted higher inflation. Then when inflation exploded at three times the target, they wanted lower inflation. Until recently judging by the surprising bear market rally, markets appeared to have declared victory over inflation on hopes that the last round of interest rate hikes was the last, or a rate cut. However, inflation remains stubbornly high continuing to infect our economic system. Falling behind, airline, port, union, actors and government workers’ demands are in the double digits pushing up business costs at a time when employers are grappling with acute worker shortages. The Ukraine war festers, further stoking global inflation. Consumer spending at 3.6% remains robust, which will keep inflation high. Borrowings and services remain strong. Economic data suggests that the economy is much more resilient, with core inflation that strips out volatile food and energy on the rise, implying another rate increase. Inflation is very much alive.

However, the vast majority of investors are still hoping—no, praying—for an early relaxation and the return of the cheap money era, when the Fed sat on the long end of the curve and pumped out free money, causing the “everything” bubble, and sky-high home and corporate debt levels. Today’s policymakers, many of whom were still in elementary school in the 1980s, are hoping for a nostalgic replay despite their lack of experience in earlier inflationary settings. If they had been alive, they would have seen inflation rise as the Fed and European central banks were the factor in the formation and subsequent bursting of the bubbles.

Hyperinflation Now?

Today to counter the effects of the inflationary headache, quantitative tightening has caused the deflation of the global property balloon. Rising interest rates contributed to the failure of a few US banks and earlier this year, a “too big to fail” bank with more than half of America’s 4,000 odd banks with unrealized losses of $1 trillion dollars or more. Yet the economy dodged the much- feared recession in the face of the more aggressive monetary tightening. The reason? The tightening was not enough nor duration. Deficit spending and the unabashed money printing that funds spending continues. Hyperinflation will result if left to fester, especially because the essential components are still present. Turkey, Argentina, and Brazil are already experiencing extreme hyperinflation. The Bank of Russia had to raise interest rates from 3.5% to 12% as a result of the Russian ruble’s decline to below one penny. Despite a little “relief” from skyrocketing inflation, markets still have to contend with the Ukraine War, mounting geopolitical tensions, oil and food scarcity, and other persistent inflationary pressures. All are driven by demand.

Meanwhile China’s once mighty property sector which drove more than a quarter of economic activity is facing a liquidity crunch after property developer Big Country Garden revealed losses of $6.7 billion and giant Evergrande defaulted. As America and Japan learned, China’s debt-struck real estate market will take years, maybe decades to recover. In Turkey, interest rates reached 25% as the central bank reversed the unorthodox policy of artificially keeping interest rates low which resulted in hyperinflation. In Argentina where inflation is 100%, the government is still printing pesos after an 18% devaluation following the primary win by Milei.

Similarly in America, the printing press is used to pay for the record deficits and record debt to GDP (excluding World War II), all to make America great again. America has become the biggest deficit spender in the developed world with the world’s largest debt. This is worrying because Biden’s massive government spending spree to green America is the most aggressive industrial policy since World War II which will push inflation higher. As in the sixties, America has again opted for both “guns and butter,” with the same inflationary repercussions. Fasten your seatbelts…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Emissionary Zeal

A year ago, Mr. Biden’s $369 billion Inflation Reduction Act (IRA) package of tax credits and climate subsidies gave inflation a big boost while starting a worldwide arms race over who could provide the most subsidies for green technologies, automakers, and battery manufacturers. Due to the intervention, there was an increase in demand for skilled labor, essential supplies, and equipment as too much money was being spent on too few things. But simply throwing money at the issue won’t make it go away. Tesla has already received $1 billion for a battery facility in Buffalo that was built at the wrong time and location, costing $1 billion in writedowns. According to the US Department of Energy, just 150,000 public chargers are available for the approximately 4 million EVs currently on the road. The IRA also allotted $6 billion in cash to assist states in developing the necessary charging network. Then there is the chase for critical minerals which could take 10 years to fill demand, because mining for those minerals could take that long. Compared to a regular car, EVs require six times as much mineral input of an ordinary car. So much money spent, so few emissions and results.

There is more grim news to come. Detroit is on strike, joining Hollywood writers and actors resulting in the most missed days of work since August 2000, according to the Wall Street Journal. The discontent is comprehensive. The United Auto Workers (UAW) threatened by the green movement went on strike against Detroit’s “big three” carmakers simultaneously for the first time ever, when 19,000 workers of 146,000 UAW workers walked out of a few plants but crippled the car industry since the ripple effect could hit some 40 or so other plants and the potential shutdown of thousands of parts producers who employ hundreds of thousands of workers. The UAW was looking for a 40% increase in hourly pay over 4 years, a 4-day work week (32 hours), a boost in cost of living (COLA) and 5-week holidays. The union also wants to bring electric vehicle workers under the union banner because the assembly of EVs requires fewer workers because neither Tesla nor Revian are unionized. Inflation will continue to rise as a result of pandemic-bolden labour, a pro-union government, tight labour markets, declining productivity and now eye-catching wage boosts. Next up? A government shutdown in 45 days?

Surprisingly the majority of America’s funding to date has gone to battery plants of which S. Korea and Europe are the main beneficiaries. Those new semi-conductor plants? Ironically located in Republican districts. Then there is the consolidation of America’s steel industry where four steelmakers are about to become three, in a catch-up play as America attempts to rebuild its steel sector, but at great cost. Who is to pay for this, with debt levels sky-high?

In pursuit of these climate goals, the arms race between Europe, Japan and America is an attempt to outspend each other with the introduction of massive subsidies for tech and clean energy in order to attract new investment. Canada even joined in, promising $10 billion to salvage a modest $1 billion deal with Stellantis, after blowing the budget on the Trans Mountain Pipeline expansion. In this new cold war, clean technology, hydrogen, batteries, semiconductors and all of the above are considered crucial, but very few question the economics, believing that the end justifies the means, ignoring there is little hope in recouping costs.

How to Lose Friends and Influence (The Gun)

Geopolitics will be a factor. The Ukraine war was just a starter as the geopolitical faultlines shift with the rising rivalry between Beijing and Washington over “national security” issues. Today, China’s weaponization of critical minerals exports is a tit-for-tat reaction to America’s blocking of investment in machines, export controls and access to cutting-edge technology. China has a healthy lead in technology from AI to robotics. Needed is a perspective of politics and history because Joe Biden’s China strategy is repeating the mistakes of the past. Today there isn’t even a political off-ramp as both political parties vilify everything Chinese in a xenophobic bout of nationalism, with a focus on the upcoming 2024 election. The US no longer sees China as a competitor but adversary and thus the cold war is being fought not with missiles but economic weapons of digital technology, subsidies and AI. The battle will affect us all. The greater the economic damage, the more difficult the political choices, because Biden’s policies unwittingly makes America more reliant on China for resources and financing.

While China has been the locomotive, powering global growth for more than four decades, the world’s second biggest economy appears to be heading for a serious slowdown or even worse, deflation according to weekly Western media reports and the policymakers who have been predicting a crash for over three decades. The reality is different. China’s economy is expected to grow by 5%, in part because of robust trade with its Asian neighbours, Mexico and Europe. Outstripping Japan, China is the world’s car maker and exporter of cars (both combustion and EVs) which is a bright spot, helping its economy reduce its dependence on real estate. Its economic weight as a manufacturing juggernaut has resulted in record overall trade with the US because much of the US industrial base was moved overseas. And as a result, the US and China remain intricately intertwined, especially in technology. And unlike western inflation, China’s inflation rate actually dropped 1.4% in the second quarter due to cheap energy prices (thanks to Russian crude), and a slow emergence from the punitive Covid lockdowns.

However, by letting some of the overleveraged real estate developers go rather than keeping them alive as zombie businesses, as is frequently done in the West, China’s Xi has “targeted” economic stimulus rather than the bazooka-like spending often used here. Savings are rising, and Alibaba is seeing strong sales. Chinese interest rates are even lower than those in the US, which are at their highest point in 22 years. As a result, China is able to relax lending restrictions and support its struggling real estate market. However, there is a low demand for loans and a decline in foreign direct investment, amid worries that the slowdown is more structural and long-lasting. Deflation talk in China is merely that—talk…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

However, the deteriorating relations between the US and China has harmed both nations, as China sends fewer goods to the US while the US pays more for imports from other countries, which stokes inflation. China, which has a market of 1.4 billion people is embroiled in a strategic competition with the United States and still the country’s third-largest export market. China has switched from real estate to exports to regain its momentum. Yet foreign investors have sold off their holdings in China as a result of the escalating tensions and a crackdown on foreign corporations in China, however, due to China’s robust capital markets and attractive valuations, the Shanghai Stock Exchange has surpassed Nasdaq and Hong Kong as the top IPO in the first half of the year.

Who Needs Whom?

The globalization of trade and capital has lifted all boats boosting China out of poverty while turning America into the superpower bringing prosperity and lower costs to their consumers. The huge trade surpluses created mountains of dollars for example, which were recycled into dollars and dollar assets, financing America’s growing deficits. That model is broken. Both Trump and Biden have dismantled decades of policy initiatives which hurts America precisely when it is most needed. Both need to tread carefully. Action speaks louder than words.

America is saddled with debt and the burden of trillion-dollar borrowings is made difficult, if not impossible because China and others no longer wish to finance America’s profligacy. Despite oil prices up 30% since the summer, Saudi Arabia’s once gigantic mountain of US Treasuries has shrunk to a paltry $100 billion. According to the US Treasury Department, 16 countries dumped some $20 billion of their Treasury holdings in July. China sold $13.6 billion, bringing holdings to $822 billion, a 14-year low according to US Department of the Treasury. In total, BRICS have sold $123 billion this year. The problem is that in 2024, nearly one third of all US government debt, or $7.6 trillion must be refinanced – that is America’s Achilles heel.

In a fresh salvo, there were rumours since denied, that China had imposed a ban on iPhones for certain government agencies and government employees, that caused an overnight drop of $200 billion in Apple’s market cap, underlining the fragility of the tech war. The rumour mirrored America’s earlier ban on Huawei whose newest 5G smartphone, Mate 60 Pro is powered by China’s SMIC’s advanced Kirin 9000s chip, despite US sanctions designed to cutoff the tech giant from technology. The barring of inexpensive Chinese solar panels at a time when America needs more is another issue. The expense of being green in America will cause more inflation, affecting Americans the hardest, and right before the 2024 election. The relationship needs a reset on both sides.

Mr. Biden’s messianic belief in the powers of government, intervention and diplomacy is being put to a test. The consequence of his cold war with China is clear. Supply chains have been broken and America industry must play catch-up to replicate what they lost. America’s hegemony is fading as America “de-risks” economic ties with China. In an era of geopolitical fragmentation this broader de-risking though, has risks. Despite Biden’s efforts to build alliances to counter China, the unintended consequence is that America’s allies have moved closer to China because supply chains and investment are moving to intermediate countries rather than direct with China and are just “repackaged,” pushing up the costs for American consumers. In addition, many don’t share the US view that China is a geopolitical villain nor view it in their interest to put all their eggs in the US basket (Canada excepted). On that score, Biden’s huge geopolitical bet making India a critical ally as a counterweight to China is also risky, since India is a full-fledged member of BRICS and the Canadian-Indian schism is too difficult to ignore.

BRICS+ On Steroids

Another source of tension is that China has built a rival alternative to the G7, flipping the world order upside down with the expansion of the BRICS, a five-nation grouping of Brazil, Russia, India, China and South Africa founded in 2006. By doubling its size, the move has several alignments with multi-currencies and multi-objectives. This power of strategic partnerships saw India make its first crude oil payments in rupees, rather than dollars. China and Russia are trading in renminbi and the Saudis are selling oil in petroyuans. The Bank of China opened a branch in Saudi Arabia. The renminbi is the fifth most used currency in international payments. And as the largest buyer of Saudi crude, the expansion of the use of the renminbi in finance and trade comes at the expense of the petrodollar, once the backbone of the dollar’s reserve status. Dollars are simply being used less and less.

Part of the calculus is that the sanctions that froze Russia out of the dollar-based international financial markets, highlighted the risks of holding foreign reserves in dollar assets. A backlash over the weaponization of America’s financial might has accelerated the de-dollarization trend and was one of the reasons for the expansion of the BRICS group as a counterweight to Western dominance. More than 60 heads of state participated in the BRICS summit in South Africa, with the BRICS countries accounting for 37% of the world’s GDP in terms of purchasing power parity (PPP) and 40% of the world’s population, respectively. Comparatively, the G7 accounts for less than 10% of global population and 30% of GDP.

The addition of six new countries makes the rival bloc stronger, including three of the world’s largest oil producers which will have climate change implications with a growing division between emission reductions. Saudi Arabia, the newest member, predicts that the Middle East will become the “next Europe” within five years with the help of China, which has grown its diplomatic clout in the region where the US had previously held the hegemonic position. The BRICS’ New Development Bank already plays an increasingly important role in facilitating trade among the BRICS countries using national currencies instead of dollars. China’s Asian Infrastructure Investment Bank rivals the World Bank and there is a push to reform the Bretton Woods monetary framework with talk of a BRICS+ monetary unit backed by gold. Can this disparate group act as a cohesive economic unit and put aside traditional rivalries that plague the European Union? De- dollarization could be a good starting point.

Coupled with the many declines in usage of the dollar, the Ukraine war is a catalyst for this de- dollarization movement. Sanctions left few countries supporting Russia, however, China and Russia developed an alternative to the Western based SWIFT payment system that even unsanctioned nations including BRICS+, fearful of America’s weaponization of the dollar have sought ways to bypass the dollar. Today, the dollar-based system is being fragmented by currency swaps, regional payment systems, bilateral agreements and settlement systems. Western-based institutions like the IMF, World Bank and United Nations are facing calls for change. No longer is it automatic that dollars are to be recycled into Treasuries, which is worrisome because America’s debt keeps mounting higher.

The BRICS+ organization and its adherents are significant because they not only control a growing portion of the global economy, but also more and more of the planet’s limited resources. For five essential metals, Latin America alone is home to more than a fifth of the world’s reserves. The addition of Iran and Saudi Arabia, two of the top oil producers in the world and the latter a longtime ally of the US, comes after China helped restore diplomatic ties between Tehran and Riyadh. The second- and third-largest oil producers, Saudi Arabia and Russia, shocked the markets after the BRICS summit by extending their one-month production cutback through the end of the year. This increased oil prices by 30% to almost $100 per barrel, with the US Strategic Petroleum Reserve at its lowest levels since 1983, sparking fears of resurgent inflation as the kingdom reasserts control of the oil market.

Inflation is a Monetary Phenomenon

What will it take to tame inflation? To date, rising rates haven’t hurt demand. Looking back to the eighties we can recall when Paul Volcker, Fed Chair in 1979 moved the federal funds rate from 12 percent to 22 percent. US debt was less than $1 trillion then. Surprisingly inflation continued to rise, and it took more than a year for inflation to pullback. Then it took four more years of high interest rates and a painful recession to bring down inflation from double-digit levels back down to 2 percent. Today, higher rates have only caused the failures of a few banks and a “too big to fail bank,” and a recession is nowhere in sight and like then, markets are celebrating the pause. US debt is at $33 trillion. However, the celebrations are premature. If history is any indication, we haven’t seen anything yet.

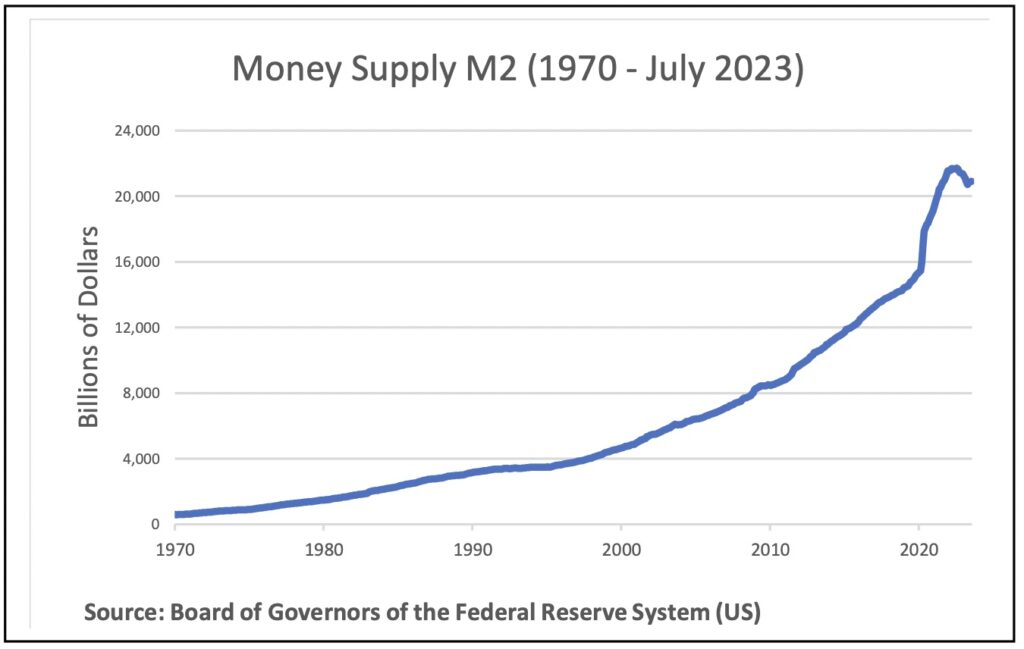

Noted American economist Milton Friedman once said, “corporations don’t cause inflation; governments create inflation.” He also observed that, “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in input.”

There is also substantial historic evidence of a causal relationship between the growth rate of the quantity of money and that of a country’s GDP. This standard of quantity of money is fundamental, yet neglected by our central banks and policymakers who want the benefits but not the costs – they can’t have it both ways. Consequently, the boom/bust periods of the past fifty years can best be explained by this lack of monetary discipline, particularly after severing from gold in 1971. The mistakes of the eighties and 2008 are part of this long-term pattern, continuing with today.

Simply inflation then and now is due to the too high rate of growth in the quantity of money. Milton Friedman also said that inflation is caused by too much money chasing too few goods. Money supply, overall money in the system measured as M2 has grown 120% or 8% a year. This growth is what fuels inflation.

Since 2008, the Fed has financed the debt-driven American economy with helicopter money in the form of four, maybe five rounds of quantitative easing. The federal deficit is expected to double this year at 6 percent of GDP, and for the next decade. Consequently, the Fed’s balance sheet topped $8 trillion as it bought bonds with newly created money made more difficult because the Congressional Budget Office (CBO) noted that one third of the current deficits goes to pay interest on money borrowed earlier. In fact, the US will spend more on interest payments than they spend on defense spending.

Divided State of AmericaSince 1971, the dollar has been a fiat currency whose only backing is confidence in the United States. History shows that countries that run persistent deficits will eventually be forced to adjust, often via a currency crisis. A shift away from the dollar would weaken the currency and drive inflation higher, forcing the Fed to raise rates, since one third of treasuries are owned by foreigners. US government finances are out of control. In 2011, credit rating agency Standard & Poors stripped the US of its triple (AAA) credit rating, citing a weakening in the “American policymaking and political institutions”. Then in August, the Congressional game of chicken prompted Fitch to downgrade the rating due to “repeated debt-limit political standoffs.”

And now, the last credit rating agency, Moody’s is poised to downgrade America’s national debt following the threat of another government shutdown. America’s debt is unsustainable. Yet the US government continues to pour more money at the problem through programs such as the Inflation Reduction Act, the Chips and Science Act and the Infrastructure Investment and Jobs Act which costs hundreds of billions, sucking investment and manufacturing from US allies. The war in Ukraine and China cold war has increased pressure to spend hundreds of billion more on defense which will further stoke inflation and the demand for critical minerals. In addition to greening the economy, there are other social priorities as well as the exorbitant cost of government borrowings as a result of higher rates. As a consequence of choosing both “guns and butter,” the US budget deficit has doubled under Biden, reaching $2 trillion in the year just ended. All this debases the nation’s currency.

America appears divided. American society is deeply polarized from politics, taxes, abortion, cultural identity, to the pandemic, which has undermined democracy as the rule of law is constantly tested through the lens of partisanship by the courts and lawmakers. That polarization has them even replaying the last election. That polarization also affected foreign policy with the formation of new world orders. The political system is dysfunctional. There is declining trust in our institutions making things worse. This fall, the US again risked defaulting when the debt-ceiling agreement expired, only to repeat the exercise in 45 days. While popular lore has that the US never defaulted on its debts, truth be told it has, when Franklin Roosevelt refused to pay treasury bondholders with gold in 1933, in 1979 when the Treasury missed payments and in 1971, when Nixon severed the dollar’s linkage to gold.

In the years after 2008, America has lost its way. Bailouts, multiple rounds of money printing, income disparity, climate change and wars have contributed to declines in productivity, dollar value and democracy itself. The US isn’t immune from the laws of economics. Its debt is at record highs because politicians won’t stop spending with new borrowings necessary to meet payments on existing debt – a never-ending circle. America’s advantage lies in its adherence to the rule of law. If America casts that aside, by defaulting on its debt, or letting its politicians bend elections or spend other people’s money, it risks everything. Because the next burst bubble, China won’t be around to help.

As Good as Gold

Gold held its own under both the gold standard in the post-1945 and when the system of fixed exchange rates saw sterling collapse almost 100 percent. At the end of World War II, the UK was bankrupt and British sterling collapsed when Britain was forced off the gold standard. The US dollar subsequently replaced sterling but in 1971, the dollar’s linkage to gold was severed because of America’s growing debt load. Déjà vu. Gold then and today was the asset to own. No wonder central banks are the largest buyers of gold, with China the largest buyer followed by Turkey, Singapore and Poland. China purchased 188 tons year to date, holding 2,136 tons or 4% of its reserves. Today the Shanghai Gold Exchange has become the largest gold player in the world.

Instead of focusing on debt levels, shifting geopolitical fortunes, or bank collapses, US markets see the glass as half full. The $33 trillion national debt of the United States is mostly the result of continual deficit spending supported by printed money, which has caused the hyperinflations in Argentina, Turkey, and Russia, forcing those countries to fund their massive budget deficits with diminishing quantities of their hard currency. The dollar is the world currency and with the help of foreign investors, America is able to pay its bills, which is an “exorbitant privilege.” However, since World War II, America’s share of world trade has decreased by 50% as American sanctions, the Russian invasion of Ukraine, and the cold war with China exacerbates this loss.

History shows that reserve currencies are not immune to the laws of gravity, particularly with America’s mounting debt load as a result of their politicians’ reckless spending and the Fed’s resultant borrowings. The geopolitical shifts in the world order also presents an opportunity to challenge the dollar’s dominance. America has the world’s largest debt and with a series of disconnected policies, running alongside a cold war, trade war and a financial war, America needs to attract more money to fill its financial gap. In this inherent fragility with America wanting it both ways, gold is a good thing to have.

Gold

Gold peaked in May at $2050/oz and despite moaning, Keynes’ barbaric metal is actually within 9% of the all-time highs even with the recent pullback. In other currencies, gold performed well as gold in yen is up 20%, 70% in Turkish lira and 11% in dollars. That will change. Gold is an index of currency fears, a barometer of investor anxiety and hedge against inflation. If people believe that the dollar is overvalued or markets inflated at a time of geopolitical tensions or bordering on hyperinflation, then gold is a good thing to have as a natural insurance policy. We believe that gold’s pullback provides an excellent purchase opportunity. We also continue to believe gold will reach $2,200/oz this year as a perilous adjustment in currencies and the global economies lies ahead. Next year the Americans will elect another inflationary president. That will be good for gold, but bad for the dollar.

ALSO JUST RELEASED: FROM BAD TO WORSE: It’s Becoming Catastrophic For Tapped Out Consumers CLICK HERE

ALSO JUST RELEASED: This Global Ticking Time Bomb Is About To Be Unleashed CLICK HERE

ALSO JUST RELEASED: Global Markets Nervous As Government Shutdown Looms, Plus “Rent Too Damn High” CLICK HERE

ALSO JUST RELEASED: IMPORTANT UPDATE: Gold, Commodities And Inflation CLICK HERE.

To listen to Gerald Celente discuss the unfolding collapse and what surprises to expect next CLICK HERE OR ON THE IMAGE BELOW.

Just Released!

To listen to Alasdair Macleod discuss the financial crisis that is about to erupt and what this will mean for gold and silver CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.