Even though the US dollar has been strengthening recently, the price of gold has been on a tear closing today at another all-time high and is continuing even higher in after hours trading. Here is a look at what is moving these markets.

DOLLAR BULLISH: To Cut Or Not To Cut, That Is The Question

March 28 (King World News) – Peter Boockvar: You really have something to say about what you want the cadence of rate cuts to be as the whole world watches when you title your speech “There’s Still No Rush.” This from the same guy who gave a speech in November 2023 titled “Something Appears to Be Giving” and where he said they could be cutting rates within 3-5 months. “It has nothing to do with trying to save the economy. It is consistent with every policy rule. There is no reason to say we will keep it really high.” That further stoked the asset price rally into year end that continues to this day and that is completely unbothered by what he said last night, bizarrely I believe…

In Times Of Increased Uncertainty

First, The Problem: An Undeniable Currency/Wealth Crisis & Transformation.

Fiat currencies are openly entering the last chapters of their once illusory but now steadily declining purchasing power and global credibility. La plus ça change…

This slow and steady spiral of fiat currency strength and the consequent risk of wealth destruction is nothing new. In fact, all debt-soaked systems throughout history have ended with a debased and then broken fiat currency. This is true without exception—from Ancient Rome to the Modern West.

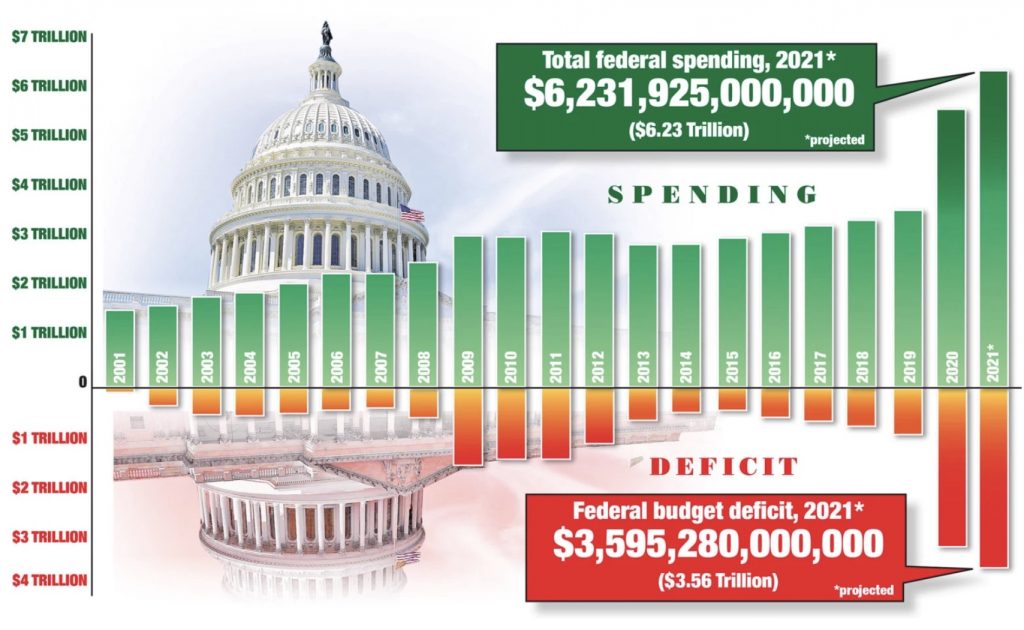

Today’s global currencies are empirically following the same familiar pattern. In a global setting of unprecedented (and rising) debt levels which have risen from $258 trillion in 2020 to well over $330 trillion by 2022, etc. 2023, etc. 2024…

Out Of Control Spending:

The US Portion Alone Is Trillions

In early 2002, this legend made major investments for himself, his family a his group of investors into physical gold when the price was $300 per ounce.

His company is now the world leader for direct investor ownership of physical gold and silver outside of the banking system. It is also the industry leader in wealth preservation through precious metals for HNW clients in over 90 countries seeking private and unencumbered ownership of their assets outside of a fractured commercial banking system.

To listen to this amazing interview about the surge in the price of gold over $2,200 this week as well as the coming mania in the gold market, silver, inflation, and what to expect next CLICK HERE OR ON THE IMAGE ABOVE.

Sponsored

I say bizarrely because higher for longer interest rates is a real thing and should not be ignored, but it is. Waller said last night after mentioning the progress they’ve made towards their inflation goal and with the labor market now in “better balance”, he said “But the data we have received so far this year has made me uncertain about the speed of continued progress.” He still wants to cut interest rates this year upon further progress, “But until that progress materializes, I am not ready to take that step” and because he said the US economy is strong and the labor market is resilient, “the risk of waiting a little longer to ease policy is small and significantly lower than acting too soon and possibly squandering our progress on inflation.”

In other words, a weaker economy is more the trigger for sooner rather than later rate cuts and less so a further slowing in inflation. To this, at the end of his speech he said “in the absence of an unexpected and material deterioration in the economy, I am going to need to see at least a couple months of better inflation data before I have enough confidence that beginning to cut rates will keep the economy on a path to 2% inflation.”

He also was rather skeptical of the recent rebound in productivity as it comes after a string of weakness where over the past few years overall productivity is only averaging about 1.25% per annum, rather lackluster. He laid out his case.

So two things here, Waller joins voting member Bostic in wanting to wait and only likely expecting 1-2 cuts this year and Powell and Michelle Bowman likely are in this corner I’d say. The other, can we finally throw out the dot plot in the garbage as its relevancy is really only one day? I say this because it is only a snapshot of what members think on the day of the meeting and those thoughts can change by the next day. And, there is no differentiation between voters and non-voters.

Bottom line to what Waller said last night for purposes of policy, “In my view, it is appropriate to reduce the overall number of rate cuts or push them further into the future in response to the recent data.” While he said that could change, “Based on what we know now, there is no urgency in taking that step.”

Notwithstanding the current expression by Waller and Bostic that maybe we’ll get one or at most 2 cuts this year (Bostic wants just one), the fed funds futures market is still currently pricing in 70 bps of cuts (100% of two and 80% chance of a third) this year.

King World News note: Even though the price of gold has been on a tear, silver remains particularly cheap at this moment in history, but may finally be ready to unleash on the upside. The next upside break will take the price of silver to a new all-time high above $50 so it is a good idea to use any weakness to continue to accumulate physical silver and enjoy the ride.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.