The prices of gold and silver soared in 2024. Take a look…

KWN just released a powerful audio interview as we kickoff 2025. But first…

January 2 (King World News) – James Turk: Both gold and silver fell short of my year-end targets, Eric. Those were a $2700-$3000 range for gold, and instead of silver probing overhead resistance at $50, it’s testing underlying support at $30. Nevertheless, both precious metals had a good year, with gold up 28.2% while silver slightly underperformed rising 21.3%.

But as you know, Eric, I put more focus on the long-term. Doing so is consistent with the dollar cost averaging strategy that I have been recommending to accumulate the precious metals as a way to save purchasing power.

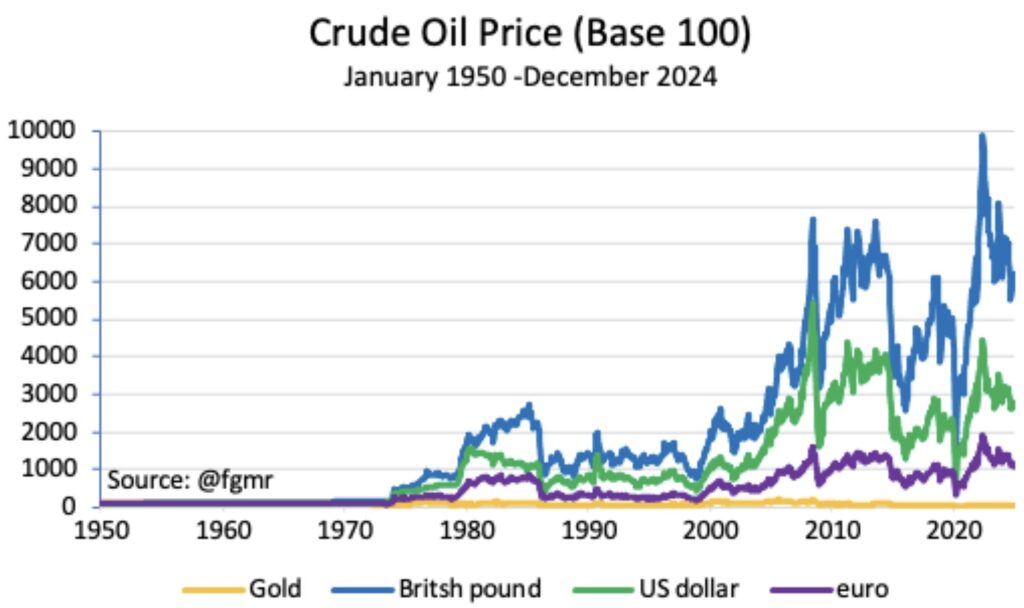

The following chart illustrates the success of this strategy. An ounce or a gram of gold today purchases the same amount of crude oil as it did over seven decades ago.

Saving purchasing power is an important part of one’s personal financial management, but it doesn’t make sense to save dollars or other fiat currencies. Their continual debasement and depreciation is evidenced by their ongoing inflation in the above chart.

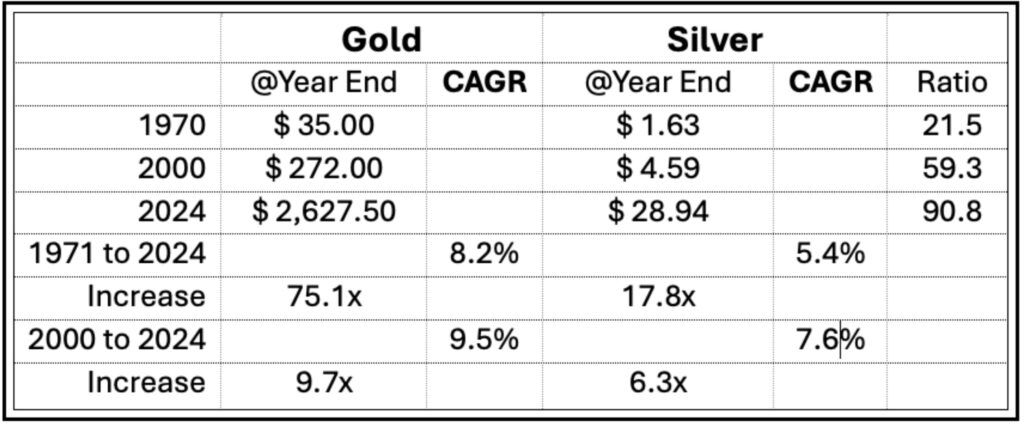

There is another way to show that saving precious metals is a good strategy. I’ve put together the following table showing the exceptional Compound Annual Growth Rate (CAGR) of both precious metals.

I’ve calculated their CAGR for two time periods. The first is from 1971 when President Nixon removed all discipline on the monetary system by breaking the dollar’s link to gold, and then also from 2000 to show that CAGR is rising this century.

An ounce or gram of gold still purchases the same amount of crude oil as it did in 1950. Rising CAGR simply means that the rate of dollar debasement is increasing. It’s losing purchasing power at a faster rate.

Silver hasn’t been keeping up with the loss of the dollar’s purchasing power as well as gold. We can see that from their respective CAGR, but also by the rise in their ratio from 21.5 in 1971 to the rarefied heights of 90.8 today…

ALERT:

Look at which company has positioned itself to become the next K92 high-grade gold powerhouse! CLICK HERE OR ON THE IMAGE BELOW.

Of course, these past results don’t prove that future results will be the same or even similar. The future can’t be predicted, but we know that these results happened because the monetary system was severely damaged in 1933 when FDR confiscated gold, and then completely broken in 1971 when Nixon severed the last links to constitutional money, which of course is gold and silver.

So while we can’t predict the future, we should assume that gold and silver will continue to climb higher in 2025 because there will be more dollar debasement and inflation until we see some meaningful change. That would mean returning to the constitutional monetary system that existed from 1787 to 1913, the year the Federal Reserve was established. I don’t see that change happening in the year ahead, but then again, the future can’t be predicted.

So instead of making guesses about the future, I would like to focus on value. Gold and silver are always good value in a broken monetary system because despite their daily, monthly and annual fluctuations, they preserve purchasing power over long periods, as we can see from the chart and table above. But there is another good value opportunity whose time I believe has come – the shares of precious metal mining companies.

Turk Just Warned Financial Crisis Set To Erupt In Early 2025!

To listen to what this financial crisis that is set to erupt in 2025 will look like and how you can safely navigate your way through the coming global shockwaves CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.