As we come to the end of the trading week, rate cut odds have plummeted, plus a look at haves and have nots, and “Brother, can you spare some liquidity?”

The Haves And The Have Nots

February 2 (King World News) – Peter Boockvar: Wow, what an action packed week. Is it 4pm yet?

There is a world outside of the incredible $270b market cap gain in two stocks today and that outside world is still very much a mixed bag.

I guess Jay Powell’s press conference wasn’t enough on Wednesday in his conveyance of information and now he wants to talk to ‘the people.’ I doubt he says anything new but if I were to guess, I’d think he would be using this venue as a way to push back on the Congress people who want him to cut interest rates aggressively especially because of the unaffordability of homes, even though zero rates and MBS buying was the main reason why home prices rose 40% in 2 years. He’ll mention how important it is to keep inflation down and that stable prices is the foundation of healthy economic growth. While Jay said they likely won’t cut rates in March, rate cut odds in the fed funds futures market are still at 40%…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

“Brother, Can You Spare Some Liquidity?”

New York Community Bank wasn’t the only bank this week that announced their pain from US commercial real estate (along with their new capital ratio challenges). In case you didn’t see yesterday it ensnared a Japanese bank, Aozora Bank. They announced a surprising loss Thursday because of their exposure to US real estate. “Due to higher US interest rates and a shift to remote work accelerated by Covid-19, the US office market continues to face adverse conditions combined with extremely low liquidity.” The stock is down 34% in the past 2 days. Understand here that the problem with US commercial real estate is not just office, the higher rate environment negatively impacts any landlord that has debt coming due and if the rate on its existing loan was priced pre 2022. There is much more pain to come when one’s cost of capital goes from 3% to 8%.

Auto Sales Struggle Even As Prices Tumble

US auto sales in January were well below expectations coming in at 15mm at a SAAR. The estimate was 15.7mm, the December print was 15.83mm and it compares with the January 2023 level of 15.74mm. It’s also the least since March 2023.

Wards Intelligence said:

“Causes for the month’s weaker results could have included some payback for December’s surge. However, affordability and inventory likely played roles, as availability remains well below historically normal levels for a market running at a 15 million plus annualized rate, and at the same time interest rates for financing purchases are at long time highs, the mix on dealer lots is weighted toward higher priced vehicles.”

You’ve heard me say before that the auto industry was the last industry standing in manufacturing as dealer lots got restocked, which seems to have run its course and now we have lessening end demand.

Speaking of the industrial side and echoing what Texas Instruments said a few weeks ago, Microchip Technology, a company that sells semiconductors to 125,000 customers “across the industrial, automotive, consumer, aerospace and defense, communications and computing markets,” said:

“Our December quarter performance fell short of our November guidance, primarily due to weaker business conditions. Revenue declined 21.7% sequentially as weak demand drove customers to cut shipments and extend shutdowns to further de-risk their inventories, which prevented us from fulfilling previously planned shipments from backlog.”

“While we remain confident in the long term opportunities for our business, we are cautious about demand in the near term given the weak macro environment and customers’ ongoing actions to reduce inventory. As such, we are taking steps to limit discretionary spending and tightly manage inventory levels during this downcycle. As a result, we intend to have 2 week shutdowns in our large wafer fabrication facilities in each of the March and June quarters and reduced activity in many of our factories, resulting in underutilization charges.”

“As we enter the March quarter, we anticipate customers may continue to reduce inventory levels in the short term as they adjust operations and seek to match demand in an increasingly dynamic market.”

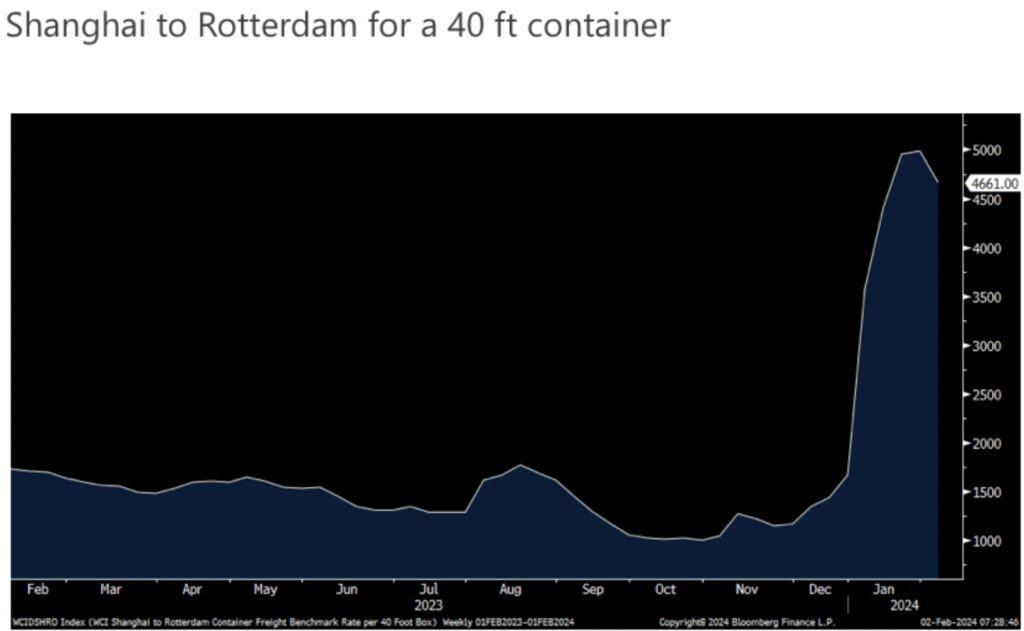

Container Shipping Prices Remain In The Stratosphere

There was slight relief in world container shipping prices for the week ended 2/1 as the Shanghai to Rotterdam trip now costs $4,661 per container vs $4,984 in the week before, though still up from $1,667 at the end of 2023.

Shifting to where the Boomers are spending their money, as are many others, cruising which is still doing great.

From Royal Caribbean:

“Momentum continues in 2024 with a record breaking start to the wave season. Bookings have consistently outpaced last year across all key products at much higher rates. In fact, the five highest booking weeks in our company’s history all occurred since the last earnings call. As a result, our capacity is up 8.5% y/o/y. We have less inventory available to book in 2024 than we did a year ago for 2023 and half as many staterooms left in Q1.”

“We continue to see particularly healthy demand from North America where about 80% of our guests will be sourced this year…We continue to see a very positive sentiment from our customers, bolstered by strong labor markets, high wages, surplus savings and elevated wealth levels. Year-over-year growth and spend on experiences is double that of spent on goods and cruising remains an exceptional value proposition with lower penetration, higher consumer consideration and high purchase intent.”

Again with Europe, “bookings were softer for the impacted itineraries for few weeks last October, but rebounded relatively quickly and are now significantly higher than same time last year…We are also very pleased with the trends we are seeing on other North American itineraries.”

Back on the industrial side, International Paper talked about the tough 2023. “During much of the year, underlying demand for our products was lower, slower, as consumer prioritized spending on services and essential goods…Demand for our products was further constrained by inventory destocking as our customers and the broader supply chain worked through elevated inventories of their products. The lower demand combined with declining sales prices for our products and sticky cost inflation resulted in lower revenues and earnings in 2023 when compared to prior periods.”

As for their outlook, “Given the fluid market environment, we have chosen not to provide a full year earnings outlook. However, we will share our view of demand trends and IP improvement initiatives as well as other financial assumptions. Overall, we believe the demand environment will continue to improve across our portfolio…We expect the first quarter of 2024 will be an earnings trough due to seasonally low volumes, seasonally higher costs, and unfavorable impacts from the January winter freeze…Regarding demand trends, we expect packaging and fluff pulp markets to grow approximately 3% y/o/y.” They expect to trail the market in its North American box business.

This was the 2024 outlook from Stanley Black and Decker:

“our view is that these markets will remain dynamic in 2024. Overall, we expect relative strength and demand from professional tools and portions of our industrial markets. However, we believe the consumer and outdoor demand trends will continue to be weak. Together, this results in a modestly negative outlook in aggregate for all of our markets.”

“There are a few key macroeconomic indicators that more directly impact our larger markets in North America, which are somewhat mixed. Examples of this mixed North American Tools and Outdoor markets are as follows. New residential builds are forecasted to improve from current levels, yet remain modestly negative y/o/y. Residential repair and remodel is currently expected to retract. And the outdoor power equipment industry continues to show signs of customer destocking, and we don’t expect the pivot to growth during 2024.”

One more thing, rate cut odds…

Rate cut odds for March now stand at just 22% vs 40% right before the jobs release. That’s the lowest percentage since late November. It peaked at 100% in late December.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.