Another inflation wave is underway, and the Fed will have to decide whether to cut rates into inflation.

Sentiment In A Stock Market Mania

March 14 (King World News) – Peter Boockvar: When highlighting stock market sentiment data strictly to take the temperature of the room and watching out for extremes, both bullish and bearish, from a contrarian standpoint, I’ve mentioned that a 40 point spread between the Bulls and Bears in the Investors Intelligence survey should be considered extreme. Well, yesterday’s survey revealed an uber extreme read as Bulls got above 60 at 60.9 while Bears fell to just 14.5 from 16 last week where you now need a telescope to find a Bear.

The Bear read is a 6 yr low and now we have a 46.4 Bull/Bear spread which is a flashing red light in the short term. This by the way incorporates trade thru last Friday which was a reversal day so surprising that the mood after that wasn’t tempered at all. Today’s retail focused AAII did see Bulls fall by 5.8 pts to 45.9 after a like rise last week to the highest since December. Bears though were little changed, up .1 pts to 21.9 as those Bulls went to the Neutral side.

Bottom line, in the short term this is very much worth taking note where a market rest / consolidation / digestion / correction / pullback, etc… are now more possible. I emphasize ‘short term’ as sentiment indicators should only be taken as such…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Copper And Commodities Threaten Inflation Wave

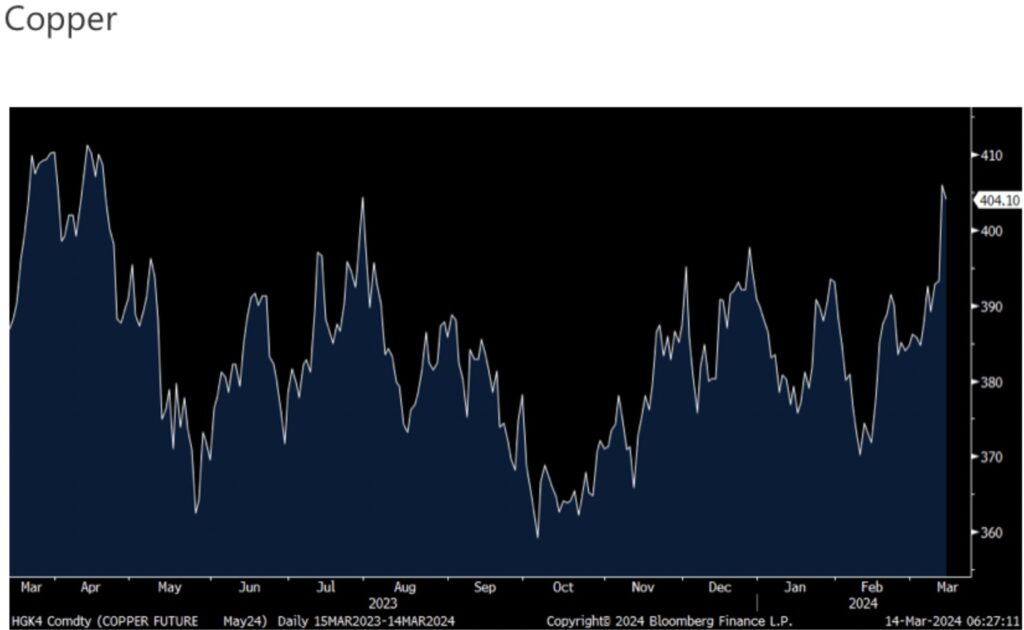

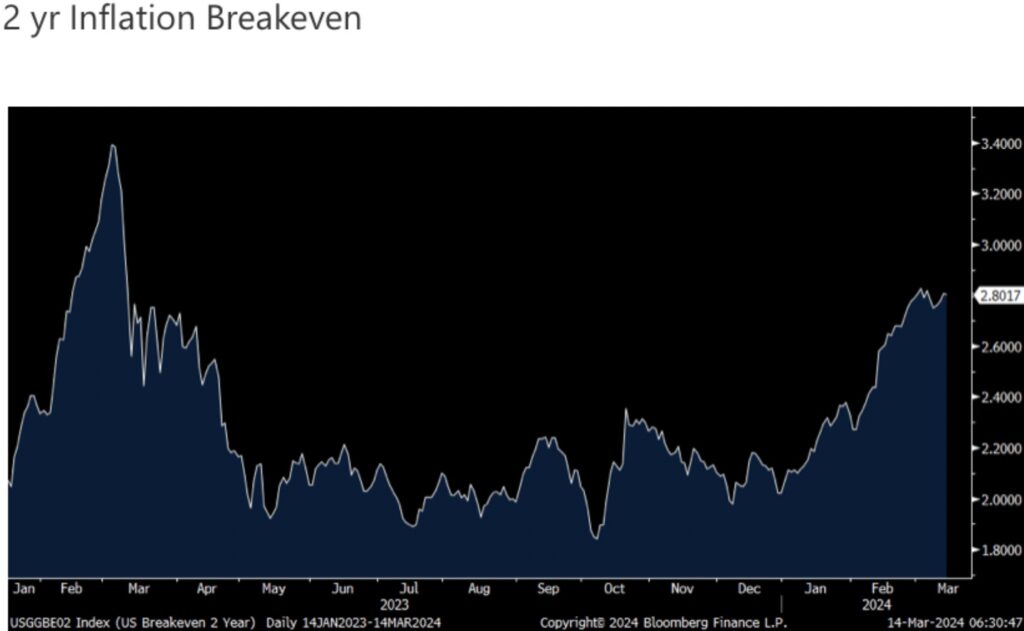

While it seems that the Fed so badly wants to start cutting rates, albeit gingerly, because they are afraid of over doing their stay, commodity prices are getting more volatile again and won’t make their job easy at all. Especially since it threatens the disinflation we’ve seen in goods prices. Copper prices jumped almost 13 cents a pound yesterday, up 3.3% to a one year high as China will be cutting back smelter production. It’s pulling back a touch today.

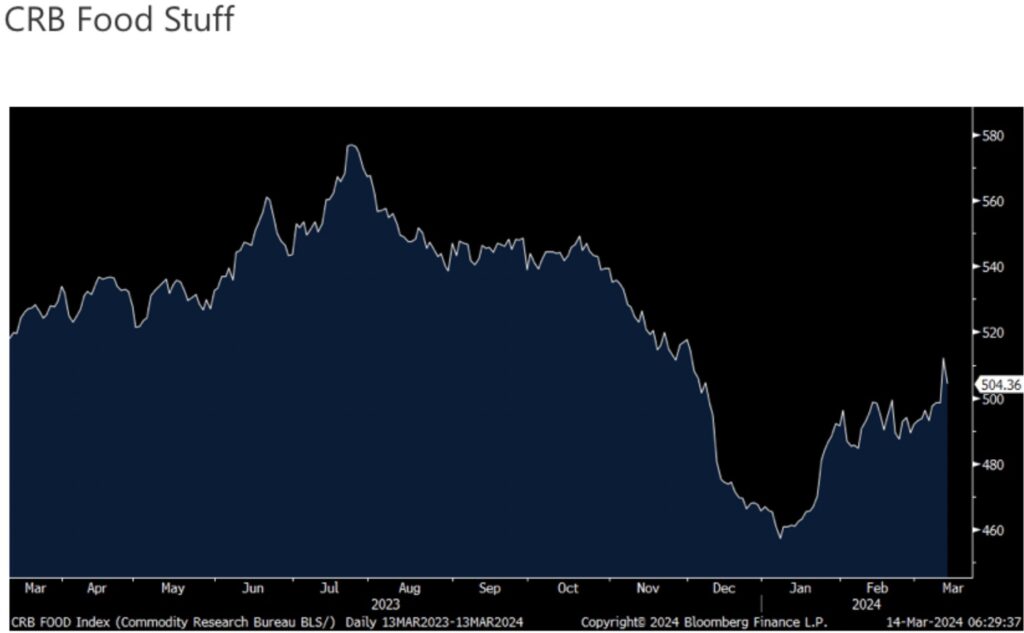

We have oil prices back to $80 and gasoline prices at a 4 month high. The CRB raw industrials index touched the highest since October last week. The CRB food stuff index closed Tuesday at the highest since early December before pulling back yesterday.

We remain bullish and long energy, copper, uranium and fertilizer stocks, along with precious metals. Inflation breakevens are hovering around one yr highs.

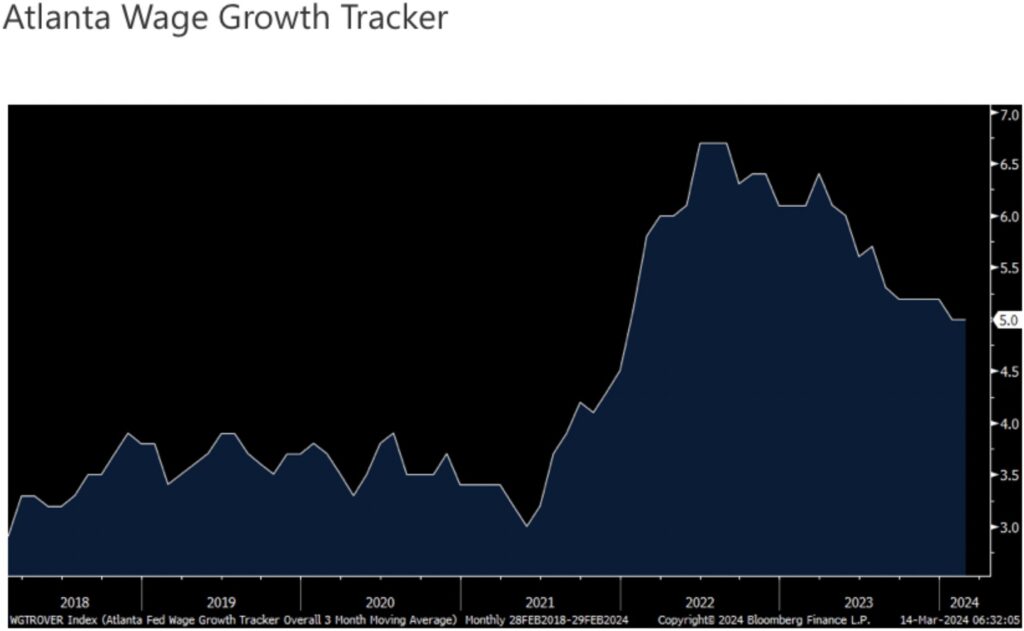

Also influencing the inflation story, particularly for service heavy businesses that sometimes have only price in its ability to offset, the Atlanta Fed’s February wage growth tracker came out yesterday and it remained at up 5% y/o/y. While off its 2022 highs, it still remains well above its pre Covid pace.

For ‘job stayers,’ the wage gain held at 4.7% and for ‘job switcher’ it fell to 5.9% from 6.1%, but compares with the 20 yr pre Covid average of 3.7%. The Fed’s job from here will not be easy.

Real Estate

In the Lennar earnings release they talked about the reliance on discounting in order to drive sales. “We are pleased to report another strong quarter as we remained focused on consistent production pace driving sales pace, while using pricing, incentives, marketing spend, and margin informed by dynamic pricing to enable consistent sales volume in a fluctuating interest rate environment. Although affordability continued to be tested by interest rate movements, purchasers remained responsive to increased sales incentives.”

Further, “The macroeconomic environment remained relatively consistent throughout our first quarter, with interest rates fluctuating within a manageable range, employment remaining strong, housing supply remaining chronically short due to production deficits over a decade, and demand strength driven by strong household formation.”

While the new build market is doing ok for big builders, smaller builders aren’t doing as well and, the near 30 yr low in the pace of existing home sales turnover slows things down. Union Pacific at a JP Morgan conference yesterday said “you still have interest rates that are impacting the housing market and that has a ripple effect through our business. So, while primarily it hits lumber, you also have cement, roofing and then you have the consumer side of things, everything that goes in the new house, the carpets, the lamps, the furniture. So that’s an impact as well.”

Meanwhile In Japan

Moving overseas, as anticipation grows that the BoJ will finally rid itself of NIRP and maybe YCC either next week or in April, JGB yields continue to creep higher. The 10 yr yield was up 1 bp to .78%, matching the highest since November. The 40 yr yield was up 1.2 bps to 2.08% and nearing again an 11 yr high. The yen is up a hair, and just off the best level in 6 weeks vs the US dollar. Maybe in sympathy, yields rose across Asia but are down slightly in Europe as the doves at the ECB are getting vocal about cuts. The US 10 yr yield is little changed at a 2 week high.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.