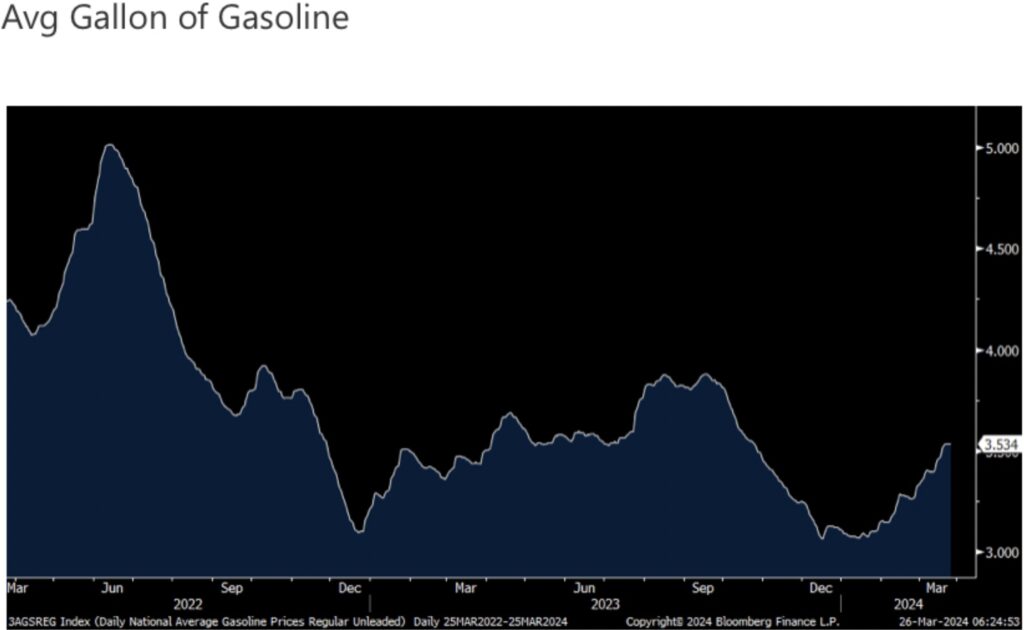

The consumer is being strangled by high inflation that is now accelerating as consumers spend more for gas to fill up their tanks and food prices continue to soar. Take a look…

Already Shaky Consumers Spending More At The Pump

March 26 (King World News) – Peter Boockvar: With the average gallon of gasoline at the highest level since October and higher by almost 3% y/o/y according to AAA, a Bloomberg News article yesterday cited AAA’s estimate for where prices can go this summer during the summer travel season. It’s $4, which if seen would be the most expensive since August 2022. Let’s hope they are wrong since the US consumer is already showing some shaky knees, especially the lower to middle income one, when seeing and listening to both the retail sales data and what we heard from a variety of retailers and restaurant companies over the past month.

They cite low inventories and “Attacks on Russian refineries have taken about 600,000 barrels a day of capacity” off the market and we know commodities are fungible. Also, “maintenance at US refineries and unexpected outages caused by leaks and fires also have had an impact on supplies and prices.

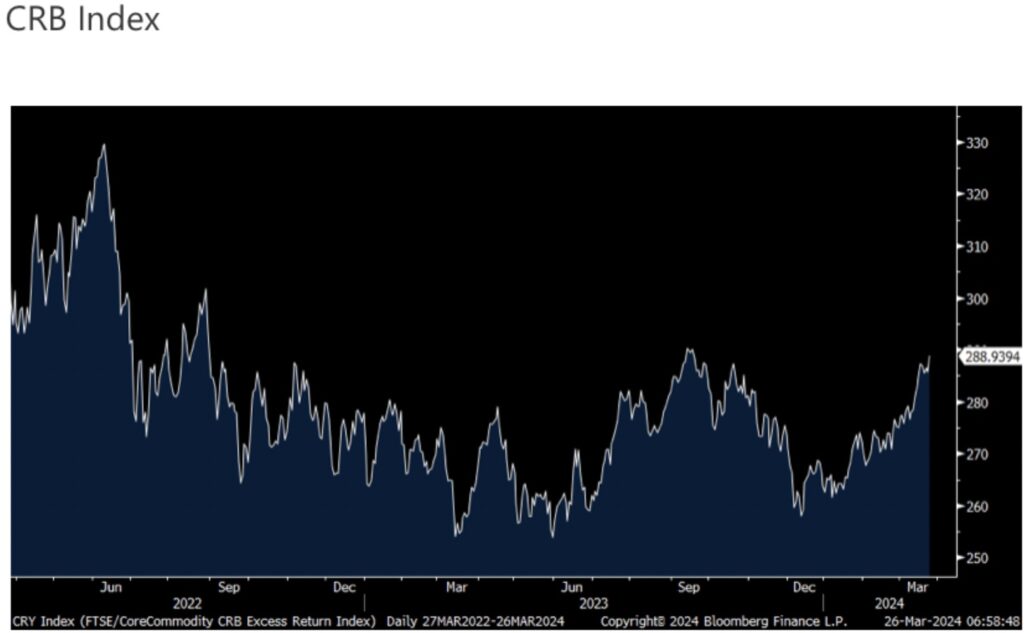

Food Prices Keep Spiking

With another spike in cocoa prices (was up 8% yesterday and by another 4% today), along with other soft commodities, the CRB Food Stuff index was higher by another 1.3% yesterday. It’s now up y/o/y and it’s the last thing food companies, restaurants and consumers need right now as traffic and volumes are more squishy. And, the overall CRB index is within less than 1% of the highest closing print since August 2022, the last thing the Federal Reserve wants to see just as Powell gets dovish.

A few weeks ago we saw a negative print for the March NY manufacturing index and some hope when the Philly index went positive but Dallas reported yesterday that its survey remained deeply negative at -14.4 and has been now for 23 straight months. Of note, prices paid rose to a 6 month high and those received rose to the most since February 2023. The overall 6 month business outlook was around the flat line, at 1.3 vs +6.2 in February and -10.4 in January…

In Times Of Increased Uncertainty

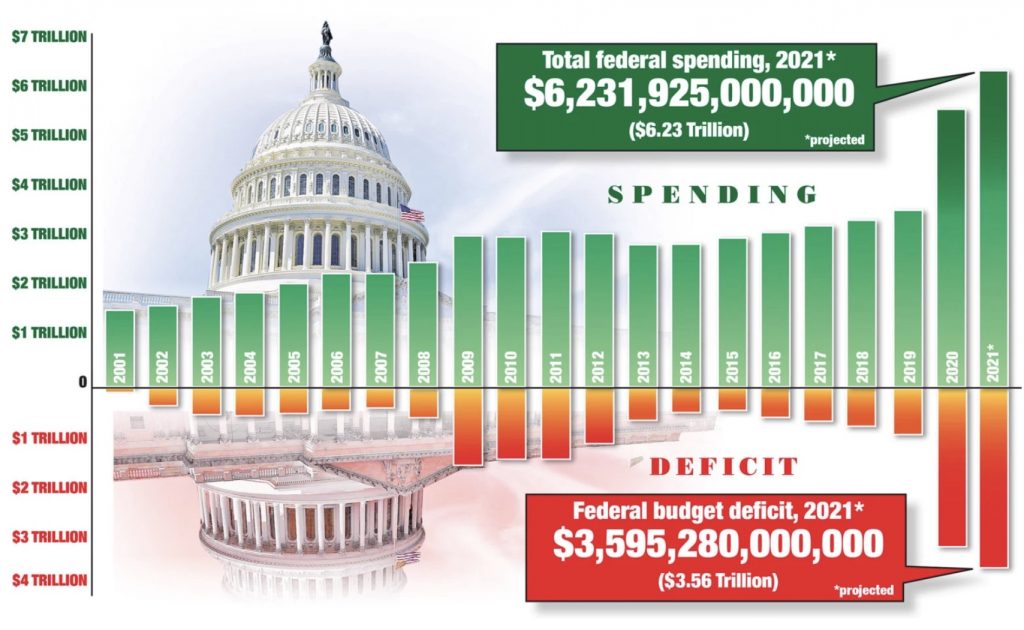

First, The Problem: An Undeniable Currency/Wealth Crisis & Transformation.

Fiat currencies are openly entering the last chapters of their once illusory but now steadily declining purchasing power and global credibility. La plus ça change…

This slow and steady spiral of fiat currency strength and the consequent risk of wealth destruction is nothing new. In fact, all debt-soaked systems throughout history have ended with a debased and then broken fiat currency. This is true without exception—from Ancient Rome to the Modern West.

Today’s global currencies are empirically following the same familiar pattern. In a global setting of unprecedented (and rising) debt levels which have risen from $258 trillion in 2020 to well over $330 trillion by 2022, etc. 2023, etc. 2024…

Out Of Control Spending:

The US Portion Alone Is Trillions

In early 2002, this legend made major investments for himself, his family a his group of investors into physical gold when the price was $300 per ounce.

His company is now the world leader for direct investor ownership of physical gold and silver outside of the banking system. It is also the industry leader in wealth preservation through precious metals for HNW clients in over 90 countries seeking private and unencumbered ownership of their assets outside of a fractured commercial banking system.

To listen to this amazing interview about the surge in the price of gold over $2,200 this week as well as the coming mania in the gold market, silver, inflation, and what to expect next CLICK HERE OR ON THE IMAGE ABOVE.

Sponsored

Here were some of the notable company comments in a variety of industries and mostly squares with another negative print in this survey:

Food Manufacturing

“Will the consumer continue to spend enough to promote growth? This is the question I cannot answer confidently.”

“We are working on several new growth opportunities that are promising for late 2024. We are leaning into data driven processes and automation to improve the efficiency of this additional business. This includes AI and API (application programming interface) programs.”

“Beef prices and availability are hurting margins and making it difficult to run product profitably. Chicken prices are also on the rise.”

Printing and related support activities

“We have been on a ‘hooray’ roll regarding incoming orders, with a current huge uptick compared with the prior year to date. We are benefiting from a few diverse customer bases that need our services, plus we are coming up on our very busy time of the year, with growth forecast for that period as well. If not for these unique and somewhat isolated customer needs, I believe it would be very slow for us right now. Instead, we are adding workers in both the plant and office to handle the volume of work.”

Nonmetallic Mineral Product Manufacturing

“The bad weather in January and February nationwide caused a downturn in new orders. This, coupled with the slight increase in interest rates (and no further decreases in mortgage rates), are not a good direction for homebuilding and remodeling and will cause us to miss our first-quarter expectation.

Primary Metal Manufacturing

“Capital expenditures are increasing to add new capabilities and new products. This is why our outlook is improved. Legacy business is declining sharply.”

Fabricated Metal Product Manufacturing

“A business is only as good as its customers’ business and is completely dependent upon its customers’ demand—and demand is weak. It’s a far stronger, deeper recession than publicized. Whether a lack of customer economic confidence, post-COVID caution, interest rates, inflation or a combination of all, it has stopped demand beyond the essential spending of deferred maintenance and repairs that buyers cannot defer any longer. Even with ‘competition retraction,’ businesses are serving the same and similar market segments, closing permanently or ceasing operations. Order volume remains unimproved.”

Machinery Manufacturing

“We kept thinking orders would pick up in the first quarter, but they have not. In fact, they’ve gotten even fewer and farther apart. Is it election uncertainly, a lack of peace overseas, money still being too expensive, or is it just a wet blanket over the entire economy? We don’t know, but we’re anxious to get some momentum going into the second half of the year.”

“We are seeing general business activity slowing and competition increasing. We generally see this trend as business slows and our competitors become more hungry. However, we think that the third and fourth quarters will be better as the political landscape hopefully improves.”

“After a very slow start for the year, we are seeing a slight increase in business. Hopefully, this trend will continue.”

Computer and Electronic Product Manufacturing

“Only time will tell the true underlying health of the labor market. While there are no disclosures we’re in a recession, ask any manufacturer on the globe and they will tell you we are deep into it. The backbone manufacturing of this country isn’t looking good at all. What is clear is that economic risks abound, and a soft landing is far from the truth out here. I have never seen it this bad in the capital equipment industry in the last 30 years.”

“We have seen a $400,000 decrease in sales this year. I am very concerned.”

Transportation Equipment Manufacturing

“Election, energy and interest rate uncertainty makes business planning difficult.”

Misc. Manufacturing

“Political discussions about taxes are extremely dishonest, and future proposed increases to taxes will further reduce U.S. manufacturing competitiveness globally. I find it very insulting and disingenuous when medium-sized companies are called out as not paying “our fair share” of taxes. Currently, if you look at our total tax paid versus our total profit, we are taxed at over 60 percent as a medium-sized manufacturing company. We can’t expand employment, technology and innovation to compete with China with higher taxes.”

“Our sales have been unusually low since October 2023, and we see the trend continuing but more dramatically in the next four months. We are laying off nonessential workers and cutting hours for employees, effective immediately. Our automotive OEM [original equipment manufacturer] business is down by about 20 percent. We are seeing a continued drop in our catalog sales. Our overall volumes have been gradually reducing for several years. We are unable to determine why this is occurring.”

To listen to Alasdair Macleod discuss China losing control over the price of silver and what this will mean for the silver market in 2024 CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.