With the price of gold futures surging back above the $2,600 level and silver futures above $31, take a look at what is happening around the world.

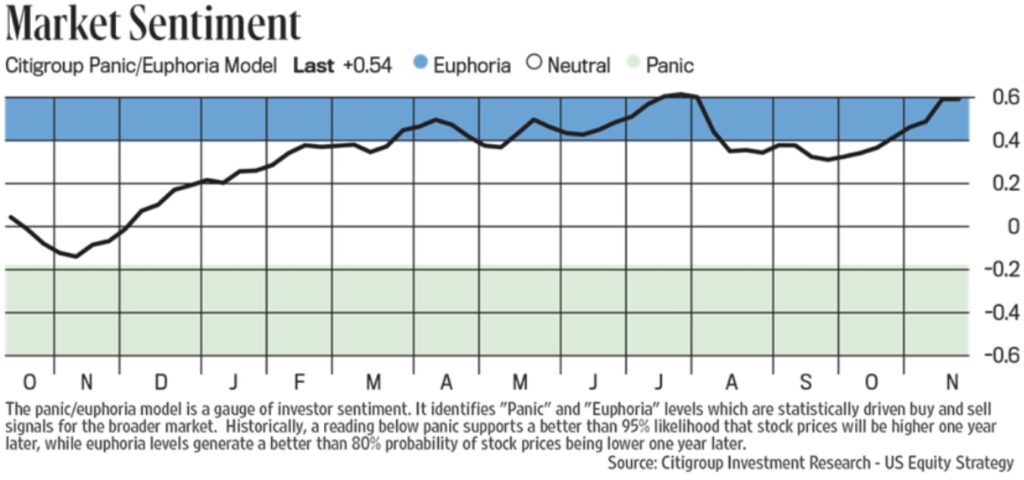

November 18 (King World News) – Peter Boockvar: I mentioned last week that market exuberance had gotten extreme post election as measured by the weekly Investors Intelligence sentiment survey. That was followed up this weekend with the updated Citi Panic/Euphoria index which jumped to .54 from .44 and is back to the highs seen in July right before the BoJ/yen driven market selloff. A read of .41 or more is considered Euphoria and we are thus well above that. Bottom line, this market ebullience was certainly a good set up for a pullback seen late last week and we’ll see likely after Nvidia’s numbers Wednesday night whether there is more to come.

Bond Yields Rising Around The World

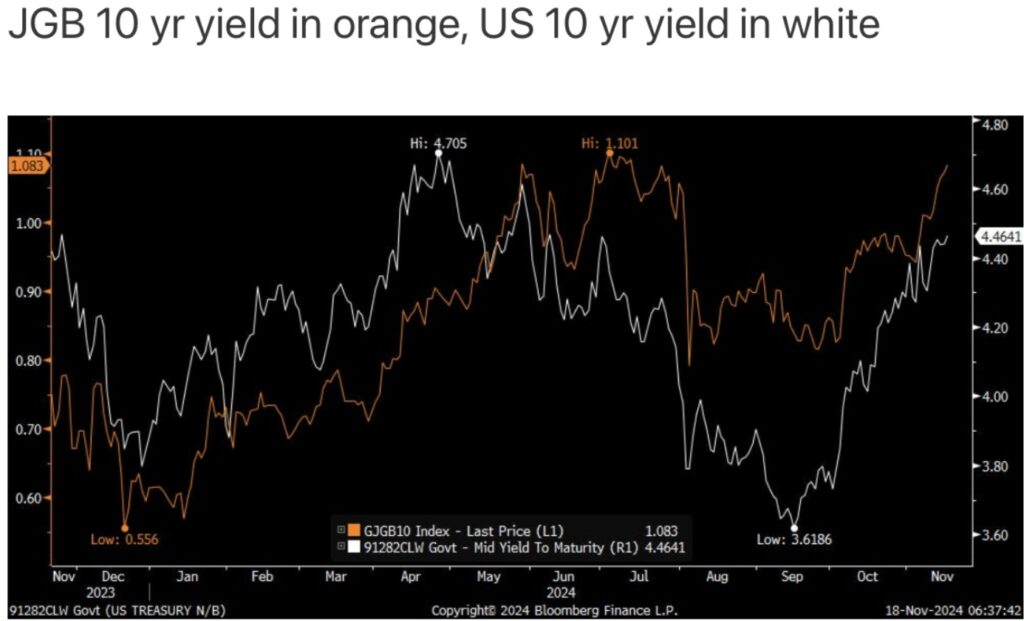

While it may not happen in December and we might have to wait until January to see it, Governor Ueda of the BoJ does seem to be getting ready to raise rates again but with his typical caveats. On one hand, “I think that gradually adjusting the degree of accommodation in line with the improvement in economic activity and prices will support long-term economic growth and contribute to achieving the price stability target in a sustainable and stable manner.” Will it be next month? “For the December meeting, for example, we will make the right policy decision at that time and adjust our outlook as needed after assessing risks and additional information that we’ve gathered since the October meeting.” I consider that latter comment on timing typical vague, non-committal commentary.

So also on one hand, JGB yields continue to rise but on the other, the yen continues to fall. One factor for the weak yen particularly this morning was also this comment from Ueda where he seems almost indifferent if the yen weakens or strengthens because of the mixed impacts. “It’s true a weak yen pushes up costs and has a big negative impact on consumers. But it’s positive for exports and inbound tourism. The overall impact on Japan’s economy isn’t easy to assess.”

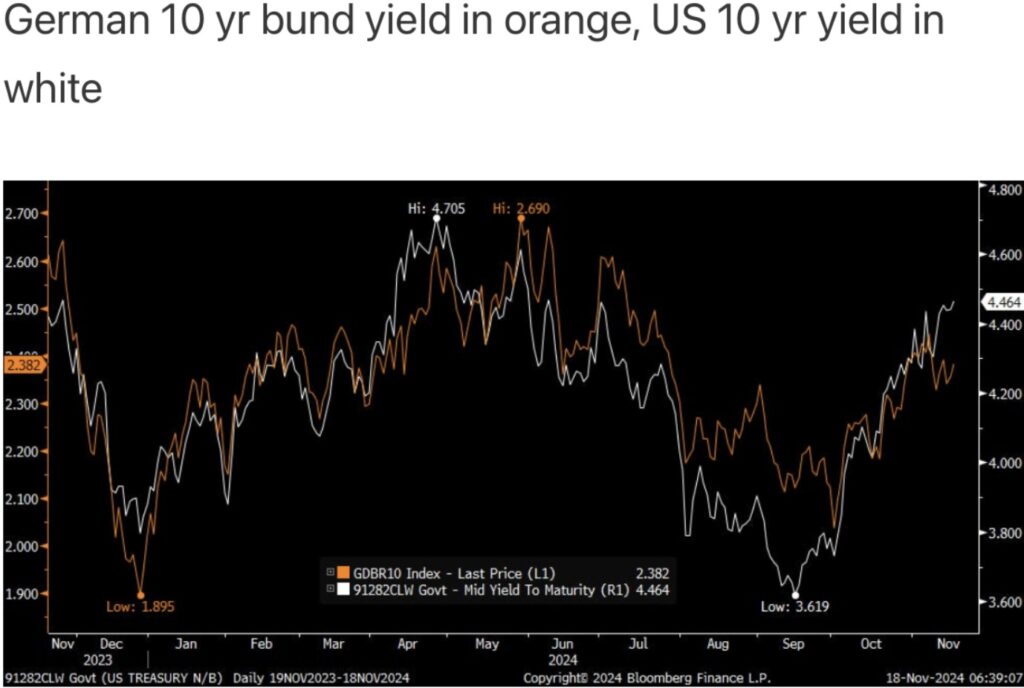

I do want to say this, for the umpteenth time, US bond yields are not just moving on its own fundamentals and ones analysis of US growth, inflation and debts/deficits. They are also moving in sympathy with movements in overseas bond markets as well, particularly the JGB market. We’re all in this global bond boat together, same with Europe. Below is a chart of the US 10 yr yield compared with the 10 yr JGB yield and the one below that compares the US 10 yr yield with the German 10 yr yield.

Oil Rig Count Continues To Decline

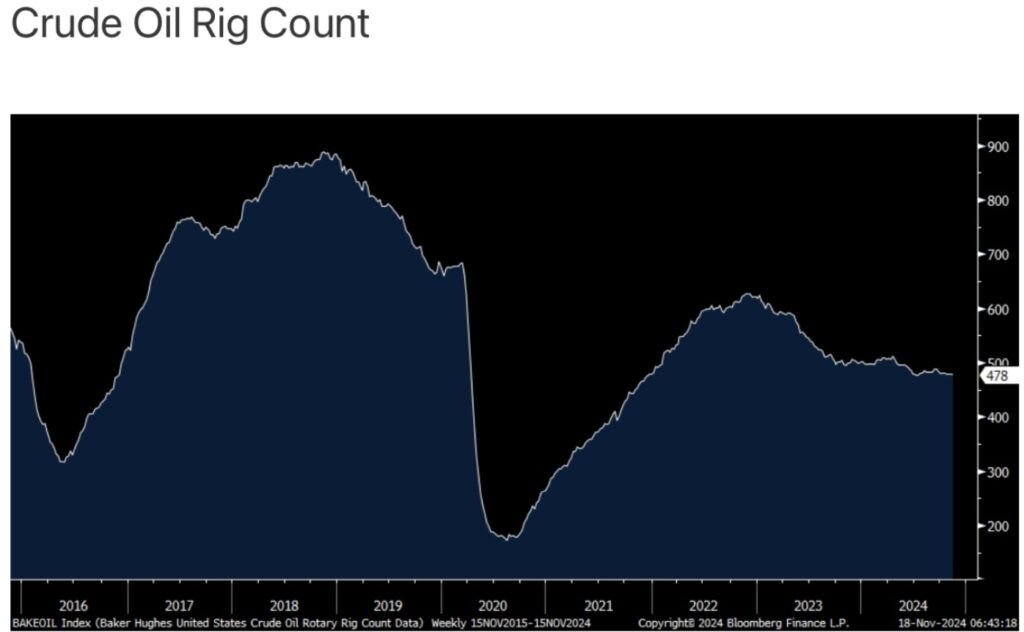

The Baker Hughes oil rig count for the week ended 11/15 fell by 1 to 478 rigs, the least in 4 months and is one rig away from matching the smallest since December 2021.

If we take away Covid, it would be the lowest amount of oil rigs used since December 2016. Being more efficient and much more sensitive to shareholders and less on drilling for drilling sake, the US oil industry is remaining disciplined. And why we remain bullish and long energy stocks.

GET READY: A Radical 2025 Lies Ahead

To listen to Gerald Celente discuss his the radical 2025 that lies ahead as well as his predictions for gold, global markets, war, and what surprises to expect in 2025 CLICK HERE OR ON THE IMAGE BELOW.

ALSO RELEASED!

To listen to the man who helps oversee $170 billion discuss how investors around the world can prepare themselves for the turbulence in global markets that lies ahead CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.