We are seeing warning signs that inflation may be set to accelerate, again. Plus a look at gold and banks.

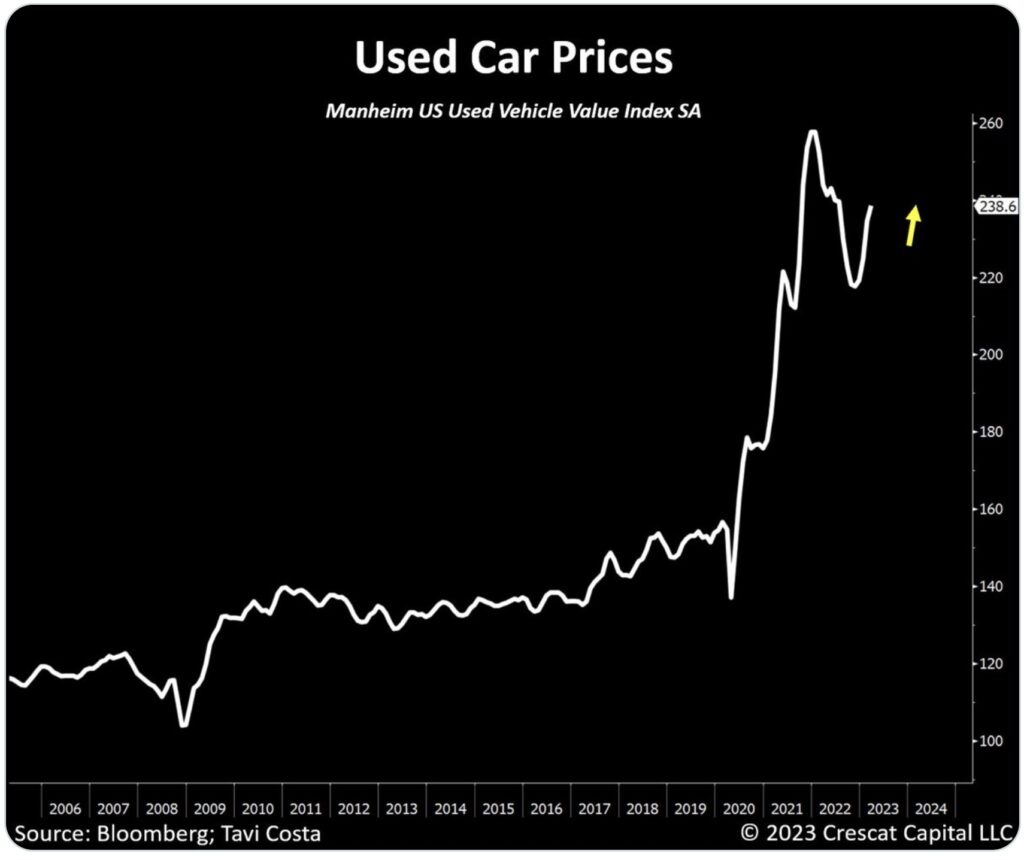

Used Car Prices

March 28 (King World News) – Otavio Costa: Used car prices increased again for the 5th month in a row. Prices continue to firm up at historical levels, despite being down about 2% on a year-over-year basis. Inflationary forces remain stubbornly high due to structural macro drivers. The Fed just erased 5 months of QT in two weeks and that should only add fuel to the inflation fire.

INFLATION ALERT:

Used Car Prices Ramping Higher…Again

Gold

Fred Hickey: COT report thru 3/21 out and Managed Money (hedge fund & CTA) net long gold position grew -but only to 81K net long. Remains well below levels seen at any of the gold tops over past several years (in some cases, only one-third of those levels). Still underinvested. Open interest low too.

Some Banks Are Doing Fine

Peter Boockvar: I’m going to continue to harp on the point that what we don’t need is blanket insurance coverage on all deposits I believe (on how could they financially anyway). Here I want to point out again that it will be a profitability hit for most, as well as shareholder dilution, and needed mergers for a small few. And also note here (ahead of the hearings this week) that not all bank executives got sucked in to buying duration over the past few years in a desperate search for yield. Others were MUCH better managed. Here is what the CEO of M&T Bank said in his shareholder letter out last week:

“As 2022 began, M&T and our peers were still dealing with the impact of the government stimulus, and bank balance sheets were flush with large cash balances with limited options to invest. Loan demand was tepid and yields on investment securities were at historically low levels. As noted last year, we chose to be patient in investing the cash until rates offered a better return and there was less risk to our shareholders’ equity.

As yields on investment securities and loans rose to levels meaningfully above those available in 2021, we reduced our interest bearing cash balance by 40% to just under $25b at the end of last year, funding loan growth and purchasing investment securities. The timing of these actions allowed us to benefit from rising rates over the course of the year, simultaneously reducing the potential negative impacts of future rate declines.”

Also, I read that First Citizens Bank prior to the SVB deal had done 14 bank takeovers since 2009, with government assistance, of troubled banks. If you’re a bank CEO of a small/medium sized bank and you saw the 50% rebound in First Citizens Bank yesterday in response to the SVB takeover and government help, you should be searching far and wide for every fragile bank out there to buy…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

I also want to put numbers to the inevitable profit hit for banks. Putting aside the bad loan risks, particularly with parts of commercial real estate, let’s dive into the profit hit from a rise in deposit rates paid. Let’s assume that in total banks raise them by 200 bps (some more, some less and I’m not sure where checking account rates go). On a pile of $18 trillion of bank deposits, that is a rise in costs of $360b. For perspective, according to the FDIC, net income for the US banking system (4,706 commercial banks and savings institutions insured by the FDIC) was $263 billion in 2022. That compares with $233 billion in 2019.

So in order to mitigate this hit, assuming the deposit increase occurs, will mean higher loan rates for the rest of us as well as less of it. Also, this extends to the massive non-bank sector which will be filling in a bunch of lending gaps, if they can continue to gain access to wholesale funding, but assume we’ll be talking about double digit cost of capital for many. As for that non-bank sector, the government regulators have much less of a handle on it for sure.

Here were some notable quotes in yesterday’s March Dallas manufacturing index which was another negative print, joining all it’s peers except KC which printed zero.

Computer & Electronic Product Mfrg:

“We continue to struggle to find qualified manufacturing employees. We are investing heavily in automation to increase productivity and allow us to meet demand without adding head count. This also allows us to pay more to the people we have, which should help us to retain skilled people.”

“We are closely monitoring the banking meltdown with customers and suppliers. There has been minimal impact so far”

“We expected things to cyclically slow, and all markets are correcting except auto.”

“The collapse of SVB could be the beginning of more challenges ahead.”

Machinery Mfr’g:

“Our outlook is horrible. The level of certainty is zero. Production is hand to mouth. We cannot find workers.”

Nonmetallic Mineral Product Mfr’g:

“We are laying off workers for the first time since 2010.”

ALSO JUST RELEASED: Michael Oliver – We Are Now In A Major Upside Trend Shift For Silver Bulls CLICK HERE.

ALSO JUST RELEASED: We Are Still Facing Major Economic Problems CLICK HERE.

ALSO JUST RELEASED: To Bond Killers And Other Villains Destroying Our World CLICK HERE.

ALSO JUST RELEASED: Leeb – JP Morgan’s Massive Gold Derivative Short Position May Be Larger Than The Bank’s Assets CLICK HERE.

ALSO JUST RELEASED: Gold Breakouts Everywhere As Bank Crisis Now Set To Accelerate CLICK HERE.

***To listen to Dr. Stephen Leeb discuss JP Morgan’s precarious short position in the gold market and much more CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss available physical gold and silver inventories disappearing, why the bank runs and crisis are set to accelerate and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.