On the heels of the selloff in Asian markets, one of the greats in the business sent King World News a powerful piece discussing what spooked global markets today. There is also a note from Peter Boockvar included in this piece.

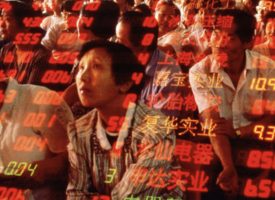

From Art Cashin’s note: Overnight And Overseas – Markets were a bit spooked by a jump in the spot offshore yuan in rather heavy trading late in the session. There were rumors of PBOC involvement and/or structural shifts due to expiration. The spike was over 1%, very large in that market.

The impact of that sent Shanghai down 1.5% while Hong Kong, Tokyo and Australia got dinged for 2.5%. European markets joined the negative party to a somewhat lesser degree. The Bank of England left rates unchanged.

The dollar strengthened against both the Euro and the Yen. Crude and gold are both a touch better. Yields are a bit firmer and U.S. futures are flat giving up big gains around dawn.

Another View On The Yuan Move – My friend, Peter Boockvar, over at the Lindsey Group has a view on the yuan move I noted. Here’s what Peter wrote:

The Chinese took another step overnight of liberalizing their capital markets, facilitating more activity in yuan and hoping to satisfy the SDR demands of the IMF in China’s attempts to achieve reserve status. Speaking at the World Economic Forum in Dalian, China, Premier Li said “not long ago, we allowed foreign central banks to participate in the interbank bond market.

The next step is to allow foreign central banks to directly participate in the interbank foreign exchange market. Before the end of this year, we will complete the cross border yuan payment system that facilitates the development of the offshore yuan market.” The onshore yuan was little changed overnight but the offshore yuan rallied in a likely attempt by the PBOC to converge the two exchange rates. This also could be a message to the markets that they will still keep a tight grip on the FX rate notwithstanding their attempts at the same time to have it freely floating. Orderly moves are the focus.

Traders will carefully watch the action in the yuan overnight.

Consensus – As noted, markets are particularly jumpy this morning. I would continue to monitor the action in crude (WTI), with inventory data at 11:00. Hints around that Fed is likely “on hold”. Best to stick with the drill – stay wary, alert and very, very nimble. ***ALSO JUST RELEASED: An Astonishing Look At The War In Silver And Commodities CLICK HERE.

© 2015 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.