Gold fever is sweeping China, plus another inflation wave is about to hit.

“Understanding that China plays the long game is one of the most important insights you can have about what lies ahead. China’s leaders know where they want to be five and ten years out.” — Stephen Leeb

Gold fever in China

May 23 (King World News) – Ronni Stoferle at Incrementum: One of the most important factors behind the recent gold boom is undoubtedly the enormous demand from China. Chinese demand for gold is no longer being fueled solely by the PBoC, but increasingly also by Chinese private investors. The financial situation in China could be summarized as “shrinking pool of investment opportunities meets high liquidity”…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

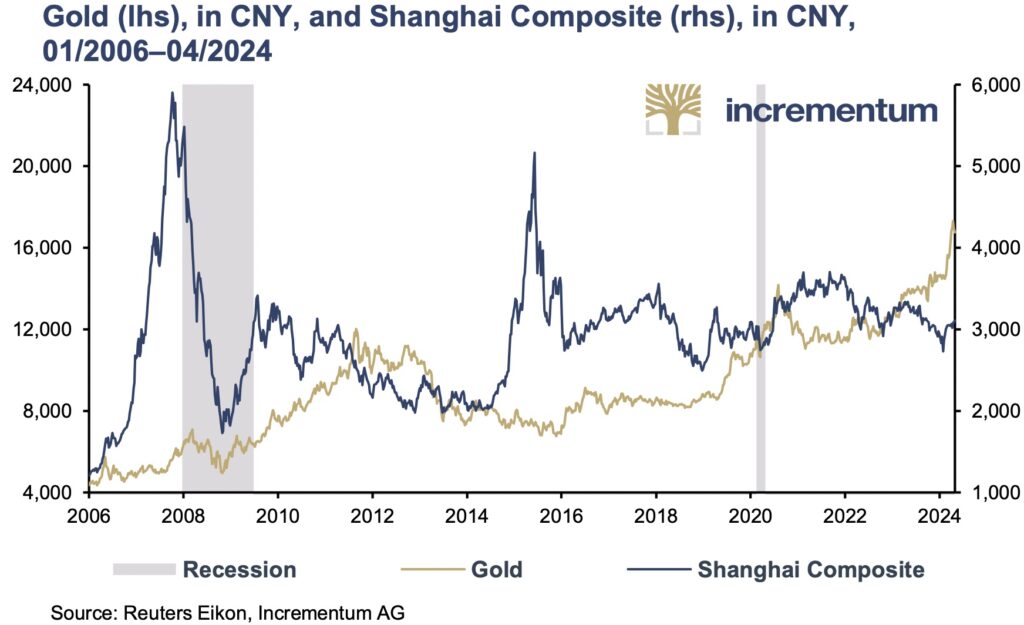

Now that the Chinese real estate market, traditionally used for retirement provision, has hit turbulence, there is a substantial need for alternatives. Chinese bonds and savings accounts are also becoming less attractive in view of the ongoing decline in interest rates, while Chinese equities have been trending sideways (volatile) since 2016. Despite a rally of 15% from February to the end of April, the leading Chinese stock indices are still well below their historical highs.

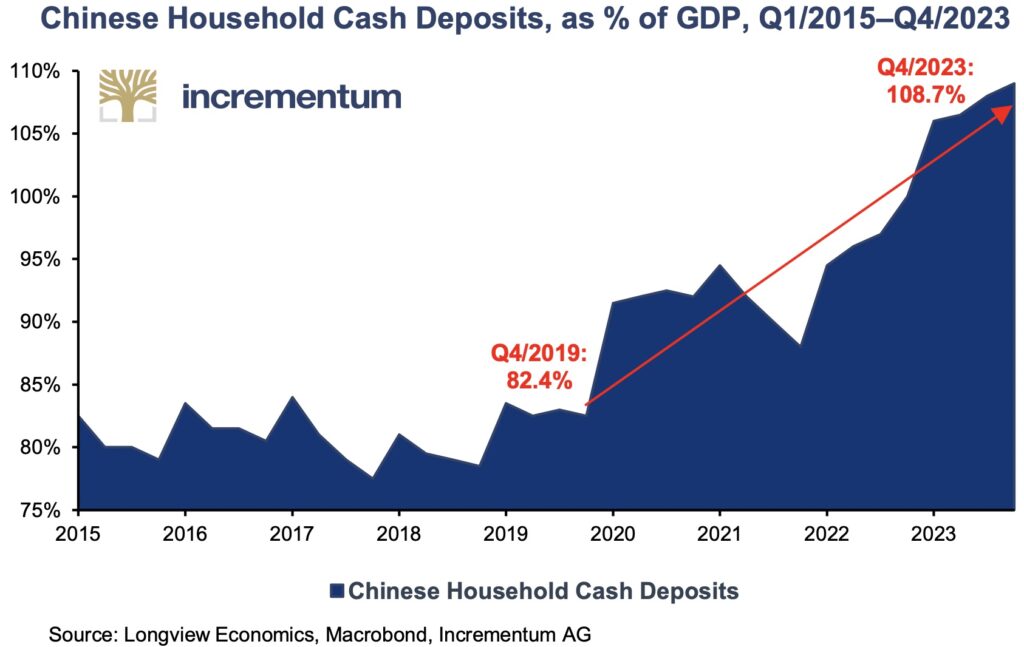

These uncertainty factors combined with continued high liquidity – the Chinese population’s cash holdings are at a record high – create superior conditions for investing in gold. In addition, it is worth noting how the Chinese horoscope influences the investment culture. 2024 is under the sign of the dragon, which symbolizes vitality, power and dominance in the Chinese zodiac. This boosts the appreciation of solid, stable investments such as gold.

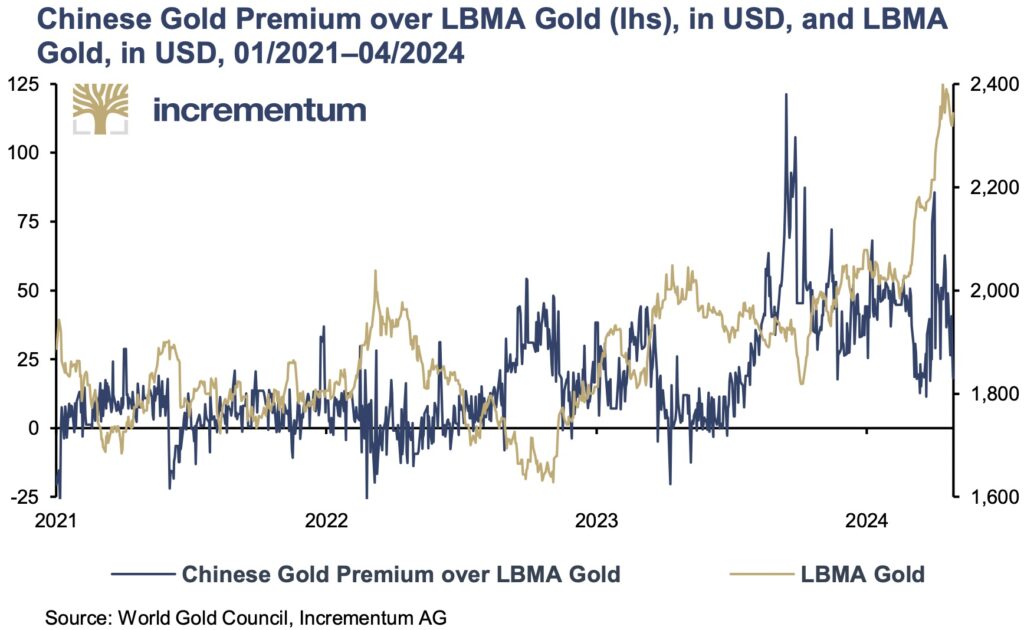

The enormous Chinese appetite for gold can be seen in the premium for Chinese gold compared to LBMA prices. The high domestic demand in China is also being fueled by China’s youth, who have recently discovered gold beans as an investment opportunity. In addition, import restrictions or tariffs on gold imports could keep prices in China artificially high. Another reason is likely to be China’s withdrawal from the LBMA gold auctions last year, which may have restricted the volume of gold flowing into China.

Another Inflation Wave

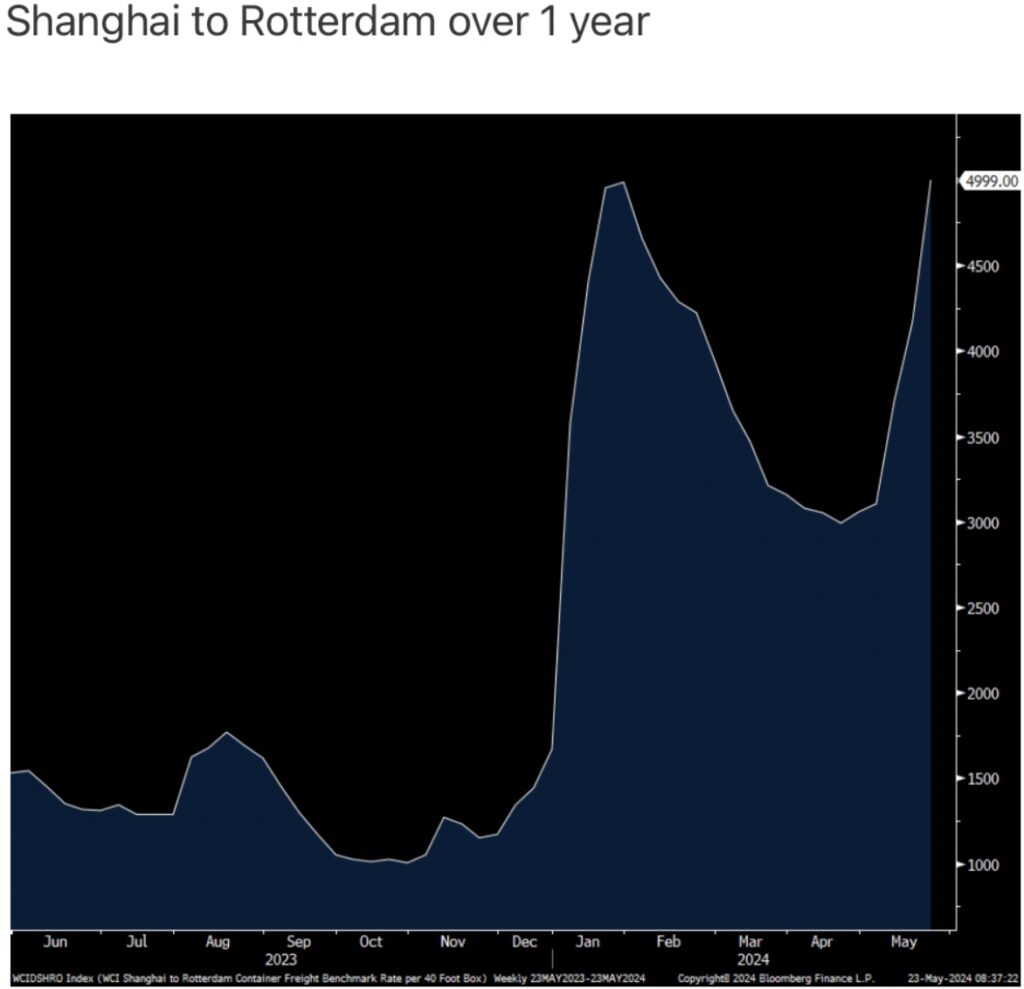

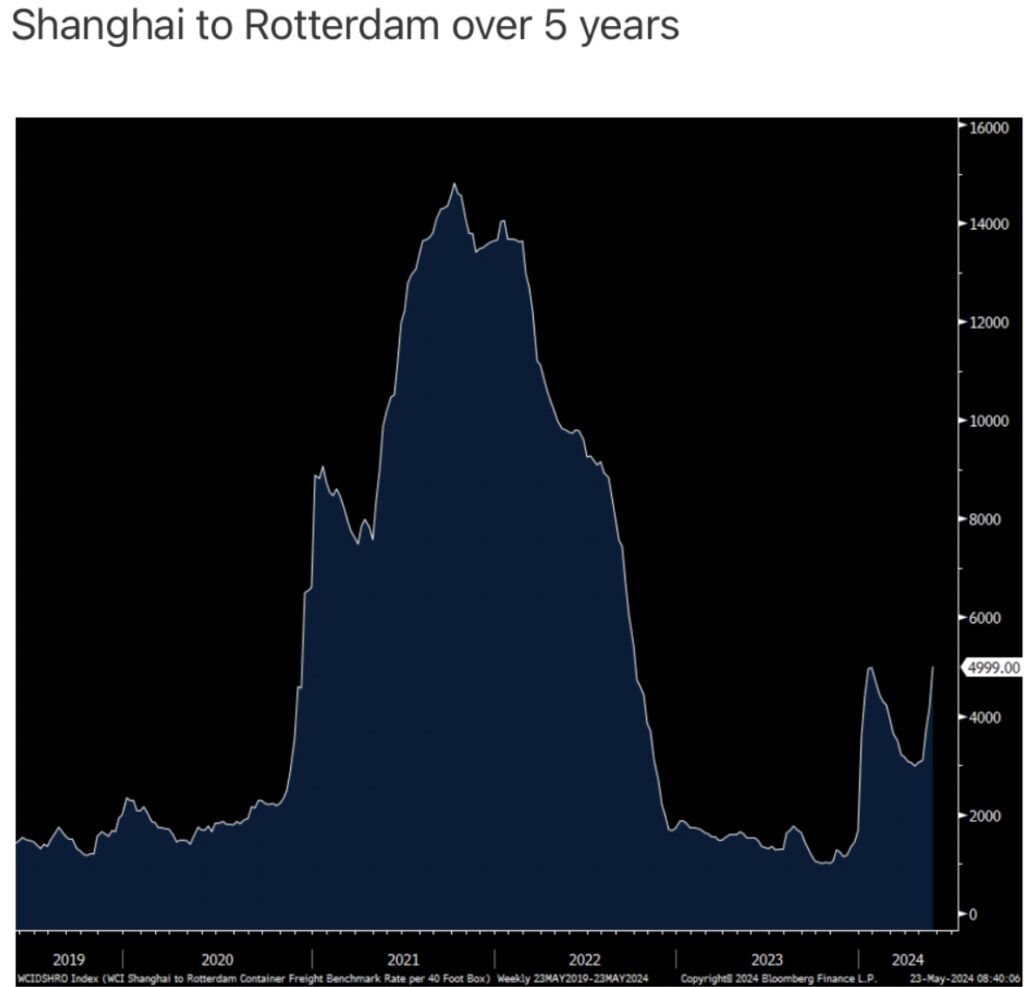

Peter Boockvar: The Shanghai to Rotterdam route jumped another $827 w/o/w and at $4,999 have now exceeded the mid January jump and are up 200% year to date.

Another “Transitory” Inflation Wave Is About To Hit

The price is still well below the 2021 skyrocket but well above where it stood in February 2020 at around $2,000.

Another “Transitory” Inflation Wave Is About To Hit

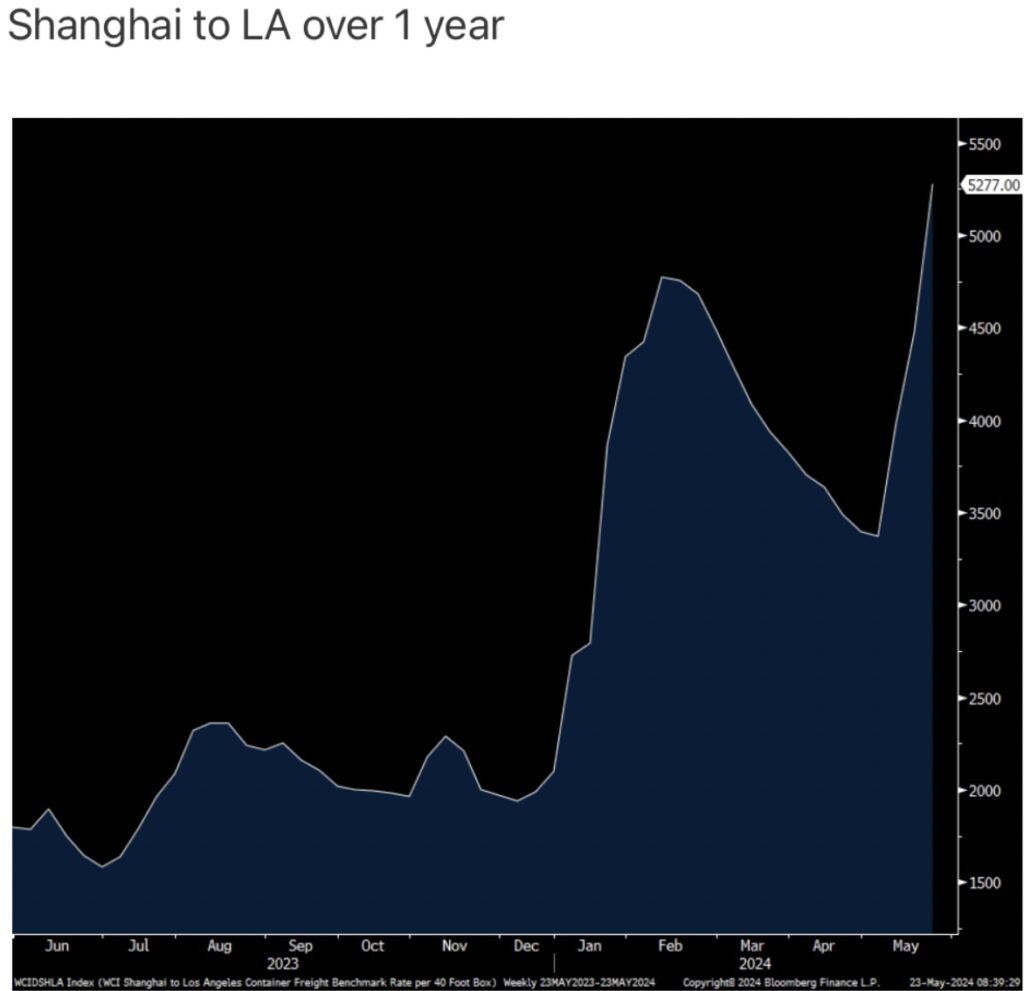

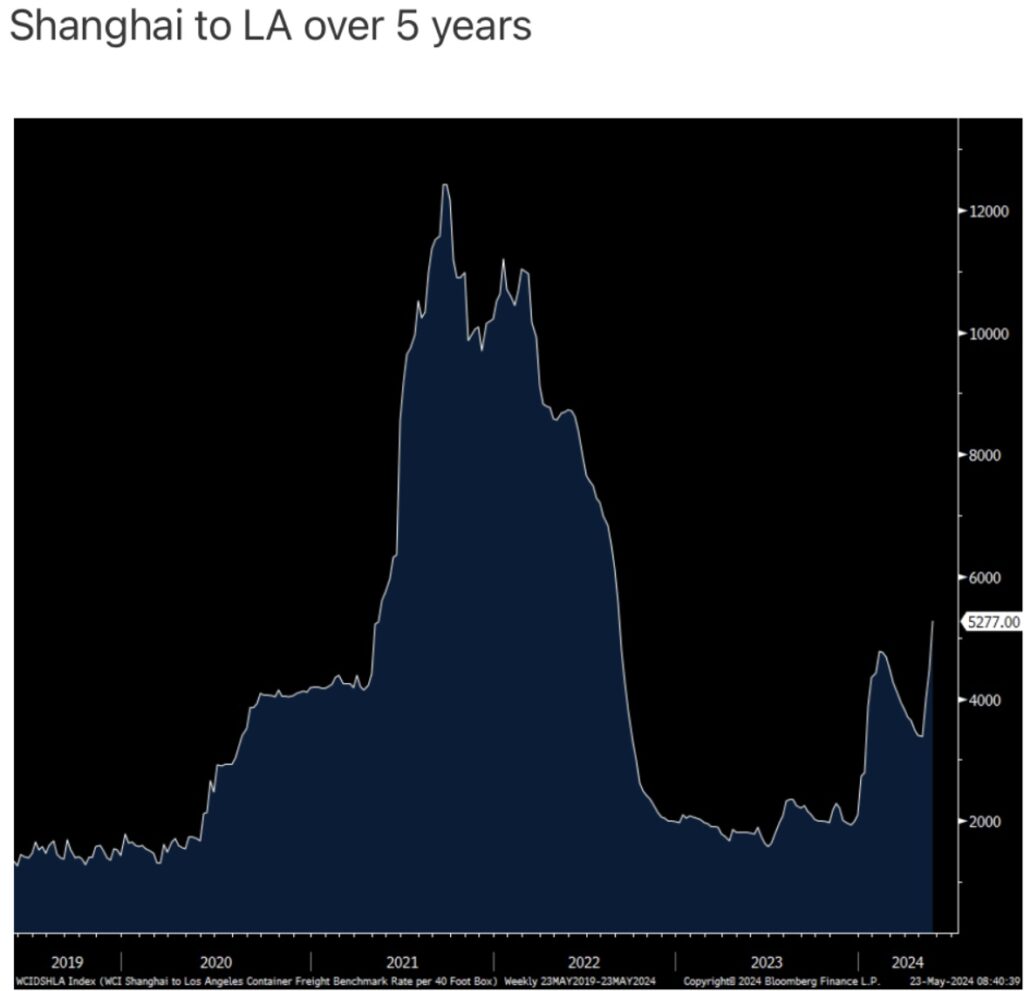

The Shanghai to LA trip is now above $5,000, higher by $801 w/o/w to $5,277 vs $2,100 at year end 2023.

Another “Transitory” Inflation Wave Is About To Hit

Another “Transitory” Inflation Wave Is About To Hit

Bottom line, inflation volatility is here to stay.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.