About last Friday’s historic plunge in gold and silver…

Friday’s Historic Plunge In Gold And Silver

June 11 (King World News) – SentimenTrader: A historic plunge in gold and silver.

Key points:

- Gold and silver futures plunged 3% and 6%, respectively, within 15 days of closing at a 3-year high

- Similar precedents suggest a consolidation for gold and an unfavorable outlook for silver

- When comparable declines occur simultaneously, the outlook for both precious metals deteriorates

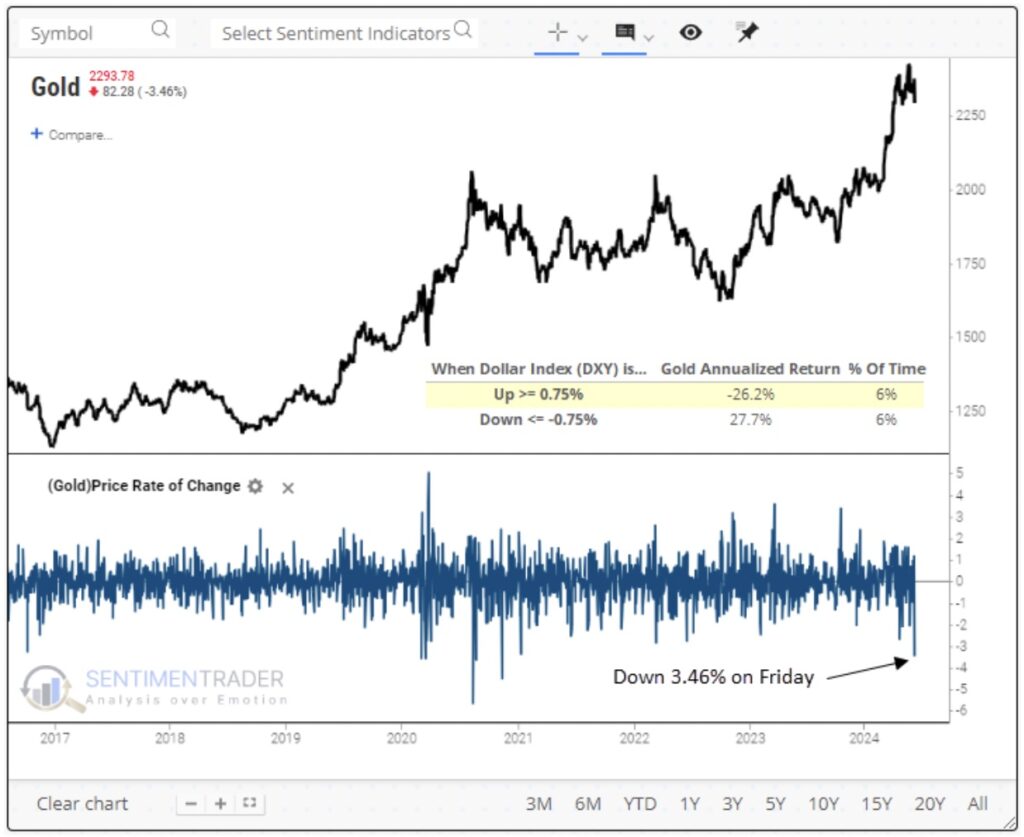

The dollar index jumps, and precious metals dump

The inverse relationship between the dollar index and precious metals was evident following the release of the latest payroll numbers. With the dollar index surging by 0.75%, bolstered by stronger-than-expected employment data, gold and silver experienced significant declines, dropping over 3% and 6%, respectively.

As the table in the following chart reveals, when the dollar index experiences a daily gain of 0.75% or more, gold futures show an annualized return of -26.2%. Conversely, when the dollar index declines by -0.75%, the precious metal increases at an annualized return of 27.7%.

Gold and silver are currently in well-defined uptrends, with my composite trend model indicating bullish scores of 8 and 10, respectively. Thus, the key question arises: does the largest one-day drop in over three years signal a distribution phase in a topping pattern, or is it simply a single-day panic within the context of a bullish consolidation in an uptrend?

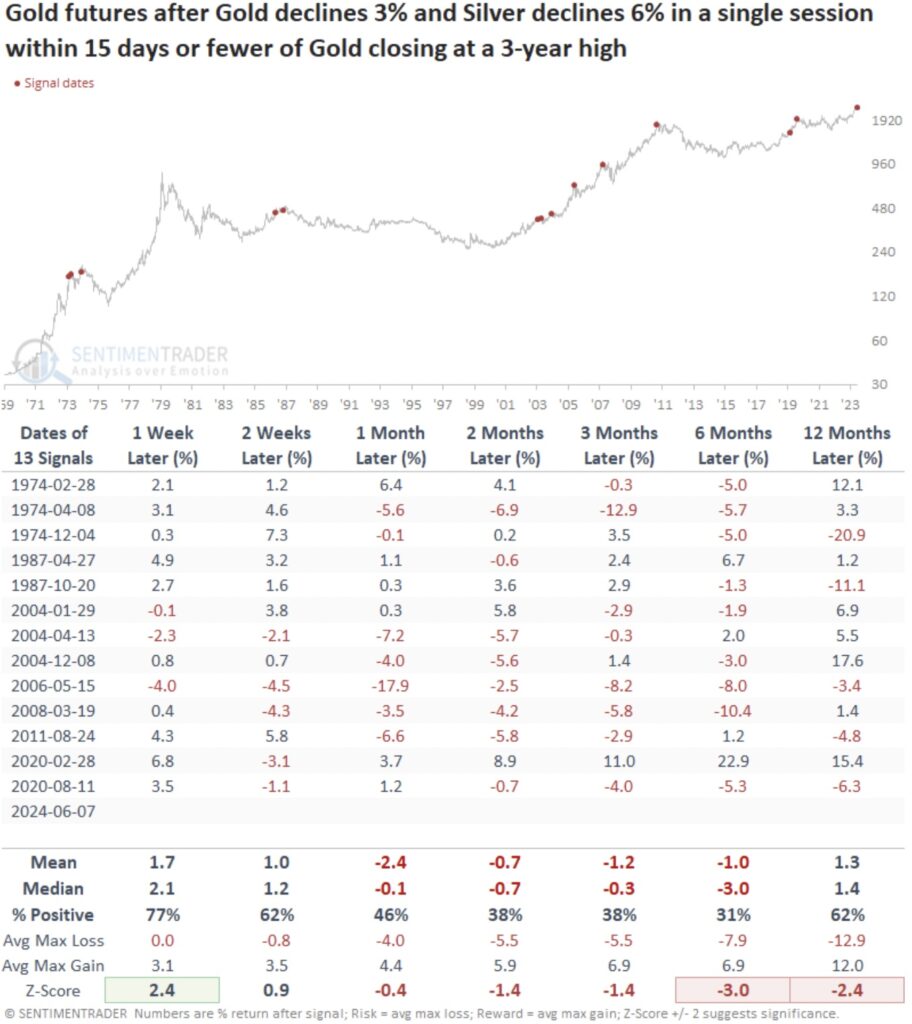

Similar one-day panic-selling events typically led to a consolidation

Following a 3% or more decline in 15 days or fewer from closing at a 3-year high, context similar to now, Gold futures tended to bounce back over the next week, displaying a 66% win rate. However, the relief rally was short-lived, as the precious metal showed a coin toss over the subsequent one-and-two-month horizons. Additionally, since 2003, returns for gold were negative at some point over the following two months in all but one instance.

A year later, the metal was higher 72% of the time, supporting the odds that a multi-month consolidation eventually resolves to the upside. I would also note that there has never been a one-off instance that marked a top. i.e., the peaks in 1974, 1980, 1987, 2011, and 2020 had at least one prior precedent.

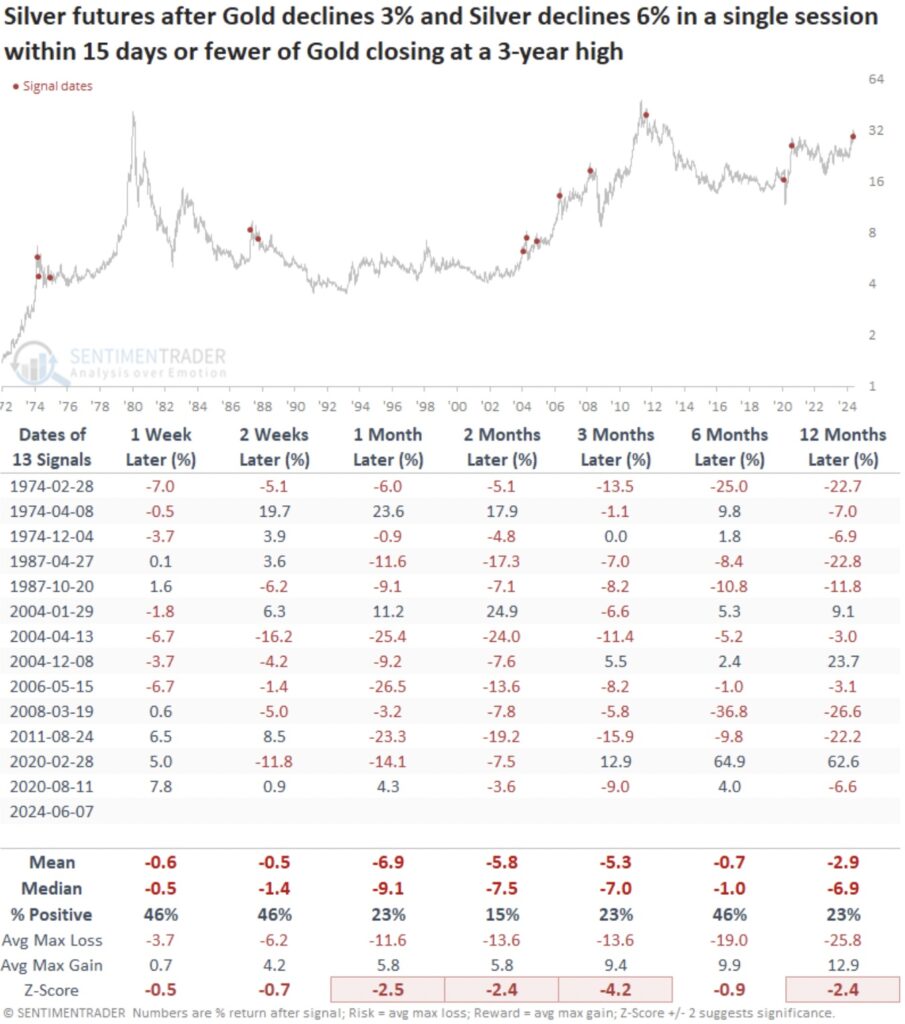

The more volatile precious metal, silver, declined over 6%

Similar to gold, silver displays a negative correlation to the dollar index. When the dollar rises by 0.75% or more in a single session, silver produces an annualized return of -24.4%. In contrast, when the dollar falls by -0.75%, annualized returns jump to 23.2%.

Similar one-day panic-selling events suggest a more unfavorable outlook

Whenever silver drops by 6% or more within 15 days of reaching a 3-year high, it has historically shown a negative median return in 4 out of 5 horizons over the following three months. Since 1993, there hasn’t been a single instance where silver didn’t turn negative at some point during this unfavorable three-month window.

The idea of a bullish consolidation period within an uptrend is not encouraging, with win rates and median returns over the subsequent six and twelve months looking fairly stagnant.

What happens when gold and silver plunge simultaneously?

Whenever gold and silver declined by over 3% and 6%, respectively, in the same session, and gold was trading within 15 days of a 3-year high, the precious metal showed a solid tendency to bounce back over the following week, rising 77% of the time. However, the outlook for the metal deteriorated meaningfully over the subsequent one to six months, displaying a negative median return in all time frames.

The bottom line is that when gold and silver decline significantly in unison near a peak, the market message suggests gold could be in the penalty box for more than a few months.

The outlook for silver appears bleak after both precious metals declined by a substantial amount in unison near a three-year high. That was especially the case over the subsequent two months, which shows the metal falling 85% of the time.

Although silver maintains a composite trend score of 10, indicating that all 10 medium-to-long-term trend-following indicators are positive, I would urge traders to vigilantly monitor price trends for any signs of deterioration.

What the research tells us…

Gold and silver remain in well-defined uptrends. While one day typically does not make a trend, the significant drop in both metals within three weeks of closing at a three-year high suggests traders should be alert for at least a consolidation and possibly something more profound like a trend change. With several critical events like the release of the CPI report and an FOMC meeting on the horizon, the fireworks in precious metals could be just getting started. As my colleague, Jay Kaeppel is fond of saying, “Follow the trend, but don’t fall in love with the trend.” To subscribe to the internationally acclaimed work that Jason Goepfert and his team produce at SentimenTrader CLICK HERE.

Friday’s Gold & Silver Takedown

To listen to James Turk discuss Friday’s orchestrated $82.50 takedown in the gold market and $2.20 in silver CLICK HERE OR ON THE IMAGE BELOW.

Friday’s Gold & Silver Takedown

To listen to Alasdair Macleod discuss Friday’s orchestrated gold and silver takedown as well as what the Chinese are up to and more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.