Yes, gold has broken decisively above $3,000, but now all precious metals are breaking out. Take a look…

$3,000 Gold And Another Metal Assaulting All-Time Highs

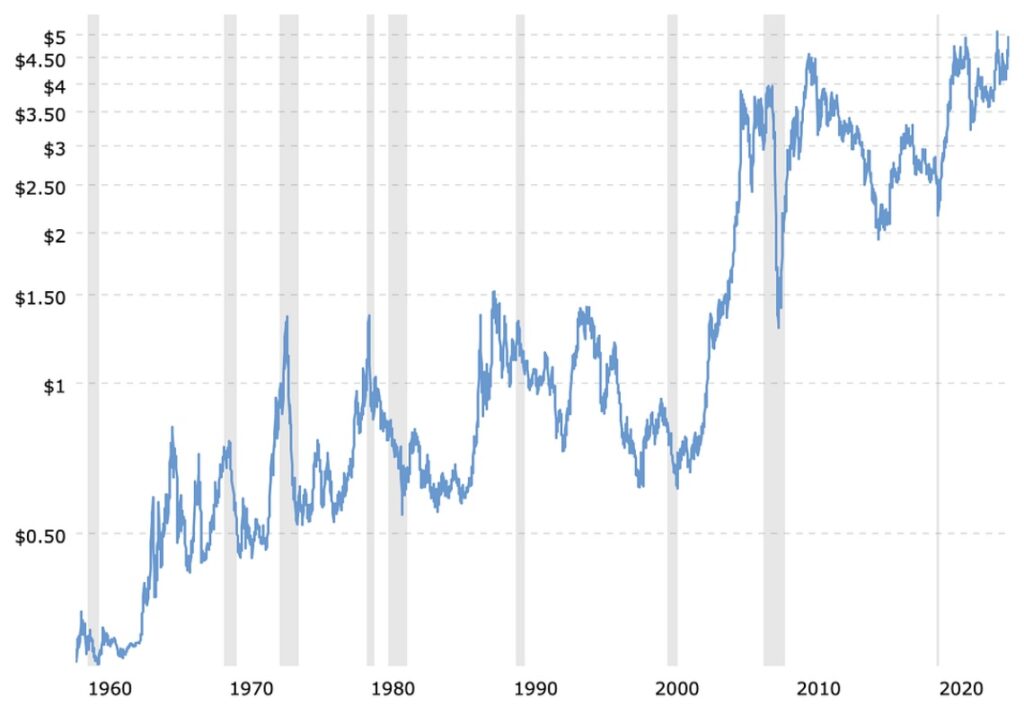

March 18 (King World News) – Peter Boockvar: Before I get to housing starts, I need to mention the price of copper that is touching $5 per pound today. That might not mean much to many but we are just about hitting a record high dating back to the 1960’s. I’d argue that copper is the most important industrial metal in the world in terms of its broad uses. I reiterate our bullish and long stance on commodities/stocks.

KING WORLD NEWS NOTE: Copper Attacking All-Time Highs!

With gold breaking through $3,000 too, can Jay Powell & Co really have any confidence to do anything right now? They are of course not tomorrow but as we will also see the dot plot, can anyone really predict the coming months/quarters with any confidence whatsoever and different from the last time they tried to crystal ball the future? Little chance.

Prices Rising As US Dollar Tumbles

Also of note for the Fed to digest was the rise in February import prices with the US dollar now falling. They rose .4% m/o/m vs the forecast of no change. They are now up 2% y/o/y vs 1.8% in the month before. Prices ex food and energy also were up .4% m/o/m and now by 1.4% y/o/y. Price gains in ‘industrial supplies’ drove the increase so I assume this again was the front loading of shipping product ahead of tariffs but with commodity prices now rising too, something to watch from here post tariffs.

Housing starts in February totaled 1.501mm, well above the estimate of 1.385mm and up from 1.35mm in January (revised down by 16k) and vs 1.526mm in December. Single family starts got back what it lost in January and then a bit some at 1.108mm. Multi family starts, very volatile month to month, were 393k vs 355k in January, 437k in December and 284k in November.

Weather messed around with the data as starts (both single and multi family) in the Northeast fell by 50k in January but rebounded by 46k in February. The South had bad weather too and starts were 895k in December, 689k in January and 815k in February.

Permits were little changed m/o/m with single family at 992k, down 2k from the month before. Multi family totaled 464k vs 479k in January and at a 4 month low. Multi family construction rose massively over the past few years but those days are now over.

All Precious Metals Breaking Out

Graddhy out of Sweden: All these precious metals ratio charts are now breaking out.

KING WORLD NEWS NOTE: HUI Gold Mining Index Set To Skyrocket 5,000% vs Tech STOXX

KING WORLD NEWS NOTE: AG Also Set To Skyrocket vs NVDA

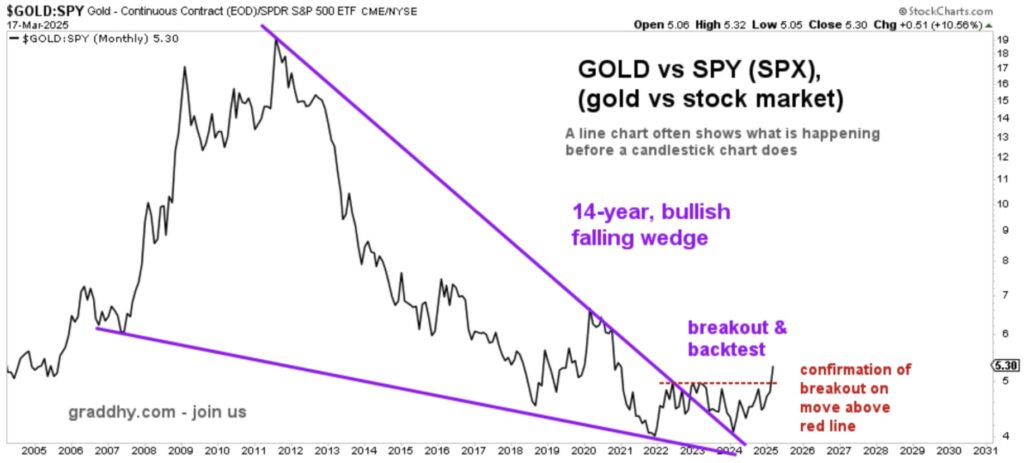

KING WORLD NEWS NOTE: Gold Will Also Skyrocket vs S&P 500

KING WORLD NEWS NOTE: Finally, GDX Gold Mining Index Will Skyrocket vs S&P 500

Global Capital Rotation Kicking Into High Gear

The global capital rotation into precious metals is not starting now. Nor is it “confirmed” now. It started when these ratio charts below turned, which I posted on in real-time back then for each chart. The “confirmed” capital rotation turn is not now, it happened many, many months ago.

Shared the above charts with King World News previously saying they were to break out. They have now done that, all of them. Very few believed it when I posted it, but that is how it must be – most have to be at the wrong end of sentiment at big levels, breakouts and turns. Including analysts, “experts” and services.

Among many other clues for this was that gold had the 8 year cycle low back in 2022 (which I called in real-time), plus broke out of a 13-year bullish pattern a year ago (which I noted when it happened). This means gold is only 2.5 years into the present 8 year cycle, and that it broke out of a 13-year pattern base 14 months ago.

With a bullish backdrop like that – plus many other significant clues if one knows where to look – do not listen to the ones calling for outrageously low numbers during the declines, since gold is now in a resumed, raging bull market since 14 months back. The precious metals tide turned 14 months ago with gold and silver’s historical breakouts, which meant they resumed their bull markets.

JUST RELEASED: $3,000 Gold!

To listen to Alasdair Macleod discuss the gold price breaking above $3,000 and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.