With the price of gold within reach of a new all-time high and silver above $25, the question everyone is asking is will the short squeeze continue? Well, it looks like the odds are stacking up against the bullion bank shorts.

Articles will be released on Saturday and Sunday on King World News and audio interviews will resume next week!

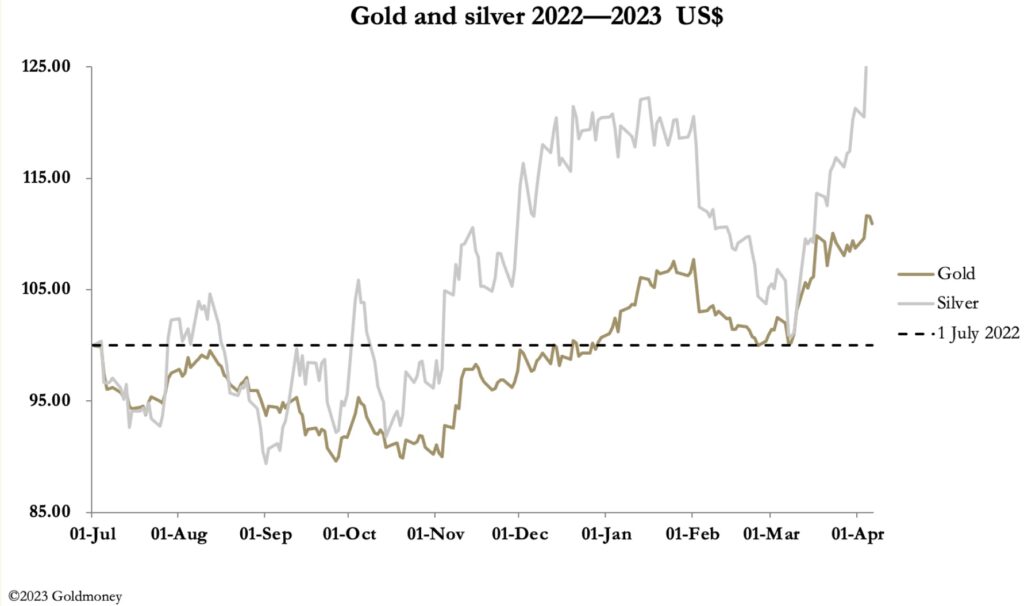

April 7 (King World News) – Alasdair Macleod, head of research at Goldmoney: Gold and silver rallied ahead of the Easter weekend, with silver being exceptionally strong. Gold closed last night at $2008.8, up $39 from last Friday’s close. And silver was up 90 cents at $24.97.

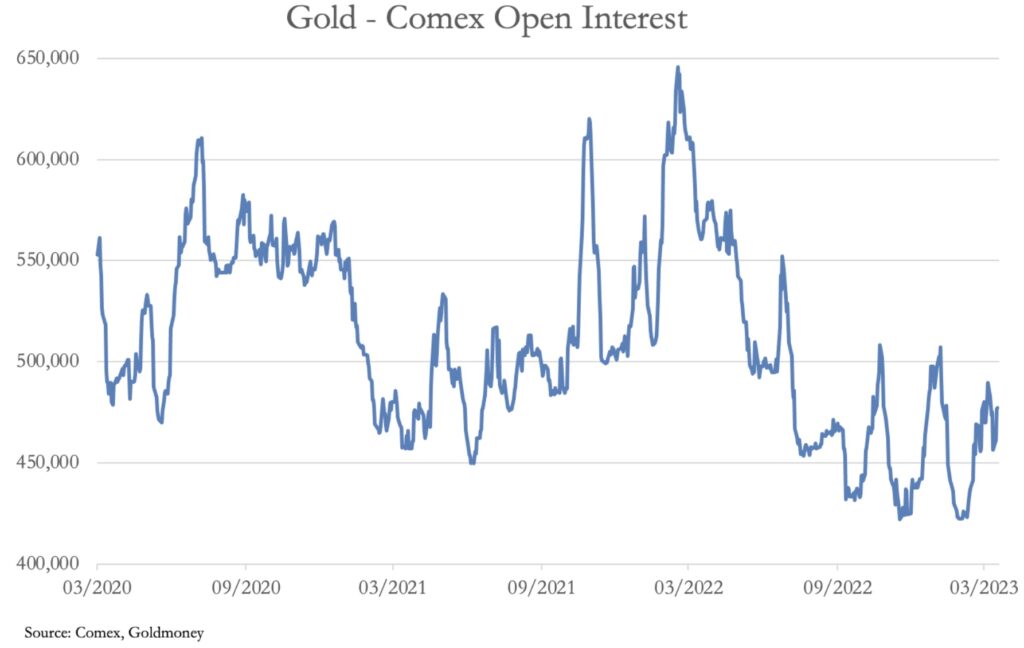

On the last Commitment of Traders report dated 28 March, the Managed Money category was net long 99,160 contracts on Comex, approaching the neutral position of about 110,000 net longs. Since then, it is likely that this category has begun to creep into marginally overbought territory. However, measured by Open Interest, the gold contract as a whole is still not overbought.

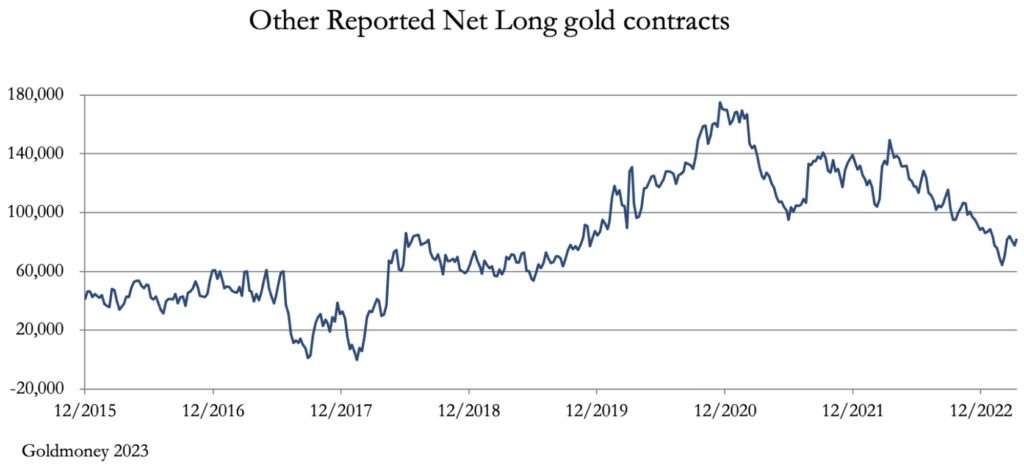

With Managed Money moving into marginally overbought territory, it is the Other Reported category which is lagging. This is next.

The reason is not far to see. It is this category that stands for delivery. Associated with the April contract expiry alone, 20,684 contracts have stood for delivery (64.3 tonnes), with a further 1,265 contracts yet to be resolved.

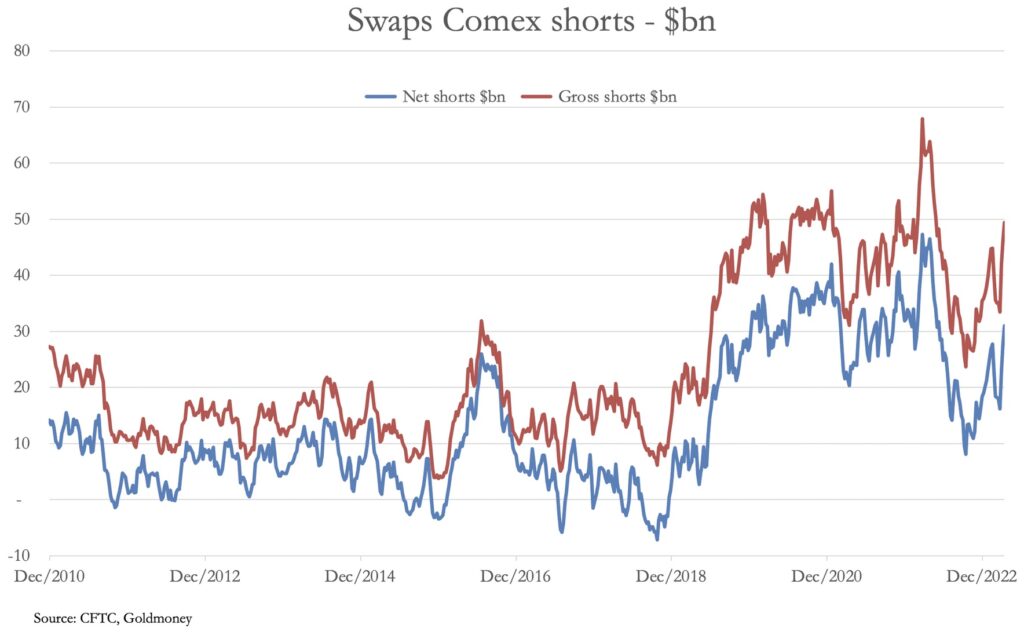

For the Swaps (mostly bullion bank trading desks), this is a problem. Every time they hit the market, buyers for delivery take the opportunity to accumulate their physical positions. And we can see from the COT data that their collective liabilities are beginning to climb again, with their gross shorts at $44.9 billion on 28 March. That’s spread between 23 traders in this category, for an average exposure of $1.73bn each.

However, Easter is always an opportunity for them to mark down futures prices, triggering long stops and positioning themselves for post-Easter trade. US equity markets are closed today, and many European markets are closed for Good Friday as well. And London along with many European markets are closed on easter Monday.

Normally, one would expect the market to soften ahead of the Easter weekend as traders anticipate the Swaps’ actions, and the fact that it hasn’t suggests that physical buyers are driving the action, if not yet the price.

Bullion bank traders seem sure to have a go at covering their bears, taking advantage of light holiday trade. But the odds are stacking up against them. With their bank treasurers seeking to reduce the size of their bank balance sheets, they are likely to be restricted from increasing their shorts much more, so there is an increasing chance of capitulation.

It should be noted that central banks are increasing their physical stocks, sending a clear signal that they are selling dollars. The dollar’s TWI is our next chart.

If the TWI breaks below 100.5, not only are the foreign holders of dollars likely to accelerate their selling, but the hedge funds in the Managed Money category will smell blood and in their pair trading strategy sell dollars and buy gold futures.

Therefore, the dollar’s TWI performance is probably the best indicator to watch. Meanwhile, silver has outperformed due to stock shortages, and improving prospects for the Chinese economy. The gold/silver ration is down to 80.4, has further to fall, but as yet indicates it is not being priced as money.

Articles will be released on Saturday and Sunday on King World News and audio interviews will resume next week!

ALSO JUST RELEASED: SPROTT: A Massive Gold Short Squeeze May Be In The Cards CLICK HERE.

ALSO JUST RELEASED: This Will Be The Next Major Upside Catalyst For Gold CLICK HERE.

ALSO JUST RELEASED: Gold Has Been On A Tear But Look At What Is Massively Undervalued vs The Metal Of Kings CLICK HERE.

ALSO JUST RELEASED: Celente – China’s Rising Power Threatens Dollar But Also The IMF And World Bank CLICK HERE.

ALSO RELEASED: GOLD & SILVER BEING UNLEASHED: Gold Price $30 From Hitting 5,000 Year High CLICK HERE.

ALSO RELEASED: Gold Approaching Massive Cup & Handle Breakout, Plus Look At This Inflation Catalyst CLICK HERE.

ALSO RELEASED: Gold Surges Above $2,000 Ahead Of The Collapse Of The Super Bubble CLICK HERE.

ALSO RELEASED: Greyerz Just Warned The Everything Collapse Is Going To Devastate The World CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.