With the price of gold already flirting with all-time highs, this will be the next major upside catalyst for gold.

The Golden Question: What Is Next To Break?

April 6 (King World News) – Matthew Piepenburg, partner at Matterhorn Asset Management: As we warned throughout 2022, the Fed’s overly rapid and overly steep rate hikes would only “work” until things began breaking, and, well…things have clearly begun to break, including the petrodollar.

Even prior to the recent headlines regarding US regional banks, “credit event” stressors were already tipping like dominoes around the world, from the 2019 repo crisis and the 2020 bond spiral to the 2022 gilt implosion.

Then came SVB et al in 2023, and, of course, the forewarned disaster at Credit Suisse…

But as we also warned literally from day 1 of the sanctions against Putin, the oh-so-critical petrodollar would be among the next dominoes to tip, and tipping is precisely what we see.

As argued below, petrodollar shifts are yet another headwind for USTs and USDs, but an obvious tailwind for gold.

But before we dig into this historical tipping point, it’s important to see the forensic cause of all that is breaking…

The Bond Market, Of Course…

We can’t repeat this point enough: The bond market is the thing.

And toward this end, the signs of generational and global shifts in global trade, currency settlements and political instability is directly tied to broken sovereign credits reeling under the pressure of artificial rate hikes…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

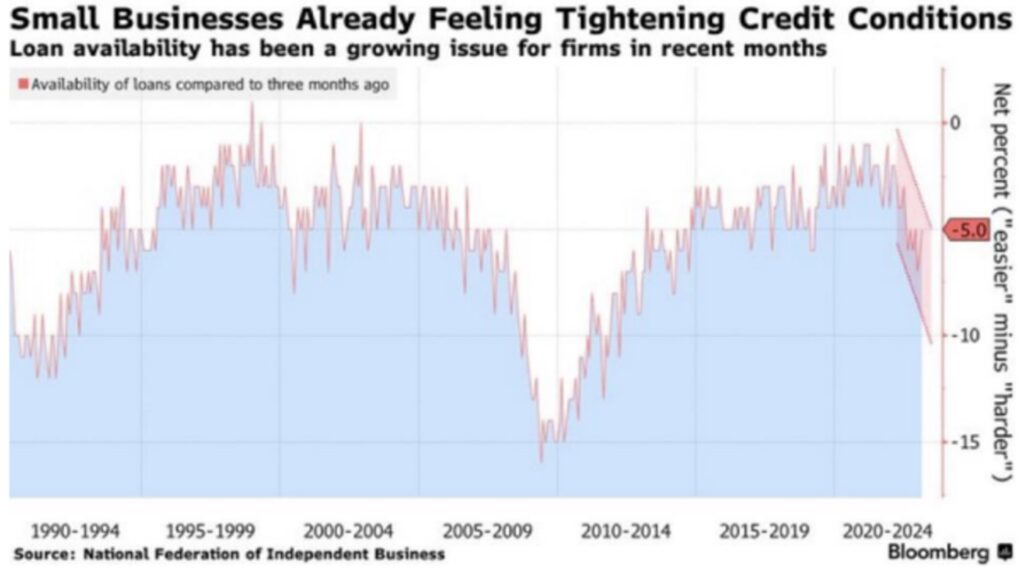

Less Credit, Less Growth, More Volatility

In the wake of recent bank failures and now carefully muted headlines, credit is tightening behind the curtains, and that’s a bad sign.

Even the safer companies in the US with “investment grade” credit status aren’t issuing bonds into a credit market that has seen volatility on the short end of the UST market which looks more like a crypto-coin trade than a “risk-free-return” UST.

The recent gyrations in the 2-year UST and futures market surpassed vol levels seen in 1987, 9-11, or even the GFC of 2008, but I’m betting those details didn’t make the headlines of the financial media with much attention to detail…

As the WSJ recently noted, however, March issuance of bonds by even the highest rated companies came in at just under $60B, significantly below the five-year average of $180B for the same month.

And as for the junkier companies and their junkier bonds, well…their luck, as well the demand for their IOUs, has all but dried up.

March saw US zombie/junk borrowers (who live off “extend-and-pretend” low rates and yield-desperate investors [suckers]) issuing only $5B in bonds, compared to a five-year average of over $24B for the same month.

Hmmm.

Uh-oh?

Stated simply, easy, cheap and freely available credit, which has been the fun but toxic wind beneath the otherwise broken wings of the so-called post-08 “recovery” (bubble), is ending/breaking, which means hope for any vestige of US economic growth is now all but an open joke.

Small banks, which will be falling off the vine one by one in the coming months as depositors openly move toward the larger banks and money markets, means that credit, and hence hope, for small businesses in the US will be harder to get than an honest voice in Congress.

Needless to say, none of these open signals of tightening credit bode well for Main Street in particular or economic growth in general.

The Fed’s Generational Sucker-Punch

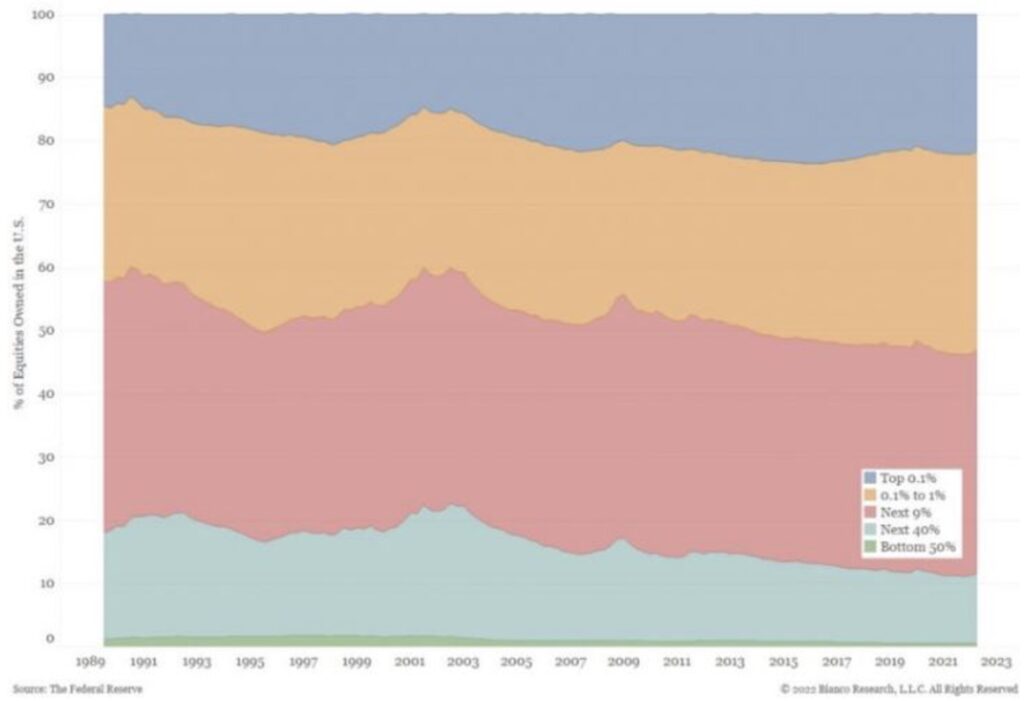

The Fed may have given the top 10% of the US 90% of all the bubble wealth which came from their post-08 rate repression…

… but now that same centralized (and rate-hiked) bank is giving the ignored 50% of small business owners and average Joes on Main Street the sucker-punch of a generation.

The recession in which we likely already find ourselves will nevertheless (and soon) become more and more undeniable, and yes dis-inflationary, within an over-all inflationary backdrop.

In the near-term, moreover, such slowing growth and tightening credit will also be a tailwind for the USD.

But those dis-inflationary winds and rising dollars won’t last for long in my opinion.

Why?

Here are six simple reasons…

Why Dis-Inflationary Forces and a Rising USD Will Indeed be “Transitory”

Of course, I hate using a word like “transitory” … but here are six reasons a strong USD and near-term dis-inflationary forces likely won’t last for long.

With:

1) Uncle Sam running twin deficits while…

2) the US stares down the barrel of $33+T in year-end debt levels and…

3) declining tax receipts (down 10% y/y) with…

4) true-interest expense on outstanding US sovereign debt at 118% of tax receipts—and all within the setting of…

5) openly tightening credit while facing…

6) a de-dollarizing world with less rather than more interest in American IOUs/USTs…

… the US will hit that fork in the road where it must print money to survive.

In short: A Pivot Will Come

Why?

Because, when forced to choose between imploding credit markets or a dying currency, the central planners will sacrifice the dollar, not the market(s).

As warned many times, the currency is always the last bubble to pop in a broken financial system.

And that, folks, is precisely when the inflationary forces of magical mouse-clicked trillions will surpass the dis-inflationary forces (above) of a broken economy and an increasingly loan-less banking system—all of which we can thank each and every central banker since patient-zero Alan Greenspan took a chair at the Eccles Building.

All Roads Lead to Gold…

All of this, of course, leads us to my favorite topic and asset: Physical gold.

Needless to say, my colleague, Egon von Greyerz, and I have always had a lot to say about this so-called “barbarous relic.”

Many, of course, will just chalk such conviction to the good-ole “gold bug” retort, but those who understand the math and history of money in general or broken credit cycles in particular are a bit more than just “gold bugs” …

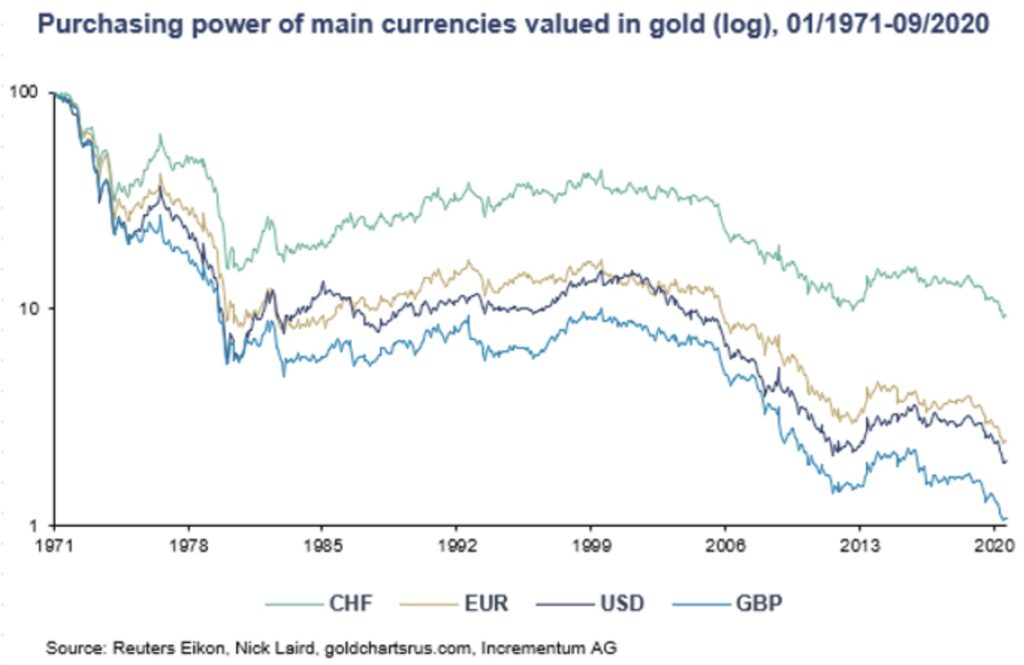

And as for gold’s inevitable direction, we know it will trend north for the undeniable reason that currencies, ever since Nixon welched on the Bretton Woods gold standard, have been steadily trending south.

It’s really that simple.

The OPEC Factor… History Rhyming, Gold Shining

But notwithstanding our consistent and common-sense arguments, let’s look at the petrodollar shifts of late.

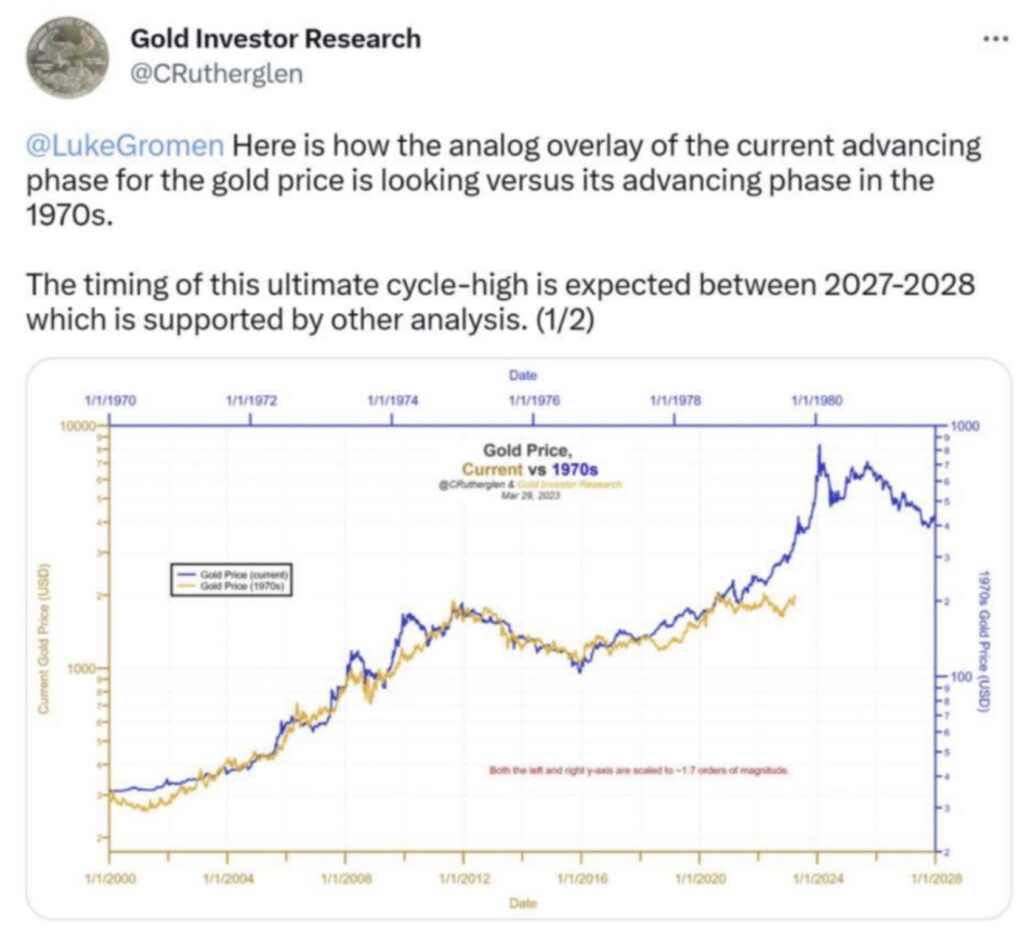

Toward this end, folks like Chris Rutherglen and Luke Gromen have done an exceptional job in reminding us of the history as well as critical importance of gold, oil and credit markets.

History Rhyming

As I’ve presented elsewhere, history (borrowing from Mark Twain) may not repeat itself, but it certainly rhymes.

And toward this end, Rutherglen and Gromen have shown the poetry of rhyming patterns in the context of the ever-changing petrodollar politics, which, modestly, we too foresaw over a year ago.

As we warned from literally day-1 of the western sanctions against Putin, the end result would be disastrous for the West in general and the USD in particular.

And nowhere was this US Dollar prognosis truer than with regard to the petrodollar—i.e., those good ol’ days when nearly every oil purchase was linked to the USD.

However, and as Gromen and Rutherglen suggest, that oil-USD linkage was never a sure thing in the 70’s, and will be even less of a sure thing in the years ahead.

And this, folks, will have a massive impact on gold in the years ahead.

How so?

Let’s dig in.

Gold and Oil—Ready to Link?

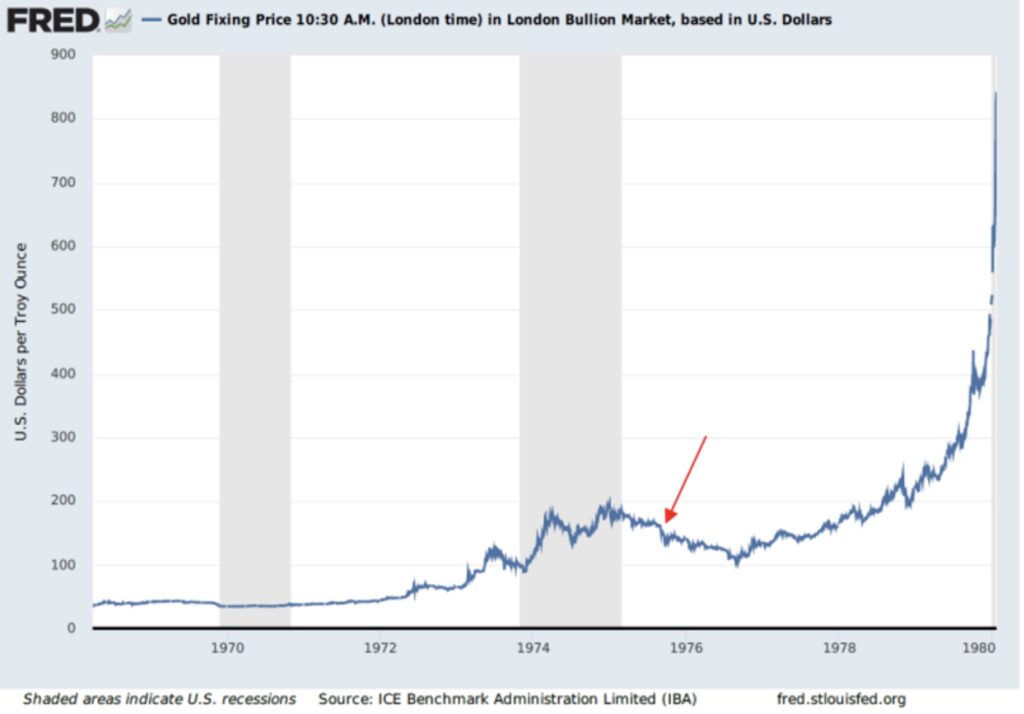

Although still in diapers when Nixon closed the gold window in 71, and still watching Saturday morning cartoons when gold soared from $175/ounce in 1975 to over $800/ounce less than five years later…

… I am at least old enough now to glean a few historical lessons and patterns which may point toward similar and rising gold valuations tomorrow.

Gold, as Gromen and Rutherglen remind, was ripping in the late 70’s largely because it was not yet a foregone conclusion that oil would be pegged to USDs.

In that bygone era of disco, ABBA, wide neckties and checkered suits, neither OPEC nor Europe was against the idea of settling oil transactions in gold rather than USTs.

This was because those very same USTs (thanks to Nixon’s welch) were not very well…loved, trusted or valued in the 70’s.

(See where I’m going [rhyming] with this?)

Fortunately, Paul Volcker was able to seduce the oil nations into trusting Uncle Sam’s fiat money by cranking (and I do mean cranking) interest rates to the moon to restore faith in the UST and hence give OPEC the confidence to sell oil in dollars rather than settle in gold.

Specifically, Volcker took rates to 15+%, a move which placed real rates on that all-important 10Y UST at +8%.

Such hawkish policy was thus a game changer for making the petrodollar a reality and hence the USD the world’s reserve energy asset (and bully) for a generation to come.

Powell Ain’t No Volcker

Unfortunately, and thanks to Uncle Sam’s embarrassing bar tab (i.e., debt levels), those days, and those USDs and USTs, have fallen from grace, and hence are slowly falling off the radar of OPEC.

For this, we can also thank an openly cornered Powell’s so-called war on inflation, which has, among so many other backfired fiascos, led to a slow and steady process of de-dollarization and declining faith in that oh-so-important global IOU otherwise known as the UST.

The Oil Nations Aren’t Stupid

The OPEC folks know that Uncle Sam’s IOU’s aren’t what they used to be.

Unlike Volcker, however, Powell can’t get the 10Y UST to an 8% real (i.e., inflation-adjusted) rate.

Even his so-called “hawkish” nominal rates of 5% have crushed credit markets, Treasuries and nearly everything else in its path.

And if Powell even dreamed of pushing rates to 15% ala Volcker to seduce OPEC, he would literally murder the entire US economy with a double-digit rate hike against a $31T public debt pile.

In short, there is simply no way to compare Volcker’s options in the 70’s to Powell’s debt reality in 2023.

This means the Fed can’t do what will be needed this time around to prevent OPEC from looking outside the USD or UST and hence inside the gold markets as a primary asset to settle its energy transactions.

The days of the mighty petrodollar, as I warned (in two languages) over year ago here, here and here, are slowly but steadily coming to end.

Think about that a second.

Or better yet, look at it for a second—with kudos again, to Gromen and Rutherglen.

Something to Think About

Boiled down to simple math, if the 2020’s rhyme with the 1970’s, which is clearly plausible, and gold becomes a primary (or even secondary) settlement asset in the energy market, this factor alone would place gold near $9000 an ounce by 2027 or 2028.

Again, something to think about, no?

In the interim, I’d hate to be in Powell’s shoes.

We’ll have to see if he’ll try to save the petrodollar by destroying the US economy or, who knows, even something worse…

Perhaps his neocon neighbors in DC will distract us with more war games?

We can only wait and see as the US runs out of good options and is left with only the bad (and desperate) ones, a pattern which Hemingway, rather than Twain, made perfectly clear and is worth repeating:

Got gold? This will link you directly to more fantastic articles from Egon von Greyerz CLICK HERE.

ALSO JUST RELEASED: Gold Has Been On A Tear But Look At What Is Massively Undervalued vs The Metal Of Kings CLICK HERE.

ALSO JUST RELEASED: Celente – China’s Rising Power Threatens Dollar But Also The IMF And World Bank CLICK HERE.

ALSO JUST RELEASED: GOLD & SILVER BEING UNLEASHED: Gold Price $30 From Hitting 5,000 Year High CLICK HERE.

ALSO JUST RELEASED: Gold Approaching Massive Cup & Handle Breakout, Plus Look At This Inflation Catalyst CLICK HERE.

ALSO RELEASED: Gold Surges Above $2,000 Ahead Of The Collapse Of The Super Bubble CLICK HERE.

ALSO RELEASED: Greyerz Just Warned The Everything Collapse Is Going To Devastate The World CLICK HERE.

***To listen to Gerald Celente discuss the death of the dollar and gold skyrocketing CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss the silver squeeze and the lack of available physical silver supplies CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.