On the heels of the failed assassination attempt on former President Donald Trump, what is happening with gold and the US dollar is absolutely stunning.

July 14 (King World News) – Matthew Piepenburg, partner at VON GREYERZ AG: Between politics (driven by self rather than public servants), markets (driven by debt rather than profits) and currencies (diluted by over-creation rather than chaperoned by a real asset), it is fair to say we live in not interesting but surreal times.

But amidst the surreal, the dollar, as many believe, is our rock, our immortal albeit often unloved constant.

The USD: Too Big to Fail?

Whatever one thinks of the dollar, we can’t deny its centrifugal force, exorbitant privilege and entirely unequaled market power (from the current SWIFT and Eurodollar systems to the derivative and petrodollar markets).

And even as broken, debased, inflated (and inflation-exporting) as the USD is, its place as a world reserve currency (with 80%+ of global FX transactions) is firm.

More importantly, the USD is a currency (base money) that only the Fed can print into existence and which the rest of the dollar-thirsty and dollar-indebted world (i.e. Eurodollar markets) can only lend into existence (like a second derivative credit currency) in a perpetual dollar-roulette of “debt and print” or “debt and lend.”

This effectively makes the USD the world’s base money (and denomination) for the vast majority of derivative global debt instruments, which means everything else (including Eurodollar lending) is essentially just credit-related.

And because credit makes the $330T debt-world spin, the USD, by extension, makes the world spin.

In short, one might argue the USD is too big to fail, right?…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

The Immortal Greenback?

Given the baked-in global demand and credit role for this otherwise diluted super-dollar, the national and global system which it has ruled since 1944 will thus likely and only end (save for a miraculously peaceful Plaza Accord 2.0) in some form of what Brent Johnson rightfully described as “profound violence—economic and/or military.”

But according to the dollar bulls, even a collapsing system and, hence, tanking US bond market, would send UST yields to the moon and, hence, the USD (ironically) even higher.

In short, no matter how some spin it—the dollar is king, and every central banker in DC knows this, right?

After all, such dollar realists have discovered the hard truth through the lens of realpolitik global finance: The dollar, love or hate it, is the base money of the global financial system and, as such, will be “the last to fall.”

Gold Backing?

As for any return to a gold-backed dollar, those same realists would remind us of the infamous 1896 “Cross of Gold” case laid out by William Jennings Bryan, who warned that with a dollar tied to gold, credit would eventually tighten to such levels that the average citizen and small business would be left bleeding credit-dry in the streets.

Furthermore, there’s the equally realistic stance that no country would want to be tied to a gold chaperone (or “standard”) for long, as this would only impede their sovereign ability to mouse-click their own currencies into existence when needed (i.e., whenever backed into a self-created debt wall).

Money, and hence the USD, they ruefully conclude, will therefore be whatever the strongest country (bully) on the block says it is, and like it or not, the US and USD are still flexing the strongest biceps in the global neighborhood, right?

Assuming Nothing (or History) Ever Changes

But each of the foregoing (and reasonable) conclusions only hold true if one assumes that the US is and remains the strongest bully (and money) on the block.

The evidence of history, however, which is dynamic rather than static, may suggest otherwise.

For now, however, the dollar matters most to many.

China, Russia, or India, for example, may be important, but few of us can or would predict that the yuan, ruble, or rupee will replace the greenback.

I certainly don’t.

So again, the USD will remain the king of liquidity.

And even for those who take de-dollarization seriously, will the BRICS+ nations really be able to agree to a gold-backed BRICS+ currency redeemable in, say, Moscow or Shanghai?

I have my doubts—for the simple reason that as much as the BRICS+ nations collectively distrust the now weaponized USD, they don’t trust each other enough to relinquish their option to print their own currencies at will.

But that doesn’t end the discussion on gold’s new and rising role in a changing dollar/world.

Going Around Rather than Replacing the Dollar

For me, debating a gold-backed new currency or “end of the dollar” drama thesis is missing the bullseye.

The facts and evolving history of today and tomorrow suggest that the real story is not about replacing the dollar, but simply going around it in a new price direction paved in both black and real gold.

Toward that end, look at what the rest of the world and its central banks are doing, not what they (or our financial leadership) are saying:

- Since 2008’s GFC, Putin has been hording gold;

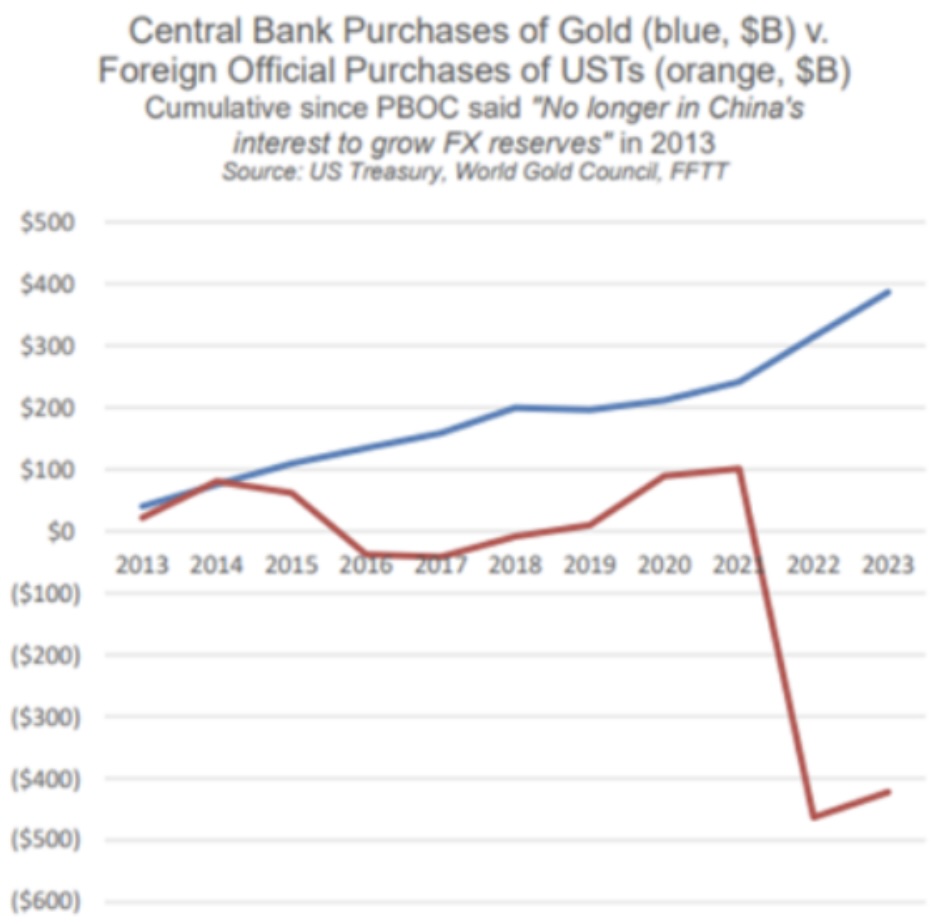

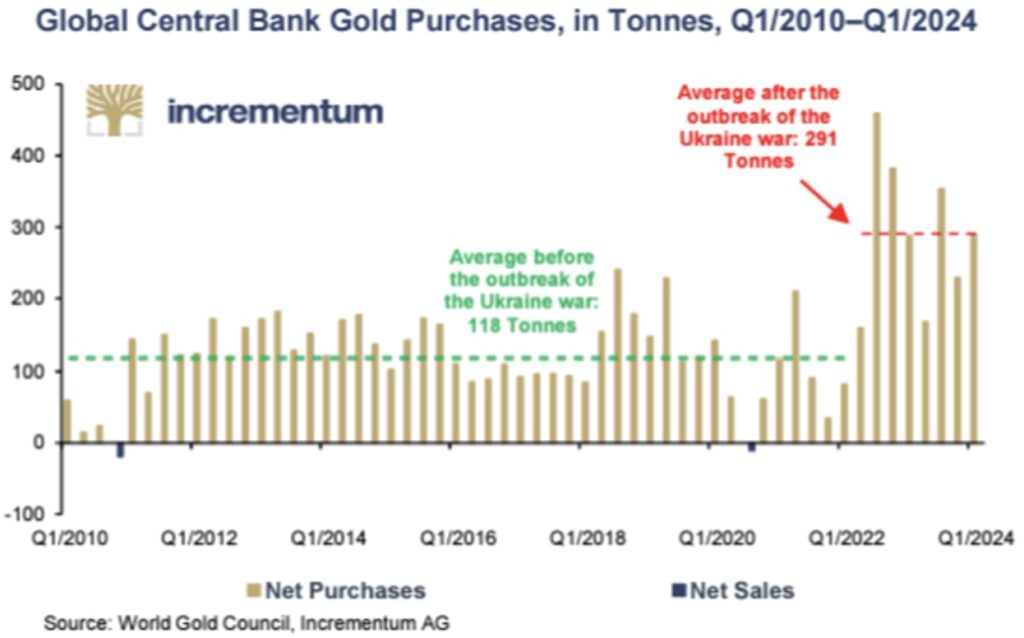

- Since 2014, global central banks have been net-sellers of USTs and net buyers of physical gold;

- In 2023, 20% of global oil sales were outside of the USD;

- Despite being pegged to the USD, Saudi Arabia, the UAE, and other GCC nations’ favorite import out of Switzerland this year is physical gold;

- More than 44 nations are currently executing trade settlements outside of the USD;

- Both Japan and China, historically the most reliable buyers of Uncle Sam’s IOUs, are now dumping billions and billions worth of them;

- Russia is the world’s greatest commodity exporter, and China is the world’s greatest commodity importer—and they like each other far more than they do Biden or the next White House resident; more importantly, it is a matter of national survival for China to buy oil outside the USD;

- Russia is now selling oil to China in yuan, which the Russians then use to buy Chinese goods (once made in America); thereafter, any delta in the trade is net settled in gold (not dollars) on the Shanghai Exchange. This, folks, is BRICS scalable (think India…);

- Between swap lines, the CIPS alternative to the SWIFT system and rising negotiations between Gulf oil nations and other BRICS+ big-whigs, the current move away from dollar-denominated oil trades is real rather than imaginary;

- Given the growing decline of physical gold and silver levels in the New York and London exchanges, they can no longer price fix gold as in the days of yore, nor can they justify a different 200 moving day gold price than one more fairly priced in China’s exchange;

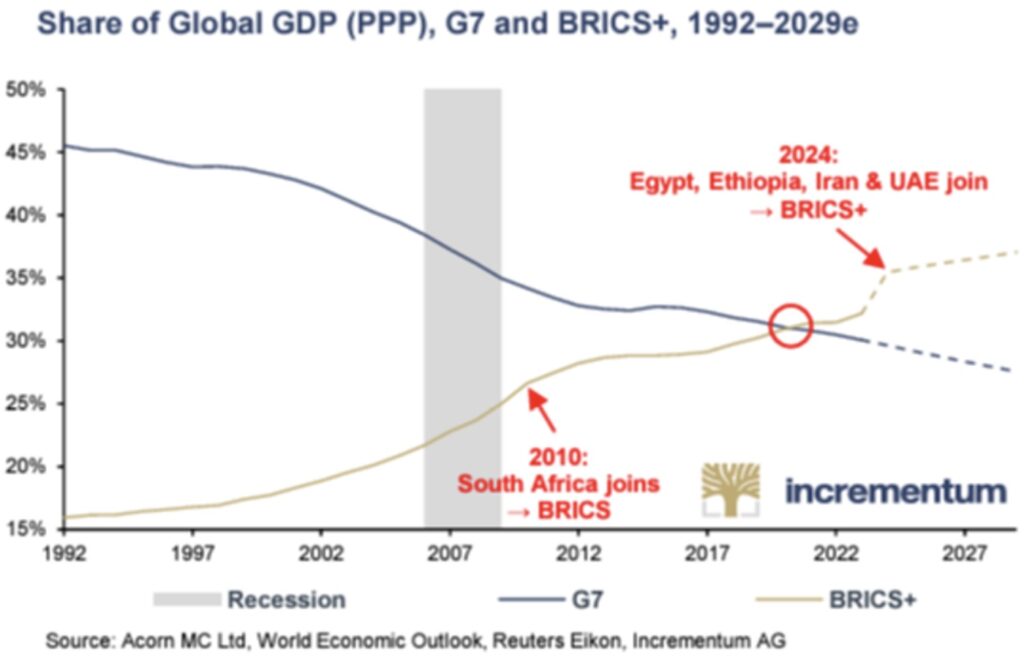

- The BRICS+ nations are no longer USD pawns but rising rooks. Their share of global GDP is surpassing that of the G-7;

- In 2023, the Bank of International Settlements declared physical gold a tier-one asset alongside the 10Y UST;

- Nations are openly (and naturally) preferring gold as a reserve asset over the other “tier-one” option–a dollar-based IOU of “risk-free-return,” which by any honest (current and future) measure of inflation offers a negative real yield, in other words: “return-free-risk;”

- No matter how enamored the green crowd is of ESG, we are decades and decades (as well as trillions and trillions) away from carbon-neutral, and like it or not, energy matters and fossil fuels literally fuel the world;

- China and India each have populations of over 1.4B. If oil demand increases even slightly in either of these BRICS countries, oil prices in rupees and yuan (and every other fiat currency) will explode—and two of the biggest players in the oil space don’t want to use dollars to pay for it. Instead, they’d prefer to net settle their oil and gas in gold, which buys more energy than dollars can;

- Given that the annual production capacity for oil is 12-15X that of global gold, and with gold increasingly becoming the favored oil payment, gold’s price relative to oil can only go up;

- This explains why gold is openly (not theoretically) becoming a more trusted reserve asset than the US Treasuries:

Central Bank Purchases Of Gold (BLUE LINE) vs US Treasuries (RED LINE)

In short, Energy matters, and rather than the USD being the base layer of money (see above), energy very well could be.

And THAT, folks, is how a system changes “violently and or militarily,” as most US direct and proxy wars have something to do with…oil.

And that oil, by the way, is increasingly being net-settled in gold—day by day, and minute by minute, for the simple reason that history is like a hockey puck: You play where it is headed (gold), not where it sits (the USD).

The Other Bullies Are Coming Together

Returning to the prior assumptions of the Immortal Dollar thesis above, if money is whatever the strongest bully/power says it is, what happens to the previous notion of “money” when a collection of rising and resource-rich bullies/powers (BRICS+) is growing stronger, and their preferred focus is oil and not the dollar?

What happens after a neutral reserve asset is weaponized against a major nuclear power and energy exporter (Russia) already in financial bed with the world’s largest energy importer (China)?

The answer is simple: That once “immortal” reserve currency is less trusted and hence less in demand.

Is it any coincidence, for example, that after DC weaponized the USD, the BRICS+ roster of nations increased to include the major oil exporters?

Is it a coincidence that Saudi Arabia’s crown prince, whatever you think of him, gave Biden a fist-pump and Xi a warm handshake?

And let’s be blunt: Does anyone truly believe oil is irrelevant? That American wars (direct or indirect) with Iraq, Libya and Syria were about protecting freedom and democracy?

Or might these conflicts have had something a bit more to do with energy in general and oil in particular?

What the US elite doesn’t want you to know is that oil matters more than dollars, and that more countries today would rather pay for that oil in gold.

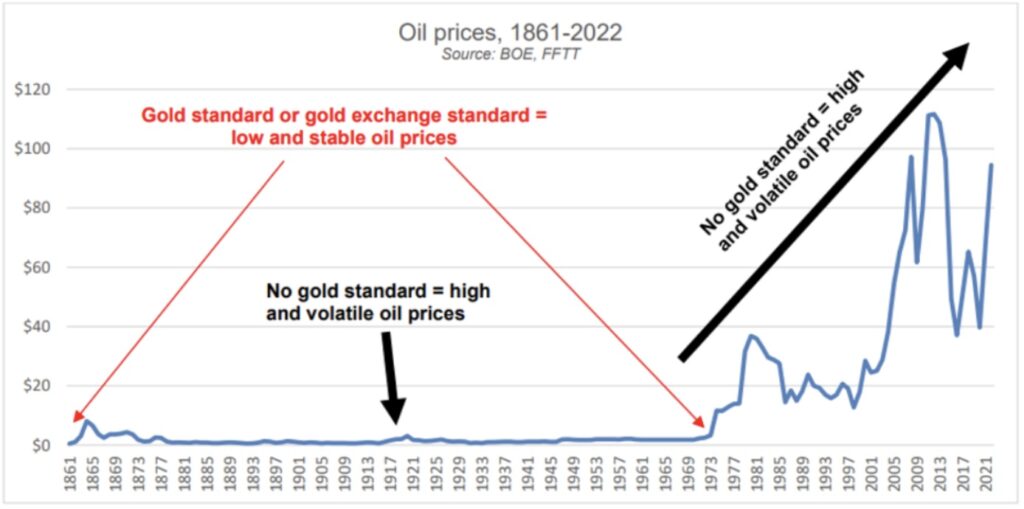

And do we think the Saudis haven’t noticed that gold-backed oil sales are significantly and historically more stable than dollar-backed oil?

Is it, therefore, a coincidence that since DC weaponized the USD, global central banks have been stacking gold at historical levels?

Is it a coincidence that more and more nations are net settling commodities and other trade deals in gold rather than dollars?

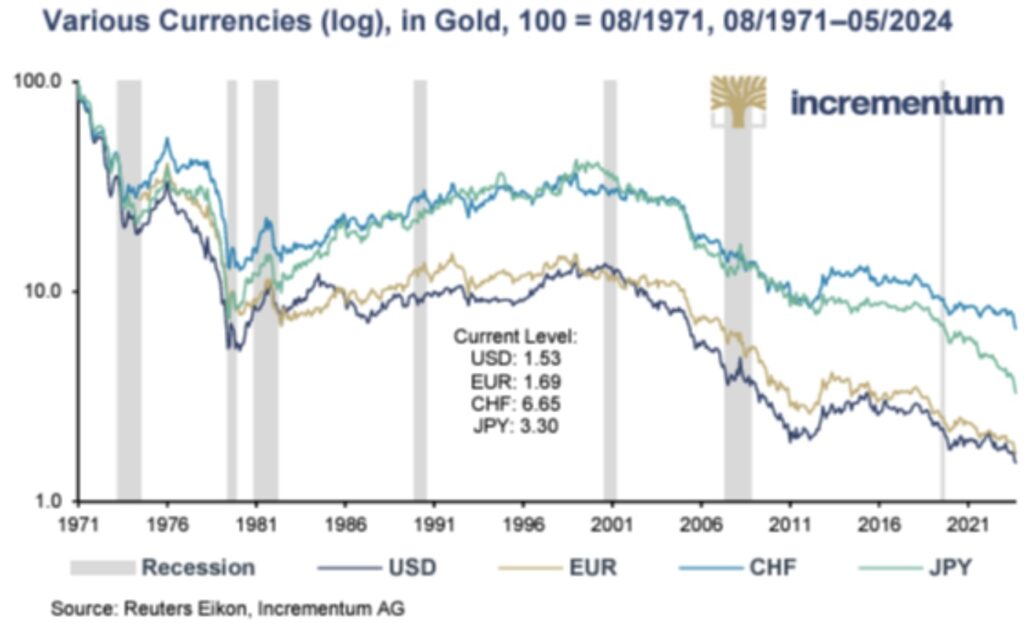

Is it a coincidence that nations and their central banks would rather save in gold (a finite asset of infinite duration) rather than US IOU’s (an infinite asset of finite duration), whose returns can’t beat inflation and whose purchasing power, even in dollar terms, has fallen greater than 98% when measured against a milligram of gold since 1971?

Is it a coincidence that within 2 years of de-coupling the USD from gold in 1971, DC desperately raised its interest rates and strengthened its dollar so that Saudi Arabia et al. would agree to force the world to buy oil in strong dollars, thereby creating forced demand for an otherwise over-supplied/printed USD?

But is it also just a coincidence that 50+ years (and a 98% weaker dollar later), Gulf nations like Saudi Arabia are now slowly turning away from that petrodollar after a generation of seeing it debased by over $100T in US public, private, and household debt—all of which has made an increasingly unloved UST increasingly unable to withstand further rate hikes and hence dollar-strength?

It’s Good to Be the King

But as per above, the smart bankers at the Fed and big banks still want us to believe the dollar is king, and that despite all its flaws, the great straw-sucking demand from a dollar-centric world is precisely what makes the greenback too big to fail.

But what if the world is energy rather than dollar-centric? And what if the BRICS rise is more than a chimera but a new puck direction?

Think about that. No one in DC or Wall Street wants you to.

Pride Comes Before the Fall

The certainty that tomorrow’s dollar will remain yesterday’s dollar is, in fact, a dangerous sign of hubris (and historical ignorance) before the fall.

After all, if we can see the decline of the USD’s purchasing power since 1971, can’t others?

And if we can see that UST returns are losing (technically defaulting) to current and future inflation, can’t others?

And if we can see that the fake liquidity (QE or other) required to pay Uncle Sam’s rising bar tab will continue to be highly inflationary (and dollar-debasing), is it not reasonable to assume that the rest of the world can see this too?

Going Around Rather than Against

In fact, and based on what is being done rather than said, the rest of the world appears to see precisely what we are seeing.

The BRICS nations are not seeking to destroy or replace the dollar. Instead, and like the Germans facing the Maginot line, they are already and openly going around it.

How?

By using local currencies for local goods which are then net settled in a timeless asset: Gold.

And if we can see that holders of gold can purchase significantly more energy (i.e., oil or gas) with gold ounces and kilos than they can with American dollars and USTs, is not at least reasonable to assume that gold’s role as a trade settlement asset will have higher demand as the USD suffers declining demand?

And if demand for the USD as a net trade settlement asset continues to fall rather than rise, is it not equally plausible (if supply and demand forces still apply) to suggest that tomorrow’s dollar may be weaker rather than stronger?

Two Crowns: The Timeless vs. The Temporary

And even if we were to concede the milk-shake theory’s reasonable postulate that despite all its blemishes, the dollar will be “the last to fall,” the simple fact remains that regardless of whether it falls or fails “last,” it is already being repriced, even if it may never be fully replaced?

Finally, and perhaps most importantly (and obviously), even if the USD remains “king” relative to all other fiat currencies (and this matters if you live in countries—like Turkey or Argentina-where your currency is far weaker), we can still objectively see, again, that gold holds its value even better than that USD “king.”

In short, there’s a far better “king” than the USD—it was always there.

The central bankers just don’t want you to see it.

And this precious king has a crown of gold rather than paper.

Which king will you choose? This will link you directly to more fantastic articles from Egon von Greyerz, Matthew Piepenburg, and Ronni Stoeferle CLICK HERE.

***To listen to Alasdair Macleod discuss how to make a fortune in this gold bull market CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.