Look at who is remaining bullish on gold, silver and commodities as 80% of US households are now in worse shape than they were pre-COVID.

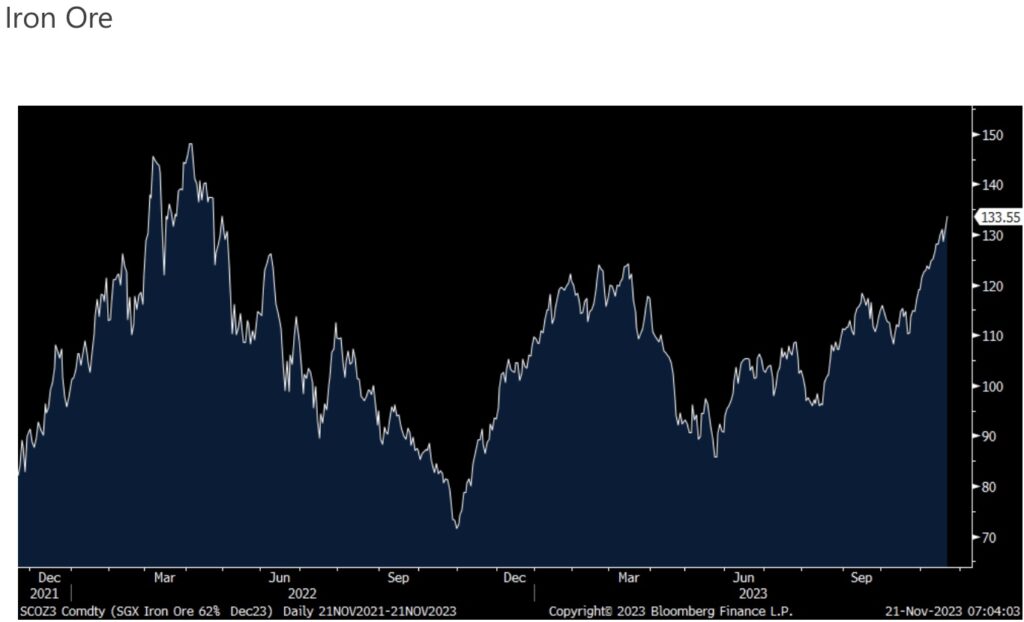

Iron Ore Prices Are Booming

November 22 (King World News) – Peter Boockvar: Shifting to China and because it’s influencing the price of iron ore, there is a big push to get unfinished projects, where consumers have already pre-paid for, done. There is a Bloomberg News story that “Chinese developers’ bonds gained along with their shares after authorities began drafting a list of 50 real estate firms that would be eligible for a range of financing as Beijing sought to support the embattled property sector.” The price of iron ore is quietly rallying to the highest level since April 2022.

We remain bullish and long certain commodities such as oil and gas, uranium, copper and precious metals.

Fed Says 80% Of US Households In Worse Shape Than Pre-COVID

Gerald Celente: As we had forecast back in November 2022, the U.S. equity markets would climb in 2023, with the S&P 500 expected to increase at least 16 percent.

As of today, the S&P 500 is up over 17 percent while the Dow and Nasdaq are up 5.3 percent and 35 percent, respectively, for the year.

The White Shoe Boy gamblers on The Street that have pumped up the U.S. equity markets have nothing to do with the reality on Main Street.

The facts are there—for all who are not deaf, dumb or blind—to hear, understand and see the indisputable data.

Last week the Federal Reserve reported that 80 percent of U.S. households are in worse financial shape now than before the COVID War.

PUBLISHER’S NOTE:

Of course the mainstream media and the people parrot the “official” line that it was a “pandemic,” which the World Health Organization declared on 11 March 2020 when the grand total of 4,219 people died of virus… out of 8 billion people.

And since that time, just 0.7 percent of the world population allegedly died of the virus, so it was not a “pandemic.”

However, absent the Fed’s household report, not a mention of the spiritual, financial, and economic damage inflicted upon the public across the globe as a result of politician’s draconian lockdowns… which we have continually detailed in The Trends Journal.

To listen to Alasdair Macleod discuss available physical gold disappearing off the market, and the coming storm that is already beginning to ignite the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: Gold Surges Back Above $2,000 As Major Indicator Collapses Near Lowest Since 1990s CLICK HERE

ALSO JUST RELEASED: HYPERINFLATION ALERT: Look What Just Happened In This Country That Is Hyperinflating CLICK HERE

ALSO JUST RELEASED: Michael Oliver – Silver Price Is About To Explode To $50 CLICK HERE

ALSO JUST RELEASED: BUCKLE UP: The Fed Is Preparing To Unleash QE To Infinity CLICK HERE

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.