Two economic indicators have plunged near the lowest levels in history. This is not the sign of a healthy economy. Take a look…

Things Are Tough All Over

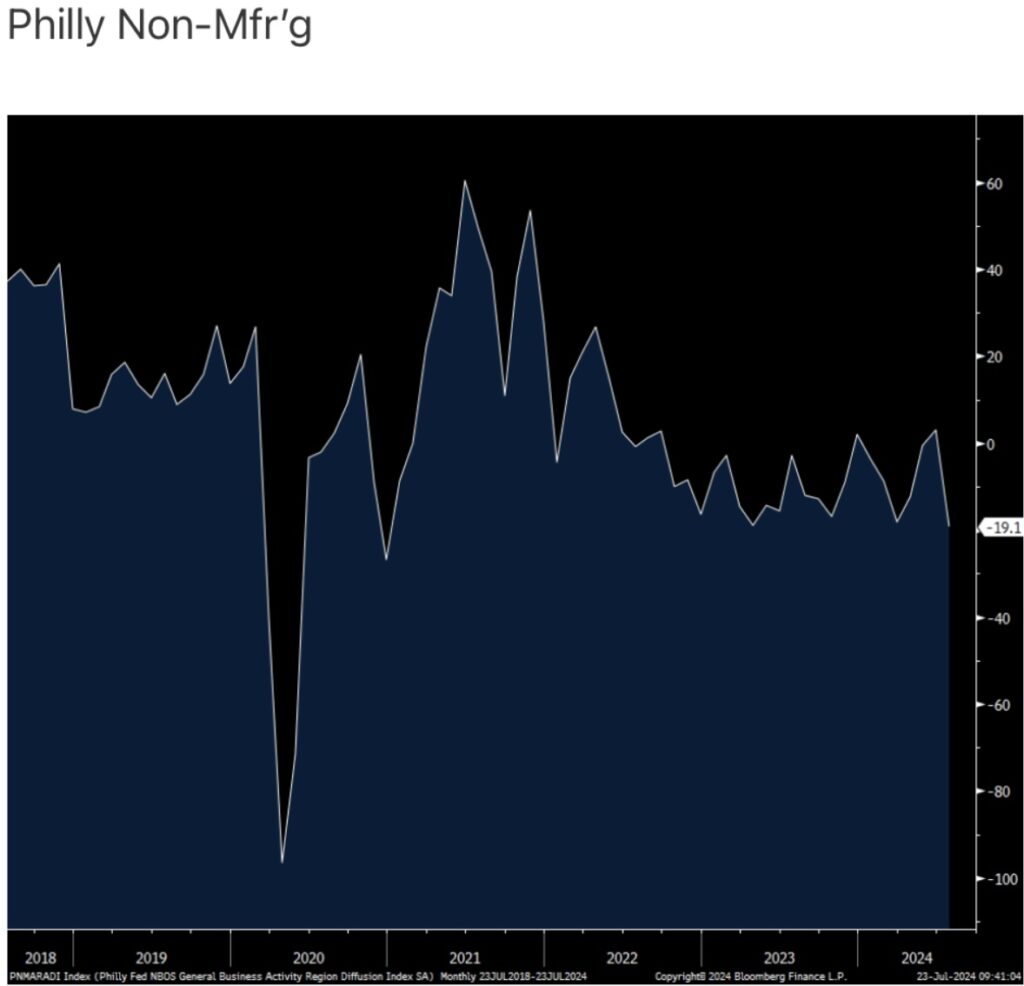

July 23 (King World News) – Peter Boockvar: The July Philly non-manufacturing index fell to the lowest level since December 2020.

Non-Manufacturing Tumbles To Lowest Level Since 2020

New orders, sales, backlogs, inventories, full time employment and the average workweek were all below zero. Prices paid rose almost 6 pts to a 3 month high. Those received fell 2.7 pts m/o/m but at 13.9 is above the 6 month average of 11. Capital spending plans were mixed…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

Bottom line, the softness in this July survey follows the June ISM services index which surprised by falling below 50 and something of course to watch from here.

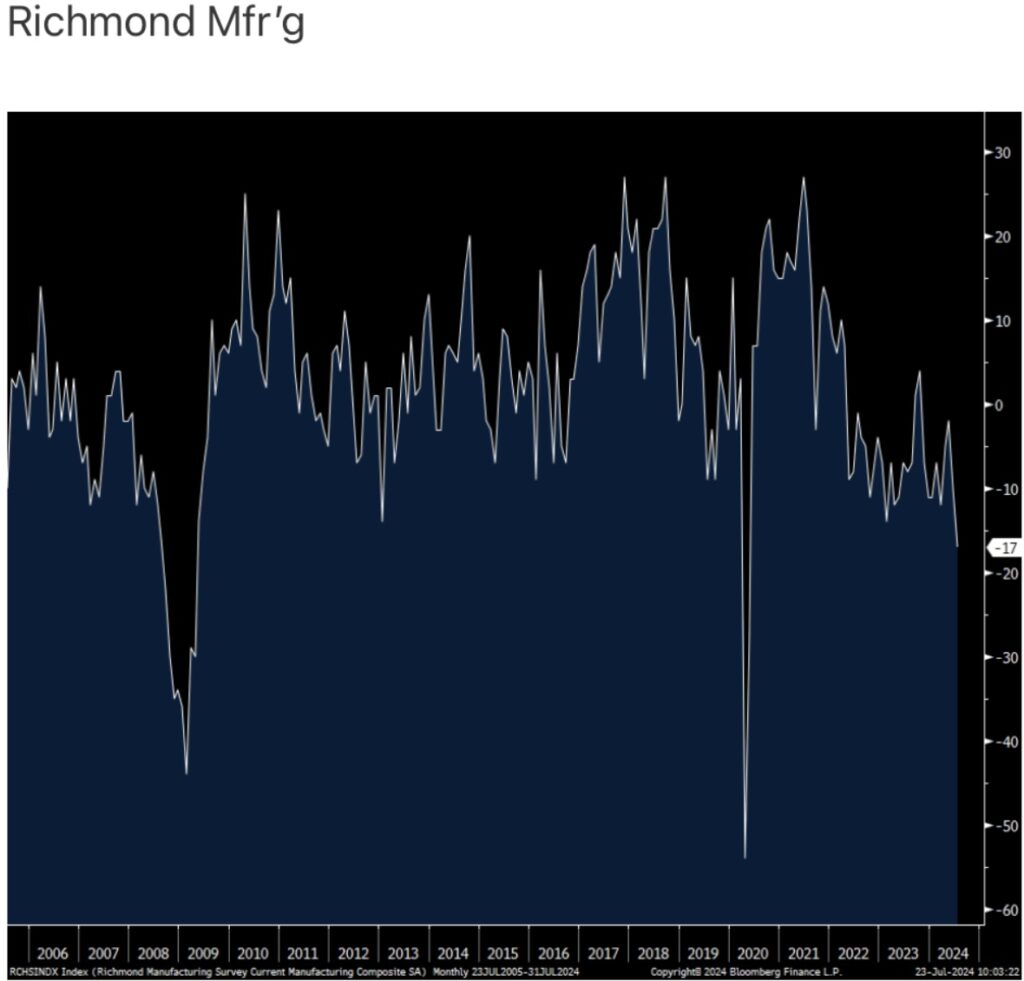

The July Richmond manufacturing index fell to -17 from -10 and follows the contraction seen in the NY survey and compares with the Philly outlier where its manufacturing survey has been positive for six straight months. The Richmond survey is negative for 9 straight months and not including Covid, the -17 print is the weakest since April 2009.

Richmond Manufacturing Survey Plunges To Lowest Level (excluding COVID anomaly) Since April 2009!

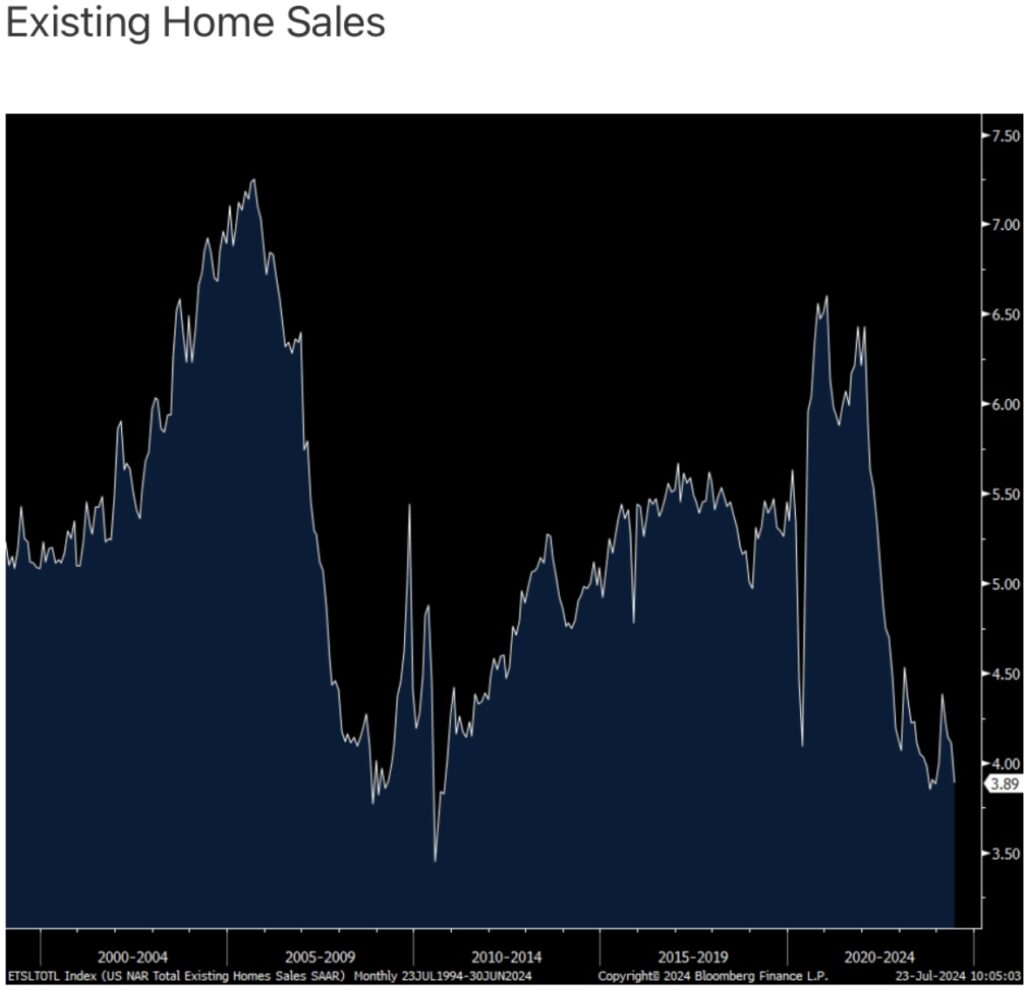

June existing home sales totaled 3.89mm, about 100k below expectations, down from 4.11mm in May and that is just off the lowest since 2010 and not far from levels seen in the mid 1990’s.

Existing Home Sales Falls To One Of The Lowest Levels In History!

Assume contracts were signed in the March, April, May timeframe and thus captures the heart of the spring transaction season.

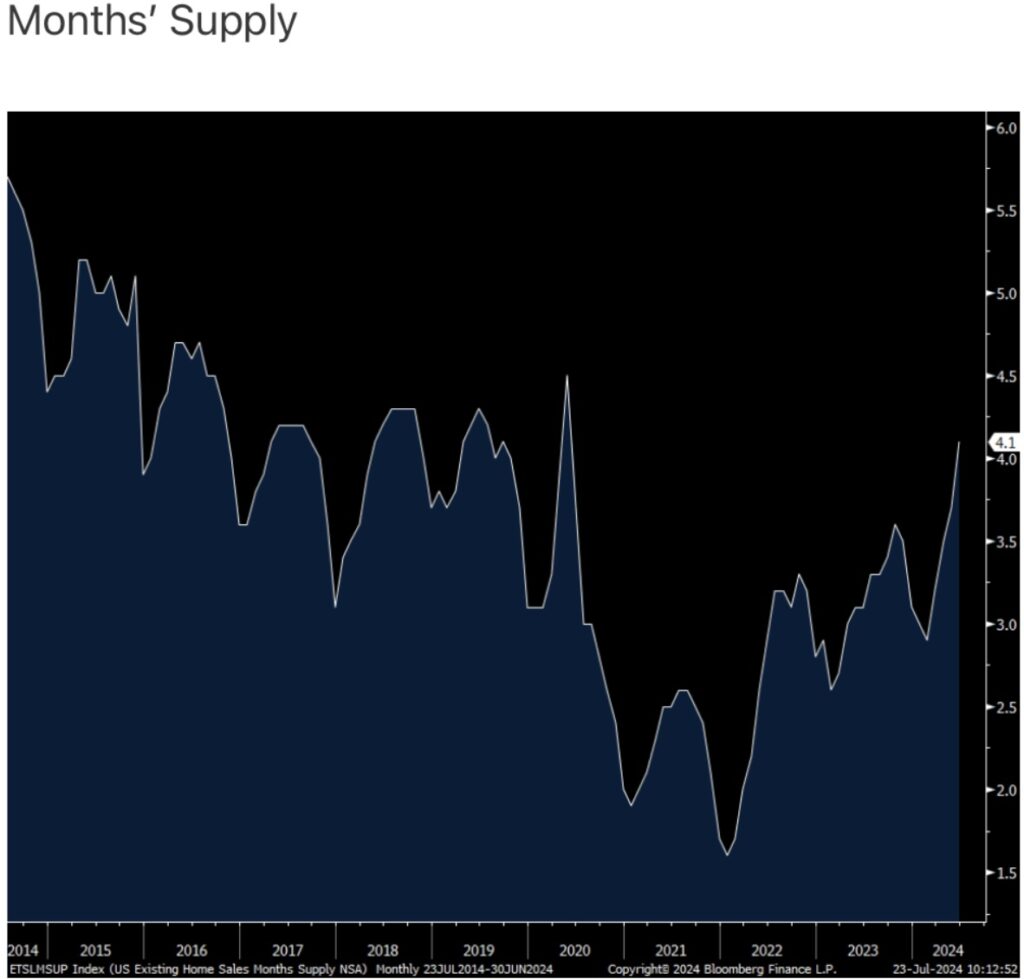

The key first time buyer made up 29% of purchases, a 4 month low. Supply did rise, as it does in the spring, with months’ supply now up to 4.1 from 3.7 and getting closer to what is normal. It was 4.3 months in June 2019. The 20 yr average is 5.4 months.

Months’ Supply Of Homes For Sale Is Skyrocketing

The median home price was up 4.1% y/o/y.

The NAR said something similar to what we heard from Zillow last week:

“We’re seeing a slow shift from a seller’s market to a buyer’s market. Homes are sitting on the market a bit longer, and sellers are receiving fewer offers. More buyers are insisting on home inspections and appraisals and inventory is definitely rising on a national basis.”

I’ll add, home price gains should cool from here, which first time buyers would certainly welcome considering the affordability challenges that has contributed to a near 30 yr low in existing home transactions, hand in hand with the slim inventory pickings over the past few years.

Just Released!

Gerald Celente’s King World News audio interview has just been released discussing the gold market and much more and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

Released!

To listen to Alasdair Macleod discuss the wild trading in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.