After a wild week of trading, this will shock the world and rock global markets.

A second audio interview will be released within hours discussing the dramatic surge in the price of gold and the mining stocks as well as the wild trading in global markets. For now…

What A Week!

April 11 (King World News) – Alasdair Macleod: Measured in gold, the dollar’s decline is accelerating as foreigners bail out and gold is the go-to refuge. It is a panic on a global scale which looks like only just starting.

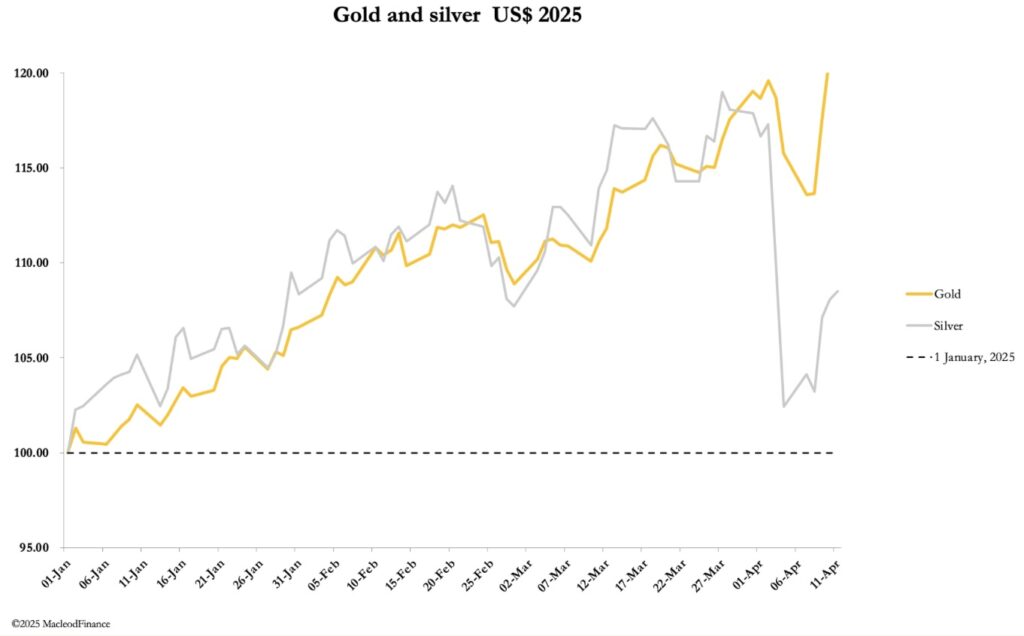

After last week’s dramatic selloff, gold and silver rallied this week, spectacularly in the case of gold. In early morning European trade today, gold was $3221, up $190 from last Friday’s close — a new record level. Silver was $31.46, up $1.88. But since last week’s dramatic selloff, silver has been left way behind gold, reflected in our headline chart.

So what’s driving these two metals?

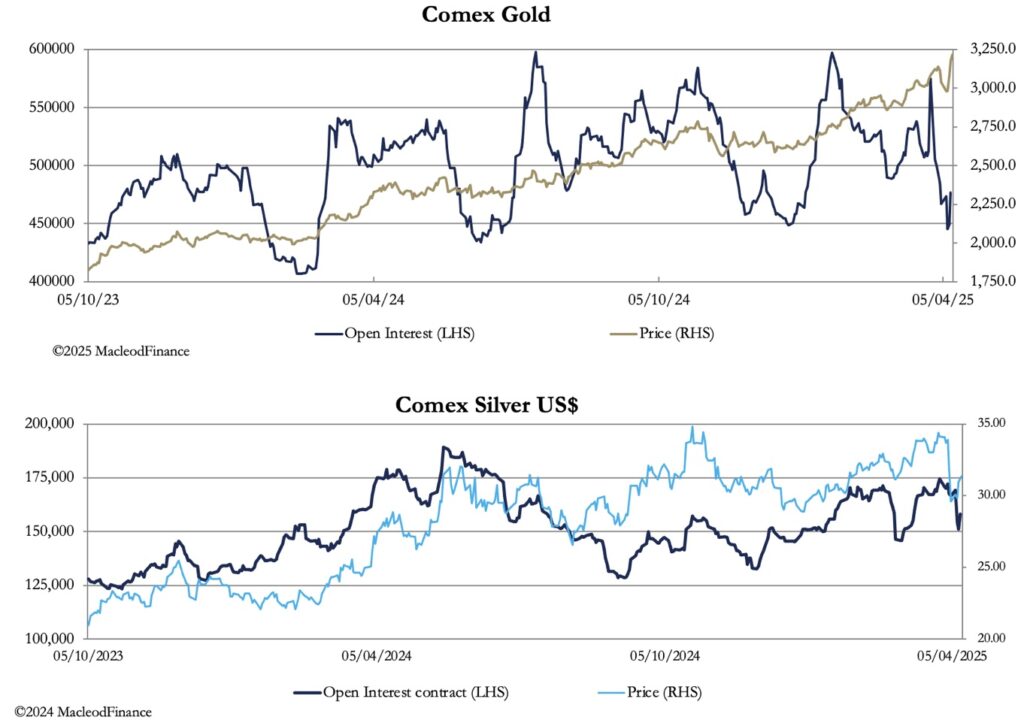

Part of the reason for this disparity is that Comex dealers have a better understanding of industrial demand factors than of money. This has led them into the wrong contract, which is illustrated in the chart below of price and open interests.

Open interest in gold recently collapsed from 574, 824 to 449,087 contracts on Wednesday or 125,737 contracts (equivalent of 391 tonnes) taking it towards oversold territory, while on balance the price barely moved. In silver, the decline in open interest was more modest, while the price fell heavily. Previously, open interest and the price had been moving together in normal bullish fashion, suggesting the price was more vulnerable to unexpected shocks.

When silver is valued as an industrial metal, its price correlates with copper. Both metals initially soared on tariff fears, then fell back heavily when markets became scared of the recessionary consequences. Gold however reflects fears for the dollar and has caught paper markets on the hop.

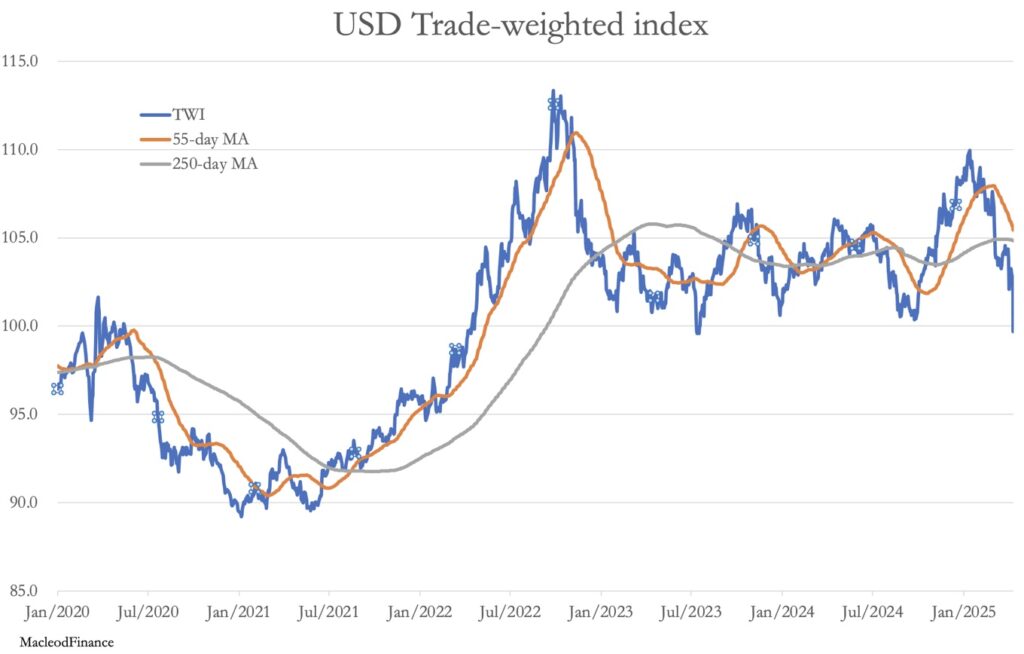

Other than the gold price itself, the best illustration of the dollar’s plight is its trade weighted index:

Ouch! This is a collapse against other currencies which are hardly paragons of virtue themselves. Not only is this a classic dollar bear market, but the momentum to the downside is consistent with becoming self-feeding.

What gold and the TWI chart are telling us is that taking everything into account markets now expect the dollar to lose purchasing power at an alarming rate. Consequently, we can kiss goodbye to prospects for interest rate cuts and lower bond yields. Instead, they will have to rise in the coming months which is bound to be a nasty systemic shock.

Let that sink in for a moment.

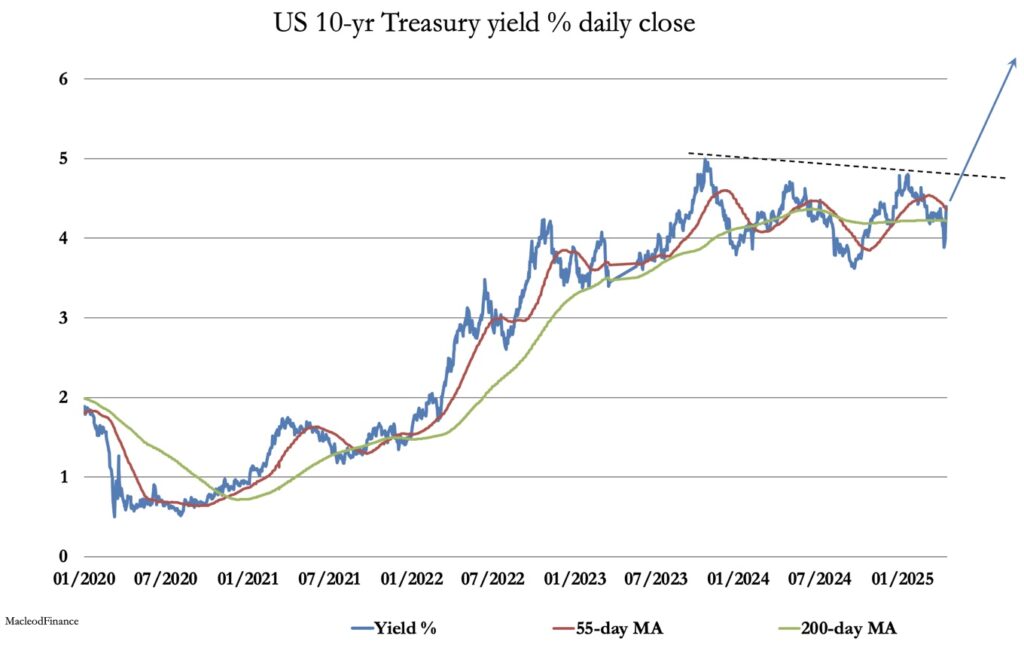

We can now sense the future direction of bond yields, and our next chart is of the 10-year UST note confirming worst fears:

KING WORLD NEWS NOTE: Soaring Interest Rates Will Shock The World And Rock Global Financial Markets

It is being sensed already, but when the pecked line is broken all dollar credit values will slide. Equity and bond values are bound to fall heavily, and foreign holders of some $32 trillion of onshore dollar assets including $14 trillion of equities will flee from not only the assets, but the dollar as well.

The question then arises as to the consequences for other currencies, which are likely to be damaged by the lethal combination of higher US bond yields, their own debt traps, and severe equity bear markets.

This is painting a very dark picture, but it is getting difficult to see how this deterioration in US and global credit values can be avoided. For now, it is only a matter of Trump’s administration undermining the dollar’s credibility. We need to monitor how market opinions elsewhere reflect these fears.

Finally, a few words on silver. While investors have been badly whipsawed in the last two weeks, it has left silver grossly undervalued. We can cite the gold—silver ratio at 103 which is an aberration. And the chart looks good as well:

All that has happened is that the price has successfully back-tested the breakout level of the previous 4-year consolidation. Rising moving averages in correct sequence tells us that the bull is intact. Silver should now be ready to break the $35 level and move on rapidly higher. Losing faith is not a sensible option in what is still a monetary metal. To listen to Alasdair Macleod discuss the wild trading in gold, silver, and global markets CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.