As we continue to kickoff an election year, this is how bad things are in the United States right now.

Things Are Tough All Over

January 9 (King World News) – Peter Boockvar: With Fed Governor, and thus voting member, Michelle Bowman echoing what Lorie Logan said about the risks to inflation from an easing of financial conditions, they are both basically saying, the more markets rally, the less cuts you see. Yes, Bowman is acknowledging the need to implement some cuts if inflation further moderates, which it will, but here is another Fed member pushing back in her own way on market expectations for 6 cuts. I’ll say again, we might get 6 cuts but it will be because the unemployment rate will be 4.5% or higher. By the way, the Fed comments over the past week have taken away one of the markets 6 25 bps rate cut expectations as of year end 2023 and have reduced them now to 5.

Bowman did not mention the balance sheet and QT but on the heels of Logan’s comments over the weekend, Joseph Wang, The Fed Guy on X, made yesterday this great point, “Linking the pace of QT with RRP balances is a bad idea because you essentially outsource your QT timeline to Treasury. The end result would be zero RRP, very high reserve levels and a huge Fed balance sheet.”

The NY Fed’s Consumer Expectations survey had more interesting info than just the inflation stats. It was good to see the continued drop in expectations for inflation at the one, three and five yr time frames and driven by lower price guesses for rent, college, and food.

They were unchanged for gasoline and medical care. On the flip side of the optimism, one year spending expectations fell to the lowest level since September 2021.

The percentage of those who don’t expect to make a minimum debt payment over the next 3 months saw its 2nd highest print since the Covid shutdowns at 12.42%. Adding to the consumer worries, expected earnings growth decreased by .2 percentage point to 2.5%, the lowest level since April 2021. “The decline was driven by respondents with at most a high school diploma.”

Bottom line on the above, it’s of course nice to see the rate of price increases slow but it’s clear that consumers are getting more stressed from the cumulative rise in inflation over the past 4 years.

About The Labor Market

With respect to the labor market, the answers to the employment questions improved. Also of note, “Perceptions of credit access compared to a year ago were largely unchanged” but with the drop in interest rates over the past few months, “Expectations about credit access a year from now instead improved.”

More on the consumer, late yesterday the November consumer credit data was released and the month saw the biggest one month increase in revolving credit outstanding, mostly credit cards, since November 2022 at $23.7b. Now, this is seasonally adjusted and DOES NOT include Buy Now Pay Later, but that is a pretty large increase right before the holidays. And, for those who don’t pay off their monthly balances are paying a 23% interest rate to borrow.

I guess the pre-announcement period has started right before earnings reports start to flood us. If you didn’t see the Microchip comments of note, here they are:

“The weakening economic environment that our customers and distributors faced during the December 2023 quarter resulted in many of them wanting to receive a lower level of shipments as they took actions to further de-risk their inventory positions. Many customers also had extended shutdowns or closures at the end of the December quarter as they managed their operational activities. The impact of these and related factors was that certain backlog that we had planned to ship when we provided our guidance on November 2, 2023 did not ship to customers before the end of the December quarter. As a result, our preliminary revenue indication for the December 2023 quarter is to be down sequentially about 22% compared to our guidance of down 15% to 20%, which we provided on November 2, 2023.”

For those not familiar with Microchip, according to their website, “The company’s solutions serve more than 125,000 customers across the industrial, automotive, consumer, aerospace and defense, communications and computing markets.” Thus, pretty diversified and touching a lot of industrial target markets.

Extreme Networks also lowered guidance and they call themselves “a leader in cloud networking.” Their press release said “Our revised fiscal quarter outlook reflects industry headwinds of channel digestion and elongated sales cycles. In late Q2, we saw multiple large deals pushing out to future quarters.”

More Reduced Guidance

Container Store also reduced its guidance. “The challenging business trends we experienced in the 2nd quarter continued. General merchandise categories underperformed compared to our expectations and were relatively consistent with our 2nd quarter performance.”

MSC Industrial, a large industrial and manufacturing parts distributor and a good proxy on these sectors, reported earnings and missed both top and bottom line estimates. They have similar end markets as Fastenal who reports next week. They said “Average daily sales declined .4% y/o/y, slightly better than the Industrial Production index, as a result of softening demand through the quarter.” They acknowledged “a slower start to the fiscal year.”

Lower mortgage rates helped to lift the monthly Fannie Mae Home Purchase Sentiment index to 67.2 pts in December, up 2.9 pts m/o/m. “In December, a survey high 31% of consumers indicated that they expect mortgage rates to go down, while 31% expect them to go up, and 36% expect rates to remain the same.”

Also, “Although consumer perceptions of homebuying conditions remain overwhelmingly pessimistic, that particular component ticked up slightly m/o/m, with 17% of consumers now indicating it’s a good time to buy a home, compared to 14% last month, a survey low.”

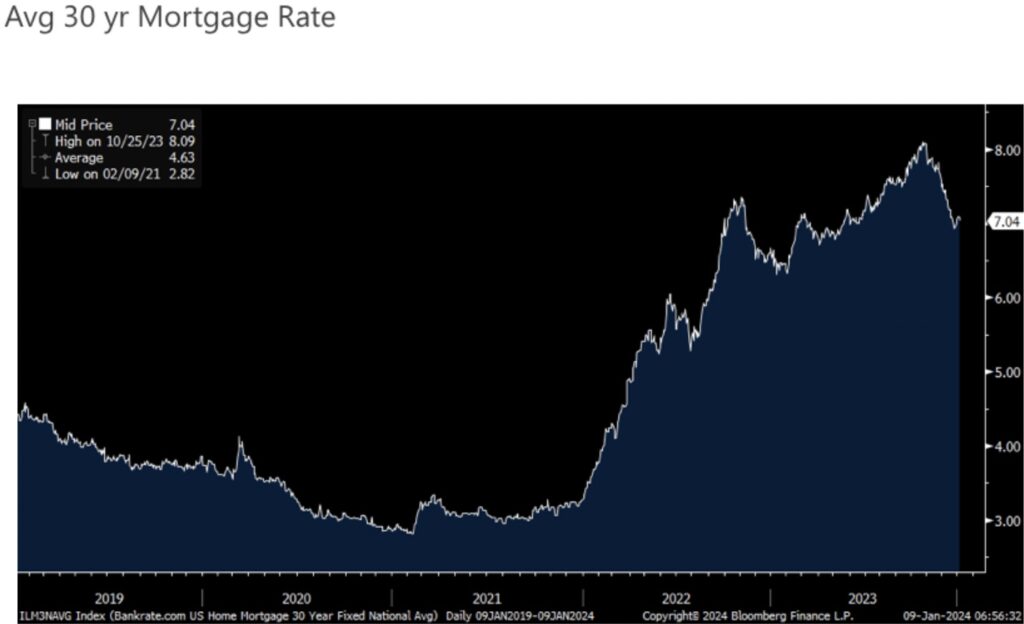

Fyi, the average 30 yr mortgage yesterday is still a very high 7.04%, more than double its 2021 level, according to Bankrate.

One of my possible ‘trade offs’ I listed on January 2nd for this year was that the Fed cuts short term rates but long term rates rise.

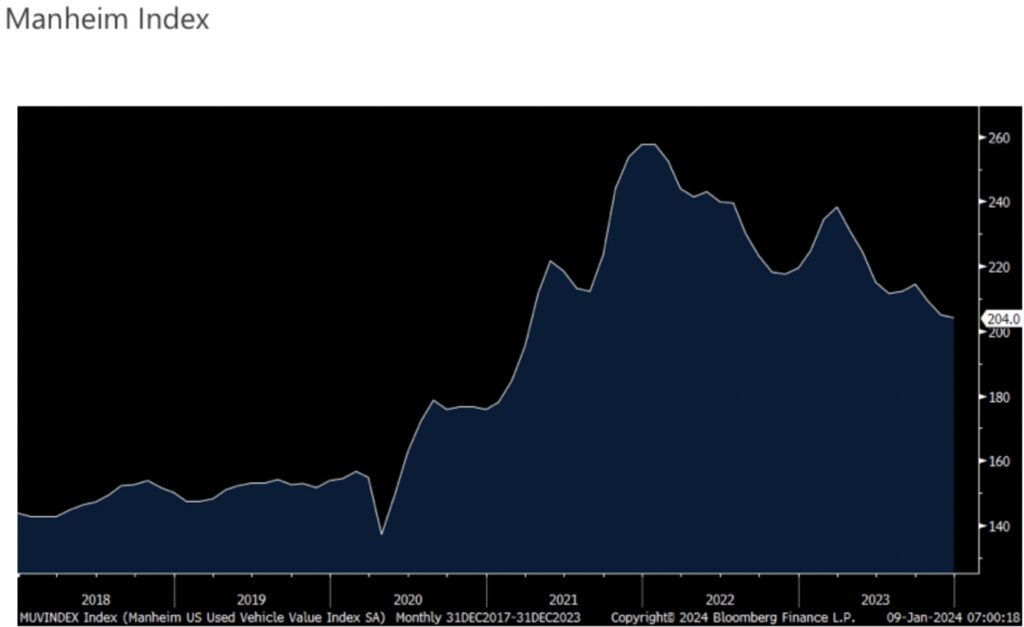

Manheim said yesterday that in December and for 2023 vs 2022, wholesale used car prices fell 7% and down by .5% from November. Welcome relief for sure but this index is still up 30% from February 2020.

The NFIB small business optimism index for December rose to 91.9 from 90.6 and that is the best level since it touched here in July.

Notwithstanding the m/o/m increase in confidence, and likely because it is still well below the 50 yr average of 98 and businesses are paying 9.8% on loans on average, the NFIB chief economist continued to sound grumpy.

“Small business owners remain very pessimistic about economic prospects this year. Inflation and labor quality have consistently been a touch complication for small business owners, and they are not convinced that it will get better in 2024.”

I’ll add my bottom line and talk specifically about the high cost of capital, paying a 9.8% interest rate on a small business loans hurts and it compares with the 10 yr average of 5.9% and the 5% and under it was at in 2020 and 2021.

Michael Oliver Audio Just Released!

To listen to Michael Oliver discuss why 2024 is shaping up to be a 1980 mania type of event for the gold market CLICK HERE OR ON THE IMAGE BELOW.

Just Released!

To listen to Alasdair Macleod discuss gold, silver, and the biggest opportunities in 2024 CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.