One thing is absolutely certain, things are tough all over. Take a look…

Things Are Tough All Over

May 14 (King World News) – Peter Boockvar: Got to get those tariffs in just a few months before some key states need to be won in November and yes, I beat up both sides over tariffs. By the way, with respect to steel in particular, the US relies on China for only about 2% of its steel imports so dumping of steel is not the issue here. Also, putting tariffs on all the key EV related stuff will just put cheaper EV’s further out of reach for lower income consumers and continue to put a bid under inflation.

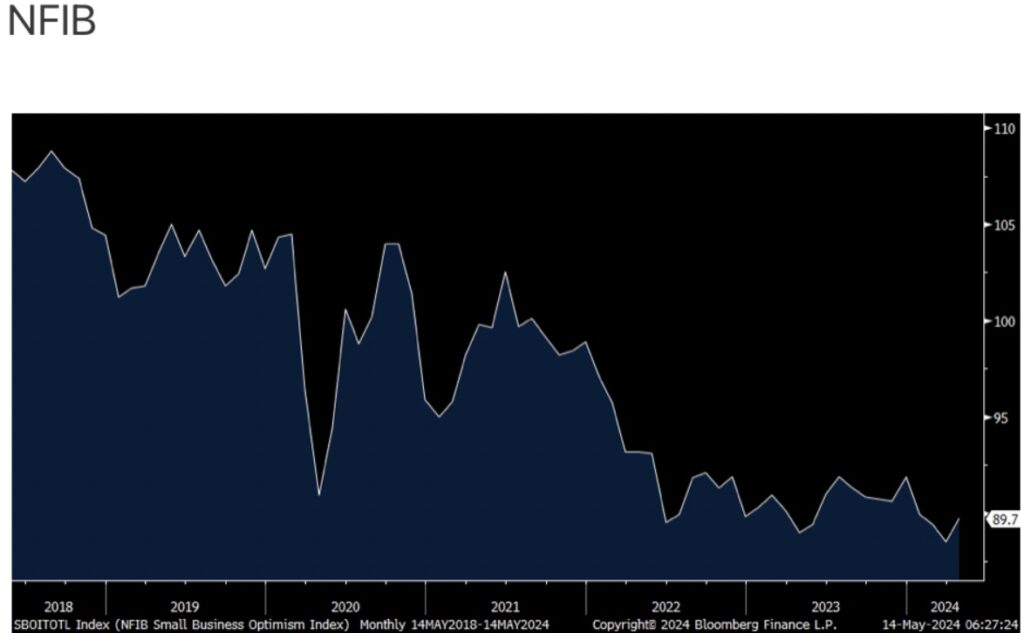

Anyway, the April NFIB small business optimism index rose 1.2 pts m/o/m to 89.7 and which compares with 89.4 in February and 89.9 in January. So, we continue to bounce along the bottom. For reference, the 50 yr average is 98.

Still No Reprieve For Small Businesses

Plans to Hire rose 1 pt to 12% after falling to the lowest since 2016 in March, not including Covid. This has been one key anecdote pointing to the slowing demand for workers on the part of small business.

Plans To Hire Remains In A Downtrend

Job openings did rise though by 3 pts but just to about the 6 month average and off the smallest amount since January 2021. Compensation plans were unchanged m/o/m. Plans to increase inventories rose 1 pt but still is negative at -7% while capital spending plans were up by 2 pts but back to its 6 month average.

Those Expecting Better Economy -37% Reading

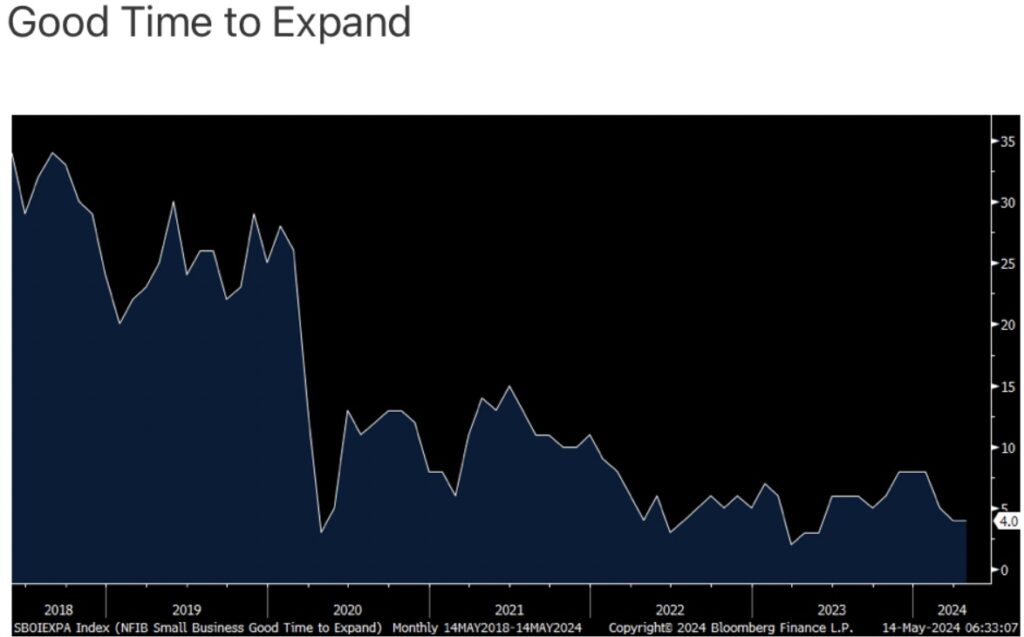

Those that Expect a Better Economy fell 1 pt and remains deeply negative at -37%. After dropping by 8 pts in March, those that Expect Higher Sales got back most of that, rising 6 pts to -12%. There was no change in those saying it’s a Good Time to Expand at 4%. For perspective it was at 3% in April 2020, during the heart of the shutdowns.

Good Time To Expand Remains Collapsed

Higher Selling Prices fell 3 pts after rebounding by 7 last month. Positively for the moderating inflation story, “A net 26% (seasonally adjusted) of owners plan price hikes in April, down 7 pts and the lowest reading since April of last year.” The earnings outlook was up 2 pts but still well under zero at -27%. Finally, and of note, credit conditions tightened to the most in 5 months. The average rate on any loan was 9.3% vs 9.8% in March and 8.7% in February.

Bottom Line

The bottom line from the NFIB, “Cost pressures remain the top issue for small business owners, including historically high levels of owners raising compensation to keep and attract employees. Overall, small business owners remain historically very pessimistic as they continue to navigate these challenges. Owners are dealing with a rising level of uncertainty but will continue to to what they do best – serve their customers.” The NFIB ‘Business Uncertainty Index’ did rise to the highest since September. Not surprisingly as small businesses are least capable of dealing with many of the major issues businesses face like managing material cost pressures, labor, taxes, higher cost of capital and the ever growing regulatory state…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Inflation Expectations

In yesterday’s NY Fed’s Consumer Expectations survey the one yr inflation guess rose to 3.3% from 3% and that is the highest since November. The 3 yr slipped by one tenth to 2.8% while the 5 yr rose to 2.8%, up 2 tenths. Driving the one yr forecast was higher expectations for home prices but also for gasoline and food, along with medical care, college costs and rents, basically all the most important, non discretionary items for people.

There was a slight drop in income expectations and expectations for employment. While there was a drop in those expecting to lose their job, “The mean perceived probability of finding a job if one’s current job was lost declined for the 4th consecutive month to 50.9% from 51.2% in March. This is the lowest reading of the series since April 2021.”

On the spending side, there was a .2 percentage point rise to 5.2% for expectations of an increase. “The increase was most pronounced for respondents with some college education.” Credit access expectations rose a touch.

Many Reporting They Are Worse Off Than A Year Ago

Finally of note, “Perceptions about households’ current financial situations deteriorated with fewer respondents reporting being better off and more respondents reporting being worse off than a year ago. Year-ahead expectations also deteriorated marginally with a smaller share of respondents expecting to be better off a year from now.”

My bottom line, we have a tale of two US consumers as one has become VERY price conscious and prioritizing their spend and another that is less so and still spending on discretionary experiences and stuff.

Michael Oliver: Gold’s Upside Acceleration Phase And How Investors Can Target Which Mining Stocks To Buy Ahead Of The Gold & Silver Mania

To listen to one of Michael Oliver’s most important audio interviews ever discussing the gold and silver mania, what to expect from mining stocks, the stock market in 2024 and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.