You are being lied to by the mainstream media. What else is new? It appears more inflation is on the way, despite the propaganda suggesting relief is on the way. This will also impact the price of gold.

Zero Chance The Fed Cuts In March

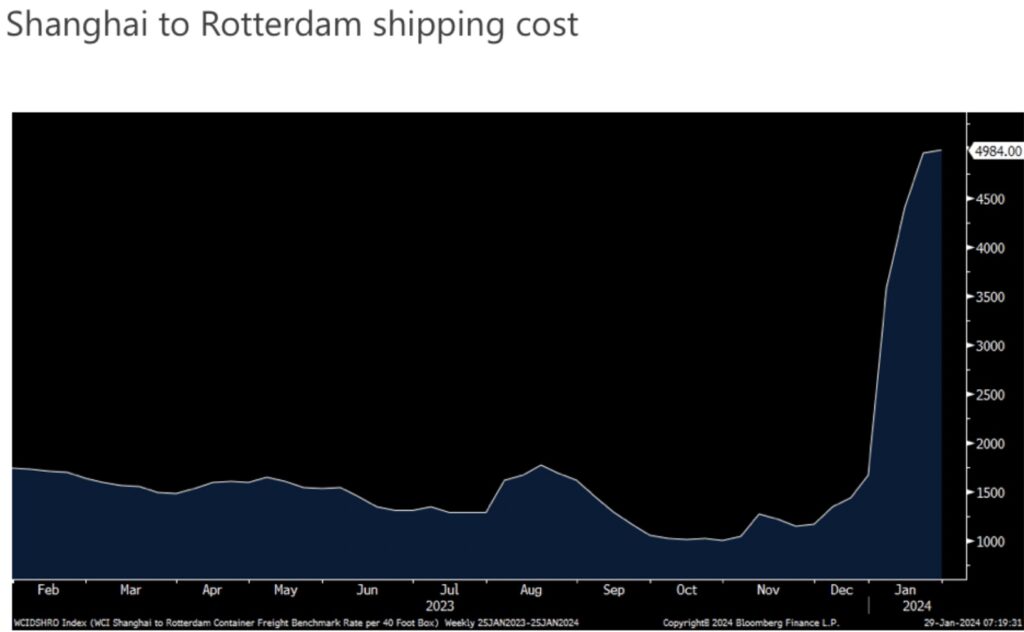

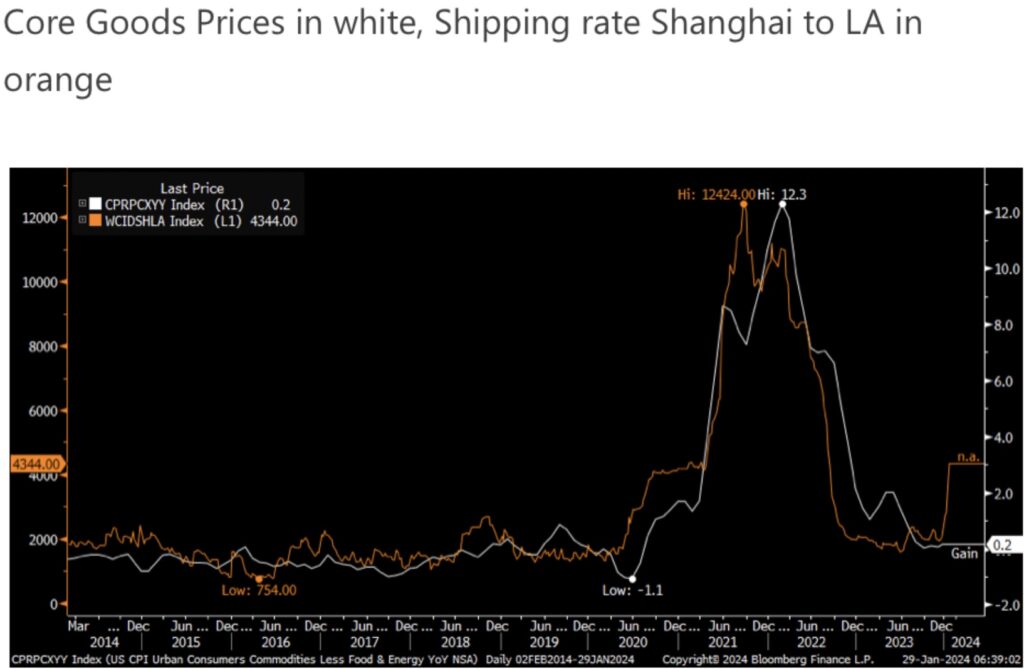

January 29 (King World News) – Peter Boockvar: We enter the week and ahead of the FOMC meeting pricing in a 52% chance of a March rate cut according to the fed funds futures. If today’s current economic and global situation still stands on that March 20th meeting I see NO chance the Fed cuts. Does the Fed really want to stimulate the demand for goods with shipping rates up 200% in a month (see chart below)? Does the Fed really want to stimulate more demand with oil nearing $80 with major geopolitical hotspots flaring up? Does the Fed really want to stimulate the economy after the Q4 GDP print? Does the Fed really want to stimulate more euphoria in markets? I’ll reevaluate thereafter as we get closer to the May 1st meeting and we see if there is further weakness in the labor market and if so, by how much.

So, I think on Wednesday Powell with his words will take out the possibility of a March cut. After that at his presser, what we really need to hear details on is what are their plans for the balance sheet. We of course have details on the Treasury’s quarterly refunding program and while I have no doubt there will be political considerations again on shortening the maturities so as not to upset the long end of the yield curve, the shorter Janet Yellen gets with issuance, the possible quicker liquidation of the Fed’s reverse repo facility takes place.

Then, the fate of QT really becomes center stage as the Fed tries to figure out what level of bank reserves is the right one. And by the way, on this REAL RATE debate, the average real rate in the 5 yr in the 10 years leading into the Great Financial Crisis, was 254 bps. The average 10 yr real rate was 294 bps. We are currently well below that.

THIS WILL BE UGLY: Inflation Catalysts Abound

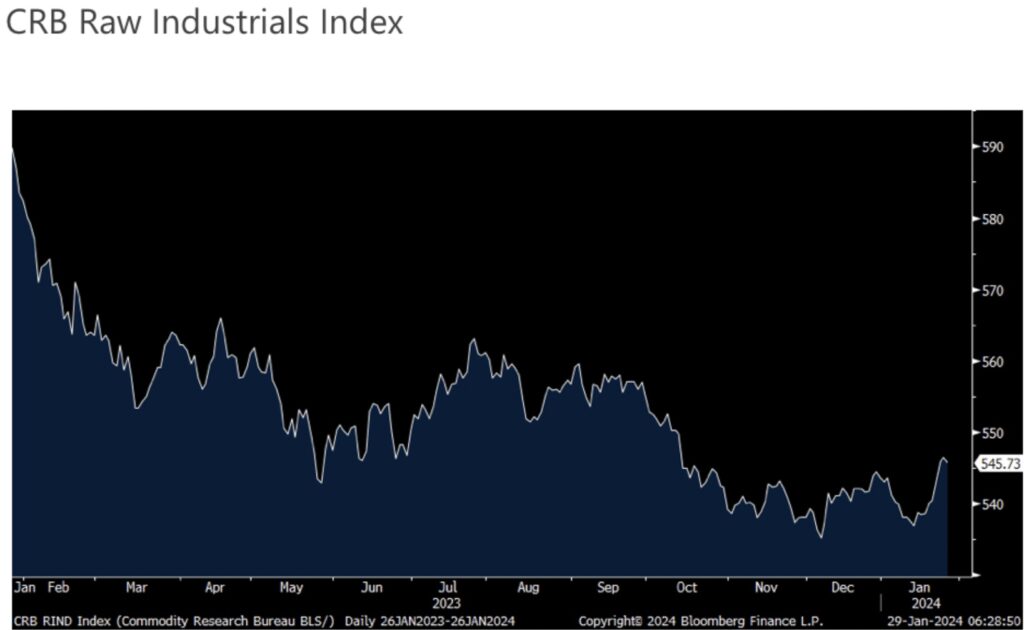

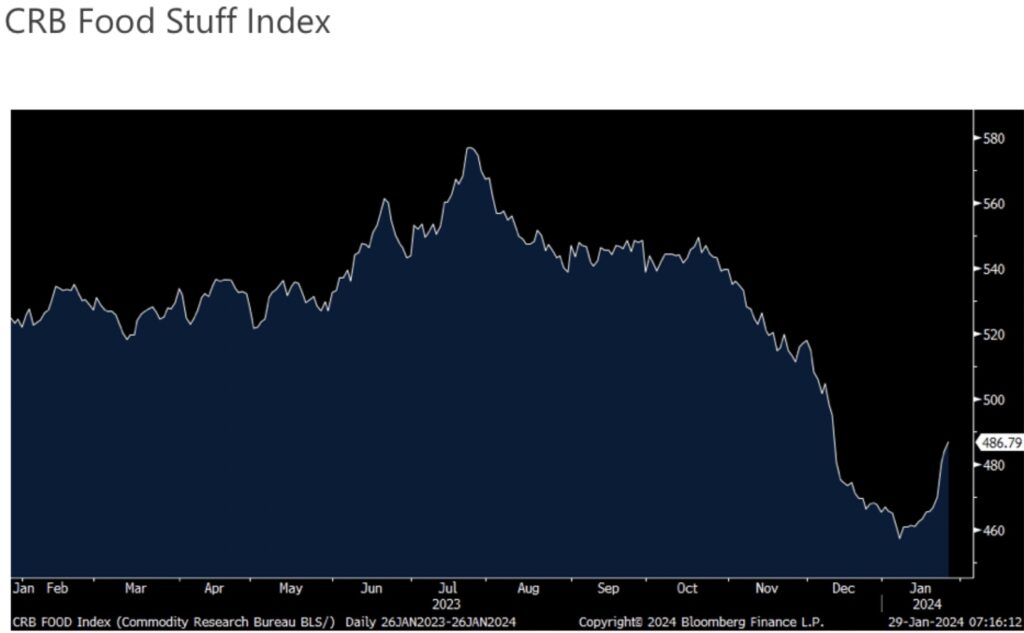

I’ll add this, what if China is successful in stabilizing their economy and commodity prices rise again? The CRB raw industrials index, while well off its highs of a year ago, closed on Friday just off its highest level since October, ticking up over the past few weeks. The CRB food index is at a 6 week high, though also still well off its highs.

BUCKLE UP:

More Inflation On The Way As Shanghai Shipping Cost Just Spiked 400% From 1,000 To 5,000

Expect Food To Become More Expensive As Well

Another Inflation Catalyst

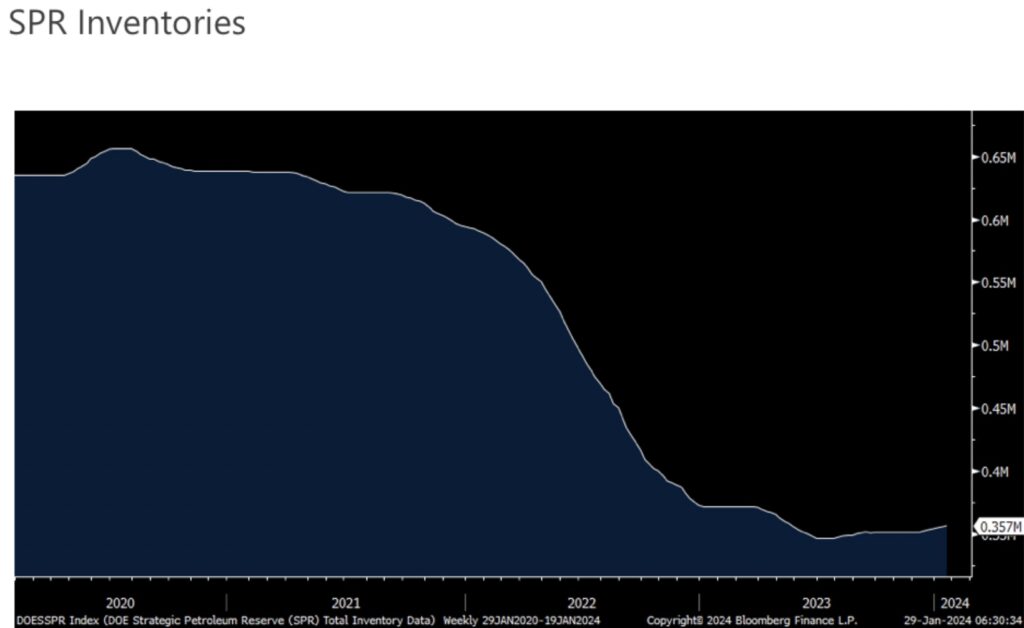

I will say this on oil, with big time worries about possible disruptions because of a war breaking out in the Middle East, it is shocking that there has not been a greater attempt at refilling the Strategic Petroleum Reserve.

US Strategic Petroleum Reserve Remains Collapsed. Promise To Refill It Has Been Broken

European bonds are rallying, and why US Treasuries are too, and the euro is falling after more ECB speak. One dovish Governing Council member Mario Centeno said:

“We don’t need to wait for May wage data to get an idea about the inflation trajectory” and he sees “a lot of evidence that inflation is falling in a sustained way.”

Bank of France head Francois Villeroy said over the weekend that the ECB could cut at anytime:

“Regarding the exact date, not one is excluded, and everything will be open at our next meetings.”

Apparently each don’t care about spiking shipping costs and rising oil prices. Then on the other hand, Peter Kazimir, another Council Member said:

“Acting hastily based on short term surprises without having more clarity about the medium term would be risky. It could easily derail the progress we have made toward reaching our target.”

He’s leaning towards June for their first rate cut and not April which the markets are now pricing in.

Government Goosing Economic Activity

Shifting to some earnings calls that I went through over the weekend, let’s highlight two in particular that are benefiting from the federal government’s IRA and CHIPS act and state government spending on infrastructure and in turn which is goosing economic activity.

United Rentals:

“Within our construction markets, both infrastructure and non-residential continued to show solid growth y/o/y as our customers kicked off new projects across a diverse range of markets. These include battery plants, semiconductor related jobs, power, infrastructure, as well as data centers.”

Eagle Materials, maker of cement and other aggregates:

“Our heavy materials performance this quarter continued to benefit from favorable business conditions. Public infrastructure spending is robust. The bulk of the United States investment in roads, bridges, highways comes from the state and local level and tax receipts continue to be strong, while state budgets remain healthy. In addition, increased infrastructure spending from the Federal IIJA funds should increase noticeably for the next several years.”

“The passing of the CHIPS Act and IRA has led to meaningful increase in heavy industrial projects focused on computer, electric and onshoring of other manufacturing.”

From American Express on the consumer:

“In the fourth quarter, billed business grew 6% as we continue to see more stable growth rates after lapping the prior year impact of Omicron back in the first quarter. This 6% growth rate does reflect a bit of softening vs last quarter, but I would point out that the number of transactions from our card members continues to grow double digits y/o/y, a good indicator of the engagement of our customer base.”

“Our growth was driven by 5% in business services spending, and although slower than last quarter, continued strong growth in travel and entertainment spending up 9% for the quarter. Restaurant spending remains our largest T&E category and reached $100 billion for the full year for the first time, while airline spending growth slowed in the quarter.”

“Spending growth from our US small and medium sized enterprise customers remained modest given unique dynamics seen by small businesses over the past few years.”

“Overall, while we’re seeing a softer spend environment, we are pleased with the continued strong engagement and loyalty of our card members across the globe. As we think about 2024, we are assuming a spend environment similar to what we’ve seen in the past few quarters.”

On credit quality, “As we had expected, our write off and delinquency rates did continue to tick up this quarter. Going forward, we expect to see this delinquency and write off rates remains strong with modest increase in 2024.”

King World News note: The catalysts that are bullish for gold continue to increase. Inflation may be a big surprise in 2024. Radically increased shipping costs along with commodity and food inflation will spell disaster for those hoping for relief from high prices.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.