Here is a look at tariff wars, stagflation and fiat money.

March 4 (King World News) – Peter Boockvar: I’m sure you’ll be seeing these stats all day but will mention it here just in case. In 2024, the US imported about $413b worth of goods from Canada, $505b from Mexico and $440b from China, including iphones. From what I’ve seen so far, in terms of retaliation against the US, it looks like the American farmer has been specifically targeted again with tariffs on US soybeans, sorghum, pork, beef, chicken, wheat, corn and cotton too by China.

The US farmer by the way also imports about 85% of their potash needs from Canada which just got 25% more expensive. They were targeted too in the Trump 1.0 tariffs in 2018 and 2019 that led to a financial package given to them. As the US consumer still has PTSD from the 2022 inflation spike, even higher food prices are going to come quickly as they are VERY short cycle items. In three weeks, Canadian tariffs will come on its imports of US cars, trucks, steel and aluminum.

I’m hopeful, as we all are, that these Canadian and Mexico tariffs are quickly removed in some sort of announced ‘deal.’

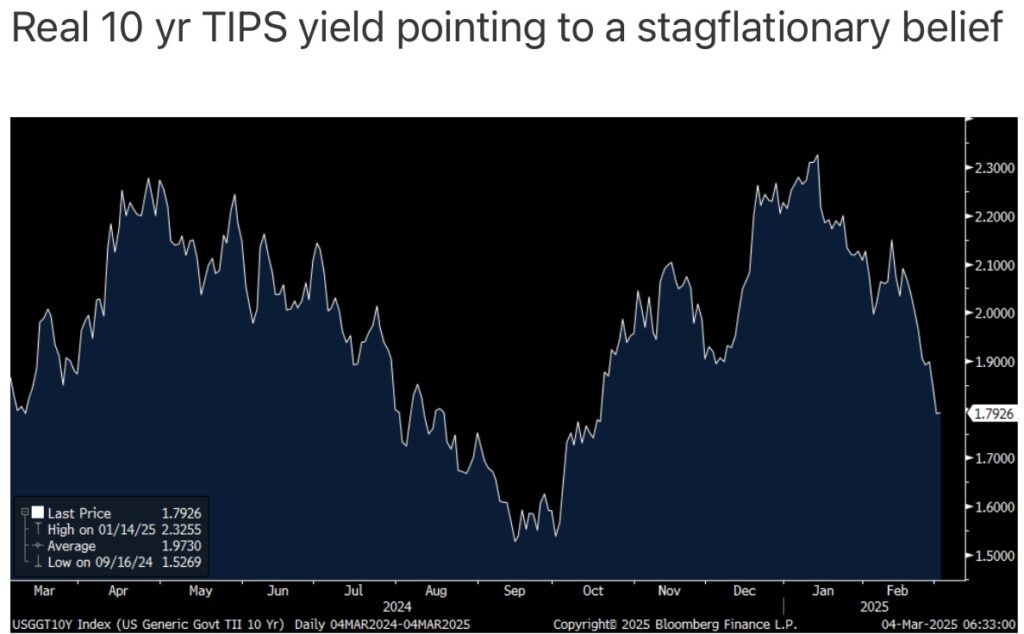

Stagflation

The interest rate drop across the yield curve is, I believe, a stagflationary response to the tariffs and the expected slowing growth. And with regards to the Fed and the about 2 ½ 25 bps of rate cuts now priced in this year, how can they have any confidence on anything? Imagine if they start cutting but then tariffs are taken off right after? What happens if they start cutting as the tariffs stay on and the dollar weakens in response and no longer becomes a mitigating factor for US importers? What happens if they do nothing and economic growth continues to weaken? Will we just see a repeat of 2019 when they starting cutting rates because inflation was then tame? Jay Powell, I’m sure May 2026 can’t come soon enough for you.

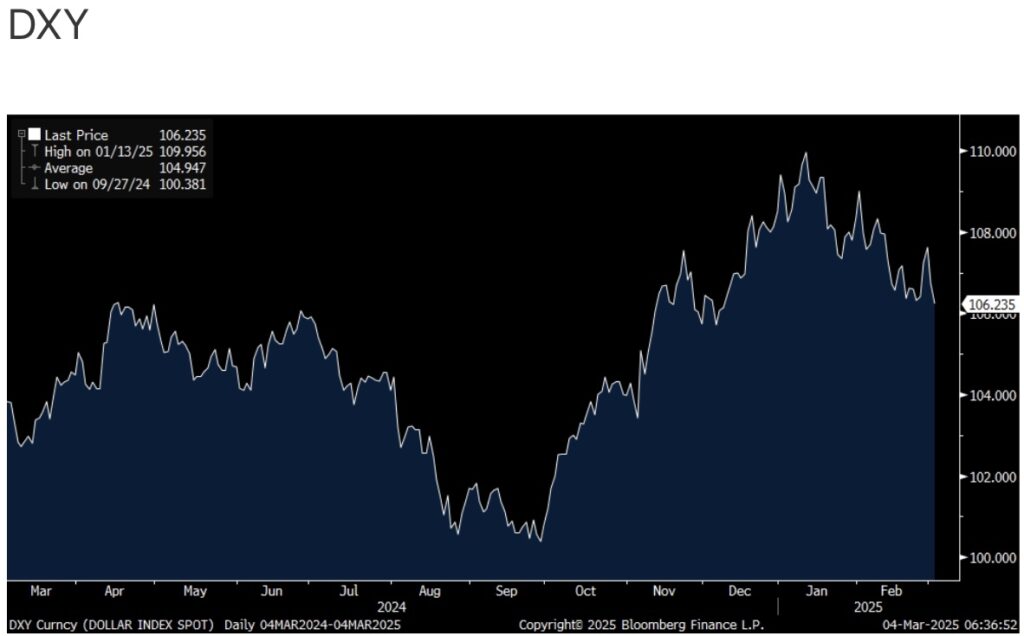

Now with respect to the dollar, which is now even more important to watch, especially against the countries we slap tariffs on. In the academic textbook, the country putting on the tariffs should see a stronger currency (on the belief that its trade deficit will shrink) that would offset the cost of the tariff which importers are logistically paying to the Customs Bureau. What happens if the dollar, after its post election rally, now starts to weaken because foreigners decide to take their money home? What if foreign ownership of the Mag 7 shrinks and that money is taken home, something I mentioned a few weeks ago? Then we end up eating more of the tariffs in terms of higher costs.

The US dollar index, heavy with euro and yen which regions have yet to be tariffed, is today trading at its weakest level since December 9th 2024.

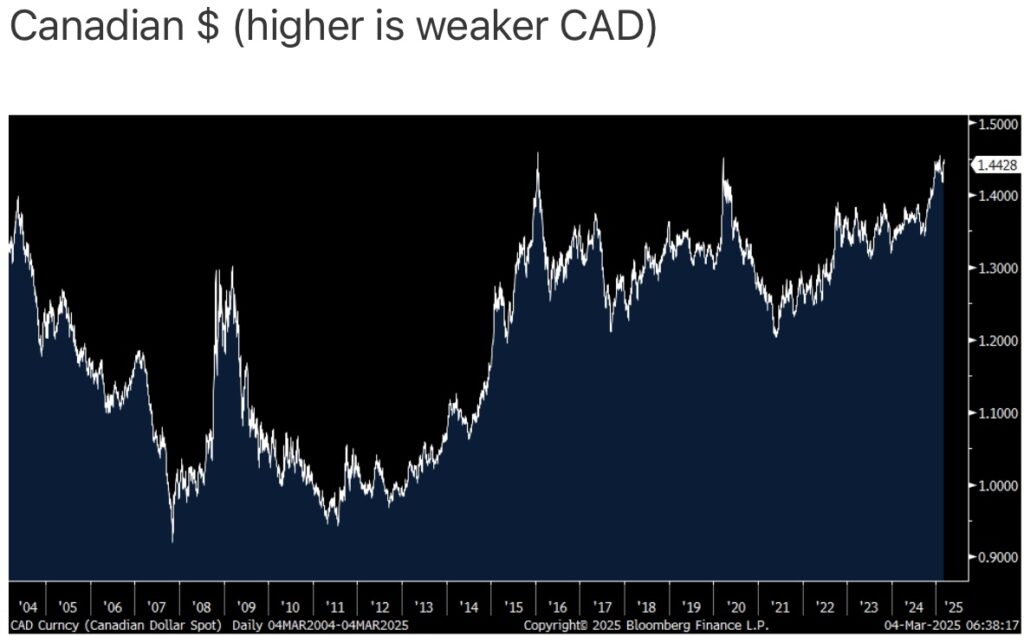

The Canadian dollar is still trading near its lowest level since the March 2020 Covid shutdowns however and 2016 before that but keep a watch on it from here as it’s up today.

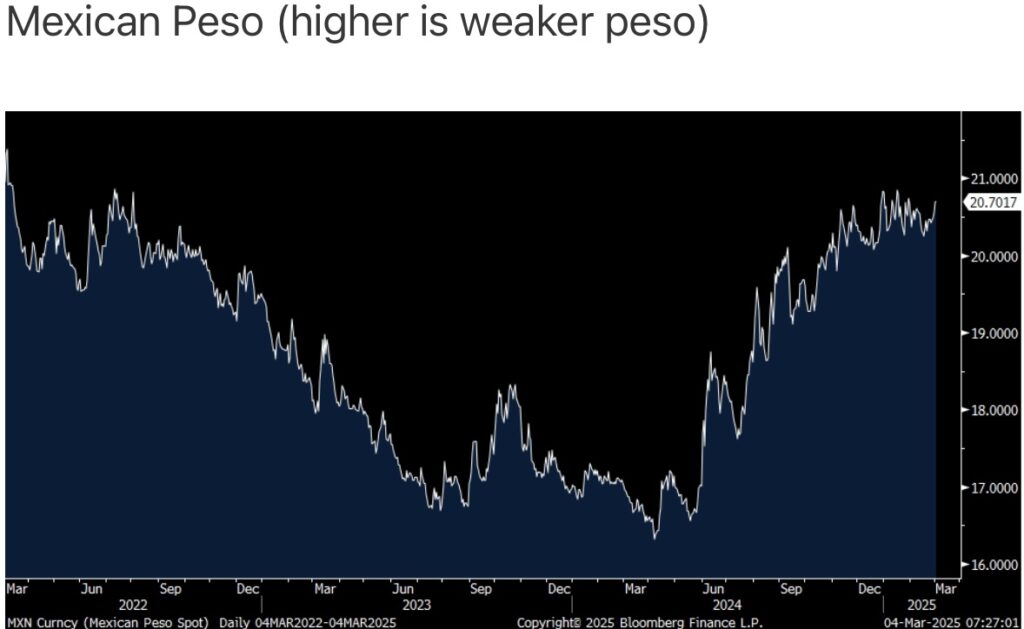

The peso is weaker today at the lowest level since August 2022 vs the US dollar.

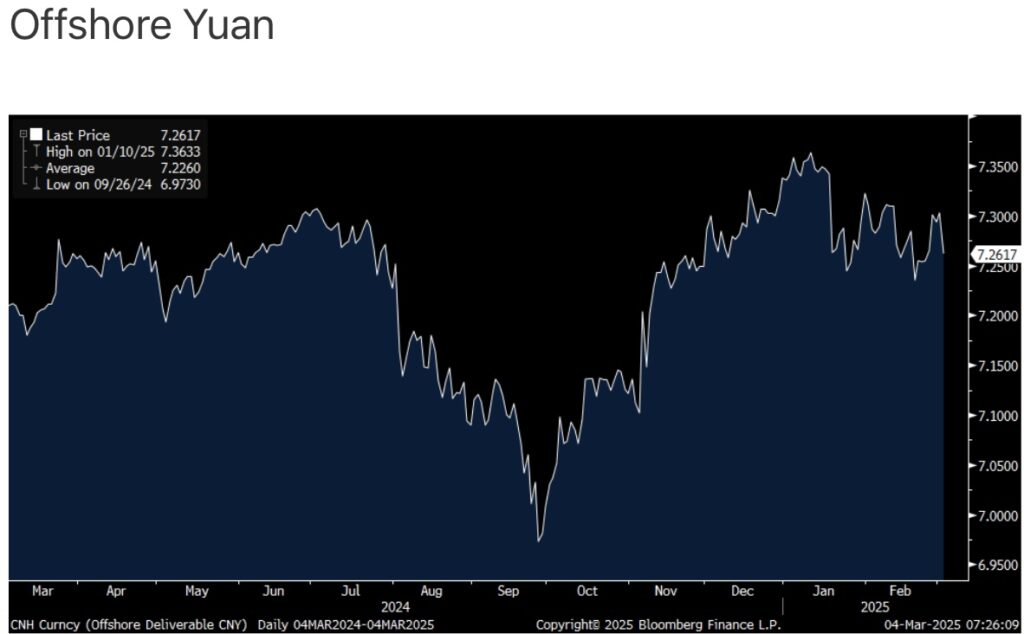

The offshore Chinese yuan is stronger today by .4% and obviously something to watch too.

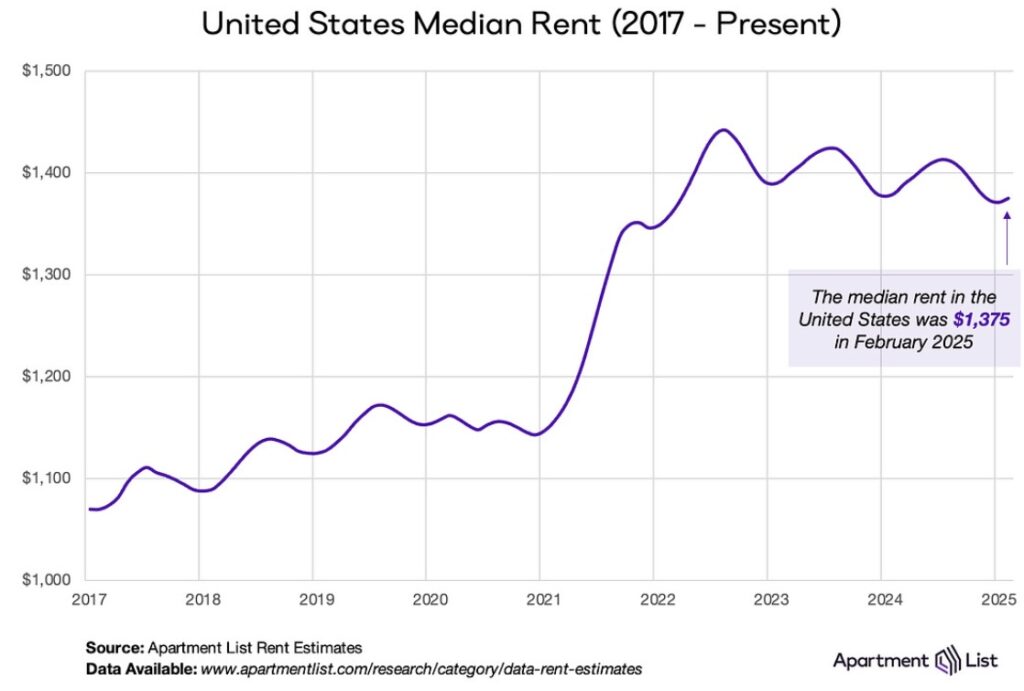

Apartment List released its February new lease data and rents rose .3% m/o/m after 6 straight months of declines. They are still down .4% y/o/y “but is slowly inching back toward positive territory.” New rents are up 20% over the past 4 years.

The supply side continues to keep a lid on rents, particularly in the sunbelt where rents are falling the most in Austin and Raleigh but also in a non sunbelt state, Denver. The vacancy rate rose to 6.9%, the highest since at least this data was first kept in 2017.

As I’ve been arguing, enjoy the rent decline while it’s here because it’s not going to last. Apartment List agrees and said, “With the supply wave now getting past its peak, it appears that the era of declining rents could be nearing its end.”

Gold & Silver On The Move

To listen to James Turk discuss the gold and silver markets and what to expect next CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.