Stock market euphoria is beginning to unwind as gold continues to surge and silver coils for a super-spike.

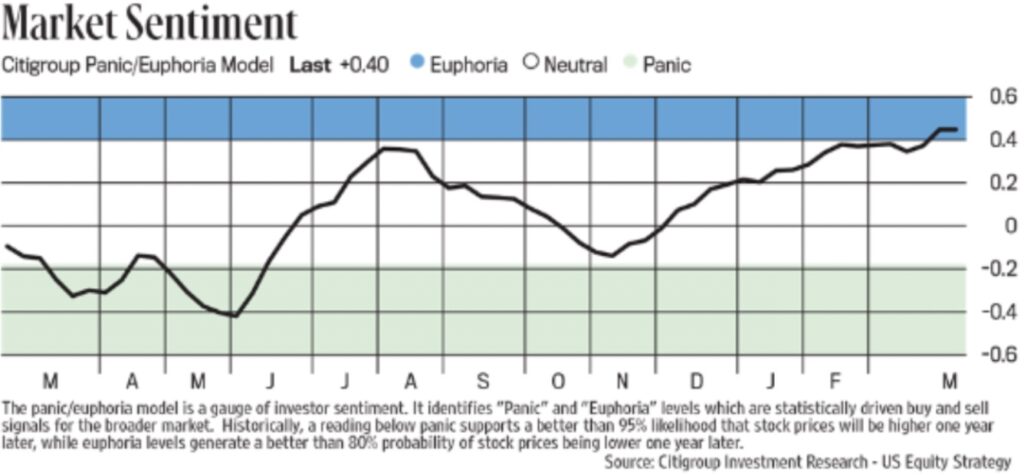

April 1 (King World News) – Peter Boockvar: I’m going to start with stock market sentiment, which I usually do on Thursday’s after I see both the Investors Intelligence and AAII surveys, because the weekly Citi Panic/Euphoria index I see via Barron’s on Saturday’s has entered Euphoria and at .40 is the highest since mid January 2022 (and which spent almost the entire year in the Euphoria category in 2021 so tough to time). The importance of this survey according to Citi itself is while it is a “gauge of investor sentiment” like others, “It identifies ‘Panic’ and ‘Euphoria’ levels which are statistically driven buy and sell signals for the broader market. Historically, a reading below panic supports a better than 95% likelihood that stock prices will be higher one year later, while euphoria levels generate a better than 80% probability of stock prices being lower one year later.”

So, as markets are higher most of the time and Citi has statistical metrics that say there is “a better than 80% probability of stock prices being lower one year later” when Euphoria has been realized, we should all take note. As stated though, it was very euphoric all throughout 2021 and markets kept elevating (though the most speculative stuff peaked in February 2021) so no one can be sure of the timing of when this matters but for those of us managing other people’s money and in the risk management business, we should take heed. Especially when we combine this with the more than 40 point spread in II between Bulls and Bears which rarely occurs.

Also, I keep hearing people arguing in both directions that we’re seeing year 2000 bubble 2.0 and some saying not even close. At least as measured by the S&P 500 price to sales ratio, it’s currently much worse now and more bubblicious though not that it means anything in the short term. It’s important to point out that the bubble in the late 1990’s that peaked in March 2000 was very narrowly focused as outside of tech, and some other stocks like GE and PG for example, the rest of the market was dirt cheap. Now, valuation elevation is more broad based as measured by that price to sales ratio I mentioned. I like to use this because it smooths out unsustainable profit margins that some companies sometimes have, like Nvidia which mathematically won’t sustain a 77% profit margin for more than a year or two, thus I prefer a P/S ratio, not that I’m picking on Nvidia, just trying to make a point.

As seen, the price to sales ratio is approaching the peak seen in December 2021 which was quite a year of speculation in just about everything with the meme and SPAC stock craze as we all remember with zero rates and epic QE…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

I bring up the extreme sentiment and this valuation metric to make NO call on the market right now but to raise antennas that we should all have a swivel head and eyes wide open when it comes to investing right now in terms of timing new investments, more so than usual and make decisions accordingly with a time horizon and risk profile that best fits your situation because there is little room for error right now. Can this persist? Of course. Will we have a notable shaking of the tree at some point in coming quarters, I believe most likely based on my points.

A few weeks ago at his presser, Jay Powell sure sounded like a guy who was all ready to cut rates at the June meeting. Now following comments from voting members Waller and Bostic, he seemed pretty non-committal about speaking on Friday of that June time frame. “We can, and we will be, careful about this decision – because we can be. The economy is strong, we see very strong growth…That means that we don’t need to be in a hurry to cut. It means we can wait and become more confident that, in fact, inflation is coming down to 2% on a sustainable basis.” If I had a dollar for every time I’ve pointed out my opinion of the importance of the word ‘sustainable.’

I Remain Bullish On Gold

I will use this moment to mention gold again, which yes I remain very long and bullish on. Can any self respecting central banker just completely ignore its move higher and the messaging that just maybe this non interest paying, non cash flowing yellow rock is sending? I don’t think they should as for 5000 years gold has been considered money and a currency and thus a sharp move higher is a tell on markets views on price and currency stability, among other factors. I miss Congressman Ron Paul and his questioning of Fed chairs during semi-annual visits.

No one on the European Central Bank is seemingly a watcher of gold as they can’t wait to cut interest rates, especially after the lower than expected inflation prints last week from Spain, France and Italy. Rather than wait until inflation gets to around 2%, which is their SOLE mandate, on a SUSTAINABLE basis, Governing Council member Francois Villeroy said Thursday “Risks to inflation are now balanced, but risks to growth are on the downside. The time has come to take out an insurance against this second risk by beginning rate cuts…I repeat my belief that it should happen in the spring, and independently of the calendar of the Federal Reserve.”

Yannis Stournaras, a big dove on the committee, said on Saturday that “Personally I think the reduction of interest rates by four times this year, by 25 bps each time, is possible.”

Sea Transport Disruptions

We know freight cargo disruptions are happening in the Red Sea and now we’re seeing temporary diversions around the Baltimore port. As a result, more businesses are using air freight to move things and prices are rising in response. On Friday, the World Air Cargo data revealed the 4th straight week of price gains to $2.45 for the average global rate, up 3% w/o/w, though still down y/o/y. They said “Air cargo rates are rising from most of the main global regions, especially from Asia Pacific and from Middle East and South Asia, strengthened by the ongoing disruptions to container shipping and elevated demand for cross border e-commerce shipments.” While prices are down still by about 10%, “they remain significantly above pre Covid levels (+36% compared to March 2019).”

JUST RELEASED!

Michael Oliver on gold hitting all-time highs and why silver is set to explode higher along with the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss gold hitting new highs and what surprises are in store for next week CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.