The big question is what impact will eliminating QE have on the gold and silver markets?

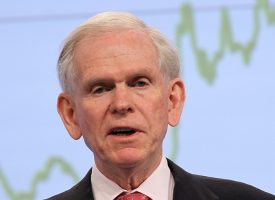

July 17 (King World News) – Eric King: “Peter, there’s this mounting pressure for central banks to eliminate QE. What impact would that have on the gold and silver markets?”

The Knee-Jerk Reaction

Peter Boockvar: “So the immediate reaction, and we saw this in mid-June when the Fed that they were finally discussing cutting back on asset purchases, we saw gold selloff along with silver. We saw the yield curve flatten as well, which is also a knee-jerk response to what we saw in previous QE-off type situations.

I think we still have to focus on and understand that any pullback on asset purchases will still very much lag the inflationary pressures that the Fed would be responding to. Therefore, getting to what real rates will do, and what we’ve seen in previous QEs is that when QE is on, the yield curve actually steepens. When QE is off, the yield curve actually flattens.

Elimination Of QE Bullish For Gold

So if the yield curve is going to flatten, at least on the longer end, that’s going to imply that real rates would actually fall, which would actually be bullish for gold. I think the…This is a very powerful discussion about exactly how the Fed and other central banks’ tapering is going to directly impact the gold and silver markets and why it will be incredibly bullish. To listen CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss the implementation of Basel 3 and its impact on the gold market CLICK HERE OR ON THE IMAGE BELOW.

© 2021 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.