Some wild questions are now being asked as global chaos continues.

Will Deal Make Things Go Back To The Way They Were?

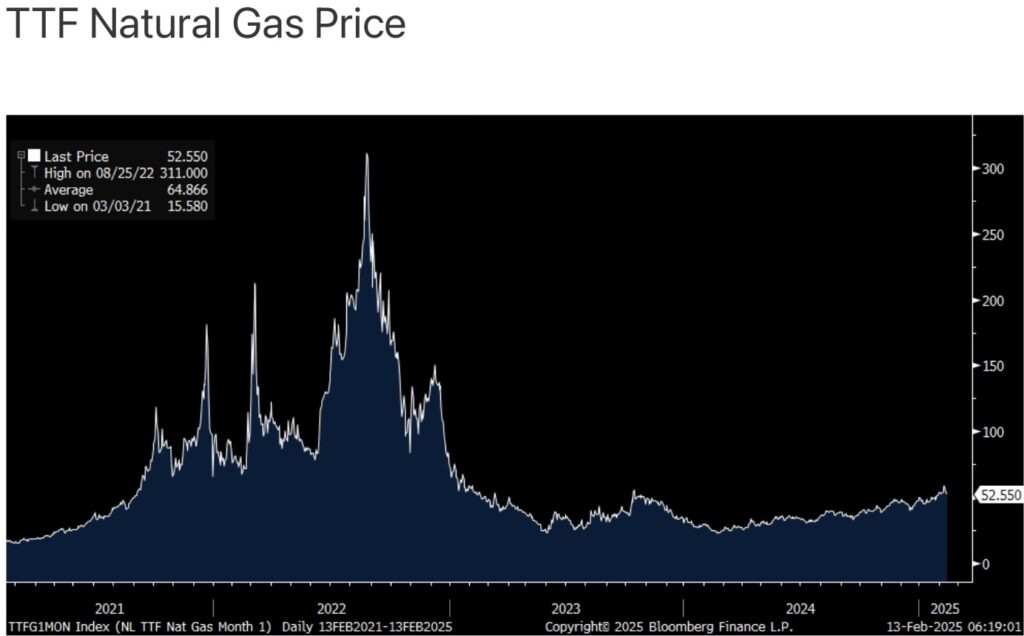

February 13 (King World News) – Peter Boockvar: On hopes that the Russia/Ukraine war can finally end (I’m guessing with Ukraine ceding the eastern part of the country to Russia in return for guarantees that Putin would never invade again, including security protections given by others), natural gas prices in Europe are down for a 3rd day but still remain above where they were a few weeks ago and double where they were one year ago today when last winter was mild.

That said, they are well below the panic spike soon after the initial invasion. Brent crude is down 1% today after a 2.4% fall yesterday but is down just slightly on the week. A key question upon an end to the war is whether the economic separation that has taken place between Russia and Europe (along with others aligned, like the US) over the past 3 years continues. Will Germany resume Russian natural gas imports? Will the US resume uranium conversion/enrichment imports from Russia? etc… I can’t imagine things going back to the way it was in terms of commerce as long as Putin is alive and his regime is still in place.

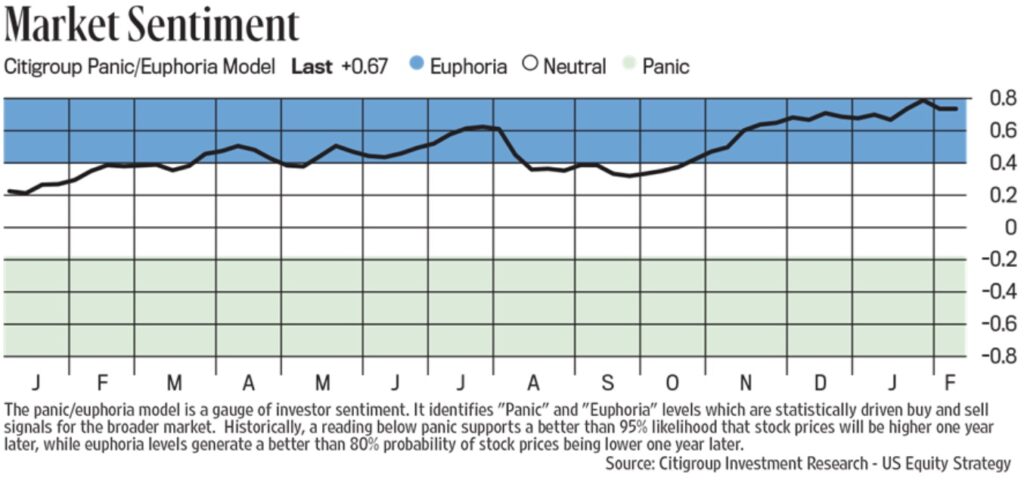

Here is a fresh stock market sentiment check. Today’s AAII measure of the mood of the individual investor is pretty bearish. While this is my least favorite gauge as it’s very fickle and reads like an EKG chart, it still can’t be ignored when it gets offsides. Bulls fell 4.9 pts to 28.4, a 4 week low while Bears rose by 4.4 pts to 47.3, the most since November 2023. On the flip side, the weekly Investors Intelligence survey has Bulls still well above Bears, though well off its peak spread. Bulls were 46.8 vs 49.2 in the week before while Bears slipped too to 29 from 30.2 with the balance expecting a Correction. The CNN Fear/Greed index closed at 43 vs 44 one week ago and slightly in the ‘Fear’ camp. The Citi Panic/Euphoria index is still well into Euphoria land at .67 vs the threshold of .41.

Bottom line, it’s muddled as I look at the Citi index and I worry but the AAII tells me too many people are cautious with the other metrics sort of in no man’s land.

Expect more rate hikes from the BoJ this year off a still microscopic level of .50%. January PPI rose 4.2% y/o/y, up from 3.9% in December and above the estimate of 4%. That’s the quickest pace since June 2023.

The 10 yr Japanese inflation breakeven closed overnight at the highest level since it was first introduced in 2013 at 1.61%. Longer term JGB yields are higher as is the yen.

Meanwhile In The UK…

The UK economy in December unexpectedly expanded by .4% m/o/m vs the estimate of up .1% and this helped to lift Q4 to an increase of .1% q/o/q vs the forecast of down .1%. It was mostly government spending though that drove the growth as there was no contribution from household spending and business investment declined. The new Labor government has layered on more taxes on top of an already overtaxed citizenry.

MAJOR GOLD PRICE PREDICTION 2025!

To listen to one of Gerald Celente’s best interviews ever discussing his shocking predictions for 2025 CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED! Gold Hits New Record High This Week!

To listen to Alasdair Macleod discuss gold hitting a new record high this week as well as some surprises happening in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.