Silver’s cup & handle may unleash above $50 in 2023, plus more major surprises for 2023.

Silver

January 4 (King World News) – Graddhy out of Sweden: That is one very nice chart.

Stair-stepping up the right side of the green rounded bottom.

Silver’s Major Breakout!

Silver Ready To Unleash?

Otavio Costa: It’s hard to find a better looking chart than this one.

Time to get aggressive with gold, silver, and the miners.

Silver’s Cup & Handle May Unleash Above $50 In 2023

Gold: Nice Start To 2023

Fred Hickey: …it’s been a very nice 2023 start for gold (+$14) [on Tuesday] even with a strong dollar headwind today. Good to see that correlation not working (at least for now)…

ALERT:

Billionaire mining legend Pierre Lassonde has been buying large blocks of shares in this gold exploration company and believes the stock is set to soar more than 150% in the next 6 months. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Food Prices

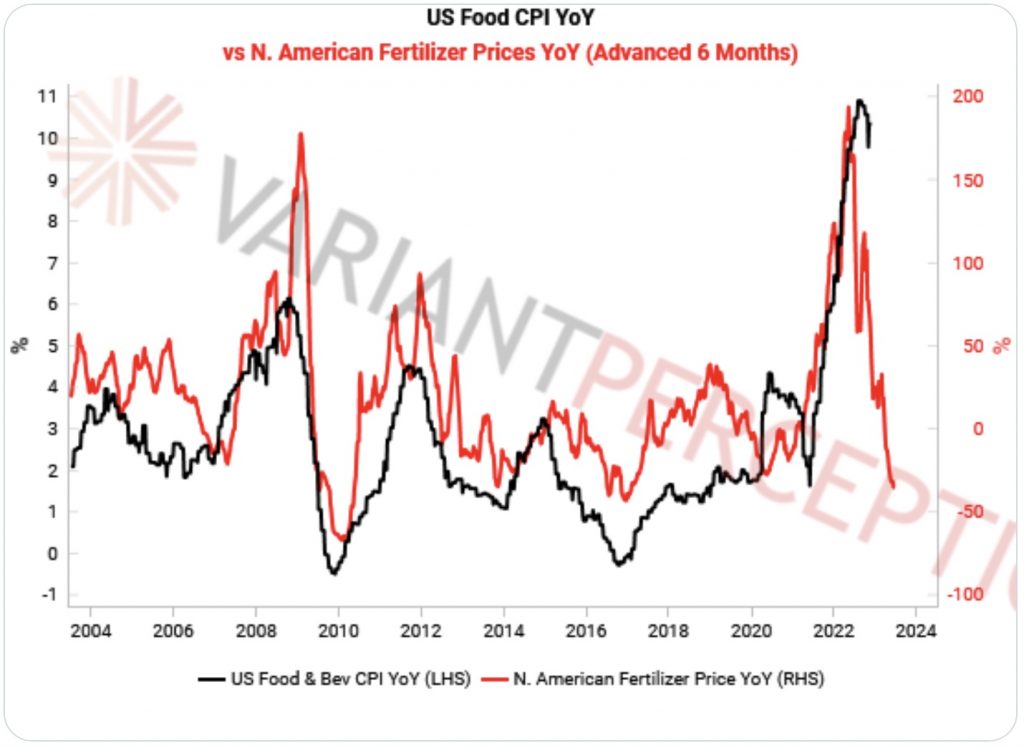

Variant Perception: Fertilizer prices lead food inflation…

Some Relief From Food Inflation In 2023?

Fertilizer Price Collapse (RED), Should Lead Food Cost (BLACK) Lower

“Rent Too Damn High”

Peter Boockvar: Ahead of the scrubbed FOMC minutes today at 2pm, the WSJ is running a story today titled “Apartment Rent Growth Set to Keep Slowing This Year… Tenants maxed out on rental spending combined with new apartment supply are expected to moderate increases.” On that supply, “The biggest wave of new rental buildings in nearly four decades is expected to cut the pace of rent growth across the country.”

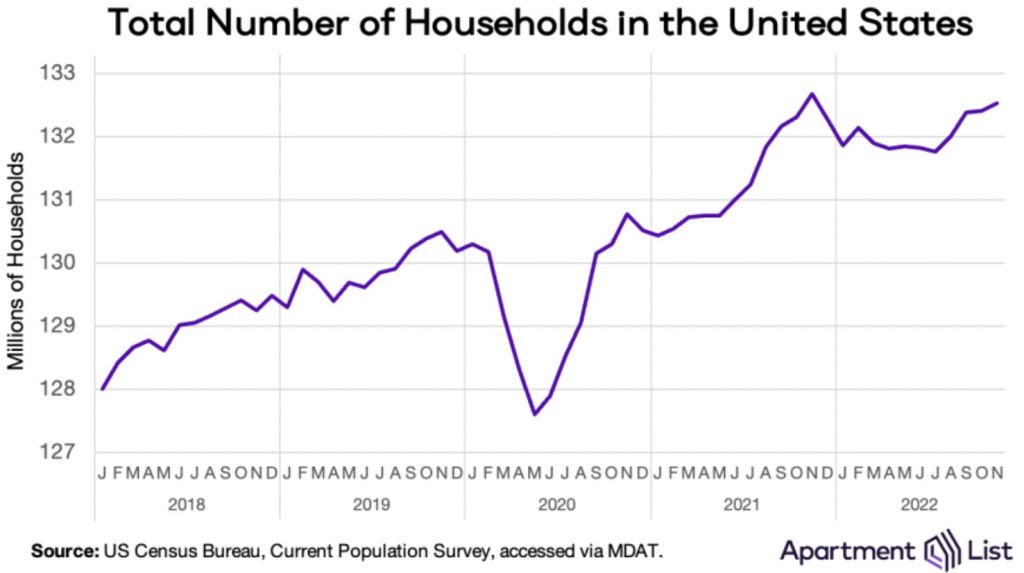

If you didn’t see in the days right before Christmas, Apartment List published its 2022 Rental Market Recap Report and listed its three ‘Key National Trends’, along with its regional trends but I’ll focus on the former here.

1) “Rent growth comes back to earth…2022 marked the end of a prolonged period of astronomical rent growth” they said and they expect yr end rent growth for 2022 “will likely come in below 4%; this is close to the moderate level of growth we saw in 2018 and less than 1/4 of last year’s growth.”

2) “More options for renters.” They also talk about the rising vacancy rates due to moderating demand and rising supply.

3) “Lack of household formation drives cooling demand…On the demand side of the rental market equation, 2022 saw a major slowdown in the number of new households looking for a place to live…It appears that renters are exhibiting much more caution in striking out on their own, as higher housing costs and general inflation have eroded their budgets, and as fears of a potential 2023 recession loom large in the public’s economic sentiment.” Household formation is below its 2021 peak.

The net result of this key category of CPI, 30% headline and 40% of core, is that the Fed is running out of reason to keep on hiking rates and why I think they don’t have many left (after likely being wrong that December would be the last). This said and what the Fed will emphasize when that day comes is the ‘higher for longer’ theme that will replace ‘how high’ with respect to rates. Again, they don’t want to see a decline in inflation, have them get soft, and then watch inflation inflect higher again. Also, we know they are focused on wage growth which is running at double the pre Covid pace, although no longer accelerating.

A Lot More QT To Come?

So with today’s minutes as we search for the end of rate hikes, I’m only going to write on it if there is something really new rather than just hearing about some think this, several want that, a few believe this. Lastly on this, we also know ‘higher for longer’ will be combined with continued balance sheet shrinkage and to emphasize again, QE was meant to lift asset prices and QT does the reverse and there is possibly a lot more QT to come.

Cost Of Transportation Plunging

The December Logistics Managers’ Index rose 1 pt m/o/m but has still fallen in 7 out of the past 8 months. While the rise in inventories is going to be a key factor in Q4 GDP, “Like November, inventory levels are increasing at a much slower rate than was observed throughout most of 2022.” Inventory levels were much higher at retail than at the manufacturing level as the former “dealt with more limited warehousing as they pushed to get goods to consumers for holiday shopping.” Transportation Utilization fell below 50 for the first time since April 2020 and Transportation Prices fell to 36.9, “which is the sharpest rate of contraction we have measured for this metric in the over six years of the LMI.”

What About Inflation In 2023?

Back to the inflation discussion to tie in here, the drop in goods prices after the sharp rise is a key factor in the falling inflation stats too. But, after clearing out a lot of inventory going into the holidays, retailers are going to hold less inventory thereafter relative to what they had prior to the holidays. For many other reasons too, like just in case inventory management and persistent wage growth higher than usual (particularly out of Asia), the zero price trend on average for core goods prices in the 20 years leading into Covid will not be seen again for a while I believe once inflation settles out on the downside. As for the deflationary aspect of technology on goods prices, yes that has been a factor since the history of time, but all good prices have to do is rise 1-2% per year and you’ll have overall inflation at 3-4% instead of 1-2% because of the persistence of service prices.

Mortgage Applications Tumble

Mortgage apps saw a sharp drop in purchase applications of 12% w/o/w and 4.4% with refi’s but around the holidays this data is worthless info as the MBA does a poor job of seasonally adjusting. That said, we of course know the challenges in housing.

Gold Back Above $1,850

After Germany reported a less than expected December CPI figure yesterday (helped by government energy subsidies), France did today with the m/o/m print falling by one tenth instead of rising by 4 tenths as expected. The y/o/y pace slowed to 6.7% from 7.1%. As stated with Germany, these figures are distorted by energy price caps but France is going to see a 15% rise in January and February energy bills because of price cap readjustments and then inflation will fall back down again in March. Either way, hopes for a peak in inflation has the European bond market rallying again today with yields down double digits. That in turn is helping to drop US yields. The euro though is rallying as the DXY is giving back half of yesterday’s gains and gold is back above $1850.

As For The Bear Market In Stocks…

As for the equity bear market, I don’t know exactly how it progresses from here as the consensus seems to be down 1st half and rally in the 2nd half but the consensus is usually wrong. All I’m confident about is it ain’t over. The biggest financial bubble in the history of bubbles, that being in sovereign debt, and everything in turn priced off that risk free rate, doesn’t end with the S&P 500 down just 20%+ off its highs. It doesn’t end at 17x multiples. It doesn’t end at a price to sales ratio not far from March 2020. It doesn’t end without a notable earnings recession (I’m talking $180 or below this year as higher inflation recedes and it was the only thing providing revenue growth at the same time higher interest rates and wage costs compress margins). It doesn’t end with credit spreads nowhere close to previous wides. It doesn’t end until everyone throws in the investing towel not wanting to ever own a stock again. That said, buying stocks in a bear market is the best time to do so as tremendous values are created.

2023

“But it isn’t easy reconciling how things play out in 2023. On one hand I’m worried about the trajectory of economic growth but I also believe the full reopening of China in Q2 will be a huge economic positive. However, one that might mostly be positive for China, the rest of Asia and parts of Europe such as Germany that do huge business with China. The US doesn’t export much there. It will certainly be good for commodities and the countries that produce a lot of them such as some in South America.

Debt House Of Cards

I’ve expressed my worries many times here about the leveraged loan market and all those companies that have exposure to floating rate debt, including many small businesses with their local banks. For reference, the leveraged loan market is about $1.4 trillion in size (not including bank loans given to small businesses), about the same size as the US high yield market. For those with IG or high yield debt, the risk isn’t as much in 2023 and 2024. Steve Liesman on CNBC last week highlighted in a chart that the massive maturity wall for these two groupings won’t be hit until 2025 and 2026. It totals about $1 trillion in 2023, goes to almost $1.4 trillion in 2024 and then more than doubles to $3.25 trillion in 2025 and just above that in the year after. So those that have termed out their debt for the next few yrs will be much better off than those who didn’t or didn’t hedge their floating rate exposure.

Energy Inflation

Energy will still be a huge issue for Europe as we progress thru the yr because it will be much harder to refill gas storage going into next winter. The war in Ukraine is not ending anytime soon. And, the reopening in China will lead to MUCH higher crude oil prices I believe, something north of $125 per barrel. I read last week that according to the International Energy Agency in September, China was on track in 2022 to purchase the smallest amount of oil since 1990. Let that sink in with prices currently still near $80. Oil prices are going much higher I will repeat and I’m not just talking back to $100 and $125 could be conservative. We remain long energy stocks, particularly European majors that trade at half the multiple of US ones and we also own natural gas stocks.

China: Unleashing The Consumer

Speaking of China, the unleashing of the Chinese consumer and tourist beginning in Q2 will be massive I believe. I don’t think people appreciate how important they were pre Covid and after being essentially locked up for 3 yrs, having them back will be a huge economic factor. According to UN data, in the 5 yrs leading into Covid, Chinese tourists spent about $250 billion per year. Just a week ago, Trip.com (a stock we own) said that sales for travel tickets rose 4x over the previous day. Pre Covid, according to Bain & Co, the Chinese consumer made up 1/3 of global spending on luxury items vs between 17-19% in 2022. In a Bloomberg story last week, they quote a 26 yr old Shanghai resident who had Covid and said:

“I can’t wait to embrace the freedom and make a long distance trip with my friends. Three years have been wasted. Omicron cannot deter me. I’m so thrilled to be setting off in two weeks’ time.” Multiply that feeling and action by the many millions.

I remain very bullish on the Asian economies and markets (particularly India, Singapore, Vietnam and Japan) as a result of this as they are major beneficiaries of not just the Chinese consumer but also a rebound in the overall Chinese economy. According to the WSJ, pre Covid, about 1/3 of tourists to Japan and South Korea were Chinese. About 25% of visitors to Thailand were Chinese in 2019. In the FT last week, they quote someone from the Shenzhen based head of McKinsey’s Asia travel practice who said, “Pre-pandemic, China was the world’s largest source of outbound tourists, with 150mm travelers going abroad each year.” He forecasts international trips by Chinese travelers would be 50% of 2019 levels by the summer vs 5% just recently. That will eventually get back to 100%.

Interest Rates

I am still very much of the belief that longer term bond yields will surprise to the upside even in the face of falling inflation and economic growth, although China’s reopening could reverse those two factors. I remain worried about the impact of more ECB rate hikes and QT at the same time we’ll likely see more YCC spread widening when Kuroda leaves at the same time US budget deficits and debts might FINALLY matter for investors and the Fed continues on with QT. This in turn will lead to a higher 10 yr US yield. These regions were the epicenter of the global bond bubble. There are so many more attractive high quality bonds to buy with maturities no further out than 2-3 yrs.

Inflation

Inflation will fall notably this year as the goods price inflation continues to reverse and rent growth continues to slow. Maybe we’ll even see some zero y/o/y prints by yr end. BUT, that is NOT where inflation will end up settling out at in 2024 and it will be 3-4% rather than 1-2% for reasons I’ve stated many times before. Thus, any rate cuts by the Fed in the back half of 2023 will be limited, if it happens. And if I’m right on oil prices, headline inflation will really get whipped around this year.

Gold Will Do Very Well In 2023

Gold, which had a great year in 2022 relative to just about everything else, will do well in 2023 as the headwinds of a very aggressive Fed and coincident strong dollar are just about over.

ALSO JUST RELEASED: Gerald Celente’s Shocking Global Predictions For 2023 CLICK HERE.

ALSO JUST RELEASED: Here Is Why 2023 Will Be A Big Deal For Gold, Silver And The US Dollar CLICK HERE.

ALSO JUST RELEASED: BUCKLE UP: The Terrifying Global Reset Is About To Begin CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.