Here is a look at shortages of physical gold bullion, plus another look at why gold continues to rally.

Gold, the Next Battlefield

February 11 (King World News) – John Ing: Gold is money. Consequently gold is going to be a good thing to have, particularly when the US dollar as a percentage of global reserves has fallen to 57 percent, a 30-year low according to the International Monetary Fund (IMF). Only ten years ago, the dollar’s share was 66%. The euro usage has ticked up to 20 percent. We believe the decline in the dollar as a reserve currency is due to a pick-up in central banks’ purchases of other alternatives. Although gold is not a “foreign exchange reserve” asset, gold is a reserve asset and central banks have been increasing their holdings, buying more than 1,000 tonnes or 20 percent of the world’s production at the expense of the dollar. Last year, total physical demand was almost 5,000 tonnes, a record high.

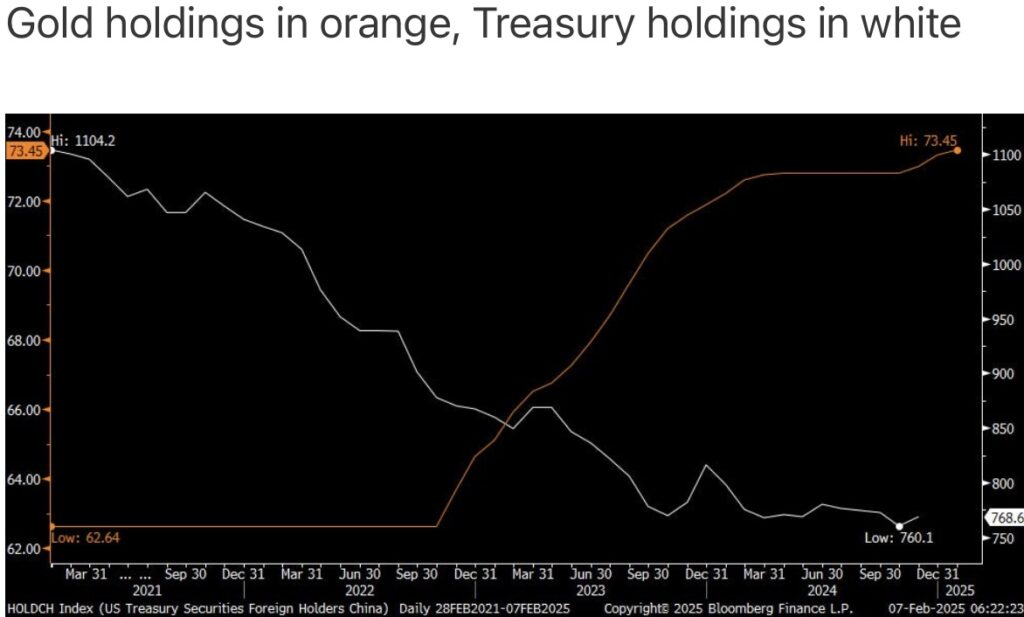

Gold is also expressed in dollars and some central bankers have even swapped their US Treasury holdings for gold, signaling, in our opinion, a more fractious global order. Gold is indestructible, peace is not. China too has tripled their gold reserves since 2008 and the Shanghai Gold Exchange has become the largest physical gold player in the world. China bought 10 tonnes in December 2024 resuming gold purchases after a six-month pause. Should the world wean itself off the US dollar, it would reshape the global economy and geopolitical landscape. Gold is a hedge against this regression.

The Best Trump Trade Is Gold

Gold has been on an astonishing run, smashing records, in all currencies. To a certain extent, that makes sense given that bubbles keep getting bigger, inflation remains resilient, America’s deficits keep widening (currently 8 percent of GDP) and, with Trump 2.0 the world is riskier and more uncertain. Gold is both a hedge against calamity and a store of value (thus the outperformance in all currencies). We continue to believe gold will surpass $3,000/oz with a new target at $3,300/oz.

The best Trump trade is gold.

Shortage Of Physical Bullion

Today there is a shortage of physical bullion as buyers scramble to buy physical on fears of tariffs resulting in a repatriation of bullion back to Comex markets with almost 400 tonnes moved from London to Comex’s NY vaults. We also believe that major central bank buying has squeezed the physical market, causing a scramble among derivative players for physical such that New York prices are trading at a premium to London, the world’s major market. The tightness is due to more demand than supply. Peak gold has arrived.

On the other hand, gold shares are under-owned and have not duplicated bullion’s record setting performance, yet. Fundamentally gold stocks are cheap. Most have generated strong free cash flow, possess stellar balance sheets yet the lack of an institutional following has meant gold stocks have become value plays. The seniors have boosted dividends and accelerated share buybacks to attract institutional interest, but it has not been enough to attract new buyers. The problem is growth or the lack of growth. There have been few discoveries and production growth is flat since the industry has not replaced declining reserves. Consequently there has been a pickup or focus on M&A activity because it is cheaper to acquire reserves on Bay Street rather than spend the dollars to explore. In addition, growth can be had through acquisition since the market cap per reserves in the ground for the top dozen miners are trading at $700/oz.

Consequently we believe the mining developers are attractive. At this time there are more buyers than sellers. First, there are the mining companies themselves looking to grow, then there are sovereign players or state backed entities such as China’s Zijin looking to acquire ounces in the ground and expand their geographic footprint. The industry is stuck in a game of musical chairs, but there are so few chairs. There has also been a lack of capital for exploration so there have been fewer discoveries. Most miners today are extending existing deposits (brownfield) development and so the explorers are unusually cheap. The problem is that it can take 15 years from first discovery to first production (permitting issues, financings and time to validate economics), so only “size” deposits stand a chance. Thus the developers with projects to come on stream within the current cycle are best able to capitalize on the current bull market.

Wondering Why Gold Prices Keep Rallying?

Peter Boockvar: Wondering why gold keeps rallying and what China is doing with some of its $1 Trillion trade surplus? They continue to buy gold. Their published gold holdings as of January were 73.45 million ounces and see the chart below comparing it with their holdings of US Treasuries. We remain bullish and long gold, silver and recently platinum.

Gold Price Set To Surge Another $2,000+

To listen to Nomi Prins’s remarkable predictions for the price of gold, silver, mining stocks, uranium and much more CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED! Gold Price Hits All-Time High

To listen to Alasdair Macleod discuss gold and silver breaking out and more surprises CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.