Is The Recent Gold And Silver Breakdown Signal Still Valid?

By: Jesse Colombo – FORBES

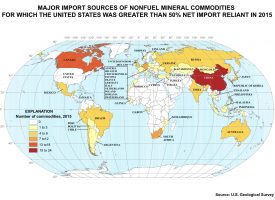

On Sunday, I wrote a piece in which I showed two potentially bearish longer-term “pennant” patterns in gold and silver that could lead to serious declines provided that gold and silver do not reverse their recent technical breakdowns below $1,200 and $19 respectively. In keeping with the erratic, low-volume trading conditions that are common around the holidays, gold and silver plunged on Sunday night (U.S. time) after Switzerland voted “no” for the gold referendum, only to spike on Monday morning after Japan’s credit rating downgrade and because of crude oil’s bounce after its 10 percent Friday sell-off.

Gold is currently trading at $1,207.70 and silver is trading at $16.42. Does today’s move invalidate gold and silver’s recent technical breakdowns? To answer this question, we need to take a look at the charts. The $1,200 level in gold that I’ve been discussing for a while is certainly not an arbitrary number as it represents a key psychological “floor” or support level that dates back to mid-2013. Many other analysts and traders are watching this level as well because a serious break below it is likely a sign that another wave of gold’s sell-off is about to begin. A failure to break below this level, on the other hand, is likely to foreshadow a bounce or rally.

Source: Finviz.com

Source: Finviz.com

Of course, nothing in the markets is as simple as just watching for a break above or below a round number that so many other people are watching; no, the markets always do their best to actually make us work for our money. As you can see from the short-term gold chart below, the yellow metal has chopped above and below $1,200 several times in the past year, “head-faking” traders who try to play the breakouts or breakdowns.

In order to avoid getting caught up in the head-fakes that seem to be endemic at gold’s $1,200 level, it may be useful to look at secondary support or resistance levels for added confirmation of the next big move. On the downside, $1,130 (the November low) is the next most important support level to watch if gold breaks below $1,200 again. On the upside, a solid close above the $1,250 resistance level (the October high) would provide added confirmation that gold’s rally is for real and not just another head-fake.

Source: Finviz.com

Source: Finviz.com

Silver is still below its key $19 resistance level that marked the metal’s lows for much of the last two years. A significant and convincing break above this level would negate the recent bearish signals. Silver follows gold very closely, so if gold eventually experiences a genuine breakdown under $1,200 and $1,130, silver would likely be following right behind it.

Source: Finviz.com

Source: Finviz.com

In my Sunday piece, I discussed…

TO READ MORE: http://www.forbes.com/sites/jessecolombo/2014/12/01/is-the-recent-gold-and-silver-breakdown-signal-still-valid/print/