We are now in the calm before the storm, the prelude to a true panic, which is why this type of move into gold has occurred only twice in the last 50 years. Gold senses the mayhem that lies ahead.

The Debt Ceiling And Gold

May 30 (King World News) – Otavio Costa: The debt ceiling issues present a much greater risk than currently perceived.

Although prior concerns have proven to be mostly peripheral, today’s circumstances are quite unique.

To be clear: The main problem relates to the potential consequences after an agreement.

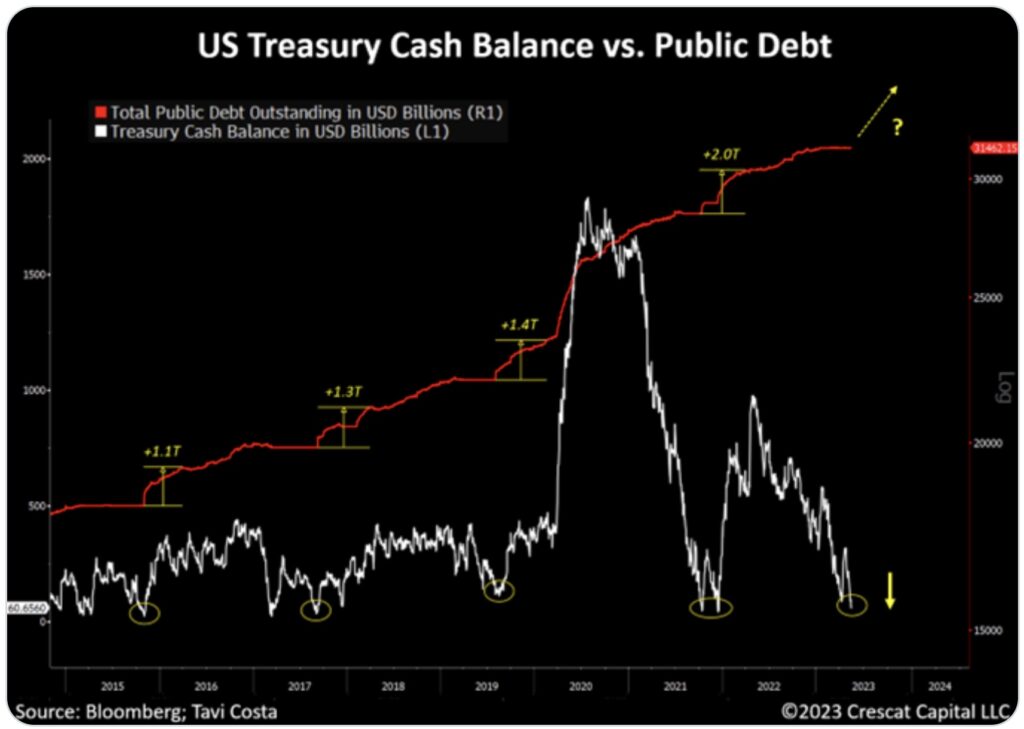

During periods that require a debt ceiling extension, the Treasury cash balance for daily operations tends to be at extremely low levels, which is the case again today.

Who’s Left To Buy? Expect Higher Interest Rates

Once an agreement is reached, the government must issue debt promptly in order to sustain its functions due to the persistent fiscal deficit imbalance.

Note, however: Over time, the issuance of Treasuries has been increasing steadily.

This time around, we anticipate an unprecedented surge in the amount of debt being raised in the ensuing months.

All else equal, this should exert major downward pressure on the price of these fixed-income instruments.

In the past, the lack of inflation concerns, the foreign investors’ demand for Treasuries, the absence of bank failures due to these instruments, and the Fed’s ultra-dovish stance allowed the market to smoothly absorb the growing debt supply without significant disruptions…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Cracks In The Cornerstone Of The Entire Financial System

It cannot be overstated that the US Treasury market serves as the cornerstone of the entire financial system.

The inflated valuation of financial assets hinges on a low cost of capital environment, making it a crucial factor in the overall economy.

It is worth noting that the recent positive developments related to a potential resolution of the debt ceiling have coincided with upward pressure on long-term interest rates.

Investors are beginning to recognize that the true risk this time around lies not in the failure to reach an agreement, but rather in the escalating and concerning nature of the debt problem.

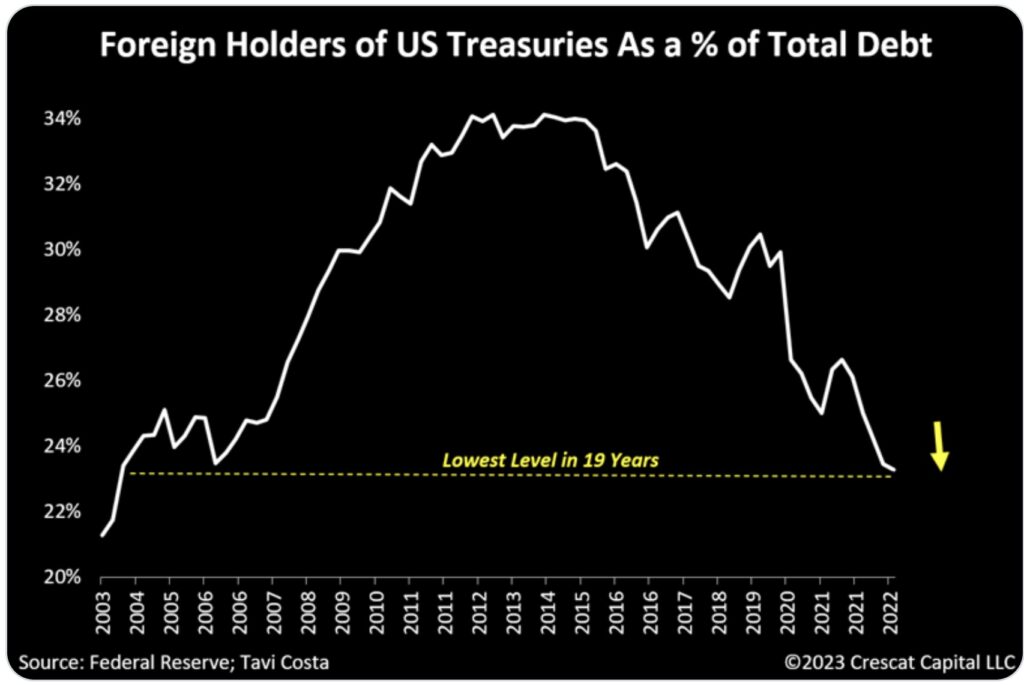

This problem is further amplified by the diminishing availability of Treasury buyers.

In the last 3 years, the responsibility of absorbing this debt fell on the Fed and US banks, but now both entities have withdrawn from that role.

Additionally: Foreign investors have not been net purchasers of US Treasuries despite the substantial influx of issuances lately.

Panic Is Coming

The current lack of demand is indeed a growing problem that may ultimately necessitate the intervention of the Fed as the buyer of last resort.

We can recall the historic selloff of UK Gilts last year, triggered by a tax cut announcement that investors perceived as posing a significant risk to the country’s financial stability.

This situation led the BOE to reverse its QT course and intervene as a buyer of UK bonds.

In our strong opinion: The US is primed to have its own BOE moment…

ALERT:

Billionaire mining legend Pierre Lassonde has been buying large blocks of shares in this gold exploration company and believes the stock is set to soar more than 150% in the next 6 months. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Gold’s Staggering Rise In The 1970s

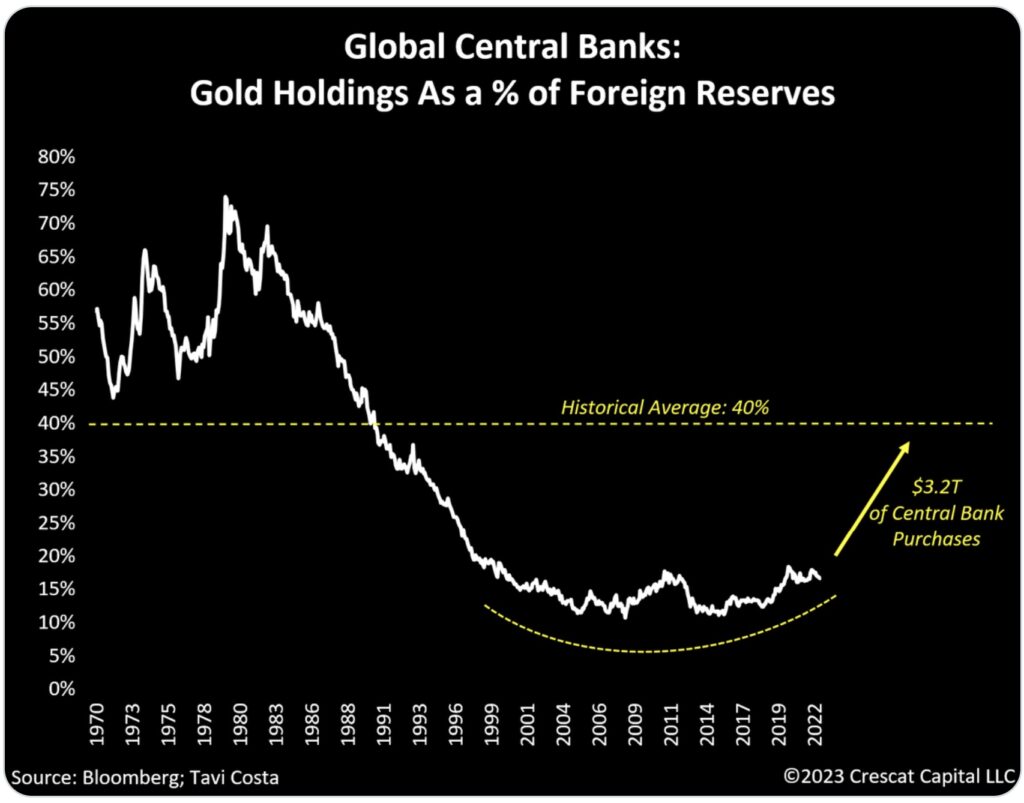

Following the end of the gold standard in 1971, central banks continued to purchase gold for the next decade. At its peak, gold holdings constituted 72% of their overall balance sheet assets.

Now, foreign central banks have reversed their stance again. They are significant buyers of gold while some have become major sellers of US debt.

Escalating geopolitical conflict has increased the importance of owning a neutral asset with no counterparty risk that also carries centuries of credible history as a haven. Gold is the only asset that qualifies.

Central banks have thus pivoted to being substantial buyers over the last several years leading to a rising percentage of gold ownership on their balance sheets.

As a % of FX reserves: If this measurement were to return to its historical average of 40%, all else equal, it would be an injection of approximately $3.2 trillion of new capital into the gold market.

Price would have to be the reconciling factor in accommodating this demand.

Gold: The Superior Choice Today

It is worth noting that during the 1970s:

US 10-year interest rates averaged around 7.5%, making long-term Treasuries significantly more appealing in terms of valuation, with a price-to-earnings (P/E) ratio of 13x.

In contrast, with a P/E ratio of 28x today:

If the rationale for owning these instruments is solely based on the premise that the system cannot endure substantially higher interest rates, then gold would be a far superior choice.

This Type Of Move Into Gold Has Occurred Only Twice In 50 Years

Today, with prices unpegged, it is highly probable that capital will divert from US Treasuries and flow into gold.

Once the metal decisively achieves record prices, it is likely to spark a new gold cycle.

These cycles, characterized by long-term trends, have occurred only twice in the past 50 years:

During the 1970s and the 2000s.

There’s Also This…

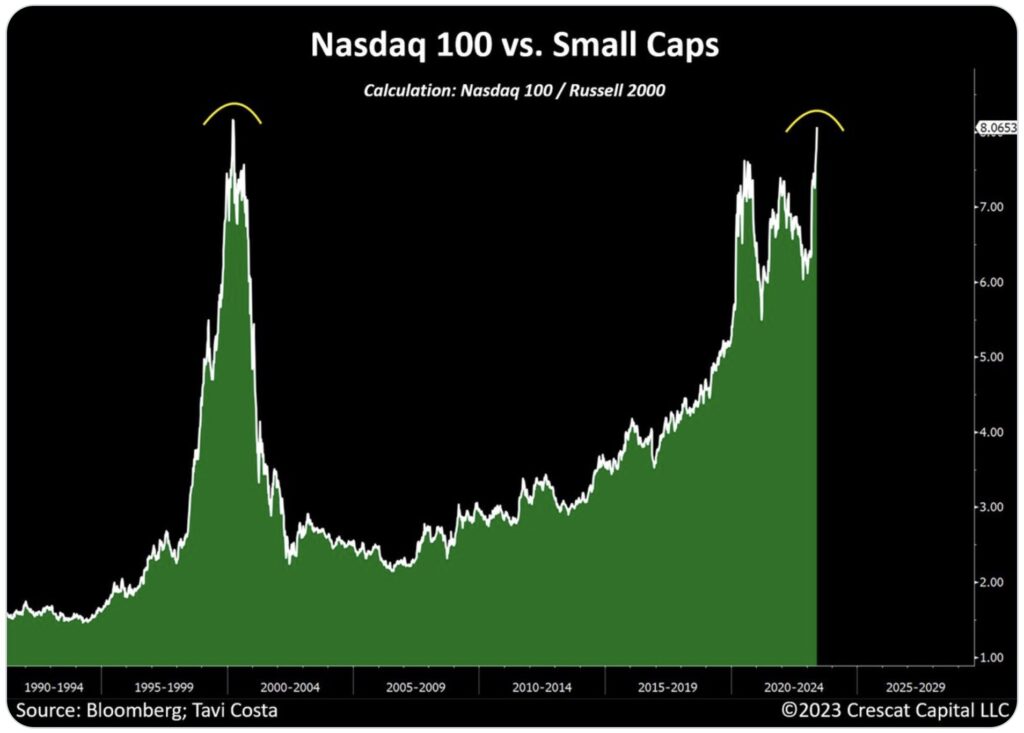

King World News note: In addition to what has been noted above, here is one of Costa’s charts detailing the massive bubble in stocks today:

ALSO JUST RELEASED: Turk – Debt Ceiling Deal Suspension Similar To Nixon Taking US Off Gold Standard CLICK HERE.

ALSO JUST RELEASED: BUCKLE UP: The “War On Inflation” Is Creating Even More Inflation CLICK HERE.

Nomi Prins just predicted the price of gold will hit $3,500 next year and also said the US is the biggest Ponzi scheme in the world in this powerful audio interview CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.